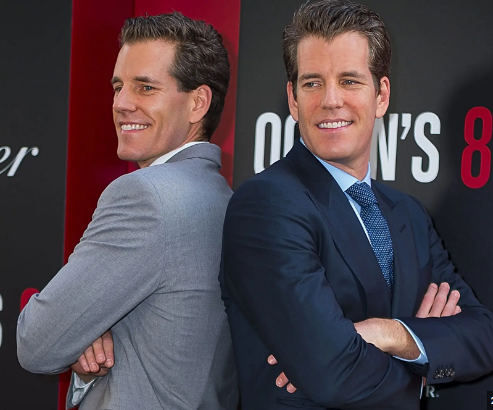

Tyler and Cameron Winklevoss are popularly known as the Winklevosses or Winklevoss. The twins are American Olympians, entrepreneurs, and venture capitalists. The Winklevoss gathered their wealth through their early investment in Bitcoin. The net worth of Tyler and Cameron Winklevoss is estimated to be around $2 billion each, summing to $4 billion in total.

More so, their success in the crypto space includes the establishment of the Bitcoin lending platform, BlockFi. The entrepreneurial mastery of the duo led to the creation of a digital auction platform called Nifty Gateway. The two organizations owned by Tyler and Cameron Winklevoss are under their umbrella holding company Gemini Space Station. It is not in doubt that the investment by Tyler and Cameron Winklevoss contributed to their net worth. However, outside the crypto space, the brothers are famous academicians and rowers. Their rowing career saw them both compete at the 2008 Beijing Olympics.

Before joining the League of Billionaires, the Winklevosses had a legal battle against Facebook and its CEO, Mark Zuckerberg. The battle gained wider recognition in the media with the brothers netting a $65 million settlement in cash and Facebook stock. In the lawsuit, they argued that Mark Zuckerberg stole their idea to design a social media platform. With the return from the lawsuit, the Winklevosses made the decision that changed their fortunes for good, by investing in BTC.

Net Worth of Tyler and Cameron Winklevoss

| Year | Net Worth |

|---|---|

| 2020 | $1.2 billion |

| 2021 | $1.6 billion |

| 2022 | $2.3 billion |

| 2023 | $2 billion |

Early Life

Both Tyler and Cameron were born in Southampton, New York on August 21, 1981. The twin brothers were brought up in Greenwich, Connecticut. They share a mirror image. Tyler is right-handed while Cameron is left-handed. Tyler and Cameron are sons to Carol and Howard Edward Winklevoss Jr. Their strong educational background can be traced to their father, Howard. Howard was an adjunct professor of actuarial science at the Wharton School of the University of Pennsylvania.

The Winklevosses have shown a strong cooperation at the early stages of their life. This cooperation formed the basis of their success. It enabled them to build Lego together and play musical instruments. At a tender age, they learnt HTML and started a web-page firm. The firm focused on the development of websites for businesses.

Tyler and Cameron Winklevoss went to the Greenwich Country Day School before attending the Brunswick School for high school. Their father’s academic background reflected their fondness for classics in High School. They both co-founded the crew program.

The Winklevosses enrolled at Harvard University in 2000 for their undergraduate program. There, they majored in economics, earning an AB degree before graduating in 2004. While at Harvard, they were members of the men’s varsity crew, the Porcellian Club, and the Hasty Pudding Club.

Thereafter, In 2009, Winklevoss joined the Saïd Business School at the University of Oxford where they obtained an MBA in 2010. During their time at Oxford, they were Oxford Blue and participated in numerous competitions.

Rowing Career

Tyler and Cameron Winklevoss started rowing at age 15. They picked up this career under the encouragement of family friends. Also, the rowing journey of their next-door neighbor Ethan Ayer at Harvard University and Cambridge University was a source of inspiration to them. Though the net worth of Tyler and Cameron Winklevoss didn’t gain much boost through this path.

The Winklevosses started rowing at the Saugatuck Rowing Club on the Saugatuck River in 1997. They co-founded the crew program because their High School doesn’t have a crew. In the summer of 1999, they made the United States Junior National Rowing Team. There, they competed in the coxed pair event at the World Rowing Junior Championships in Plovdiv, Bulgaria.

More so, during their time at Harvard University. Tyler and Camron Winklevoss rowed under the guidance of coach Harry Parker for four years. In 2004, they were part of the 6-seat “engine room” of the Harvard men’s varsity heavyweight eight boats. The crew gained the nickname, the “God Squad.” As revealed by Tyler Winklevoss, a part of the squad believed in God, while the rest believed they were God. That year, with Tyler and Cameron Winklevoss on the crew, they won numerous titles. These titles are the Eastern Sprints, and the Intercollegiate Rowing Association Championship. They also won the Harvard–Yale Regatta as part of an undefeated collegiate racing season.

The crew made more exploits later that year. They competed and made it to the Finals of the Lucerne Rowing World Cup. En route to the final, They defeated the 2004 British and French Olympic eight boats. In addition, they traveled to the Henley Royal Regatta where they competed in the Grand Challenge Cup. During the tournament, the brothers defeated the Cambridge University Blue Boat in the semi-final before losing in the final. Thereafter, the crew won the Olympic silver medal at the Athens Olympic Games a month later.

After their time at Harvard University, Tyler and Cameron Winklevoss were named in the United States Pan American Team. There, they competed at the 2007 Pan American Games in Rio de Janeiro, Brazil. During their time in Brazil, they won Gold and Silver Medals. They also competed at the 2008 Olympics Games in Beijing, representing the United States Olympics Team. At the competition, they finished sixth out of the fourteen countries that had qualified for the Olympics. In 2009, Tyler and Cameron Winklevoss won a bronze medal at the Rowing World Cup in Lucerne, Switzerland, in the men’s coxless four event.

Winklevoss Investment

Tyler and Cameron Winklevoss took a step towards the billionaire crew in 2012. Then, they founded Winklevoss Capital Management. The firm focused on investing in various asset classes, providing seed funding and infrastructure to early-stage startups. With the firm, Tyler and Cameron invested heavily in Bitcoin. In 2012, the Winklevosses revealed that they own a significant amount of the total BTC in circulation.

On July 1, 2013, the firm, through a subsidiary, filed a Form S-1 with the United States Securities and Exchange Commission (SEC)to create the Winklevoss Bitcoin Trust. The Winklevoss Bitcoin Trust is an exchange-traded fund for bitcoin. Later that year, the firm led a funding round for BitInstant, a bitcoin exchange start-up based in New York City.

A year later, the firm participated in the fundraising for Filecoin. It is worth mentioning that through the Winklevoss Investment, Tyler and Cameron invested in firms like Animoca Brands, August Locks, Carbon38, Bitski, Minibar, Rowing Blazers, Makespace, MemeBox, Teachable, and many others.

Gemini

In 2013, Tyler and Cameron Winklevoss announced plans to launch Gemini. Two years later, Gemini went live. Initially, the platform focused on providing gateways to purchase and store Bitcoin. Its storage system uses a complex system of private keys and passwords to protect users BTC in its possession. Later, the firm ventured into the provision of Financial Services which included FIX and API support.

On May 5, 2016, Gemini became the first licensed Ethereum exchange based in the United States. The development surfaced after the firm received regulatory backing from the New York authority. Thereafter, it added support for the withdrawal of Ethereum Classic (ETC). Consequently, In October 2017, Gemini added support for registered users to withdraw Bitcoin Cash. The growth of the crypto exchange added to a new height In 2018. The firm announced that it will begin offering Block Trading. Block Trading is aimed at aiding users to buy and sell large quantities of digital assets outside of Gemini’s continuous order books.

It is worth mentioning that Gemini created a token that can be regarded as a stablecoin on September 10, 2018. The firm gained regulatory approval on September 10, 2018, for its GUSD. The token is aimed at maintaining a 1:1 dollar peg. Later that year, the firm acquired an insurance initiative for virtual assets in its custody. By November 2019, Gemini already acquired Nifty Gateway for an undisclosed sum. Nifty Gateway is a marketplace for NFTs. The move emanated due to the firm’s effort to enhance its business outreach.

In May 2020, Gemini unveiled an initiative as a result of a collaboration with Samsung. The initiative aided Samsung smartphone users to link their Samsung Blockchain Wallets to their Gemini accounts. With that, they’ll be able to view their crypto balance and transfer seamlessly. The firm suffered a heavy exposure tthe collapse of FTX. On February 6, 2023, Genesis Global announced an agreement in principle with Digital Currency Group. The deal comprises Genesis Global Capital creditors and Gemini. The deal saw Gemini contribute up to $100 million in cash as part of the restructuring and recovery agreement.

Why are Tyler and Cameron in trouble?

The twin brothers, Tyler and Cameron are in hot water following the failure of their firm, Gemini to settle over 300,000 investors of its “Earn Program.” At the inception of this program, Gemini promised investors 8% annual returns on their savings. It is worth mentioning that this mouthwatering interest yield attracted hundreds of thousands of investors to subscribe to the program. At that time, the crypto market was experiencing a bull run, thereby boosting the confidence of Gemini owners to offer such huge yields on customers’ investments in the program.

As a matter of fact, the twin brothers were optimistic that the bull market will linger for long, thereby making it possible for Gemini to afford the huge returns promised. One of the brothers and co-founders of the firm, Cameron, in one of his interviews around 2021, expressed confidence in the potential of BTC to hit $100,000 soon. This thus means that the firm and its owners initiated attractive yields on the investment program owing to their confidence in the continuity of the bull market at that time.

In a bid to foster the efficiency of the program, the Winklevii collaborated with Genesis Global, the crypto lending subsidiary of Digital Currency Group (DCG). Our findings indicate that the firm is owned by Barry Silbert. The partnership made Genesis to be in the custody of the over $900 million funds invested by customers of “Gemini Earn.” As a renowned crypto lending firm, Genesis decided to lend the invested funds to institutional borrowers.

One of the borrowers is a crypto hedge fund, 3AC which collapsed following the invasion of bear market in mid-2022. At the time of its collapse, documents revealed that Genesis loaned out $2.36 billion to 3AC. The crash of 3AC made it impossible for it to pay back, leaving a hole in the balance sheet of Genesis Global.

However, the issue became worsened following the collapse of FTX in November 2022. Findings show that Genesis had $175 million exposure to the crypto exchange, thereby forcing its suspension of withdrawals. The crisis also compelled Genesis Global to cut off its workforce at that time. Following the FTX contagion, Genesis announced that it had no liquid assets to meet up with the withdrawal requests by investors in Gemini Earn Program.

Since the revelation by Genesis dominated the airspace, the Winklevoss twins have continued to pile pressure on Genesis to refund the investments of its investors. When investors realized the situation, they began to drag Tyler and Cameron, accusing the duo of swindling them through the earn program. The investors filed a lawsuit against the Winklevoss twins and DCG owner, Barry Silbert for operating a fraudulent program.

In the lawsuit, the investors accused Silbert of breaching contracts by pausing withdrawals and redemptions on Genesis Global. They charged the Winklevii for selling interest-bearing accounts without any proper registration with concerned regulators. In the same vein, the twins are also facing another legal battle with the Commodity Futures Trading Commission (CFTC). The regulator alleged that the duo gave a misleading information about the operations of their firm while seeking for approval in 2017.

It is worth mentioning that the United States Securities and Exchange Commission (SEC) has also investigated Gemini, DCG and its Genesis subsidiary on the alleged swindling of investors through the program. Upon completion of the investigation, the U.S. regulator accused Tyler, Cameron and Silbert of amassing billions of dollars with their firms. SEC also charged Gemini and Genesis for offering unregistered crypto assets as securities to investors. All these indicate that Tyler and Cameron are in trouble unless they provide a pathway for investors to access their investments.

DCG said it has started initiating measures to enable Genesis Global settle Gemini investors. In recent times, the firm announced its plan to offload the shares of some of its numerous ventures and holdings. In early 2023, DCG sold a part of the stocks in its Ethereum trust to raise $23 million. It is also looking to sell shares in Grayscale to gather more funds in the bid to bail out Genesis from its trouble with Gemini.

However, the saga took a different dimension on July 7, 2023, after Cameron Winklevoss filed a lawsuit against Digital Currency Group and its CEO, Barry Silbert in a New York court. According to the lawsuit, Cameron Winklevoss accused Barry Silbert of masterminding DCG and Genesis fraud against creditors including Gemini.

1/ Today, @Gemini filed a lawsuit against @DCGco and @BarrySilbert personally in New York court. Barry was not only the architect and mastermind of the DCG and Genesis fraud against creditors, he was directly and personally involved in perpetrating it.

— Cameron Winklevoss (@cameron) July 7, 2023

The Winklevoss brother while providing details of the lawsuit on his official Twitter handle recalled how Barry Silbert allegedly tricked Gemini to continue its Earn program. It is worth mentioning that in October 2022, Gemini announced plans to end its Earn program due to liquidity issues. Per Cameron Winklevoss’s disclosure on Twitter, Barry Silbert persuaded Gemini to continue the interest-yielding initiative despite knowing Genesis’s insolvent issues.

2/ The complaint tells the whole story, but let's start here: when Gemini notified Genesis it would be terminating the Earn program in October 2022, Barry reached out to set up a meeting to induce Gemini to continue Earn. He did this knowing Genesis was massively insolvent. pic.twitter.com/cY8H8IfnaH

— Cameron Winklevoss (@cameron) July 7, 2023

Further, he accused Barry Silbert of maliciously hiding a huge hole in Genesis’s balance sheet by claiming that the firm was battling “timing issues.” Likewise, Cameron Winklevoss alleged that the collapse of 3AC in June 2022 left Genesis with a deficit worth $1.2 billion on its balance sheet. In addition, Cameron Winklevoss in his disclosure on Twitter highlighted how the defendants on various occasions misrepresented their financial status, deceiving Gemini and other creditors. Lastly, the co-founder described the lawsuit as an important step in holding Barry Silbert, GCG, and Genesis responsible for their shortcomings.

4/ When Three Arrows Capital (3AC) collapsed in June 2022, it blew a $1.2 billion hole in Genesis’s balance sheet. Instead of coming clean, Genesis claimed that everything was business as usual because DCG had stepped in to absorb the losses. pic.twitter.com/trjTdrbrX9

— Cameron Winklevoss (@cameron) July 7, 2023

War of Words between Cameron Winklevoss and Barry Silbert over Gemini-Genesis Crisis

Since the news of Genesis’ bankruptcy dominated the airspace, Cameron Winklevoss and Barry Silbert have been engaged in a war of words. Recall that Cameron is the CEO of Gemini, founded with his twin brother, Tyler. Silbert, on the other hand, founded DCG with numerous subsidiaries which include Grayscale, Genesis and a host of others.

There you go again. Stop trying to pretend that you and DCG are innocent bystanders and had nothing to do with creating this mess. It's completely disingenuous.

So how does DCG owe Genesis $1.675 billion if it didn't borrow the money? Oh right, that promissory note…

— Cameron Winklevoss (@cameron) January 2, 2023

Amid the crisis, Cameron wrote a letter to condemn Silbert’s method of handling the business. In the letter, the CEO accused Silbert of making numerous bad decisions in the financial relationship between 3AC and Genesis. According to Cameron, Silbert allowed Genesis to give out loans to 3AC to spike the value of the GBTC premium offered by Grayscale. This, as alleged, elevated the revenue of Grayscale and provided a robust financial edge for its parent firm, DCG.

Earn Update: An Open Letter to the Board of @DCGco pic.twitter.com/eakuFjDZR2

— Cameron Winklevoss (@cameron) January 10, 2023

The Gemini CEO reflected on how Genesis continued to offer loans to 3AC despite the fall in value of GBTC as a result of the bear market. He said, “At this point, Barry Silbert had two legitimate options: restructure the Genesis loan book (inside or outside of bankruptcy court) or fill the $1.2 billion hole. He did neither.”

Silbert was also accused of hiding the financial status of Genesis Global, thereby making Gemini investors believe nothing was wrong with the lender. By virtue of this, Cameron said Silbert swindled more than 300,000 crypto investors with “Gemini Earn.”

A few days after, Silbert berated Cameron, stressing that his allegations are baseless and untrue. He made this disclosure in his letter to DCG shareholders. The DCG owner clarified the relationship between DCG, Genesis and 3AC. According to him, DCG has no direct business relationship with 3AC. He confirmed that Genesis loaned out funds to the crypto hedge fund, which it is struggling to refund after plunging into a financial crisis.

Silbert added that the DCG has intervened to bail out Genesis and manage the possible contagion of its exposure to 3AC and FTX. He announced the issuing of a $1.1 billion promissory note to Genesis to cushion the effect of its unsecured funds with 3AC.

Are Tyler and Cameron Winklevoss Pro Crypto?

It is not in doubt that both Tyler and Cameron are Pro Crypto. The duo have never hidden their love for cryptocurrency, particularly their favourite assets, Bitcoin and Doge. Over time, they used their social media platforms and media interviews to promote Bitcoin and Doge, thereby encouraging their adoption. Cameron, once said, “First they laugh at you, then they laugh at you some more, then they laugh at you even more, then Dogecoin goes to the moon.”

First they laugh at you, then they laugh at you some more, then they laugh at you even more, then Dogecoin goes to the moon.

— Cameron Winklevoss (@cameron) May 5, 2021

Tyler, in the same vein, also promoted Dogecoin on his Twitter account, saying “A Shiba Inu $DOGE is man and woman’s best friend. It may not be the hero the world deserves right now, but it may be the one that we need right now.”

A Shiba Inu $DOGE is man and woman's best friend. It may not be the hero the world deserves right now, but it may be the one that we need right now.

— Tyler Winklevoss (@tyler) May 5, 2021

In one of their interview in 2021, the twins promoted BTC, saying “Our thesis is that Bitcoin is Gold 2.0, that it will disrupt Gold as a store of value. If it does that, it has to have a market cap of 9 Trillion, so we think it could price one day at $500,000 a Bitcoin.” More so, they described the largest crypto by market cap as a “hold or a buy opportunity if you don’t have any, because we think there’s a 25x from here.”

As part of their commitment to expanding crypto adoption, Tyler and Cameron launched Gemini, a crypto exchange in 2015. The exchange was licensed in New York and has continued to offer varieties of crypto offerings to clients. It continued to thrive until it got into trouble in late 2022 after its “Earn Program” partner, Genesis plunged into a financial crisis. Occasioned by this development, Genesis which held the funds of Gemini investors could not refund the assets, thereby triggering several legal battles for both firms. Certainly, the outcome of the legal troubles will significantly impact the future net worth of Tyler and Cameron Winklevoss.

It is worth mentioning that the twins’ admiration for digital assets also extends to NFT projects. The duo view NFTs as an innovation with the potential to transform the digital economy. Owing to their love for NFTs, they leveraged Gemini to buy Nifty Gateway, an NFT marketplace in 2019. Through this platform, users are able to trade a wide collection of NFTs. The marketplace also houses several NFT drops by renowned artists and celebrities.

Crypto and NFT Holdings of Tyler and Cameron

As evangelists of cryptocurrencies, there are indications that Tyler and Cameron hold varieties of crypto assets. Although, there is no credible source to confirm the exact crypto holdings of the twin brothers. However, it is not in doubt that they hold a significant amount of crypto in their respective portfolios. Our findings traced the entry of Tyler and Cameron into the crypto sphere to 2012. At that time, they reportedly bought a large amount of BTC. This thus put them on the list of early and famous Bitcoin investors across the globe.

We rely on the estimates by Washington Post that the twins held as high as 1% of the circulating supply of BTC as of 2013. By virtue of this data, we can regard Tyler and Cameron as Bitcoin whales. Although they can only sustain the title if they still hold the same percent of BTC assets or more to date. It is worth mentioning that BTC whales are persons who hold a significant percentage or amount of the crypto. By virtue of this, they are able to influence the value of the token.

According to our findings, Tyler and Cameron Winklevoss made a lot of gains through investment in Bitcoin, thereby growing their net worth. As early investors, the massive upsurge in the value of Bitcoin elevated their financial statuses. In 2017, a book author, Ben Mezrichi identified the duo as Bitcoin Billionaires. This was following the estimates by Forbes which affirmed the net worth of Tyler and Cameron Winklevoss as $1.1 billion each. Although, it is certain that the turmoil in the market and the current crisis involving Gemini, Genesis and DCG must have inflicted a huge decline in their wealth.

Apart from cryptocurrencies, Tyler and Cameron have also delved into the world of NFTs. Although, the duo are yet to reveal the value of NFTs they hold as of the time of writing. During the boom of the NFT market in 2019, they purchased an NFT marketplace, Nifty Gateway. The project has continued to thrive, offering enablement for NFT creators and buyers to interact.

Crypto and NFT Projects Featuring Tyler and Cameron

We can link Gemini, a notable crypto project and Nifty Gateway, an NFT marketplace to Tyler and Cameron. They started the crypto project in their home state, New York and leveraged it to foster mainstream access to cryptocurrencies. The exchange is enmeshed in controversies following its failure to refund investors of its earn program. As for Nifty Gateway, it runs as a subsidiary of Gemini, providing varieties of NFT offerings to users.

Due to the enormous influence of Tyler and Cameron Winklevoss, they are expected to feature in Wall Street Memes. Only a beginner won’t have come across exciting memes from this project on either Twitter or Instagram. Some of its memes have, in the past few months, featured notable figures like Donald Trump, Joe Biden, Changpeng Zhao, and many others.

Owing to its vast community support, Wall Street Memes has been able to attain prominence. Its ongoing token ($WSM) presale has attracted participation from scores of investors and the number is still rising. Although $WSM may not have any known use cases yet, investors are optimistic about its potential to emerge as one of the next cryptocurrency to explode. You can as well become one of the investors in the token. Just visit wallstmemes.com.

Tyler and Cameron Net Worth – Our Verdict

We have been able to analyze the net worth of Tyler and Cameron Winklevoss. Our findings established that the twins made the most of their wealth from their investment in Bitcoin. They were among the early investors in the crypto, with their first investments dated as back as 2012. Around 2013, they held 1% of the circulating supply of BTC at that time. Tyler and Cameron deepened their entry into the industry in 2015 after founding Gemini. They were able to do this through the gains derived from BTC investments and settlement funds they received from Mark Zuckerberg.

Although, the net worth of these notable BTC optimists have crippled following the 2022 market turmoil that plunged the prices of cryptocurrencies. More so, their firm, Gemini is in trouble for initiating an unregistered earn program with Genesis. The aftermath of the FTX crisis made it impossible for Genesis to pay back Gemini investors, thereby igniting various allegations of fraud against the twins. It won’t be surprising if the crisis inflicts any implications on the net worth of Tyler and Cameron Winklevoss.

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

FAQs

Are Tyler and Cameron Winklevoss on the list of famous investors in BTC?

Yes. The twin brothers are famous for their investments in Bitcoin. They bought their first BTC asset in 2012, thereby becoming early investors in the token. In 2017, Tyler and Cameron were pronounced Bitcoin Billionaires according to Forbes estimates.

Why are Tyler and Cameron in trouble?

Tyler and Cameron Winklevoss are in serious trouble after their firm, Gemini failed to refund investors’ investment in its Earn program. According to our findings, more than 300,000 investors participated in the program and are yet to get their funds back.

What is the relationship between Gemini and Genesis?

Gemini collaborated with Genesis, a lending firm to keep the funds deposited by its investors. Following the FTX crisis, Genesis plunged into liquidity and could not refund Gemini investors their money. The issue has continued to generate a lot of furore between the two firms.