Join Our Telegram channel to stay up to date on breaking news coverage

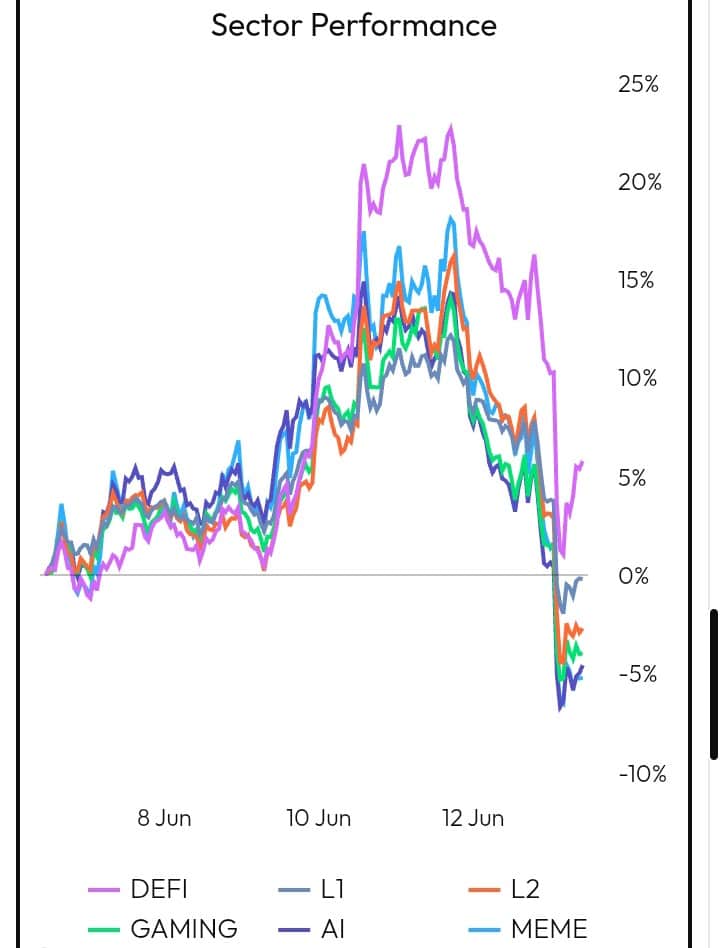

In the relentless currents of the crypto market, actual value emerges not from fleeting speculation but from unwavering progress and strategic partnerships. Every uptick you see isn’t just a number; it’s a testament to projects solidifying their positions and reshaping the digital economy. If you’re tired of the noise and eager to pinpoint where the impactful developments are truly happening, prepare to discover the assets demonstrating real resilience and charting significant growth.

Today in “Top Crypto Gainers,” we pull back the curtain on the pivotal moves driving Balancer (BAL), Centrifuge (CFG), GMX (GMX), and GoMining Token (GOMINING). From pioneering flexible AMM designs to bridging real-world assets with DeFi and from dominant perpetual exchanges to innovative tokenized mining, these are the projects making waves. Dive in to understand the strategic plays and underlying strengths that place them at the forefront of today’s market.

Biggest Crypto Gainers Today – Top List

Balancer is a decentralized automated market maker (AMM). It lets anyone create custom liquidity pools with many assets and varying weights. Centrifuge is a decentralized asset financing protocol. It links real-world assets (RWAs) like invoices and real estate to DeFi liquidity. GMX is a decentralized exchange (DEX) for spot and perpetual trading. It allows direct trades from crypto wallets with low fees. Gomining is a hash power-backed token project aiming to democratize Bitcoin mining access. Let’s dive fully into why these top crypto gainers are surging today.

1. Balancer (BAL)

Balancer is a decentralized automated market maker (AMM). It lets anyone create custom liquidity pools with many assets and varying weights. Unlike typical AMMs that need a 50/50 asset split, Balancer allows pools with up to eight tokens in any ratio. This gives liquidity providers more control over risk and exposure, while also making capital use more efficient. As a key part of DeFi, Balancer also supports smart order routing and dynamic fees to improve trade execution.

The BAL token governs the Balancer ecosystem. Holders vote on proposals, protocol upgrades, and fee models. You can also earn BAL as liquidity mining rewards by being in eligible pools. It is key to the network’s decentralization and long-term health, aligning incentives for users and developers.

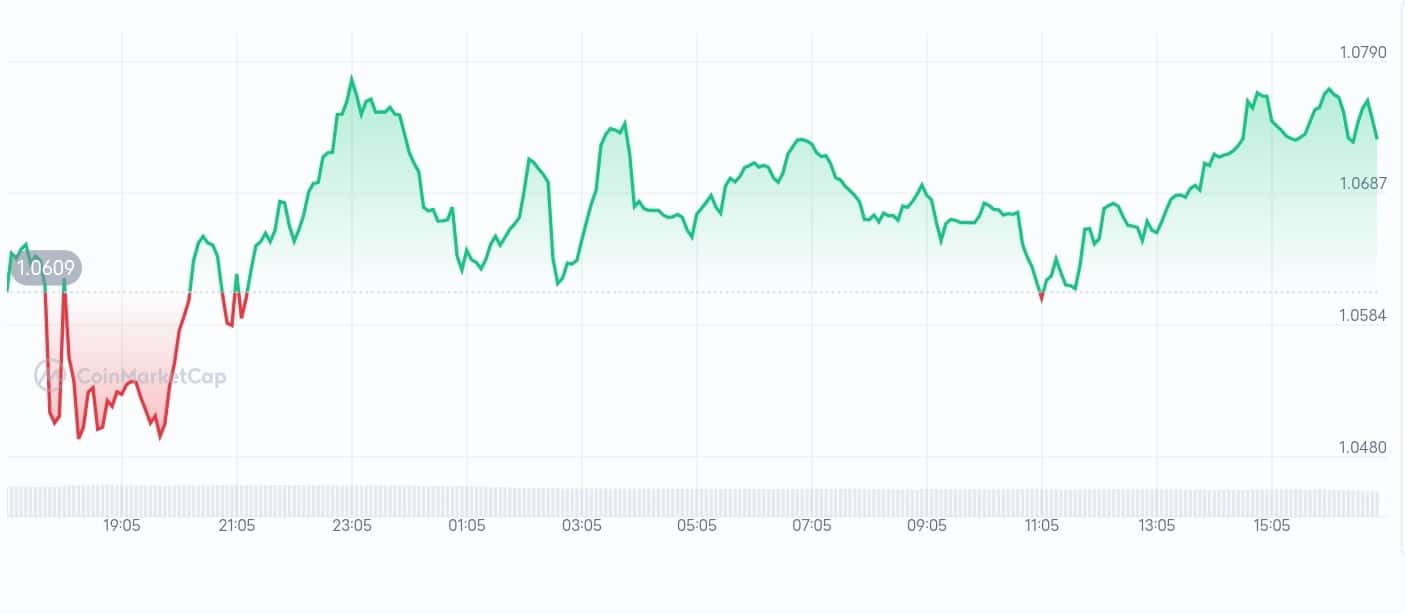

Balancer is trading at $1.078, down 1.42% over the past 24 hours 17 green days in the last 30 days (57%), with today’s range between $0.994 to $1.128, reflecting a short-term correction following recent consolidation at the $1.00 level.

We’re thrilled to welcome @LidoFinance to the Balancer Alliance.

As the largest liquid staking protocol, Lido’s commitment to decentralization and liquidity innovation makes them a natural fit for the Alliance.

Here’s what this means 👇 pic.twitter.com/uRwJfvfXOi

— Balancer (@Balancer) June 9, 2025

Balancer recently announced that Lido Finance has joined the Balancer Alliance. As the largest liquid staking protocol, Lido is officially collaborating with Balancer to enhance DeFi integrations and boost ecosystem synergies.

This partnership highlights Balancer’s strategy to strengthen its position in liquid staking and collaborative DeFi infrastructure. For investors, it signals an expanding network effect—greater integration with leading protocols like Lido can drive higher adoption, TVL growth, and long-term platform value.

2. Centrifuge (CFG)

Centrifuge is a decentralized asset financing protocol. It links real-world assets (RWAs) like invoices and real estate to DeFi liquidity. This lets businesses tokenize tangible assets and get financing through on-chain liquidity pools. This means wider access to capital without middlemen. Centrifuge bridges traditional finance and DeFi, helping unlock yield from assets that were once hard to sell.

The CFG token secures and powers the Centrifuge chain. It’s used for governance, staking, and paying for transaction fees. Holders play a role in protocol upgrades and decision-making, making CFG vital to Centrifuge’s decentralized structure.

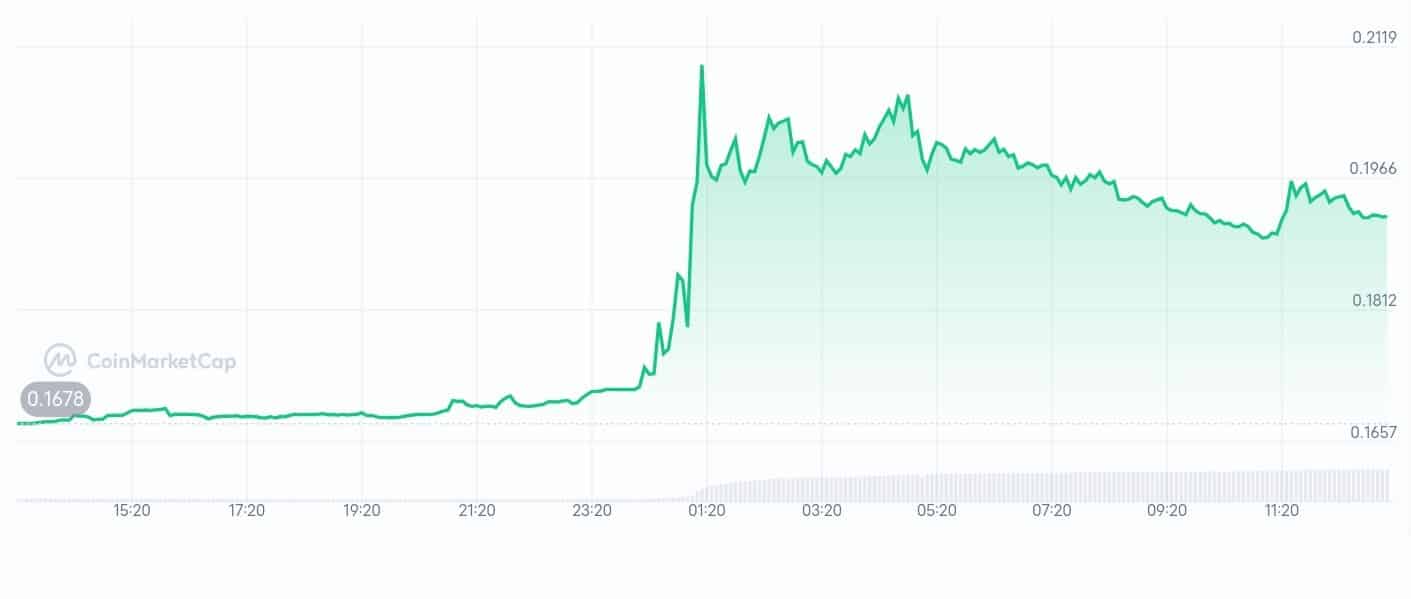

Centrifuge (CFG) sits at $0.1919, up 14.56% today and 6.91% over the last 7 days, trading between $0.1685 to $0.2065 in the past day, showing strong momentum as RWA protocols regain investor attention.

Centrifuge has surpassed $1,000,000,000+ in real-world assets financed.

Fueled by strategy. Forged through relentless execution. Day in, day out.

The CFG Renaissance is here. pic.twitter.com/G9rozcbHj6

— Centrifuge (@centrifuge) June 13, 2025

Centrifuge has just announced that it has surpassed $1 billion in real-world assets financed via its platform, achieved through “strategy” and “relentless execution.” This milestone underlines Centrifuge’s growing impact in bridging traditional finance and DeFi. For investors, hitting the $1 billion mark signals strong traction and trust in the platform’s model, making it a notable contender in the tokenized asset space.

3. SUBBD Token (SUBBD)

SUBBD is an AI-driven platform transforming content monetization within the creator-subscriber space. It combines AI tools with Web3 technology, empowering creators to manage and monetize their content efficiently, bypassing intermediaries. Featuring AI live streams, voice generators, and a 24/7 personal assistant, SUBBD presents a decentralized alternative to platforms like OnlyFans.

The $SUBBD token powers the platform, enabling access to content, offering tips, and facilitating creator requests. Currently in presale at $0.055675, having raised over $664,000, the token provides exclusive benefits, VIP access, and a 20% annual return through staking. A tenth of the total supply is designated for airdrops and rewards.

Pay with crypto to unlock the heat!

Most platforms don’t offer this, we do 😏♥️

The future is digital currencies, the future is $SUBBD 💰 pic.twitter.com/BqjewB6OV4

— SUBBD (@SUBBDofficial) June 12, 2025

SUBBD has garnered attention on prominent cryptocurrency platforms, including Cryptonomist, Coinspeaker, Bitcoinist, 99Bitcoins, and TradingView via NewsBTC, underscoring its growing presence in the AI and Web3 domains. The platform’s expanding influence is evident, with the launch of the AI Personal Assistant enhancing creator-fan engagement and support. As AI and Web3 reshape digital content, SUBBD is at the forefront of the future of creator earnings.

4. GMX (GMX)

GMX is a decentralized exchange (DEX) for spot and perpetual trading. It allows direct trades from crypto wallets with low fees. Running on Arbitrum and Avalanche, GMX offers smooth, leveraged trading without central control. Its “real yield,” generated from user fees, makes it popular with DeFi traders.

The GMX token is used for governance and staking, letting users earn a share of trading fees from the platform. Stakers also receive esGMX (escrowed GMX) and other incentives, creating multiple layers of passive income for long-term holders.

GMX is priced around $15.08, rising 2.84% today, 15 green days in the last 30 days (50%), with a range of $14.61 to $15.33 in the past day, holding firm as a top DeFi perpetual trading venue amid choppy market conditions.

GMX takes pride in being at the forefront of innovation on the leading decentralised Ethereum Layer-2. And we are genuinely grateful for the recognition. https://t.co/gGlcSmONar

— GMX 🫐 (@GMX_IO) June 9, 2025

GMX recently kicked off Week 1 of its Chain Reaction series, spotlighting itself as one of Arbitrum’s pioneering apps. The tweet highlights that GMX has achieved nearly $300 billion in lifetime trading volume.

GMX reinforces its reputation as a leading, trusted platform on Arbitrum by underscoring its massive trading volume. This metric emphasizes stability and vigorous network activity for investors, signaling that GMX remains a heavyweight in DeFi worth paying attention to.

5. GoMining (GOMINING)

Gomining, last on the list of today’s top crypto gainers. It is a hash power-backed token project aiming to democratize Bitcoin mining access. Tokenizing mining capacity enables users to own and profit from mining operations without managing physical hardware. Gomining simplifies participation in crypto mining through an eco-friendly, scalable infrastructure.

The GOMINING token represents digital ownership of real mining power. Holders earn BTC rewards proportionate to their staked tokens and can increase efficiency by upgrading their hash rate. It blends DeFi principles with traditional mining rewards.

GoMining Token (GOMINING) is at $0.4114, up 1.30% over the past day. Trading above the 200-day simple moving average, with intraday movement between $0.4066 to $0.4162, reflecting steady demand for hash power-backed yield despite broader selling pressure.

Over the last two cycles, the GoMining community voted to permanently burn 122K $GOMINING.

The burn is still active. Supply keeps shrinking. Want to influence the next cycle’s burn rate? Then vote 🔥 pic.twitter.com/jdaviMk3iK

— GoMining (@GoMining_token) June 12, 2025

GoMining recently announced that its community has voted to permanently burn 122,000 $GOMINING tokens over the last two reward cycles. This ongoing burn mechanism continues actively, steadily reducing the overall token supply.

By shrinking the token supply, GoMining boosts scarcity and potential token value over time. For investors, this shows proactive governance and community-driven tokenomics—factors that could improve price stability and long-term growth prospects.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage