Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin has seen a tremendous upswing over the last 40 days, rising 34.2% from $76,000 on April 7 to $102,000 on May 17. Strong institutional interest is fueling this increasing trend; for example, Bitcoin spot ETFs experienced net inflows of $608.4 million for the week ending May 16, with BlackRock leading the charge with $841.7 million.

As the market heats up this May, some altcoins stand out for their innovation, usefulness, and expanding ecosystems. StarkNet, EigenLayer, Jupiter, and Injective are gaining momentum not just in price but also in relevancy. Are you looking to identify the upcoming breakout opportunities in cryptocurrency before they blow up?

6 Best Altcoins To Invest in Today

Why are leading analysts and investors currently seeking these names? What distinguishes them from the thousands of tokens that are saturating the market? This analysis will guide you through the distinct advantages of each project, current events influencing their future, and the reasons they merit a closer examination at this time, regardless of your level of experience trading or your interest in promising assets other than Bitcoin and Ethereum.

1. StarkNet (STRK)

StarkNet processes transactions off-chain using zk-STARKs (Zero-Knowledge Scalable Transparent ARguments of Knowledge), which improves efficiency, lowers costs, and increases scalability without sacrificing security.

Among StarkNet’s distinctive features are its innovative use of zk-STARKs for security and scalability, the direct Layer 2 implementation of staking procedures, and the creation of the Stwo prover, which is far more effective than its predecessors. With these developments, StarkNet is positioned as a top choice for safe and scalable blockchain applications.

STRK’s expansion has been substantial. For example, weekly transactions increased by 45% from November 11 to November 18, 2024, reaching about 800,000. In addition, the network’s fee income increased from $7,300 per month to $48,000 within the same period.

AI agents, interacting on their own chain, SN Stack under the hood.

gm Agent Forge https://t.co/Oeu3bi7SV1

— Starknet 🐺🐱 (@Starknet) May 16, 2025

With collaborations and new features targeted at enhancing trading opportunities and liquidity, the network has also witnessed developments in DeFi. In addition, StarkNet is concentrating on cross-chain compatibility, especially with Bitcoin, and has launched programs like the StarkNet Hacker Games and the CodeHawks security audit contest to encourage community growth and involvement.

2. EigenLayer (EIGEN)

EigenLayer presents “restaking,” which enables users to reallocate their liquid staking tokens (LSTs) or staked Ethereum (ETH) to secure extra services outside of Ethereum’s core network. By offering a common layer of trust, this technique improves the security and scalability of decentralized apps (dApps) by eliminating the need for each application to set up its own validator set.

According to sources, around 4% of all ETH is currently restaked utilizing the network, demonstrating its considerable popularity in the decentralized finance (DeFi) market. This expansion demonstrates the growing appeal of the protocol and its potential to serve as a key component of Ethereum’s scaling solutions.

The market capitalization of $363.29 million and the $278.55 million 24-hour trading volume indicate a robust degree of market activity and investor interest. Notably, though, EIGEN hit a record high of $5.65 on December 17, 2024, and has since dropped by almost 77%, which might reflect general market patterns or particular difficulties the project has encountered.

From Mexico, with EigenLayer 🇲🇽

We recently joined builders across LatAm at @ethcincodemayo.@anatech_eth, @morgansawerr & our AlphaEigener @ariiellus joined forces with @seedlatam, @ethereum_mexico, @0xMantleLatAm, @zkamigos, @hyperlane, @LidoFinance and more.

Here's the… pic.twitter.com/dp0k8q1RTI

— EigenLayer (@eigenlayer) May 16, 2025

EigenLayer has announced the activation of its “Slashing Upgrade,” a crucial feature intended to penalize validators who violate performance criteria or act maliciously. By improving the protocol’s security and dependability, this update aligns incentives for genuine participation and could boost institutional interest in restaking.

3. Jupiter (JUP)

Jupiter aims to make token swaps more efficient by figuring out the most economical paths between different liquidity sources, including order books, DEXs, and Automated Market Makers (AMMs). By doing this, Jupiter hopes to improve the Solana ecosystem’s user experience and offer competitive pricing.

Combining liquidity from several sites ensures users get the best exchange rates. The platform also includes tools like dollar-cost averaging and limit orders to accommodate new and seasoned traders.

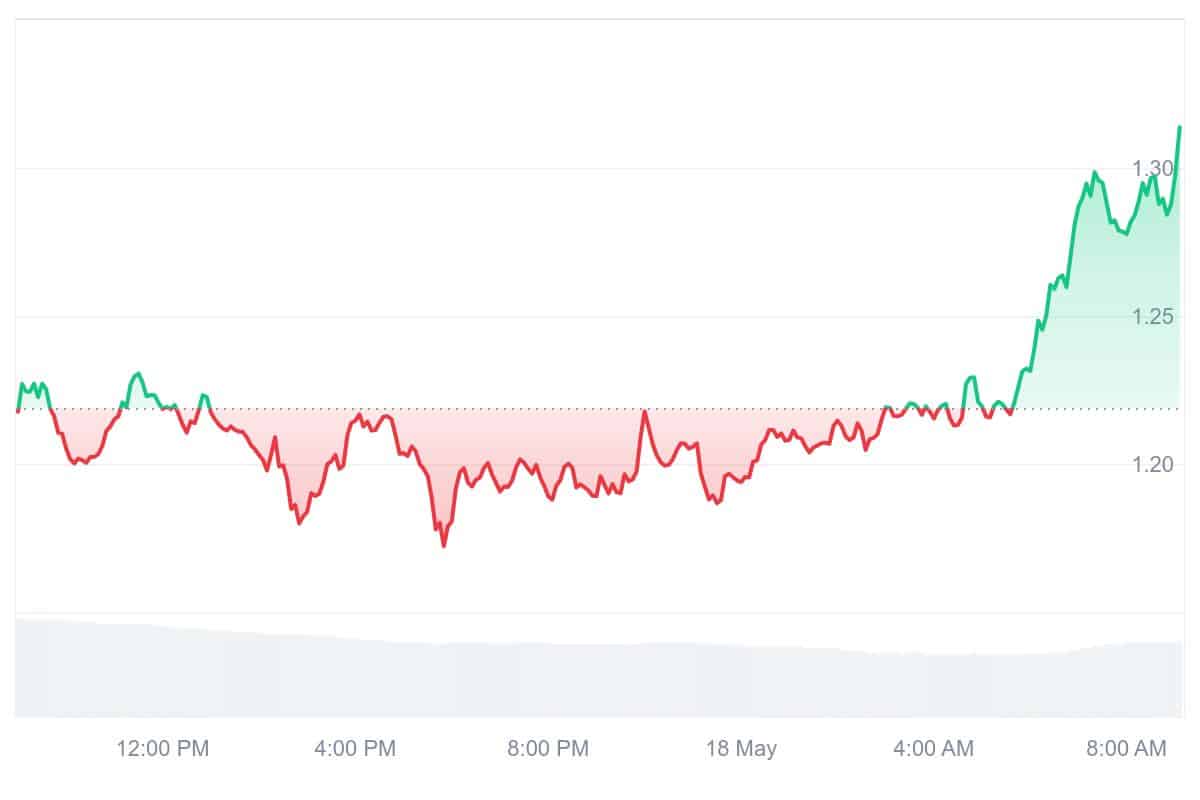

With a market valuation of $1.40 billion and a 24-hour trading volume of $97.88 million, JUP is currently trading at about $0.4823 as of May 18, 2025. Over the past 24 hours, the token’s price has dropped by 0.23%.

Accelerate with Jupiter.

Next week, catch @kashdhanda on the main stage with a banger product announcement (or two). pic.twitter.com/ftKqA2qxWg

— Jupiter (🐱, 🐐) (@JupiterExchange) May 15, 2025

Jupiter launched a substantial token buyback plan, with the goal of repurchasing $50 million worth of JUP tokens. The platform’s decision to burn 3 billion JUP tokens complements this action, lowering the overall supply and possibly raising the token’s value.

4. Injective (INJ)

Injective provides a completely decentralized, fast, and interoperable trading and financial services platform, thereby addressing the shortcomings of conventional financial systems. By eliminating middlemen and facilitating cross-chain transactions, Injective seeks to democratize access to financial markets and promote innovation in the DeFi domain.

It provides a high-performance, decentralized trading infrastructure that facilitates various financial products, such as synthetic assets, derivatives, and spot trading. Its zero gas price concept and compatibility with other blockchains make it a desirable platform for developers and traders looking for economical and practical solutions.

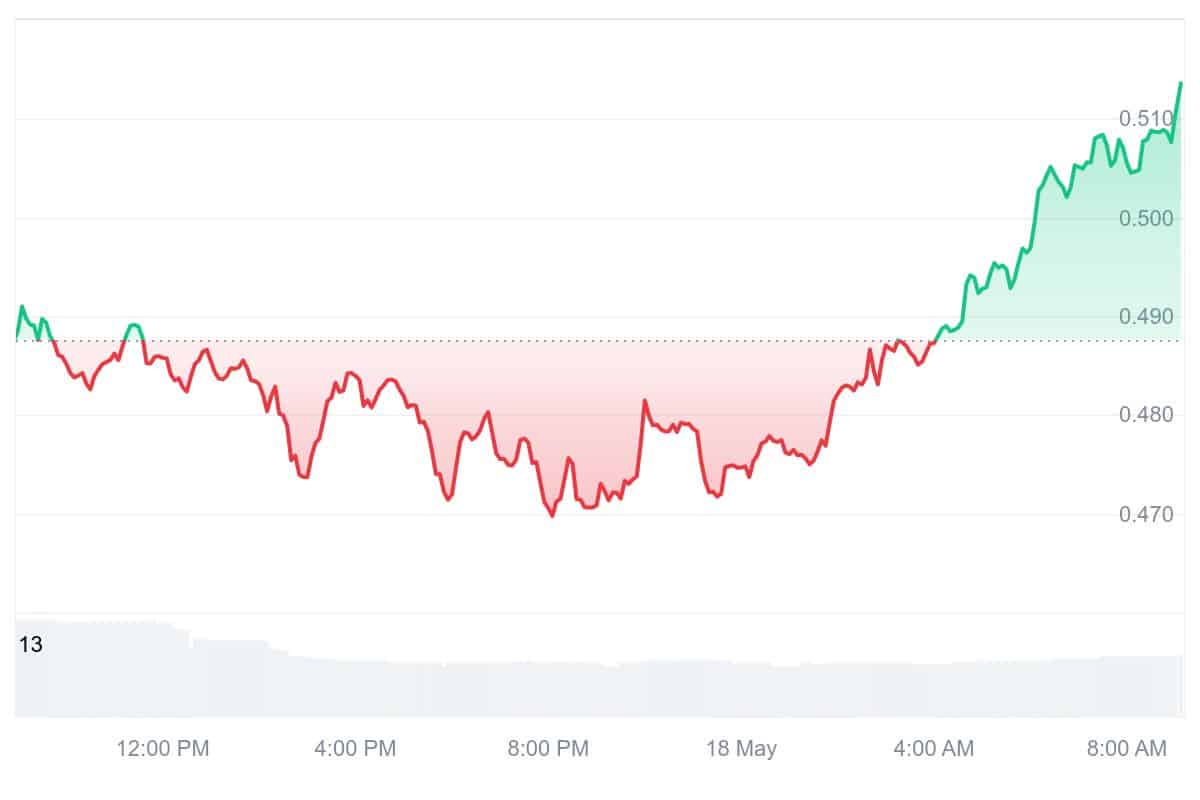

The price has fluctuated between $11.44 and $11.97 during the day, suggesting a somewhat steady trading environment. A 24-hour trading volume of $163.37 million and a current market value of $1.16 billion indicate robust market activity.

Google Cloud is cooperating with the initiative to improve its Web3 development capabilities. As part of this partnership, Injective is launching new developer tools and a validator, offering enterprise-grade infrastructure and enabling the development of creative Web3 solutions.

5. BTC Bull (BTCBULL)

BTC Bull is causing a stir in the cryptocurrency space by ingeniously fusing the thrill of meme coins with real Bitcoin payouts. In contrast to other meme tokens that are just hype-driven, BTC Bull explicitly links its value to Bitcoin’s performance by providing its holders with actual Bitcoin airdrops.

This is why you don’t fight the bull. 🐂⚔️ pic.twitter.com/kXEtjRd52p

— BTCBULL_TOKEN (@BTCBULL_TOKEN) May 15, 2025

Tokens are now priced at $0.00251, and the continuing presale has raised almost $5.7 million, attracting much attention. The token’s price rises with each presale phase, compensating early adopters. According to analysts, BTCBULL may hit around $0.0076 by the end of 2025, providing early investors with significant rewards.

The BTCBULL Token offers an alluring prospect for investors seeking to fund a venture that combines Bitcoin’s stability and expansion potential with meme currency’s viral appeal. It stands out in the crypto industry thanks to its creative incentive structure, robust community support, and clever tokenomics.

6. Berachain (BERA)

Berachain is a next-generation Layer 1 blockchain created to solve a significant issue in Decentralized Finance (DeFi): the mismatch between network security and liquidity provision. Validators and liquidity providers frequently play different roles in traditional Proof-of-Stake (PoS) systems, resulting in inefficiencies and disjointed incentives.

By introducing a new consensus process known as Proof-of-Liquidity (PoL), validators can be chosen according to the liquidity they provide to the ecosystem, thereby combining these functions. This method ensures that the people who supply liquidity are actively involved in network security, promoting a more unified and effective DeFi environment.

Decisions on the latest batch of RFRVs have been delivered by the @bgtfdn on behalf of the Guardians.

This batch adds productive BTC liquidity, grows ecosystem stablecoin depth, and brings new users into Berachain’s incentive layer through aligned liquidity and staking rewards.… pic.twitter.com/DKI0XQqMqd

— Berachain Foundation 🐻⛓ (@berachain) May 12, 2025

At around $3.18, BERA is up 2.25% from the last close, a moderate increase. A 24-hour trading volume of $45.27 million and a current market capitalization of $381.26 million indicate robust investor interest and market activity.

Recently, Sky (previously MakerDAO) and Berachain forged a strategic alliance, including the $7.5 billion USDS stablecoin in its infrastructure. Thanks to this partnership, users now have more stable trading alternatives, which also improves liquidity.

Learn More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage