On this Page:

Joe Lau is one of the visionaries behind Alchemy, the company that developed the software powering thousands of blockchain-based Web3 businesses. Alchemy has become a cornerstone for blockchain companies, providing essential infrastructure for blockchain projects and decentralized applications. As of 2025, Joe Lau’s net worth is estimated at over $2.65 billion.

Lau is most widely recognized for his work on Alchemy, but he has various other major income sources contributing to his net worth. He has worked at several prominent tech companies and has a versatile entrepreneurial career that dates back to his university days.

In this post, we will tell you more about Joe Lau, his work with Alchemy, as well as his major investments.

Breaking Down Joe Lau’s Net Worth in 2025

Alchemy’s most recent investment round in 2022 valued the company at $10.2 billion. Based on this number, Joe Lau’s 26% stake in the business is worth about $1.56 billion today. This is only a rough estimate since Alchemy remains a private company and hasn’t been publicly traded. On top of that, Joe Lau is likely to have made many other profitable investments over the years, so his wealth likely significantly exceeds his stake in Alchemy.

Below, you will find a net worth breakdown of his main sources of income and assets.

| Asset or Income Source | Contribution to Net Worth |

|---|---|

| Alchemy stake | 26% worth ~$2.65 billion |

| Personal crypto investments | Undisclosed |

| Former salaries & business earnings | Undisclosed |

| Total Net Worth | $2.65+ billion |

Joe Lau Net Worth: Early Life and Education

Joe Lau was born in 1990 in Hong Kong, though specific details about his early life and family are relatively private. He grew up with an interest in computer science and technology, which influenced his academic choice. Lau attended Stanford University, earning both a BA and MA in computer science.

While at Stanford, Lau met his business partner, Nikil Viswanathan, with whom he would later co-found Alchemy (as well as other businesses). In a podcast with Emma Casey, Lau would later share the recipe for success, speaking of the time he and Viswanathan were Stanford grads.

“The vast majority of the time, that’s not going to come from a short interaction at a pre-business club; it’s going to come from late-night conversations in the hallway of your dorm, fountain hopping, or in Nikil’s case, meeting Joe Lau through as a TA in CS 145, Stanford’s database class.” – Casey shared about their conversation.

Joe Lau Net Worth: The Stanford Grad Turns Billionaire as Alchemy’s Founder and CTO

Joe Lau’s work history is quite versatile, including roles in both academia and tech. Let’s see what led him to join the billionaires’ circle.

Early Career Days

In 2010, Joe Lau worked as a student researcher and consultant at Stanford’s Hasso Plattner Institute of Design. That same year, he started interning as a software engineer at LinkedIn.

Lau was a CS198 Section Leader at Stanford between 2009 and 2011. In 2011, he started interning as an Associate Technology Manager at Google. He was an exceptional student, which landed him the role of Teaching Assistant at Stanford University in 2011. Soon enough, he became Head Teaching Assistant at the prestigious school before he left in 2013 to join Pinterest as a software engineer.

He left Pinterest in 2014, and two years later, he co-founded Down to Lunch with his Stanford friend, Nikil Viswanathan. While the details haven’t been publicly disclosed, and we don’t know exactly what they invested in, Viswanathan has shared that he and Lao had many attempts at founding a successful business before Alchemy, saying:

“Alchemy was like our 16th pivot. Joe and I lived together out of like a tiny apartment, we worked out of that apartment for five years and we never got into a fight.”

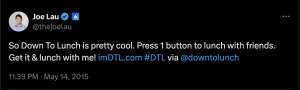

The Short-Lived Success with Down to Launch

Lau and Viswanathan found their initial success with the meetup app Down to Lunch, which topped the Apple Store charts, albeit briefly. They co-founded the app in 2016.

Despite the success of the app, the partners faced two major challenges with Down to Lunch. First, the app experienced technical failures, including server limits and a human error that disrupted sign-ups. Second, they were targeted by what they claim was an anonymous smear campaign falsely accusing the app of being used for human trafficking. This led to user concerns and negative online reviews – and even some school administrators reached out.

Despite the issues, Down to Launch maintained its traction among young users, and the allegations were reportedly debunked by relevant experts and organizations. In 2016, the app’s founders were meeting investors to discuss potential funding. However, there is no public information confirming investments or acquisitions, so no one knows how much money Lau and Viswanathan earned from this venture.

After its peak usage, the app experienced a decline in user engagement and is no longer widely used. In fact, as of now, the official website and app are inactive, which means that the service has been discontinued.

The Founding and Success of Alchemy

Joe Lau is best known as the co-founder and Chief Technology Officer (CTO) of Alchemy. Alchemy is a leading blockchain infrastructure company that powers Web3 applications. He founded it in 2020 alongside his partner Viswanathan, after having spent three years exploring blockchain technology and brainstorming ideas.

The creation of Alchemy was driven by the duo’s recognition of the challenges developers faced in building decentralized applications (dApps). Their goal with this project was to create a platform that makes the development process simple and enables innovators to participate in the blockchain ecosystem.

Under the duo’s leadership, Alchemy earned the title “Microsoft for blockchain”, which paints a pretty clear picture of its pivotal role in the industry.

By 2021, Alchemy had established itself as a major player in the blockchain technology industry, with companies like Dapper Labs and OpenSea relying on its tools to scale their businesses. That same year, the partners launched Alchemy Ventures, a venture capital arm of the business that invests in early-stage blockchain and Web3 startups. Some of their most notable investments through Alchemy Ventures include Sky Mavis, Immutable, and LayerZero Labs.

In his role as CTO at Alchemy, Lau has been instrumental in powering the infrastructure for leading blockchain companies worldwide. The company has expanded tremendously under his reign, expanding its team over tenfold in only a few years.

In February 2022, Lau’s company was valued by private investors at an impressive $10.2 billion. Lau reportedly holds a 26% stake in the business, the same as his partner Viswanathan.

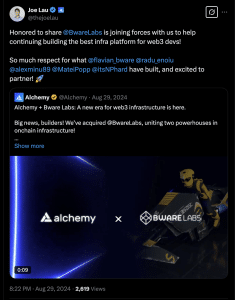

Despite market volatility, Alchemy has continued to grow over the years. In August 2024, the company expanded its operations into Europe by acquiring Bware, a move that added 25% to its staff.

If you are interested to learn about Joe Lau’s perspective on Alchemy’s mission, you might find this interview informative:

Joe Lau’s Crypto Portfolio and Investments

There isn’t much publicly available information about Joe Lau’s personal investments in crypto or assets. Since he is known for his work at Alchemy and lives a highly private life, his focus is set on building and scaling the company rather than sharing details about his investments.

However, considering his involvement in blockchain and Web3 through Alchemy, it is very likely that he has at least a few investments related to crypto, NFTs, and other blockchain-based projects.

While specifics about his personal crypto investments are limited, we did find some public records that confirm his engagement in the crypto space. He is an angel investor with investments in companies like Zerion, Toku, and Dynamic Labs.

Lessons from Joe Lau’s Journey

Joe Lau’s journey from a Stanford graduate to Alchemy’s CTO and majority shareholder is one filled with important lessons.

Alchemy was a result of many pivots and iterations in Lau’s career. He initially explored different tech solutions and worked in varied companies. His ability to adapt to new trends like blockchain technology – and pivot when needed, was essential to the success of Alchemy. This ability to quickly and decisively pivot to emerging trends is essential for entrepreneurs.

Lau’s academic background in computer science and his experiences at Stanford played a major role in shaping his career. This is where he met his future partner, Viswanathan, which highlights the importance of networking and finding the right collaborators in business.

The many failed projects of the duo before Alchemy are a reminder that not everything works out as planned. However, they took these as experiences, lessons that helped shape their future successes.

FAQ

What is Joe Lau's net worth in 2025?

As of 2025, Joe Lau's net worth is estimated at over $1.56 billion. This sum primarily comes from his stake in Alchemy.

What does Joe Lau do in Alchemy?

Joe Lau serves as the Chief Technology Officer (CTO) at Alchemy. In this role, he is responsible for overseeing the development of the company's blockchain infrastructure.

What did Joe Lau do before Alchemy?

Before founding Alchemy, Joe Lau worked at major tech companies, including LinkedIn, Google, and Pinterest. He also co-founded several businesses with Viswanathan, including the famous app Down to Lunch.