Join Our Telegram channel to stay up to date on breaking news coverage

The 50-day simple moving average for Bitcoin has risen to a record high, suggesting a bullish outlook for the market. However, the 50-day SMA’s diminishing gap with the spot price points to a possible price correction as purchasing pressure seems to be waning.

Cryptocurrencies with values under $1 can present some of the most exciting development prospects in the digital asset market, but they can also arouse suspicion and intrigue. These inexpensive tokens can be a wise place for investors to start if they want exposure to worthy initiatives without the high cost, particularly if they are part of networks resolving pressing issues.

6 Best Cheap Cryptos to Buy Now Under 1 Dollar

Do you want to know which inexpensive coins have the potential to increase in value and are supported by strong fundamentals? Or are you trying to diversify your holdings without going over budget? The 6 best cheap cryptos to buy now under 1 dollar are covered in this guide: Jupiter, Tezos, eCash, and Creditcoin. These aren’t just inexpensive currencies; they’re a part of ecosystems fostering innovation in fields like on-chain governance, data privacy, decentralized finance, and cross-border payments.

1. Creditcoin (CTC)

One of the most intriguing areas of cryptocurrency is being tackled by Creditcoin: real-world credit. By enabling transparent, borderless lending and putting credit history on-chain, it acts as a bridge, bringing together lenders and borrowers in historically underserved regions, especially those in emerging nations.

Last year, Creditcoin formed a strategic partnership with Spacecoin, SUI Layer-1, and Walrus’s decentralized storage project, demonstrating an expanding ecosystem that spans data, infrastructure, and satellite blockchains. According to Messari statistics, the Walrus decentralized storage system saw a $140 million private token sale in March 2025, demonstrating both strategic and financial support.

We’re not aiming for a few million users. We’re going after hundreds of millions. More importantly, they are people who need it, such as those in remote regions of the world.

Creditcoin’s roadmap is bold: EVM-compatibility, Universal Smart Contracts, and eventually powering… pic.twitter.com/0QPy56xIl3

— Creditcoin 🐧 (@Creditcoin) June 3, 2025

CTC has increased by over 7% in the last year, outpacing about 65% of its cryptocurrency rivals. However, it is still trading at a sharp 92% below its peak of $8.44 in March 2021 and above its low of $0.13 in October 2023.

In addition to collaborations, Creditcoin introduced a native Credit Wallet, its SwapCTC bridging tool, and a mainnet snapshot update, which improved network access, ecosystem strength, and usability.

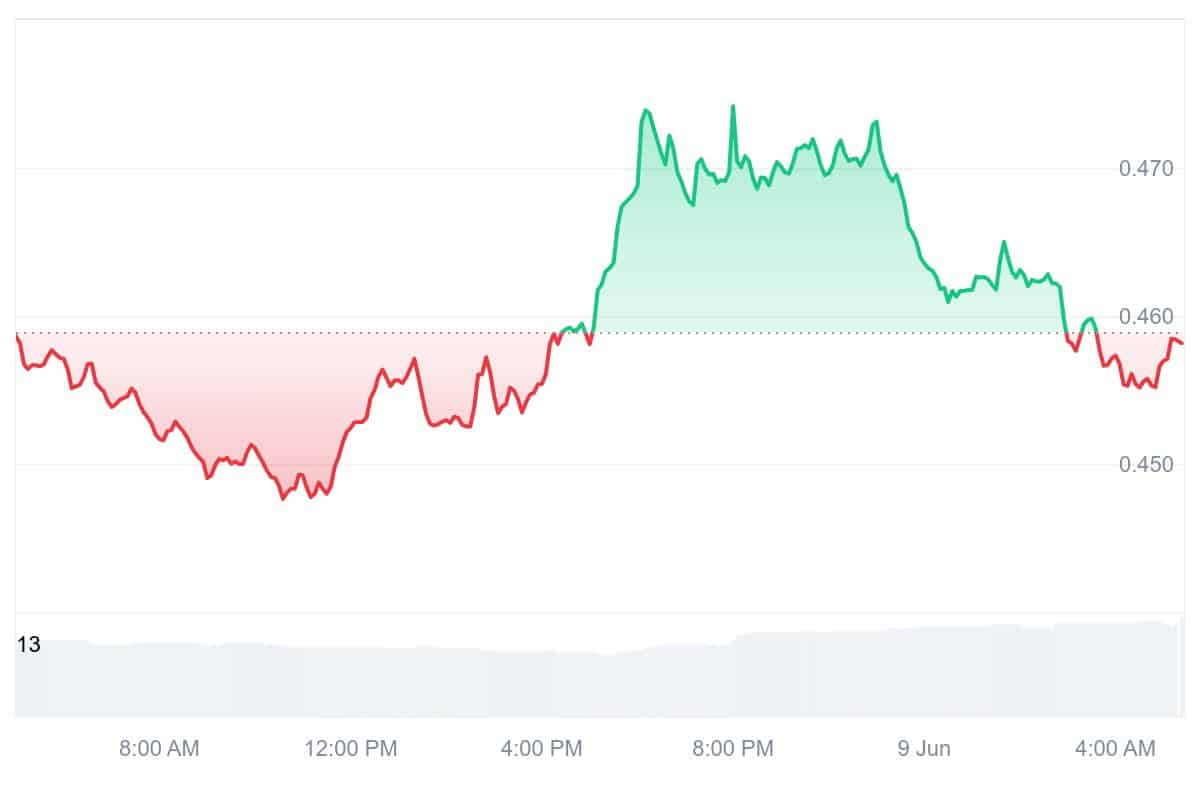

2. eCash (XEC)

By combining Proof-of-Work with the Avalanche consensus mechanism, eCash addresses the problems with Bitcoin, including its high fees, sluggish confirmation times, and scalability troubles. The final effect is quick, inexpensive transactions that can power regular payments, point-of-sale systems, mobile wallets, NFTs, and microtransactions in an easy-to-use format.

Although trading remained uninterrupted, Binance momentarily halted deposits and withdrawals in May 2025 due to a significant hardfork/upgrade at block 1,747,310,400.

XEC is trading at about $0.0000216, with a 24-hour volume of about $6.3 million across 36 exchanges. With 53% of days being “green” and a 30-day volatility of 5.75%, the sentiment suggests cautious optimism with a grain of caution.

In March 2025, CryptoAutos made headlines by accepting XEC for the purchase of luxury cars. This practical implementation shows the real-world potential of eCash by bringing usefulness to what was primarily a digital tool.

3. Jupiter (JUP)

Jupiter’s extensive and dynamic toolkit makes it distinct, which includes limit orders, dollar-cost averaging, perpetual futures, a launchpad, cross-chain bridging, and basic swaps. In the background, Jupiter’s routing engine (“Metis” into the next-generation “Juno”) gains knowledge from every trade, reducing slippage and enhancing quotations with each exchange.

The foundation of its cryptocurrency, JUP, is a governance-first approach. By locking up about 204 million tokens until 2030, the founder (“Meow”) established trust and long-term alignment as one of the 6 best cheap cryptos to buy now under 1 dollar.

The mindshare of Jupiter creators is becoming enormous.

An entire network has formed around the community across Twitter

And everyone is naturally supporting each-other pic.twitter.com/TPs5uQfb0i

— JupiterDAO (@jup_dao) June 9, 2025

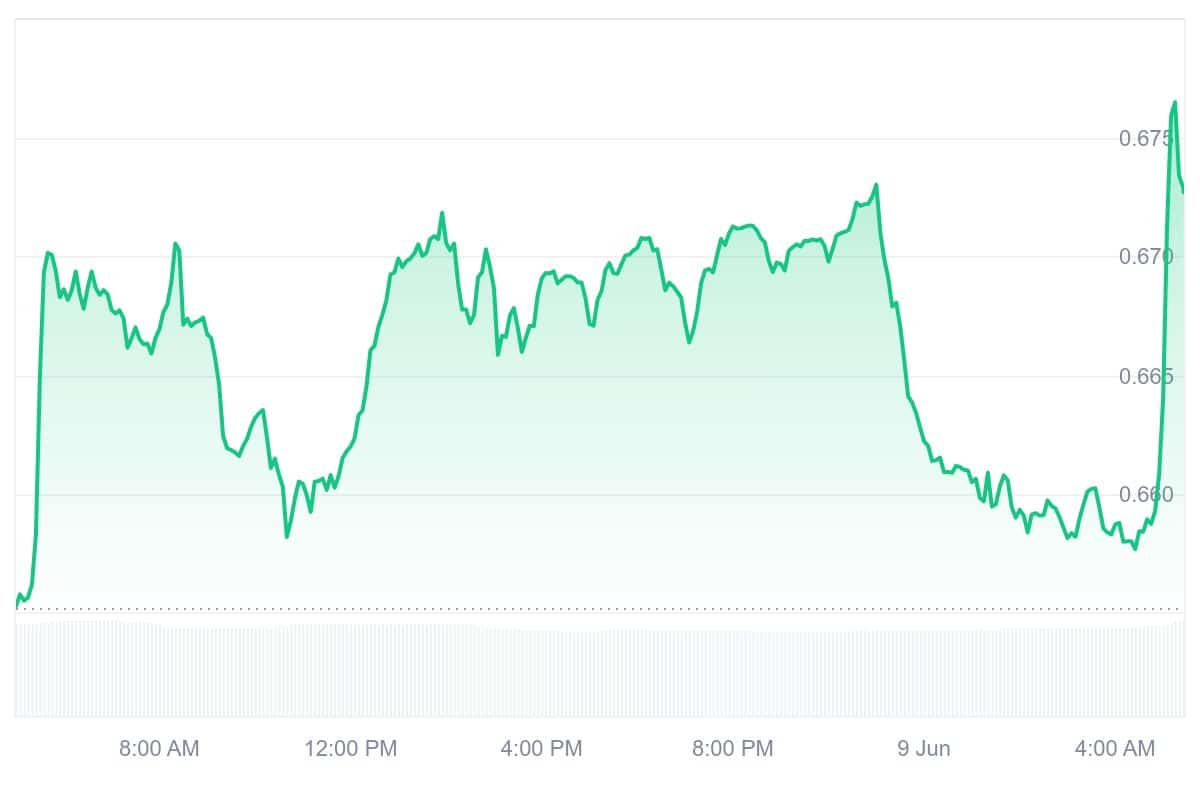

After falling roughly 53–55% from its peak of $1.84 in April 2024, the token recovered from its cycle low of $0.30 in April 2025 and is currently trading close to $0.65, indicating resiliency and renewed interest.

Recent achievements demonstrate Jupiter’s innovative streak: the launch of Jupiter Lend, fueled by Instadapp’s Fluid architecture, brought lending and borrowing to Solana and caused a 17% increase in JUP. Furthermore, JUP stakeholders have exclusive access to a PayFi ecosystem centered on real-world payments thanks to the Huma Finance presale collaboration, which unlocks actual asset utility and echoes true DeFi value.

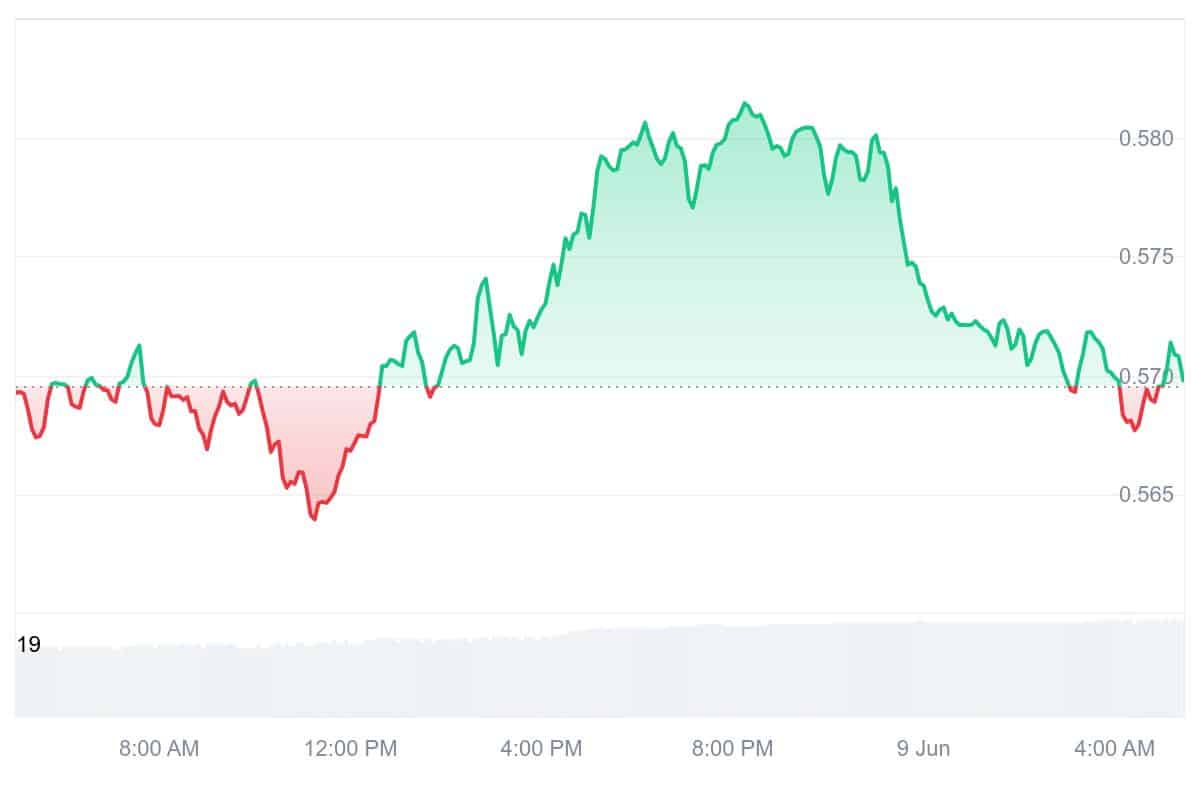

4. Tezos (XTZ)

Tezos primarily addresses the issue of blockchain sluggishness and dangerous hard forks by providing a self-correcting on-chain governance system. In place of acrimonious splits, protocol improvements can be proposed and voted on directly by XTZ holders, known as bakers.

The “Tezos X” modu-lithic redesign, which combines monolithic and modular architecture, was unveiled in mid-2024 with the goal of sub-second latency and up to one million TPS. About 5,000 smart contract deployments on L1 were documented in Q3 2024, with over 600 occurring on Etherlink, indicating a shift in developer behavior toward Layer-2 rollups.

Can the blockchain trilemma—balancing decentralization, security, and throughput—be solved?

Tezos co-founder @ArthurB explains how rollup solutions like @etherlink and Data Availability Sampling can resolve it. pic.twitter.com/h5aGVszXe8

— Tezos (@tezos) June 5, 2025

The market seems to be in a consolidation phase since the price movement is settling between $0.49 and $0.70. Upgrades or ecosystem expansion might push it higher, while bearish sentiment or more general crypto falls could make it back to the cycle low.

The partnership between Tezos and Xalts in late 2024 positioned Tezos as a formidable competitor in enterprise-grade blockchain applications by advancing real-world asset tokenization through smart-rollups and JavaScript Layer-2s.

5. Solaxy (SOLX)

Imagine the Solana blockchain operating at maximum capacity, free from choking under memecoin traffic, transaction slowdowns, and bottlenecks. That is the goal of Layer-2 scaling behemoth Solaxy, thrilling investors as its presale pushes past tens of millions of dollars in investment.

That feeling when you forget to stake your tokens…. 😭

That bag could’ve doubled! 🔥 pic.twitter.com/FJyRnmOMkI

— SOLAXY (@SOLAXYTOKEN) June 8, 2025

With its continuing presale raising over $44 million, SOLX has investors giddy, and rightfully so. At a current price of about $0.00165, its token, SOLX, provides an early entry point that appeals to both cryptocurrency fans and serious yield seekers.

SOLX‘s presale isn’t simply another hype tactic; it’s a strategic attempt to address scalability, one of Solana’s weaker points while enticing large yields and tokenomics. SOLX’s presale is a high-energy cryptocurrency moment, full of upside potential but also containing some uncertainty, whether you’re betting on Layer 2 breakthroughs or chasing yield.

6. XDC Network (XDC)

XDC Network uniquely combines the advantages of private and public blockchains. Its XDPoS consensus facilitates quick, inexpensive transactions and strong scalability while providing enterprise-friendly compliance, including mandated KYC on nodes.

A significant turning point was reached in late 2024 when XDC teamed up with Archax, the UK’s first FCA-regulated digital securities exchange. Thanks to this partnership, XDC now offers on-chain access to real-world instruments through tokenized money-market fund tokens from industry titans like Abrdn, State Street, Fidelity, and BlackRock.

XDC leads the charge as the #1 Gas Token built on @LayerZero_Core with a $2.31B FDV!

With #LAYERZERO powering seamless native expansion, #XDC can unlock broader utility, liquidity, and composability — XDC is now interoperable across chains without compromising security or… https://t.co/F4FWRI71QZ pic.twitter.com/eXOnojZCgz— XDC Network (@XDC_Network_) June 6, 2025

With a market value of around $1 billion and daily volumes of about $30 million (or 3% of its market capitalization), XDC is now trading at about $0.061. Although the technical sentiment is still slightly bearish, high volatility (9%) and a Fear & Greed Index of 62 (Greed) suggest that bullish sentiment is rising.

Following the Model Law on Electronic Transferable Records (MLETR), XDC has also launched the XDC Trade Network, working with organizations such as Singapore’s IMDA and Zanzibar to standardize trade paperwork.

Learn More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage