Join Our Telegram channel to stay up to date on breaking news coverage

The crypto market showed only modest movement over the weekend, with Bitcoin (BTC) leading a cautious rebound. The shift came after U.S. President Donald Trump extended trade negotiation deadlines with the European Union, signaling a period of policy uncertainty. Despite the lack of major gains, this development helped stabilize investor sentiment, prompting renewed interest in digital assets.

Attention has turned to select token showing potential for upward momentum. With market sentiment tilting toward “Greed,” investors are actively scouting for altcoins and emerging tokens that could benefit from increased liquidity and trading activity.

This article explores the best crypto to buy right now, highlighting projects with solid fundamentals and favorable market indicators.

Best Crypto to Buy Right Now

Chiliz (CHZ) is trading at $0.04352, marking a 2.44% uptick in the past 24 hours. Solaxy has surpassed $41 million, with 20 days remaining in its ongoing funding round. NEAR Protocol, a Layer 1 blockchain network, is priced at $2.82 and has posted a 5.39% gain within the day.

1. NEAR Protocol (NEAR)

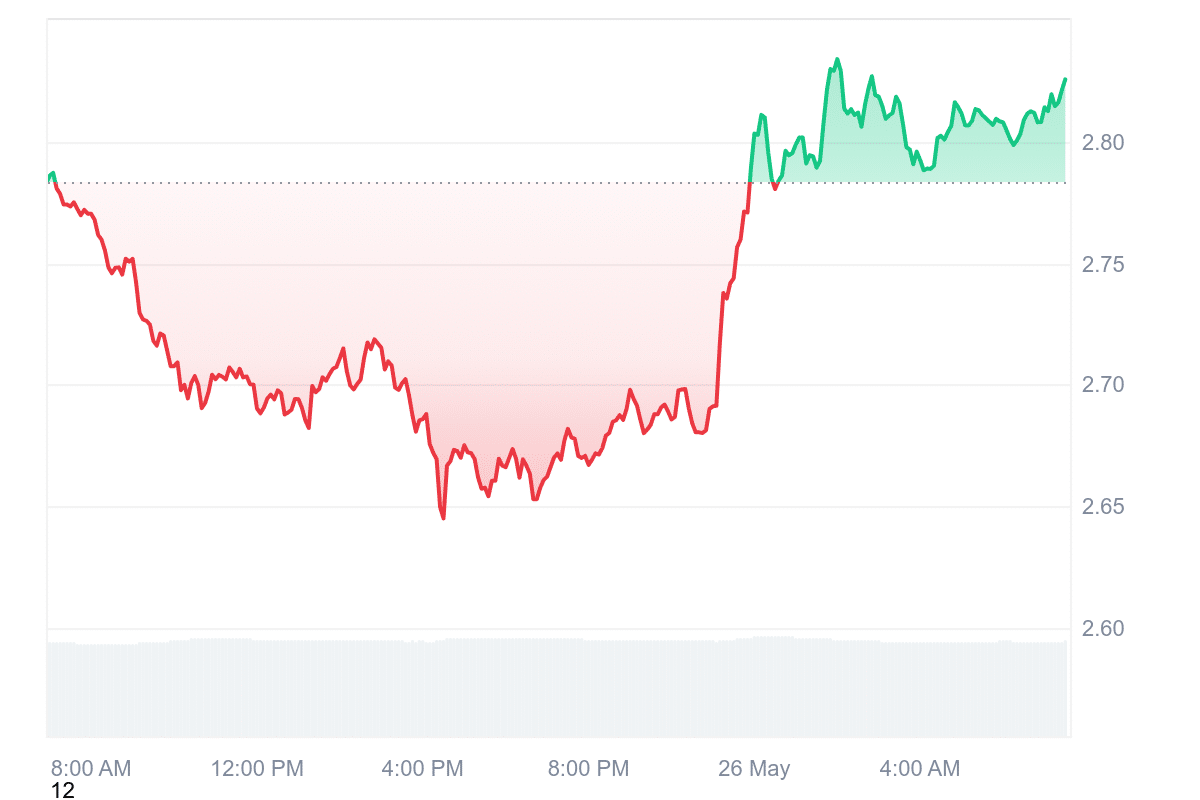

NEAR Protocol, a Layer 1 blockchain platform, currently trades at $2.82 with an intraday surge of 5.39%. The market sentiment toward NEAR appears neutral, supported by technical indicators and broader market signals. The 14-day Relative Strength Index (RSI) stands at 57.86, which suggests the asset is neither overbought nor oversold. This implies that the price could move sideways in the near term without a strong trend in either direction.

Further, NEAR shows a healthy 24-hour trading volume to market cap ratio of 0.1446. The Fear & Greed Index currently reads 73, placing market sentiment in the “Greed” zone. While this does not directly reflect the long-term potential of NEAR, it can suggest heightened interest and optimism among investors, possibly driven by broader market trends or short-term speculation.

The protocol distinguishes itself through its emphasis on scalability and user experience. At its core, NEAR employs sharding. This helps the platform handle more activity without sacrificing speed or performance. Such a structure makes NEAR suitable for hosting decentralized applications (dApps) and supports a growing ecosystem of developers and users.

NEAR Protocol remains technically robust and actively developed. Current market conditions reflect a neutral short-term outlook, with indicators pointing to moderate trading activity and cautious investor sentiment.

2. Chiliz (CHZ)

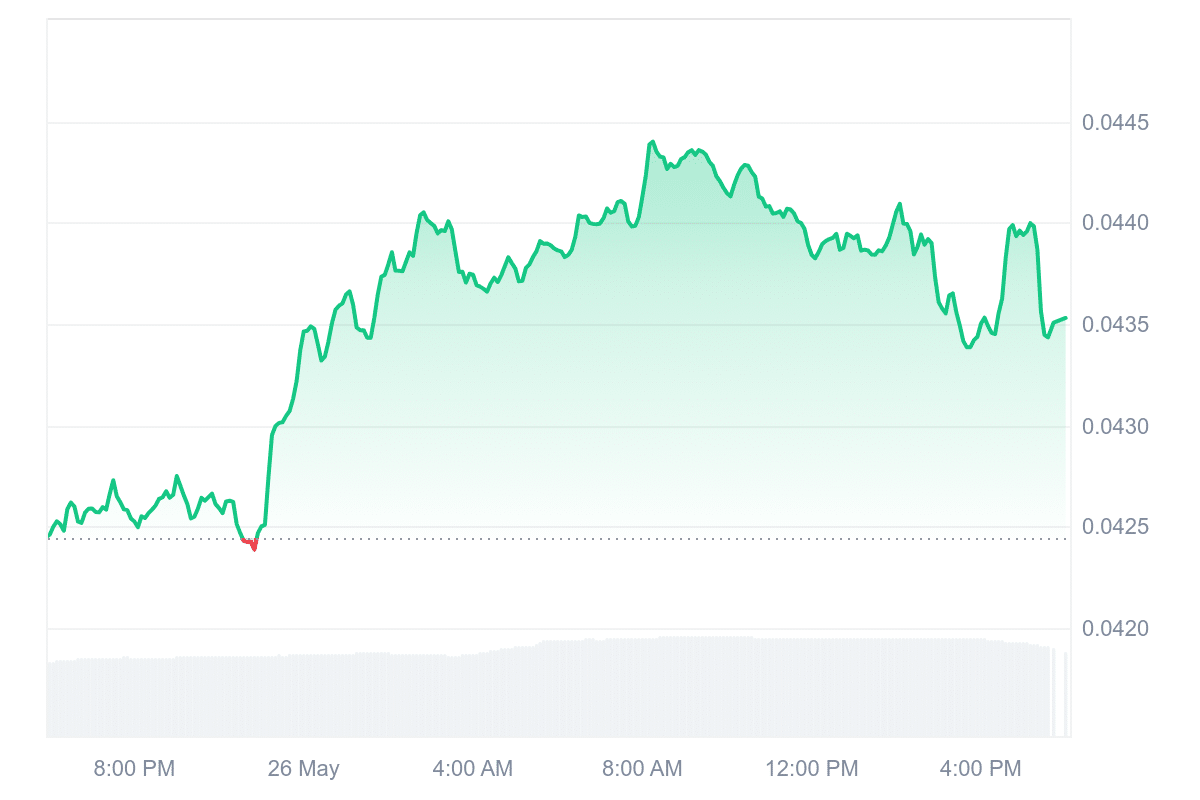

Chiliz (CHZ), a blockchain-based digital currency tailored for sports and entertainment, is currently priced at $0.04352. Over the last 24 hours, it has experienced a modest 2.44% increase. Trading volume has seen a more significant surge of 12.84%, reaching $33.47 million. This rise in volume often signals heightened investor activity, though it doesn’t necessarily indicate a sustained trend.

Market sentiment surrounding Chiliz remains neutral, with mixed signals from various indicators. The Fear & Greed Index, which highlights overall investor emotion in the crypto market, currently reads 73. This score falls into the “Greed” category, suggesting that while participants are optimistic, the market might be overheated. Historically, such sentiment can precede corrections, but it isn’t a definitive predictor.

Technical analysis reinforces the neutral outlook. The 14-day Relative Strength Index (RSI), a tool used to measure the speed and change of price movements, is at 42.56. This value sits within the typical range (30–70), indicating neither overbought nor oversold conditions.

If you're a developer, creator, or Web3 builder looking for real rewards, listen up.

Introducing Chiliz Greenhouse ✨ the new playground where YOU get paid in $CHZ for building, creating, and sharing Chiliz Chain. 🚀

Let's dive in. 👇 pic.twitter.com/Zy32pJNZvs

— Chiliz – The Sports Blockchain (@Chiliz) May 24, 2025

Beyond market data, Chiliz is also expanding its ecosystem with the launch of Chiliz Greenhouse. This initiative acts as a collaborative space for developers, writers, and entrepreneurs who want to build projects on the Chiliz Chain. Participants receive rewards in CHZ for their contributions, creating an incentive-driven environment that aims to foster innovation within the Chiliz network. It caters to a range of activities, from application development to content creation.

3. Chainlink (LINK)

Chainlink’s Proof of Reserve (PoR) has been integrated into Solv Protocol, marking a notable step toward increasing transparency and trust in decentralized finance products targeting institutional investors. The integration spans Solv Protocol, SolvBTC, and xSolvBTC, enabling real-time on-chain verification of asset backing across these offerings.

The integration comes as demand grows for real-world asset (RWA) tokenization and Bitcoin-based yield products. Institutional interest in these areas is increasing, but adoption hinges on robust infrastructure and trust mechanisms, which this partnership addresses.

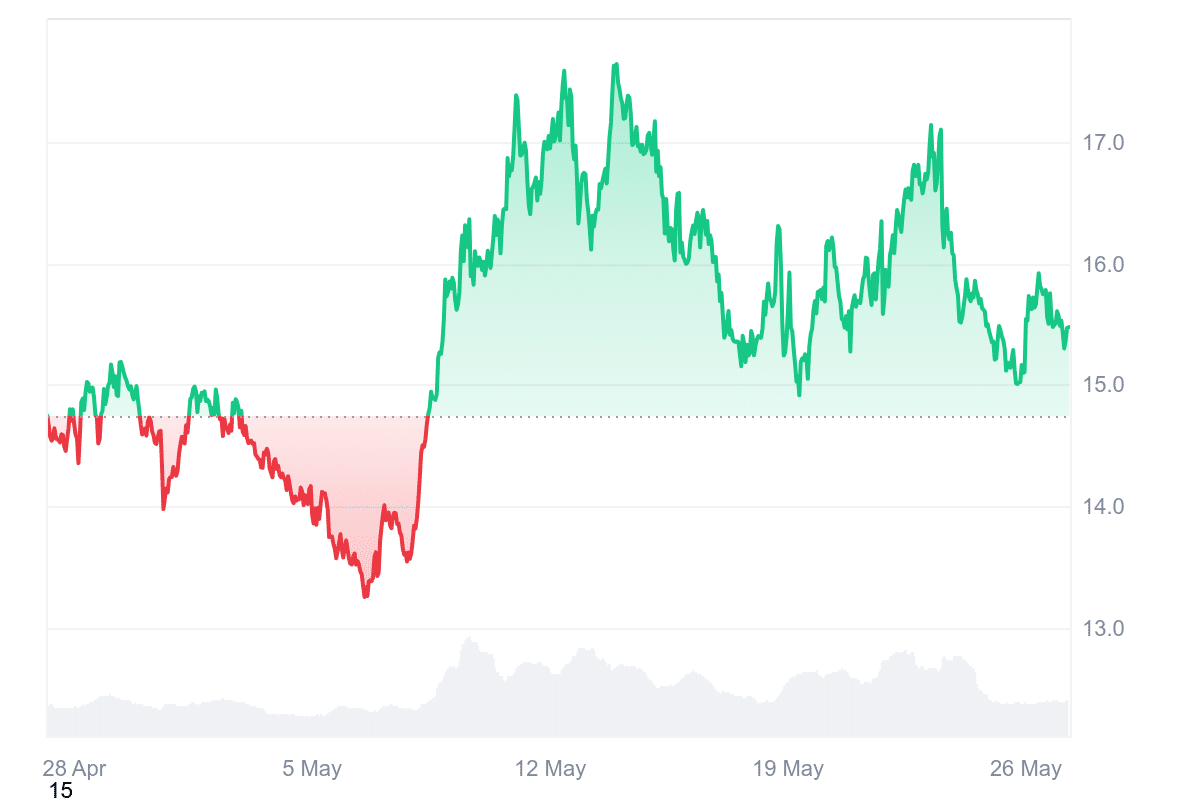

Market data shows Chainlink (LINK) trading at $15.47, with a 14-day Relative Strength Index (RSI) of 66.51, indicating a neutral stance. Over the past month, the asset’s price has ranged from $13.22 to $17.89. It has outperformed 54% of the top 100 crypto assets over the past year. It shows high liquidity, evidenced by a 24-hour volume-to-market cap ratio of 0.0695.

$2B+ TVL BTCFi protocol @SolvProtocol has deepened its integration with Chainlink Proof of Reserve (PoR).

PoR now provides real-time transparency into the backing of SolvBTC, xSolvBTC, and Solv's entire protocol TVL.https://t.co/shFxTQAoom pic.twitter.com/e55W4NPnqH

— Chainlink (@chainlink) May 26, 2025

As institutional capital continues to explore blockchain opportunities, partnerships like this offer a glimpse into how DeFi platforms can adapt to meet professional standards without sacrificing decentralization.

4. Solaxy (SOLX)

Solaxy (SOLX), a new Layer-2 project built on Solana, has recently crossed $41 million in presale funding. With around 20 days left in its presale phase, SOLX is priced at $0.001736 per token. This surge in interest aligns with a broader uptick in Solana’s market momentum, attracting investor attention toward Solaxy.

At its core, Solaxy aims to address one of Solana’s key limitations: network congestion. On high-traffic days, up to half of Solana’s transactions can fail or get delayed due to overload. Solaxy proposes a solution by implementing rollup technology.

Furthermore, Solaxy is building tools to support decentralized development. One key feature is the Igniter Protocol, a no-code token launchpad. It allows users to create their cryptocurrencies, whether for community use, utility purposes, or experiments in decentralized finance.

The team is also working on a cross-chain bridge with Ethereum. This would enable assets and applications to move between Solana and Ethereum networks, combining Solana’s high-speed transactions with Ethereum’s liquidity and user base. If successful, this bridge could benefit areas like gaming, NFTs, and decentralized apps that depend on smooth cross-chain interaction.

Notably, the project has drawn attention from crypto influencers, including the YouTube channel 99Bitcoins, predicting it could surge up to 10X after its official launch.

5. Jito (JTO)

Jito Network plays a prominent role in the Solana ecosystem by offering JitoSOL, a liquid staking solution that combines traditional staking benefits with rewards from MEV (Maximum Extractable Value). This approach aims to provide users with both yield generation and access to DeFi activities without locking up their SOL tokens.

At its foundation, Jito allows users to exchange SOL for JitoSOL. This staked version of SOL retains liquidity, meaning holders can still trade or use their tokens in decentralized applications while earning rewards.

In addition to standard staking income, JitoSOL holders also receive a portion of MEV-related revenue. MEV refers to profits gained by rearranging, including, or excluding transactions in a block.

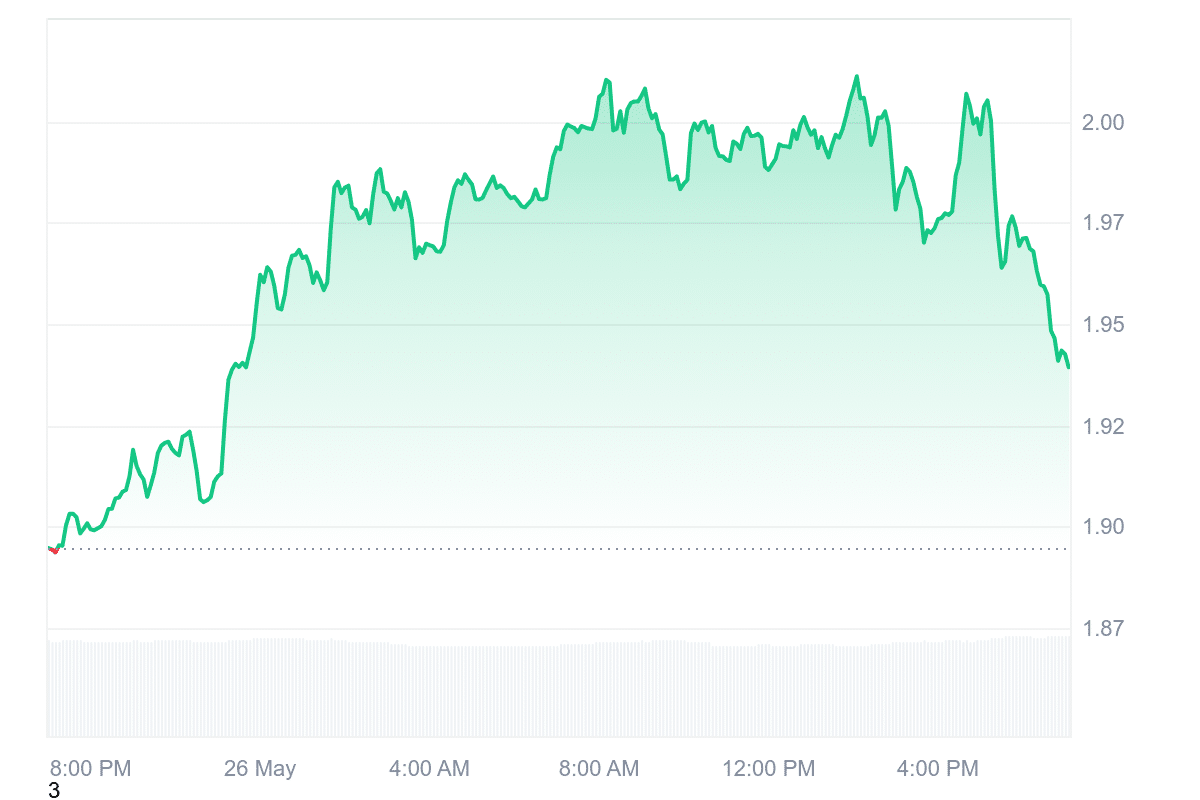

Currently, Jito’s price is $1.94, reflecting a 2.56% increase over the past 24 hours. The token exhibits healthy liquidity, as shown by a 24-hour volume-to-market-cap ratio of 0.0674. This suggests active trading relative to its market size. Sentiment around the asset is neutral, and the broader crypto market’s Fear & Greed Index indicates a level of “Greed” at 73, suggesting positive investor appetite.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage