-Micree Zhan is a Chinese electronics engineer and the co-founder and CEO of Bitmain, the world’s leading manufacturer of cryptocurrency mining hardware. As of 2025, Micree Zhan’s net worth is estimated at $5 billion.

In 2018, Zhan was named the richest cryptocurrency billionaire worldwide by the Hurun Report. He has since dropped several spots, but remains one of the wealthiest members of the crypto community. In 2019, he was ousted from his business, but has since regained control over it.

In this article, we break down how Micree Zhan became a successful crypto trader and built a multi-billion dollar crypto empire.

Breaking Down Micree Zhan’s Net Worth in 2025

In 2018, the Hurun Report’s inaugural Blockchain Rich List named Zhan the richest cryptocurrency billionaire in the world. At the time, he had an estimated net worth of 29.5 billion yuan, which equaled around $4.3 billion. His partner, Jihan Wu, was ranked second on the list.

Only a year later, in February 2019, Bloomberg ranked Zhan as the ninth richest self-made billionaire aged 40 or younger, estimating his net worth at $5.2 billion. In June of the same year, he was listed in the Bloomberg Billionaires Index as the world’s 311th richest person with a net worth of $5.42 billion.

In 2020, Zhan slipped to the second rank on the Hurun Global Rich List, with Binance’s CEO Changpeng Zhao taking over the spot. Zhan dropped down after being ousted from Bitmain, though he has since rejoined the company.

Based on Bitmain’s valuation from 2022 of $9 billion, Zhan’s stake of 56% today is worth around $5 billion. Micree Zhan leads a very private life, so very little is known about his personal assets and other business investments.

Here is a detailed net worth breakdown of his major sources of income:

| Asset or Income Source | Contribution to Net Worth |

| Bitmain stake (2018) | 36.58% |

| Bitmain stake acquisition | -$600 million investment in 2021 |

| Estimated Bitmain stake today | 56% worth around $5 billion (unofficial) |

| Crypto holdings | undisclosed |

| Total net worth | $5 billion |

Micree Zhan Net Worth: Early Life and Education

Micree Zhan was born Zhan Ketuan (Chinese: 詹克团) on January 29, 1979, in Minhou County, Fujian, China. He studied at Minhou No.1 High School, after which he enrolled at Shandong University to study electronics engineering. He graduated from the university in 2001 and enrolled at the Institute of Microelectronics at the Chinese Academy of Sciences to study for his Master’s degree in microelectronics engineering. He obtained his Master’s degree in 2004.

Very little is known about Zhan’s personal life. He was single and had no children as of 2019, but this might have changed since. He resides in Beijing, China.

How Micree Zhan Became One of the Top Richest Crypto Traders

When he obtained his degree from the Chinese Academy of Sciences, Zhan started working as an engineer at the Information Technology Research Institute at Tsinghua University.

He later ventured into entrepreneurship by launching a business that produced television set-top boxes. His business was called DivalIP Technologies and was established in 2010.

Despite Zhan’s technical expertise, the company struggled to secure sufficient investment and ultimately shut down. It was during this period that Micree Zhan met Jihan Wu, who introduced him to blockchain technology and Bitcoin. Their collaboration led to the founding of the future multibillion-dollar brand Bitmain in 2013.

Founding Bitmain

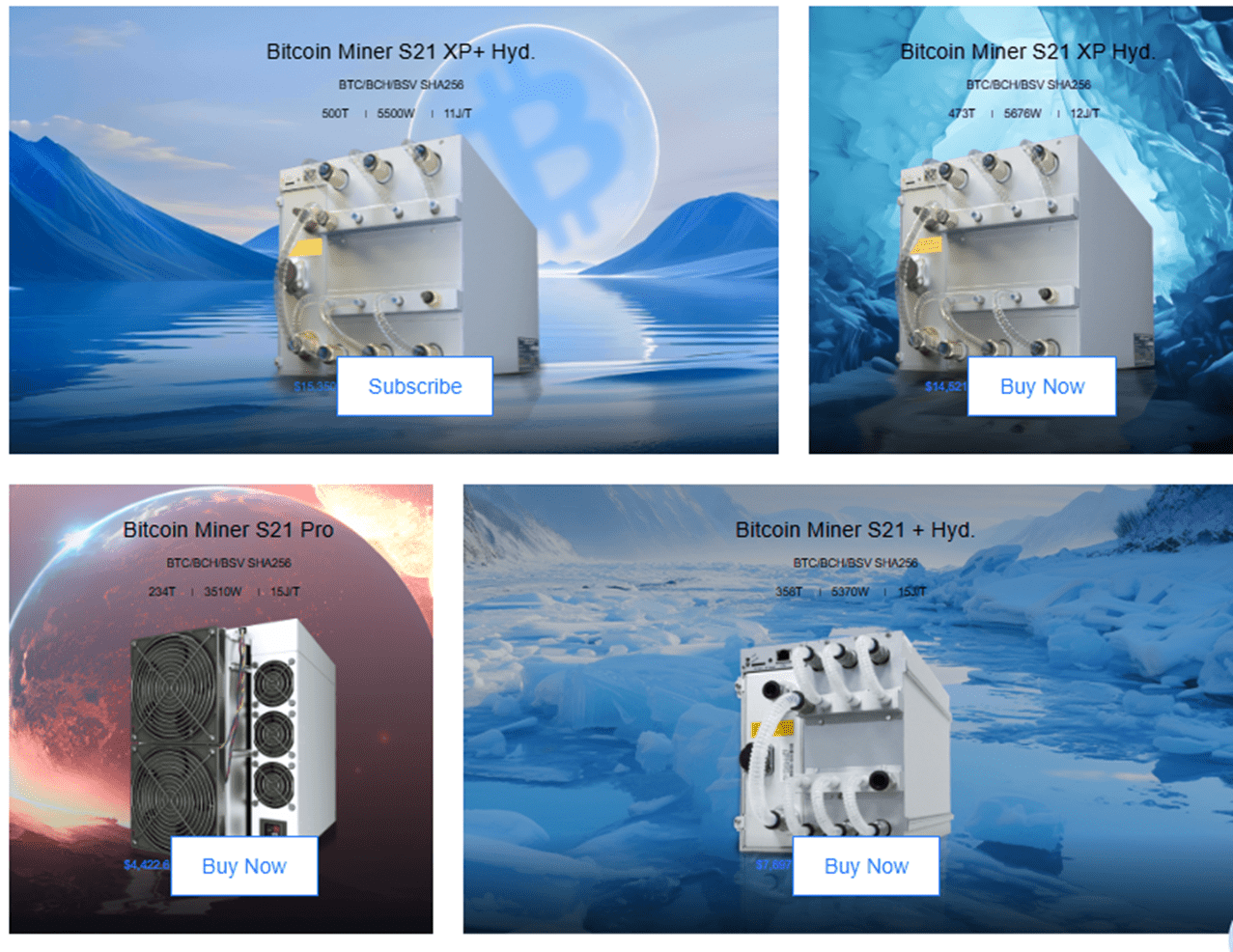

Bitmain was an almost immediate success. The business quickly grew to become the world’s largest computer chip company for Bitcoin mining at the perfect time. Bitmain was able to quickly capitalize on the rising demand for mining equipment, securing itself as the leading manufacturer in the niche industry.

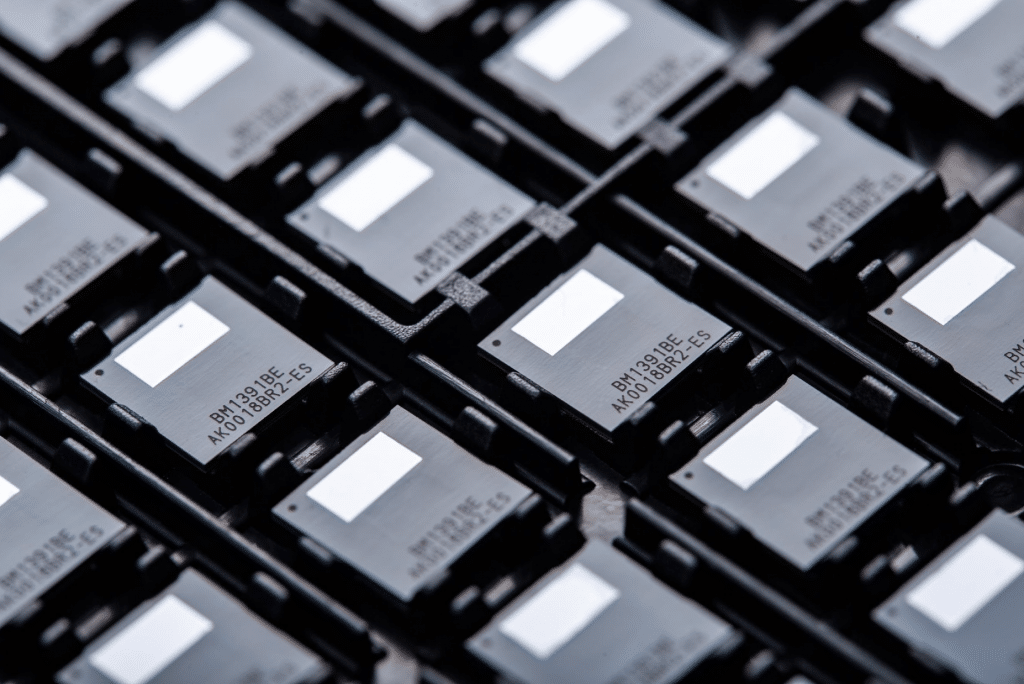

Zhan was the technical mastermind behind the company’s success, and under his leadership, Bitmain became a dominant force in the cryptocurrency mining industry by developing custom-designed Application-Specific Integrated Circuit (ASIC) chips. The chips were designed from the ground up for mining Bitcoin, so they significantly outperformed traditional computers, making them far more efficient for mining crypto.

Bitmain’s first product was the Antminer S1. This ASIC Bitcoin miner delivered a hash rate of 180 gigahashes per second while consuming 80-200 watts of electricity, making it by far the fastest and most efficient mining hardware available on the market.

The business flourished as the demand for crypto mining surged among corporate and individual investors. Soon enough, it became the world’s largest producer of ASIC chips for Bitcoin mining.

Through Bitmain, Zhan also established two major mining pools: BTC.com and Antpool. Independent miners can join these groups to pool their computing power together, sharing the rewards of any blocks they mine with the rest of the pool. This was an important development because it is incredibly difficult to mine even a single block as a solo miner. Pooling resources made crypto mining much more profitable and consistent, further driving up the value of Bitmain’s products.

In 2017, Bitmain reported $2.5 billion in revenue. The company’s revenue predominantly came from sales of its cryptocurrency mining chips and equipment.

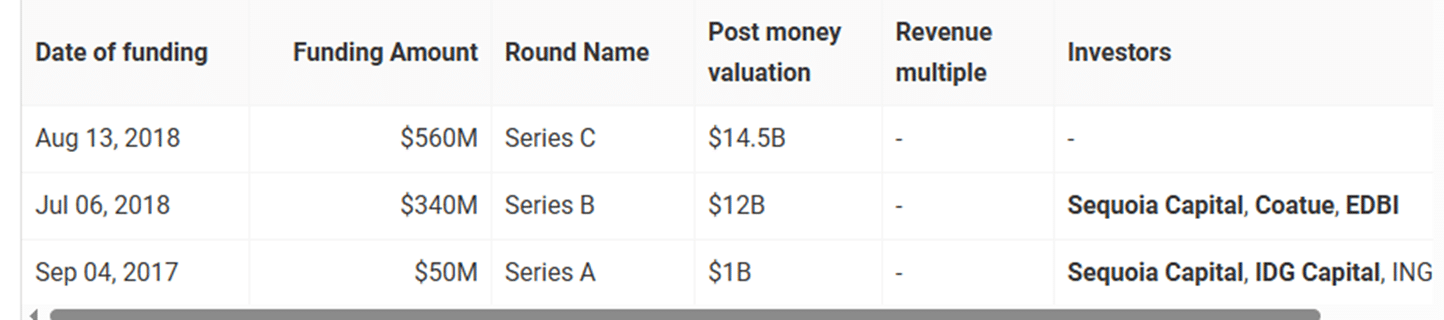

In the first quarter of 2018, the business had $1.9 billion in revenue, according to Forbes. This is when the partners started talking about the IPO on the Hong Kong Stock Exchange, which was supposed to happen before the end of the year. They secured significant investments from several firms, including the venture capital firm Sequoia Capital, as well as IDG Capital.

Bitmain has since made multiple attempts to go public, but as of April 2025, it remains a privately held company. The company’s first effort to list on the Hong Kong Stock Exchange lapsed in March 2019 without approval due to regulatory concerns and internal leadership disputes.

In 2020, Bitmain explored the possibility of an IPO in the United States, filing confidentially with the U.S. Securities and Exchange Commission. This plan was also shelved amid ongoing internal conflicts.

The company continues to face challenges, including geopolitical tensions and sanctions that have affected its operations.

Zhan’s Ousting and Return to Bitmain

In October 2019, a significant leadership upheaval occurred at Bitmain when the company was China’s leading cryptocurrency mining firm. As a result, Micree Zhan was abruptly removed from his positions as legal representative and executive director by his fellow co-founder, Jihan Wu. The move was communicated through an internal memo, which instructed all employees to cease following Zhan’s directives, threatening termination for non-compliance.

The disagreement between the co-founders had been brewing for years. Zhan advocated for diversification into artificial intelligence chip development, while Wu preferred a more concentrated focus on cryptocurrency mining hardware.

Even though Zhan held the plurality of Bitmain’s shares, 36.58% to be exact, and possessed around 60% of the company’s voting power through Class B shares, Wu’s maneuver sidelined him from the company’s operations.

WOW THIS IS MORE DRAMATIC THAN I THOUGHT

Got this internal email from Bitmain where Jihan sent to the whole company, this is INTENSE

”Micree Zhan is dismissed from all operating positions from the company immediately. No one should take order from him or attend his meeting"👀 pic.twitter.com/aguM5Rzg1b

— Dovey "Rug the fiat" Wan (hiring) (@DoveyWan) October 29, 2019

After his ousting from Bitmain, Zhan initiated legal action to reclaim his position, which led to a protracted power struggle within the company. In 2019, Wu and Zhan both stepped down as co-CEOs of the company. Wu founded Matrixport, a financial services company in the crypto market.

In June 2020, Zhan reportedly led a team of private security guards into Bitmain’s Beijing office, attempting to regain control over the company. This action followed a series of legal and physical confrontations, including a May 8 incident where Zhan was allegedly physically confronted by the CFO.

😂😂😂OH MAN the #BitMainDrama this video is verified by @BlockBeatsChina

Micree today led a team of private guards crashed Bitmain Beijing office … they broke in by brute force and tried to take back the control (after Jihan’s initial coup and series of outrageous behavior) pic.twitter.com/wkpKJ8Nr8H

— Dovey "Rug the fiat" Wan (hiring) (@DoveyWan) June 4, 2020

Bitmain’s chief financial officer, Luyao Liu, was arrested after allegedly participating in a mob attack on Zhan in Beijing. The attack occurred at the Beijing Municipal Administration of Industry and Commerce, where Zhan was attempting to register as the legal representative of Bitmain Beijing.

During the process, Liu and a group of masked men allegedly robbed Zhan of his business license, which had already been issued to him. After the altercation, Liu was arrested by the police, making this ordeal a fiery topic of discussion in China.

Bitmain later issued a statement claiming that Zhan’s labor contract was terminated in October 2019 and, therefore, he no longer held any position at the company. The company insisted that Liu remains the legal representative of the Beijing branch despite public registration documents showing Zhan as the legal representative.

The internal conflict was eventually resolved in January 2021 when Wu officially left Bitmain, allowing Zhan to regain control of Bitmain. Wu shared that the disagreement had finally been settled amicably. As part of the settlement, two major business units – BTC.com, the cryptocurrency mining pool, and Bitdeer, a cloud mining service, were spun off from Bitmain.

In the following X post by Jihan Wu, the former co-CEO shared a Resilio Sync key, a peer-to-peer file-sharing link used to share detailed documents, speaking of the settlement:

Regarding the settlement between Bitmain’s two co-founders

Resilio Sync key: BEHPKSVC4IHNZ7YXP2K5TAVZYVYUAO57E

— Jihan Wu (@JihanWu) January 26, 2021

Micree Zhan’s Stake in Bitmain

In 2018, Micree Zhan owned 36.58% of Bitmain, while his partner owned 20.5%. Recent data shows he holds a significantly higher stake today, though his exact stake hasn’t been revealed publicly.

As of April 2025, Jihan Wu no longer holds a stake in Bitmain since he settled with Zhan Micree. Under the terms of the agreement, Zhan purchased nearly half of Bitmain’s shares, including Wu’s, spending $600 million on the acquisition. He financed the transaction through a $400 million loan from Bitmain and an additional $200 million raised externally.

If he acquired all of the shares that Wu owned, this would bring Zhan’s total stake in the company to at least 56%. Still, the exact percentage of his current stake hasn’t been publicly disclosed, though he officially remains the largest shareholder.

Since the company is still hasn’t been able to IPO, it remains a privately held company of unknown value. Bitmain’s valuation has fluctuated a lot over the years. In 2018, the company raised $400 million in the pre-IPO funding round, which valued it at $12 billion. This would place Micree Zhan’s 36.58% stake in the business at $4.39 billion, which fits the Hurun Report’s estimate.

More recent estimates suggest that its valuation has decreased, though. A report from 2022 indicates a valuation of around $9 billion. This would mean that Micree Zhan’s 56% stake would be worth $5 billion. Still, it is important to note that these figures are speculation and based on available funding data and might not reflect the true value of the company.

Micree Zhan’s Crypto Assets and Stance

Micree Zhan has been a major figure not only in the business and tech worlds but also in the cryptocurrency industry. He is well-known for his technical expertise in Bitcoin mining hardware. While detailed information about his current crypto holdings remains a mystery, there has been some data indicating that he is a major crypto investor.

Many sources today list Micree Zhan as one of the largest Bitcoin holders, though we couldn’t confirm this.

What Can We Learn from Micree Zhan’s Story?

As one of the most successful entrepreneurs in the mining sector and the crypto world in general, Zhan demonstrated an ability to anticipate market shifts and adapt to emerging technologies. He realized that the best way to make a profit in a gold rush is to sell shovels and pickaxes.

Under his leadership, Bitmain quickly became a dominant player in the crypto space, making it an important pillar of the market by providing the mining hardware and software solutions that Bitcoin and other cryptos need. The company became a key player in providing ASIC chip miners, which totally transformed crypto mining thanks to their exponentially improved efficiency and computing power.

Zhan’s strategic vision is what helped his company get to the forefront of the industry, influencing the price trends of Bitcoin and other major cryptocurrencies.

However, Zhan’s story isn’t only an inspiration – it is also a cautionary tale. It speaks about the pitfalls that power struggles can have within a business. His ongoing feud with Bitmain co-founder Jihan Wu led to a protracted legal battle that, at one point, ousted Zhan from the company.

Despite his significant contributions to the crypto community, the internal conflicts destabilized the company’s leadership, leading to a long period of uncertainty for Bitmain. This part of his journey is a reminder of how personal disputes and leadership challenges can hinder even the strongest companies.

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

FAQs

What is Micree Zhan's net worth in 2025?

Micree Zhan's net worth as of 2025 is estimated at $5 billion. This estimate is based on the valuation of Bitmain, which isn't officially confirmed.

Why isn't Micree Zhan at the top of the crypto-rich list today?

Zhan's net worth has declined from previous highs due to internal company conflicts and market changes.

What role did Zhan play in Bitmain's success?

Zhan was the technical mastermind behind Bitmain, responsible for developing the ASIC chips that powered the company's mining hardware.