What is Nexo?

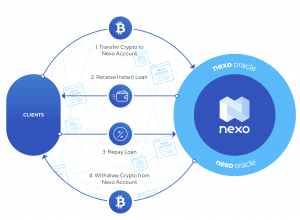

Nexo is a cryptocurrency-based lending platform that offers a multitude of different products and offerings. Primarily, Nexo is a cryptocurrency lending portal for users to get loans and store cryptocurrency without needed credit checks, lengthy application processes, or heavy fees.

Being a fully regulated digital assets institution, it mandates KYC for its users to verify their identity.

Nexo works in a lending-type fashion while simultaneously enabling additional products that can all be streamlined by their inclusive NEXO token. The NEXO token can be used for product discounts, however, also serves as a dividend yielding option for passive income. 30% of all Nexo platform income is redistributed to NEXO token holders.

Pros and Cons

Pros

- Multiple products enabled (Lending, interest accounts, and inclusive crypto).

- No late fees.

- No monthly minimums; customize your loan repayment process.

- Over 10 types of cryptocurrencies supported, withdraw immediately

Cons

- Educational resources and overall tutorials are fairly limited and can be improved.

- A limited number of supported countries and languages

- Customer services can be improved

Is Nexo recommended?

✅Nexo asserts it is a registered and regulated entity that was developed on top of the company ‘Credissimo’, which is a European automated loan issuer. In order to pursue the answer as to whether or not Nexo is a reputable and accessible business, we’ve decided to delve deep into the platform by ourselves and assess whether or not Nexo is a good Bitcoin/cryptocurrency loan platform. In our search for this answer, we’ve reviewed and analyzed Nexo from multiple fronts: A regulatory and compliance point of view, a product/fee/cost perspective, a usability angle, as well as a general utility and efficiency vision.

As a result, based on the information that we have compiled and the due diligence that we have conducted on our end, we generally believe Nexo is reputable and should be one of the cryptocurrency and Bitcoin lenders that you pursue. We generally recommend using Nexo for lending and loan processes, however, as always proceed only after your own due diligence and research.

Markets and Products

Score: 9/10

Nexo offers a variety of intuitive and game-changing cryptocurrency products. Unfortunately, at this time, Nexo is not a platform where you can access markets, as it the case with Coinbase and additional brokers. However, as it’s main purpose is to serve as a lending platform, Nexo offers multiple competitive products. If you buy Bitcoin with Nexo you will instantly be able to get a loan with them and create an account with them.

The following is a very quick/summarized overview of Nexo’s products:

- Instant, crypto-based credit line (Deposit support for over 32 different cryptocurrencies)

- Select from more than 40 fiat currencies or borrow instantly using USDT or USDC.

- Inclusive platform credit card (Nexo card) powered by MasterCard

- Rates start from just 0% and never exceed 13.9%

- NEXO token, cryptocurrencies issued legally that power the entirety of the Nexo platform

- Can convert all your crypto assets into fiat or stablecoins instantly.

- Choose between fiat, crypto, or a combination of both to repay your credit line.

- Approval within seconds; receive funds within 24 hours in most cases.

Special Features

Score: 8.5/10

One of Nexo’s largest strengths is its ability to offer exclusivity in its platform and products. Here are a few of Nexo’s most impressive and market competing offerings:

➡️Inclusive NEXO Token with Dividends

Nexo’s platform offers an inclusive NEXO token, which is something that most other lending platforms, whether cryptocurrency or not, cannot say they enable. However, what makes NEXO tokens even more impressive are the fact that they enable direct dividends from the platform’s profits. Additionally, NEXO tokens can be used on platform discounts.

➡️ Interest-bearing Accounts

Put your idle assets to work straight away by storing them and earn up to 20% annual interest immediately – no further action is needed on your side.

➡️Cryptocurrency Credit Cards

While most platforms offer cryptocurrency debit cards solely, Nexo offers the ability for cryptocurrency credit cards, since it’s a creditor.

Supported Countries

Score: 7.5/10

Nexo seems to only truly falter in the supported countries and languages sectors, mainly because of its placement. Nexo gets major points for its ability to offer its products compliantly and transparently in the United States and the United Kingdom. As it stands, however, Nexo is fairly limited otherwise. While they do ask you to proceed with caution, there are a few major countries that do not support its services, including Australia.

Languages

Score: 7/10

Nexo has fairly limited support for languages, a total of 8 including English, however, we aren’t going to hold that against them in consideration for the entirety of the platform. Languages:

- English

- 中文(简体)

- 한국어

- Español

- Русский

- Türkçe

- Deutsch

- Français

- 日本語

Lending Platform

Score: 9/10

When it comes to lending platforms, Nexo is fairly ahead of the game. The platform is based on an LTV model; this is where certain cryptocurrency is deposited on the platform as collateral, and based on the deposit, you are given a loan. For example, most Nexo loans issued have an LTV ratio of 50%, meaning you need to deposit twice the USD value of cryptocurrency relative to the cash loan you want to take out. The loan is essentially already paid off, however, this type of loan in the crypto market hedges from both missing out on large market opportunities and also having cash on hand.

Nexo offers one of the more advanced lending platforms in the industry. Currently, Nexo is in competition with strictly cryptocurrency-based lending platforms, as well as collateral-focused lenders. In both cases, Nexo provides an extremely impressive platform.

Through the technology developed with Credissimo, which is Nexo’s founding company, loans can be autonomously paid off and set according to your input. Also, since their is liquidation parameters already set, you’ll never have to worry about monthly minimum payments or the like.

Fees and Limits

Fees, as well as account limitations on Nexo, are very very competitive. Considering the platform isn’t in competition with a lot of other entities, Nexo immediately has the upper hand. However, Nexo isn’t trying to compete directly with other cryptocurrency lending platforms; in fact, through advantageous their fees and limits, Nexo places itself in direct competition with traditional investment banks and additional legacy creditors/lenders.

- Minimum: $500 in fiat currencies, $50 in stablecoins (USDT, USDC)

- Maximum: $2.M

Score: 9.5/10

Limits

Loan Limits

Arguably what has been considered one of Nexo’s largest edges is the fact that there is little to no account verification required in order to get started. The minimum loan amount that you can undertake on the Nexo platform is $500 equivalent. The maximum amount that you can currently can a loan for on Nexo is approximately $2M USD equivalent. However, when looking for loans up to $10,000, you don’t have to verify your account.

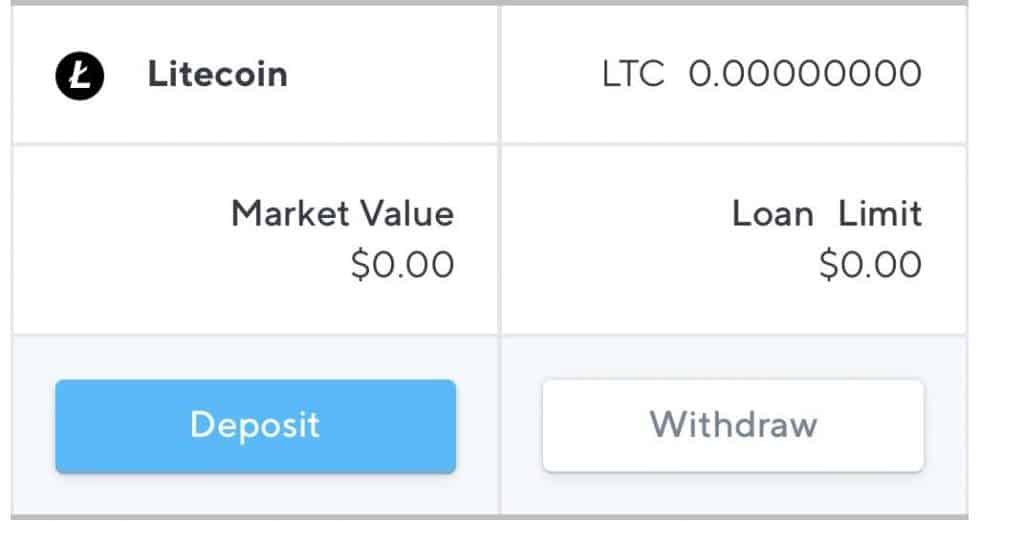

As far as minimum amounts of crypto that you can deposit, they are subject as follows:

– BTC: 0.002

– ETH: 0.02

– LTC: 0.1

– Nexo: 25.0

– BNB: 4.0

– XRP: 30.0

Lending and Credit Fees

Nexo’s fees when using their loans and credit lines are various, however, they traditionally start at approximately 6% APR and fluctuate depending on the amount of NEXO tokens you have, the amount of information you provide the NEXO platform, the amount of liquid collateral you put up, and so on.

- Nexo has no monthly minimums and no late fees.

- Average interest rates for Nexo loans are approximately 0-13.9%.

Withdrawal Fees

Nexo does not incur any withdrawal fees, only network fees retained to pay the network when transactions are made.

Account types

Score: 9/10

Nexo offers a very unique combination in its offering that blends the two account types together very well. Those accounts are as follows:

Interest Bearing Stable Coin: Opening these accounts means you are depositing a stable coin to earn yearly interest.

Loan Accounts: These types of accounts are opened when seeking a loan from Nexo.

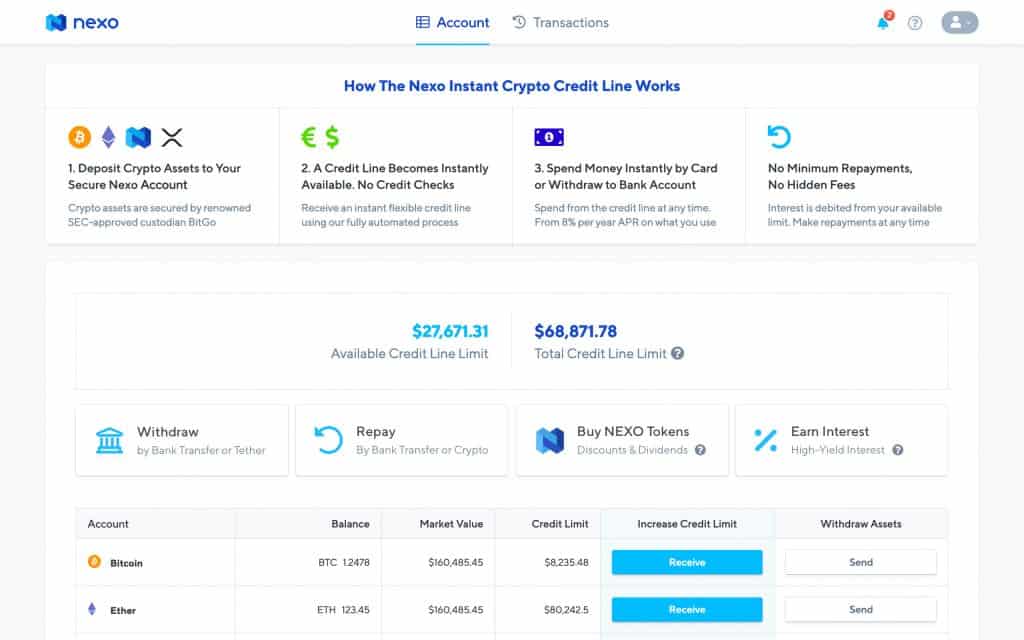

How to get a loan on Nexo

-

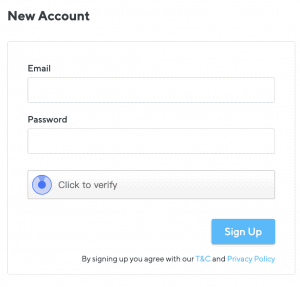

Register

The first step for getting a loan on Nexo is to register an account. For an initial loan up to $10,000, you don’t need any verification whatsoever.

To do this, click the ‘New Account’ button on the Nexo homepage. Then, enter the necessary information. This will establish a preliminary account for you. Upon doing this, you’ll then have the option to proceed forward.

Once done, you’ll need to then deposit a form of collateral on the platform that will be liquidated if the LTV ratio ever exceeds 100%. Think of it like this: Traditionally, there is a 50% Bitcoin LTV ratio. If you deposit $100,000 in Bitcoin, you will be granted a $50,000 cash loan. If the value of Bitcoin skyrockets in the future and becomes worth say, $500,000, you still only owe $50,000 worth of the loan. As a result, you’d come out with $450,000 worth in Bitcoin since you’re only responsible for the repayment of $50,000.

-

Deposit Collateral

Once you’ve successfully created an account, the next step is to deposit funds that will be used as collateral. The loan you’re issued, the interest rate, and repayment term are all variable based on multiple factors. However, in most cases, if you provide the necessary info and deposit a minimum of $500 in Bitcoin, you can get a standard loan of approximately $250 in cash.

Do this by going to your Nexo account page and pressing ‘Top Up’ or ‘Deposit’ on the Bitcoin page, or crypto of choice.

Then, simply send the specified crypto to the address that is generated for you.

-

Access Your Loan

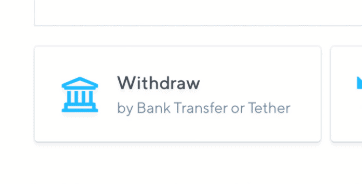

The next step is to withdraw the cash value to your bank account or stable coin address. To do this, on your account page, simply click the ‘Withdraw’ button as shown here:

Once selected, input the bank account details necessary and you can then access your loan!

Repaying

To repay the loan, either leave the amount in your account until the liquidation period hits or press the ‘Repay’ button and select how much of your held assets you want to sell.

Security and Regulation

Score: 8.5/10

Regulation

Nexo is registered and regulated with the SEC; their filings can be found under the SEC archives as ‘Nexo Capital, Inc.’ As long as you follow the proper protocols parallel to your jurisdiction in buying cryptocurrency, you should be secured.

Their token offering of ‘NEXO’ was registered and entirely compliant with the proper legislation.

Security

We’re extremely fond of Nexo because of their ability to enable such a high level of fund security and custodian. Nexo is partnered with the custodian BitGo, and offers insurance on your funds for up to $100M; all transparently.

Deposit and Withdrawal Process

Score: 9/10

Payment Options

Nexo offers a variety of different payment options when it comes to deposits and withdrawals, so let’s review each one separately.

Deposit: Deposits made to the platform are exclusively made in cryptocurrency, well, because the main purpose of the platform is to provide you a loan in fiat. Deposits for Nexo loans can be made via Bitcoin, Ethereum, Binance Coin, Litecoin Cardano, EOS, IOTA, Monero, OmiseGO, VeChain, Stellar, NEXO, XRP, Bitcoin Cash, Dash, Ethereum Classic, Kin, NEO, Qtum, Tron, and ZCash.

Withdrawal: When you are issued your loan you have the choice for withdrawal via either cash and a bank account or stable coin. In both cases, your withdrawal is generally maintained as secure.

Education and Resources

Score: 7.5/10

Although Nexo as a whole is an excellent platform and maintains excellent products that beat out its competitors, we do believe that it can improve upon its educational and resources section within the industry. The concept behind Nexo is already complex as it is, however, we feel that with the amount of institutional backing that it has, that it can improve its educational and resources-focused sectors.

As a whole, the Nexo platform isn’t something that newcomers can grasp straight off the bat within cryptocurrency. Additionally, Nexo does, in fact, offer some interactive designs and click-throughs on their website, however, we believe that Nexo should have more of a dedicated educational and assistive resource center. The following is an example of one of the educational graphics available on the homepage:

Customer service

Score: 8.5/10

Nexo offers customer service that is fairly quick and responsive; they offer 9-5 instant customer service response during the week, and email and text-based customer service 24/7 at all other times. While a perfect score of 10 would be warranted if the platform enabled 24/7 access to instant customer support, unfortunately, it’s just not the case yet with Nexo.

Nexo’s customer service is also, more importantly, knowledgable in regards to Nexo, which is something that isn’t always the case with customer service.

Nexo vs BlockFi

Both Nexo and BlockFi let you earn interest and take loans against your cryptocurrency holdings. Nexo’s interest rates on crypto holdings yield 20% yearly interest, which is way higher than BlockFi’s 6.2%. BlockFi supports fewer currencies and cryptos as compared to Nexo. Also, BlockFi being a highly regulated entity and having a high emphasis on U.S. regulatory stature, global borrowers may find trouble in looking for clarity.

Conclusion

From our due diligence and personal interaction with Nexo, we can confidently say that Nexo is our top selection as far as Bitcoin lending platforms go. Due to its regulatory abidance, a competition squishing fee structure, and transparent insurance on your funds, we highly recommend Nexo to prospective cryptocurrency users looking for a lending platform.

In each case, getting started with Bitcoin loan platforms such as Nexo requires an initial purchase of cryptocurrency; if you’re unfamiliar with buying crypto, check out our beginner’s guide on how to buy Bitcoin using PayPal.

Read more:

FAQs

My LTV ratio on Nexo is 30%, why?

This can be because of the type of cryptocurrency you've deposited for collateral, the country you reside in, and more. It's best to ask Nexo directly about your LTVs.

Who are Nexo's main competitors?

The community has considered BlockFi and SALT Lending as Nexo's main competition.

What do NEXO tokens do?

NEXO tokens give you 30% of the profit that Nexo produces, and also gives you exclusive discounts on the Nexo platform. NEXO tokens are available for purchase on a variety of validated exchanges, including Binance.

What is Nexo mainly used for?

Nexo is mainly used and known for its lending platform. Users who don't believe that cryptocurrency will fall any more than 50% from its current value, and additionally want immediate cash for their investments can use Nexo.

Does Nexo have hidden fees?

It is affirmed in the terms and conditions as well as all user agreements that Nexo will never incur hidden fees.

What happens if I miss a monthly payment on Nexo?

Nothing - your loan is relative to your collateral cryptocurrency. As long as the value of your collateral doesn't bring your LTV ratio above 100%, nothing happens when missing your monthly fee.

Can I use Nexo if I have bad credit?

Yes! Nexo doesn't require any credit checks whatsoever.

Does Nexo also offer cryptocurrency credit cards?

Yes - since Nexo is one of the only cryptocurrency creditors, they have subsequently also enabled cryptocurrency credit cards. These are credit cards issued to you Powered by MasterCard that are directly linked to the credit line that is issued to you.

Comments are closed.