Join Our Telegram channel to stay up to date on breaking news coverage

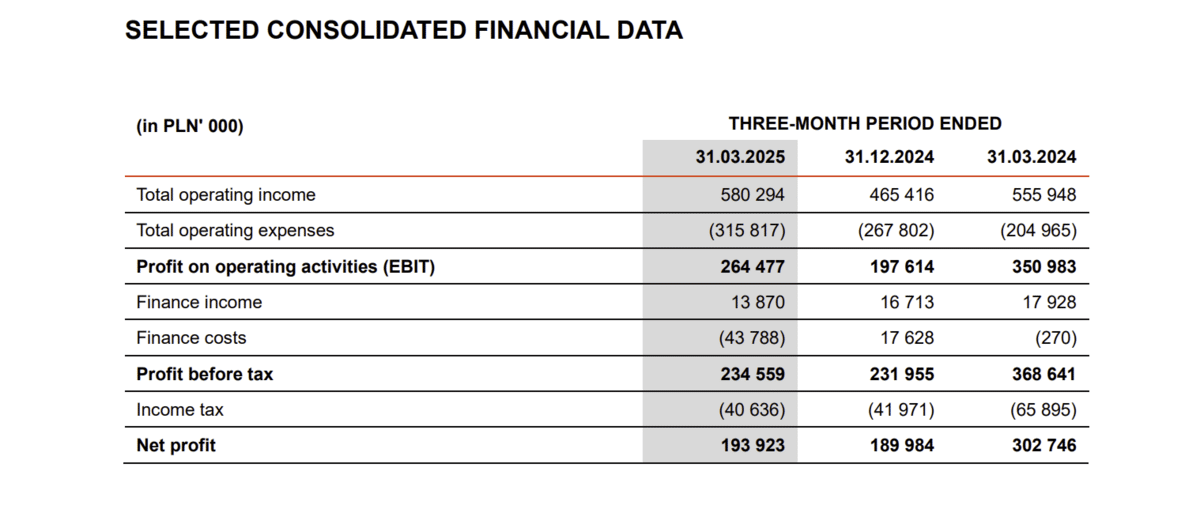

Leading global forex and CFD broker XTB has reported a record-breaking revenue of PLN 580.3 million (approximately $155 million), despite a rise in operating costs following increased market expansion and strategic investments.

We will take a closer look at the XTB Q1 2025 earnings and why it’s gained popularity in the UK market.

XTB Revenue 2025 for Q1 Hits $155M

Here’s a closer look at the XTB financial results for the first quarter of 2025 and how it was distributed across different asset classes.

Revenue Growth Driven by Increased Trading Activity

XTB’s remarkable revenue performance as per the Q1 results report can be attributed to a surge in trading volumes and an expanding client base. The total number of CFD contracts traded reached approximately 1.91 million lots, a 24.9% increase compared to Q1 2024.

In terms of nominal value, CFD trading revenue soared to $937.9 billion, marking a substantial 61.2% year-over-year growth. This uptick in trading activity underscores the growing interest in online trading platforms and reflects broader online trading trends in 2025.

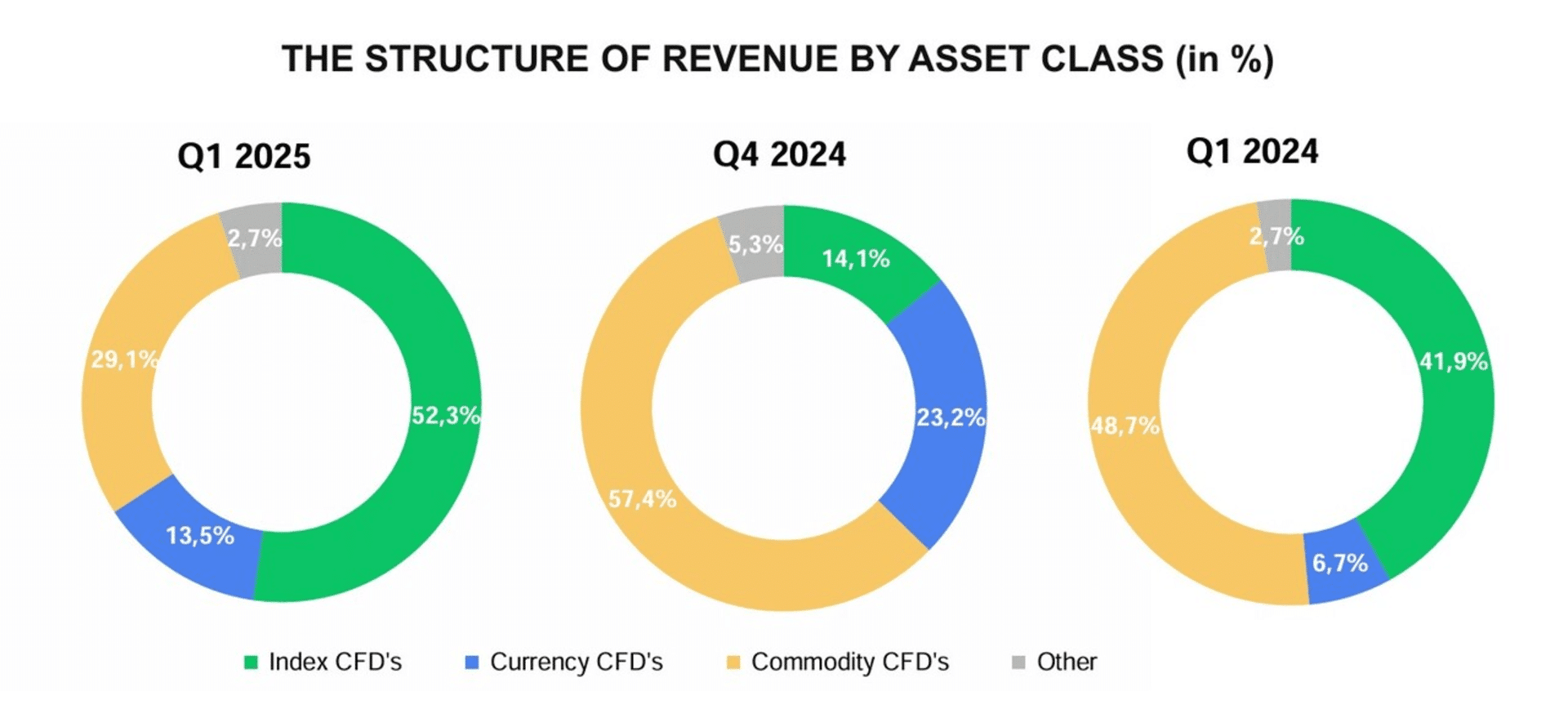

Asset Class Contributions to Revenue

By studying the CFDs broker performance, the XTB report reveals that index-based CFDs were the primary contributors, accounting for 52.3% of the total revenue. This dominance is largely due to high trading volumes in indices like the German DAX index CFD and the US 100.

Commodity CFDs, including assets like natural gas, gold, and coffee, contributed 29.1%, while currency-based CFDs made up 13.5% of the revenue. Notably, the cryptocurrency CFDs revenue, particularly those based on Bitcoin and Ripple, were among the highest in the currency segment.

Operational Costs Impact Profit Margins

While revenue figures were impressive, the XTB Q1 2025 earnings report shows flat net profit, largely driven by rising operational costs. Total operating expenses increased to PLN 315.8 million ($84 million), up from PLN 205 million ($51.25 million) in Q1 2024.

Increased Marketing and Staffing Expenses

A significant portion of the increased expenses stemmed from heightened marketing efforts, with expenditures on online and offline campaigns rising by PLN 59.9 million ($14.98 million), compared to Q1 2024. Additionally, salaries and employee benefits saw an uptick of PLN 22.2 million ($5.55 million), reflecting XTB’s commitment to expanding its workforce to support global operations.

Strategic Investments in Technology and Branding

XTB is investing heavily in its proprietary xStation trading platform and has introduced an eWallet service, offering clients commission-free currency exchange and multi-currency card support. These initiatives align with the company’s strategy to enhance its technological infrastructure and global brand presence, positioning itself favorably among global retail brokers.

Record-Breaking XTB Client Acquisition

XTB achieved record-breaking client acquisition numbers in Q1 2025. Let’s learn more:

XTB Onboards 194,000 Clients in This Quarter

XTB’s aggressive marketing strategies have yielded impressive results in client acquisition. In Q1 2025, the company onboarded 194,304 new clients, a 49.8% increase compared to the same period in the previous year. This surge brings the total client base to over 1.54 million.

Significant Growth in Active Clients

The number of active clients also saw a substantial rise, reaching 735,389 in Q1 2025, up from 416,607 in Q1 2024. This 76.5% year-over-year increase indicates a growing engagement among XTB’s user base, contributing to the company’s robust trading volumes and revenue.

XTB’s Appeal to UK Traders

XTB’s popularity among UK traders can be attributed to several factors. The platform is regulated by the UK’s Financial Conduct Authority (FCA), ensuring a high level of security and compliance.

Additionally, XTB offers a wide range of trading instruments, including forex pairs, commodities, shares, ETFs, and cryptocurrency CFDs. The user-friendly xStation platform, coupled with competitive spreads and educational resources, makes XTB an attractive choice for both novice and experienced traders in the UK.

Getting Started with XTB in 2025

For those interested in joining XTB, the process is straightforward:

- Visit the XTB Website: Navigate to the official XTB website and select “Open Account.”

- Submit Verification Documents: Provide necessary identification and proof of residence.

- Fund Your Account: Deposit funds using bank transfers or supported credit/debit cards.

- Begin Trading: Access a wide array of CFDs, ETFs, and shares through the xStation platform.

Conclusion

The XTB Q1 2025 earnings highlight the company’s strong performance in revenue generation and client acquisition. While increased financial services operational costs have reduced XTB’s profit margins, the strategic investments in technology, marketing, and global expansion position the platform for sustained growth.

The company’s ability to attract and engage a growing client base, particularly in key markets like the UK, underscores its competitive edge in the online trading industry.

FAQs

Yes, XTB is authorized and regulated by the Financial Conduct Authority (FCA) in the UK. This is to ensure compliance with stringent financial standards.

XTB adheres to strict regulatory requirements. This includes client fund segregation and protection under the Financial Services Compensation Scheme (FSCS) up to £85,000.

XTB offers a strong regulatory framework, transparent operations, and a growing global client base. All these factors make it a trustworthy broker in the online trading industry.

XTB offers a comprehensive trading platform with a wide range of instruments, competitive spreads, and robust educational resources, making it a popular choice among UK traders.

Yes, forex trading is legal in the UK and is regulated by the FCA, ensuring a secure trading environment for investors.

Withdrawals can be made through the XTB platform by selecting the withdrawal option and following the provided instructions. Funds are typically transferred to the client’s registered bank account.

Join Our Telegram channel to stay up to date on breaking news coverage