Join Our Telegram channel to stay up to date on breaking news coverage

The popular Bitcoin 2025 conference in Las Vegas attracted 35,000 people, many of them were prominent Republicans who combined their libertarian beliefs with political fervor. This combination of grassroots political influence and cryptocurrency culture is significant as Bitcoin becomes more widely accepted in the financial and policy spheres.

Despite costing less than $1, some of the most promising startups are subtly driving significant advancements in blockchain infrastructure, DeFi, and decentralized storage. Whilst they may have modest prices, cryptocurrencies like Kava, Frax, and BitTorrent have lofty goals. What makes them stand out is their practical applications, business alliances, and long-term outlook.

5 Best Cheap Cryptocurrencies to Buy Under 1 Dollar

Are you trying to find affordable high-potential cryptocurrencies? Finding inexpensive currencies that genuinely provide genuine utility, robust communities, and room for future growth might be like trying to find a needle in a haystack among the market’s thousands of digital assets. This guide presents 5 best cheap cryptocurrencies to buy under 1 dollar.

1. Kava (KAVA)

Kava was founded to address a major DeFi industry issue: disjointed lending procedures. Although MakerDAO and other platforms concentrate on a single commodity (think Ethereum), Kava’s stablecoin USDX allows users to collateralize several major cryptocurrencies across chains, including Bitcoin, XRP, and a variety of ERC-20s.

Ankr spotlighted Kava’s Ethereum–Cosmos bridge activities earlier in February 2025. Meanwhile, Kava has created a money market (HARD Protocol) that showcases institutional-level lending possibilities by collaborating with industry titans like Huobi DeFi Labs. It’s generating significant traction, performing extremely low-cost transactions (~$0.0001 charge), and connecting to Cosmos’ extensive network of over 30 chains worth over $60 billion. It has over $625 million in assets on-chain, 120 million KAVA staked, and over $2.5 billion bridged via IBC.

AI is coming for your DAO, are you ready?

Join us Friday 6/13 for a live discussion on how AI is transforming decentralized governance! 🧠

🎙️ Featuring @SerhiiKrauch (CEO, @DexeNetwork), Raghu (DevRel, Kava), and host @jbawsa.

📅 Set your reminders ⤵️ https://t.co/SMeqI54IAB

— Kava (@KAVA_CHAIN) June 11, 2025

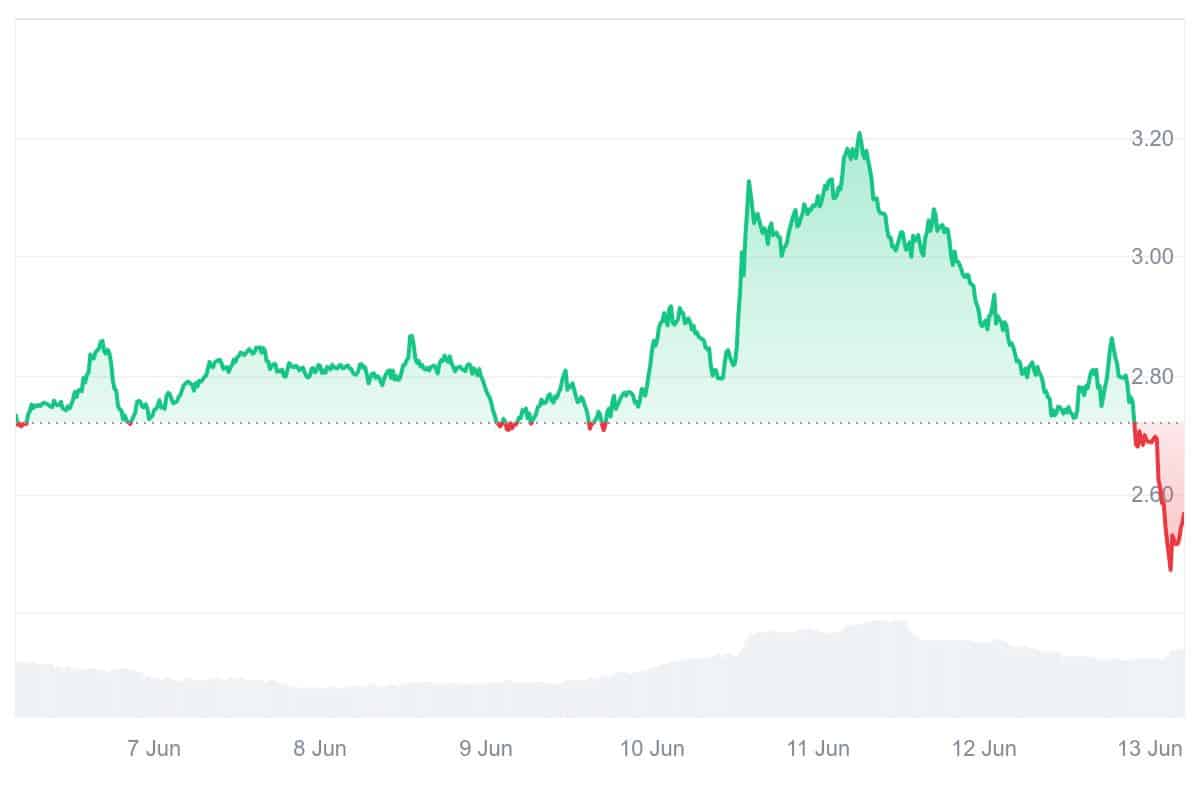

KAVA is currently trading at about $0.42, below its peak of $9 in early 2021 during the DeFi spike. Depending on the overall crypto rhythm, economists predict it may rise to between $0.69 and $0.91 by 2025, with long-term forecasts ranging from $0.61 to $1.39 by 2030. For a more aggressive development scenario, some bullish voices even predict $3–$4 by the decade’s end.

Kava will present an AMA on X (Twitter) today, June 13, 2025, to discuss how AI will change DAO governance. They recently reached 100,000 users, which comes right after they collaborated with DeXe, which complemented Kava AI’s growth. This action also signals the incorporation of decentralized AI into DeFi; Kava introduced “DeepSeek R1,” which competes with GPT-4 in open-source decentralization.

2. Frax (FRAX)

Frax is a “fractional-algorithmic” stablecoin that was created to address a particular need in the stablecoin market by providing capital efficiency and stability in a decentralized manner. Frax combines the most significant features of both fully-backed stablecoins, such as USDC, which requires a dollar in reserve for each token, and algorithmic stablecoins, such as TerraUST, which have traditionally failed.

The protocol lowers its collateral ratio and mints more via FXS when demand for FRAX increases; when demand declines, it raises collateral to bolster confidence. This adaptive “iron rule,” which states that 1 FRAX is always equal to $1, is implemented by intelligent algorithmic market operations (AMOs), such as lending through Compound or adding USDC-backed FRAX to Curve pools.

1/ Stablecoins just went mainstream – and Frax is at the center of it.

Here’s what happened at the world’s largest crypto conference, and why policymakers are backing the future of digital dollars 🧵 pic.twitter.com/XKHKOb17ku

— Frax Finance ¤⛓️¤ (@fraxfinance) June 1, 2025

Due to previous stress testing and structural changes, FRAX has experienced moderate volatility throughout the year, with its 52-week trading band ranging from $0.84 to $3,178. Its never-losing peg while cycling through extremes shows how reliable its approach has been compared to other algorithmic stablecoins.

The team has recently started implementing Frax V2, which includes high-yield farming (formerly up to 79% APR, currently about 50%), new bonds, virtual AMMs, and other collateral types. Partnerships provide liquidity and utility across DeFi through implementations into Uniswap, Curve, Compound, and cross-chain bridges.

3. BitTorrent (BTT)

BitTorrent addresses enduring issues like slow downloads and fading files over time by introducing blockchain’s incentive power to the venerable peer-to-peer file-sharing protocol. By rewarding users with tokens for uploading and sharing bandwidth, BTT transforms kindness into material gains, speeding up downloads and promoting more reliable, plentiful peer-to-peer sharing as one of the 5 best cheap cryptocurrencies to buy under 1 dollar.

It supports the BTFS (BitTorrent File System), which encourages decentralized storage, and it powers BitTorrent Speed, rewarding users who seed more aggressively. Additionally, BTT is used for gas and staking in BitTorrent Chain (BTTC), an EVM-compatible layer-2 system constructed using TRON that offers ultra-low costs of less than $0.01 and high throughput (7,000 TPS). This combination of file sharing, storage, and blockchain scalability is not only new; it is a potent trifecta that is advancing decentralized infrastructure.

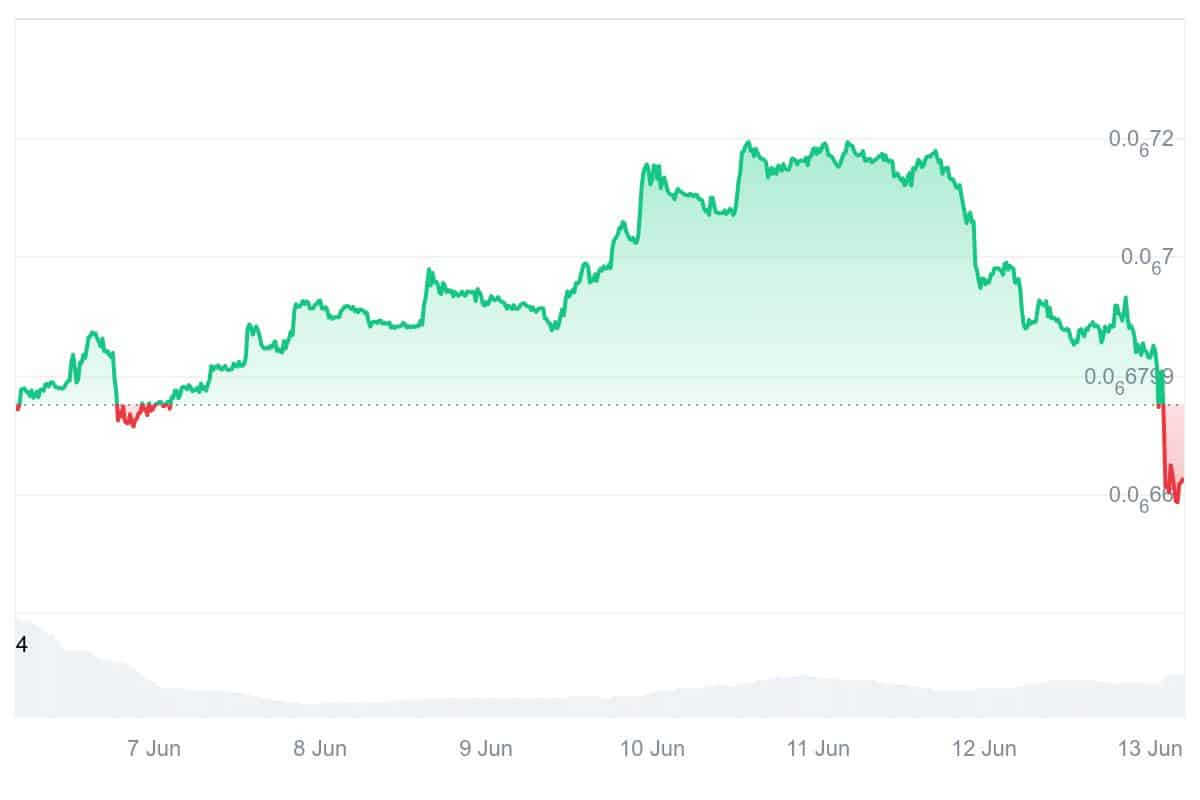

Currently, BTT is trading at around $0.000000667, with a market capitalization of under $644 million and a 24-hour trading volume of almost $21.5 million. It is still solidly in the top tier of ultra-low-price tokens, with about 968 trillion tokens in circulation out of a maximum of 990 trillion, amid a steep decline of about 4.6% in the last day and nearly 19% this month.

📖BTTC 2.0 Will Start a New Chapter in Open Governance.

It will achieve open governance and fair participation through its pluggable governance architecture, utilizing validator.

Set to enable accountable and inclusive cross-chain ecosystems.#BitTorrent #BTTC #BTT #Web3 pic.twitter.com/QRZLKl76Y2

— BitTorrent (@BitTorrent) June 12, 2025

Recent events demonstrate its involvement with TRON’s lending platform, JustLendDAO, where BTT deposits have surpassed $5.5 million, indicating rising DeFi integration. Despite recent legal attention, including a 2022 SEC action against Justin Sun and TRON for token sales, BitTorrent Inc. (formerly Rainberry) upholds its original objective by emphasizing decentralized content sharing.

4. Core DAO (CORE)

Core DAO tackles the “trilemma” of simultaneously providing security, decentralization, and scalability, which is one of blockchain’s most difficult problems. While they excel in two of these, most layer-1 chains compromise the third. Combining Delegated Proof-of-Stake with Proof-of-Work mining from Bitcoin, its Satoshi Plus consensus does this while fully supporting EVM and Turing-complete smart contracts.

CORE is unique because it combines Ethereum-style programmability and throughput with decentralization at the Bitcoin level. Thanks to its creative Satoshi Plus design, the network is resistant to centralization and prepared for DeFi, NFTs, and other initiatives. It also enables miners and stakers to earn and contribute.

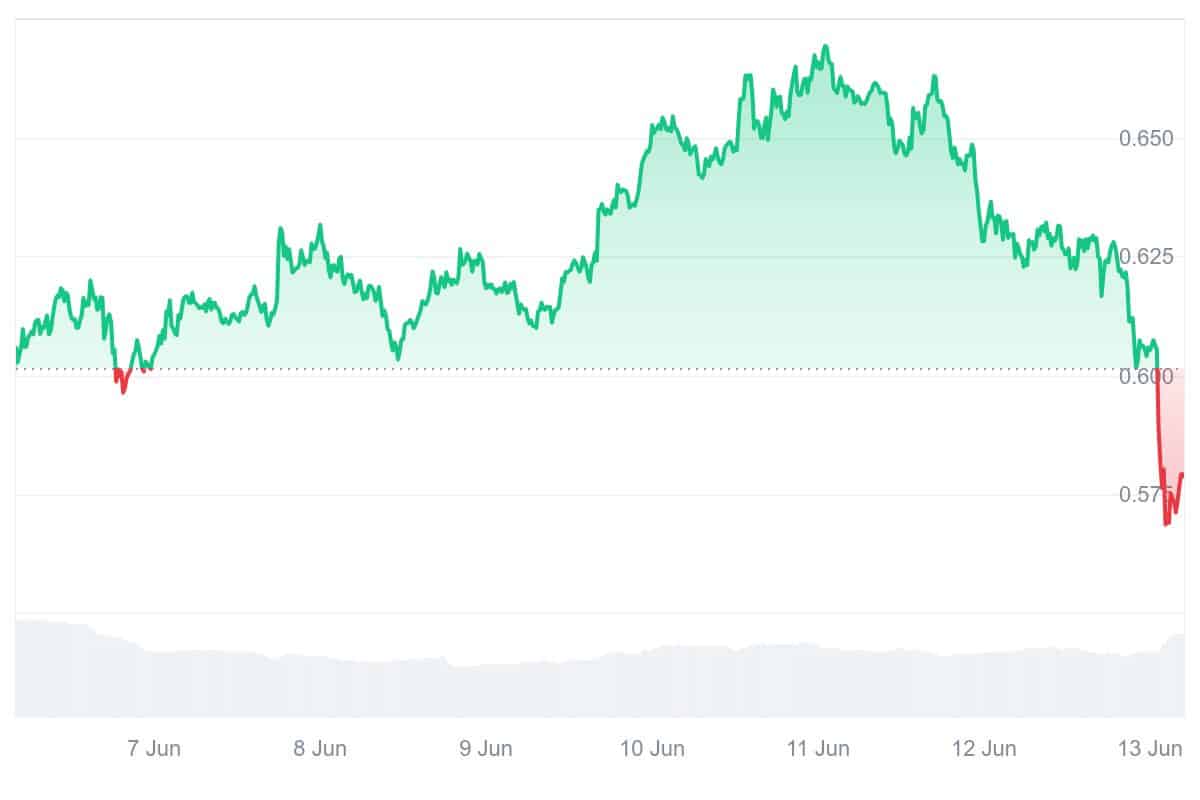

CORE’s recovery from its cycle low ($0.35) to a high of $0.89 in May indicates periods of rekindled activity and hope. However, technical indicators show generally negative sentiment, suggesting the possibility of volatility swings, and the Fear & Greed Index is in the “Greed” zone (71).

The world’s first yield-bearing Bitcoin ETP was notably released on the Frankfurt exchange through a partnership with Valour Inc. and DeFi Technologies. This product, which is supported by staking on the Core network, offered German investors a dividend of approximately 5.65%. In addition, the same group created a validator node with a stake of around 1,500 Bitcoin, demonstrating institutional confidence and real-world usage.

5. Solaxy (SOLX)

Prepare to go on an exciting adventure with Solaxy, a Solana Layer-2 presale creating a lot of buzz. Imagine enjoying eye-popping staking profits and early-stage potential while utilizing Solana’s lightning-fast network without the dreaded congestion setbacks. It’s easy to understand why investors are quickly sizing up the hype driving today’s presale enthusiasm.

Over $47 million was raised during SOLX‘s presale, demonstrating the high confidence level in the company’s plan to handle Solana’s scaling issues by handling transactions off-chain and combining them back into the mainnet. SOLX provides an exciting entry point with significant upside potential once it launches on major exchanges, all for just $0.00167 per token.

What is the lesson, then? In a presale that has already surpassed $47 million, Solaxy provides an exciting combination of enormous staking incentives, cross-chain ambitions, and presale access to a full-scale Layer-2 scaling tool. SOLX‘s presale could be the perfect time to watch if Solana really needs the next level of performance and you’re prepared for high-risk, high-reward play.

Learn More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage