Join Our Telegram channel to stay up to date on breaking news coverage

The overall feeling in the market was positive from the close of October 2024 until the beginning of this year, but things have been sluggish for the past month. After a month of bearishness and losses, many investors hope to make gains reminiscent of the November/December 2024 bull run.

Determining the next cryptocurrency to explode might be challenging as most funds are attracted to pumping assets. However, this article will explore the performance of cryptocurrencies with much growth potential, especially before the year runs out. The aim is to identify coins with some potential and help investors and traders make informed decisions about each token.

Next Cryptocurrency To Explode

Today’s article discusses the performance of potentially explosive cryptos that investors should add to their watchlist. It also includes a special mention of the presale token Solaxy. This new meme coin offers a unique blend of these two dynamics by combining meme coins’ excitement and reward potential with the practical utility of a Layer 2 blockchain solution.

1. Berachain (BERA)

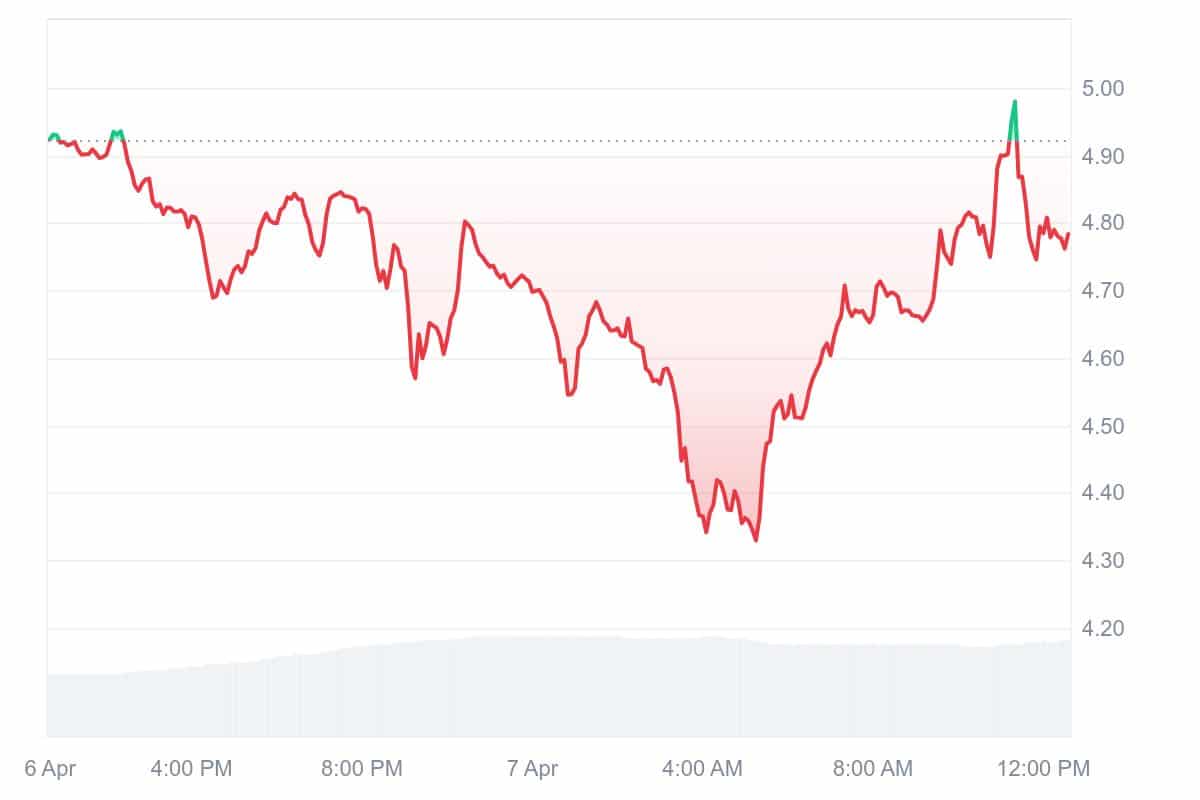

Berachain (BERA) has been drawing much attention lately as it continues its strong upward momentum. Currently, BERA is trading at $4.39 and steadily moving toward a key resistance point at $5.50. If it manages to climb past this level, it could set the stage for even more gains, with the next primary target being the $10 price mark—a level that holds strong psychological significance for investors.

From a technical point of view, things are looking positive. The Relative Strength Index (RSI) currently sits at 59, which signals growing buying interest. However, there is still room for more upside before the token reaches overbought territory. Many traders are carefully watching this level, as any decrease in demand could cause a short-term price drop.

Moreover, Berachain has recently experienced a remarkable surge in network activity. The protocol’s fee revenue has skyrocketed by over 450% in the past eight days. According to data from Nansen, total fees on the chain reached $42,160, representing a 446% jump. This sharp rise reflects a significant spike in block space demand and shows increased protocol use.

Revenue has also increased. The number of active addresses has risen by 52%, totaling 140,790. In addition, the total number of transactions has grown by 15%, reaching 9.59 million. These trends point to higher user participation and an expanding user base.

The main driver behind this surge in network usage was MEV (Maximum Extractable Value) activity, which accounted for nearly 35% of all fees. Meanwhile, Berachain’s core protocol contributed almost 19% of the total costs. This shows that foundational protocol use and advanced trading activity fuel its growth.

2. Neo (NEO)

Neo (NEO) has shown it can hold its ground during challenging market conditions. Despite the broader market’s ups and downs, NEO has recently started to trend upward, showcasing its strength and long-term potential. Although it has a relatively modest market capitalization, Neo attracts interest thanks to its steady development and occasional sharp price movements.

NEO is priced at $4.78, reflecting a minor 2.90% dip over the past day. Still, its liquidity is healthy, shown by a volume-to-market cap ratio of 0.7867, which indicates active trading. Its 14-day RSI stands at 25.96, putting it in a neutral zone—not yet oversold and not overbought—giving room for future price movements.

Neo’s blockchain is well-known for its solid foundation for decentralized applications and digital asset trading. Its two-token system gives it a unique setup—NEO is used for voting and governance, while GAS is used to pay transaction fees. This structure makes the network more functional and supports its decentralized goals.

We're teaming up with @inflectivAI to push the boundaries of #AI-powered #blockchain solutions—bringing trust-certified, decentralized datasets to Neo!

Imagine #AI agents and #dApps seamlessly querying, processing, and acting on structured intelligence. The future starts here!… pic.twitter.com/8Kl4AK70GT

— Neo Smart Economy (@Neo_Blockchain) April 7, 2025

Furthermore, Neo’s advanced smart contract tools, such as NeoVM, InteropService, and DevPack, make it attractive to developers. These features help create more sophisticated and scalable applications.

Its use of Proof of Stake (PoS) and the delegated Byzantine Fault Tolerant (dBFT) consensus method strengthens its governance model. This blend ensures secure, fair, and transparent decision-making while increasing its resistance to threats, making Neo an increasingly reliable choice.

3. Solaxy (SOLX)

Even as other altcoins make headlines, Solaxy (SOLX) is slowly stealing the spotlight. Built as a Solana Layer 2 solution, Solaxy is already turning heads with over $29.3 million raised in presale, and momentum keeps growing.

While Solana is known for its speed, heavy traffic can still lead to slowdowns and outages. Solaxy plans to fix this problem with roll-up technology inspired by Ethereum’s Layer 2 giants like Arbitrum and Optimism.

$SOLX is making waves. 🌊

Hop on the Solaxy rocket before it's too late! 🚀🔥https://t.co/mdaTX9aVVx pic.twitter.com/cD14Ocdrf1

— SOLAXY (@SOLAXYTOKEN) April 7, 2025

By processing transactions off-chain and bundling them before settling on Solana’s mainnet, Solaxy reduces congestion, cuts down fees, and improves overall performance. This move is already gaining strong support from investors who believe in Solana’s long-term future.

Moreover, Solaxy isn’t stopping there. Its roadmap includes plans to build seamless bridges between Solana and Ethereum, creating a more unified Web3 ecosystem. That cross-chain vision is already setting it apart in a crowded market.

Crypto YouTuber Jacob Bury, who has a loyal following of 55,000+ subscribers, has even predicted that SOLX could surge 10x after launch—a bold call adding more fuel to the buzz. To top it off, Solaxy’s staking program draws in long-term holders with an impressive 139% annual return.

At just $0.001686 per token, SOLX is still early in its journey and available through ETH, USDT, BNB, or bank card. With a price increase in under 3 hours, now may be the best moment to jump in.

4. MANTRA (OM)

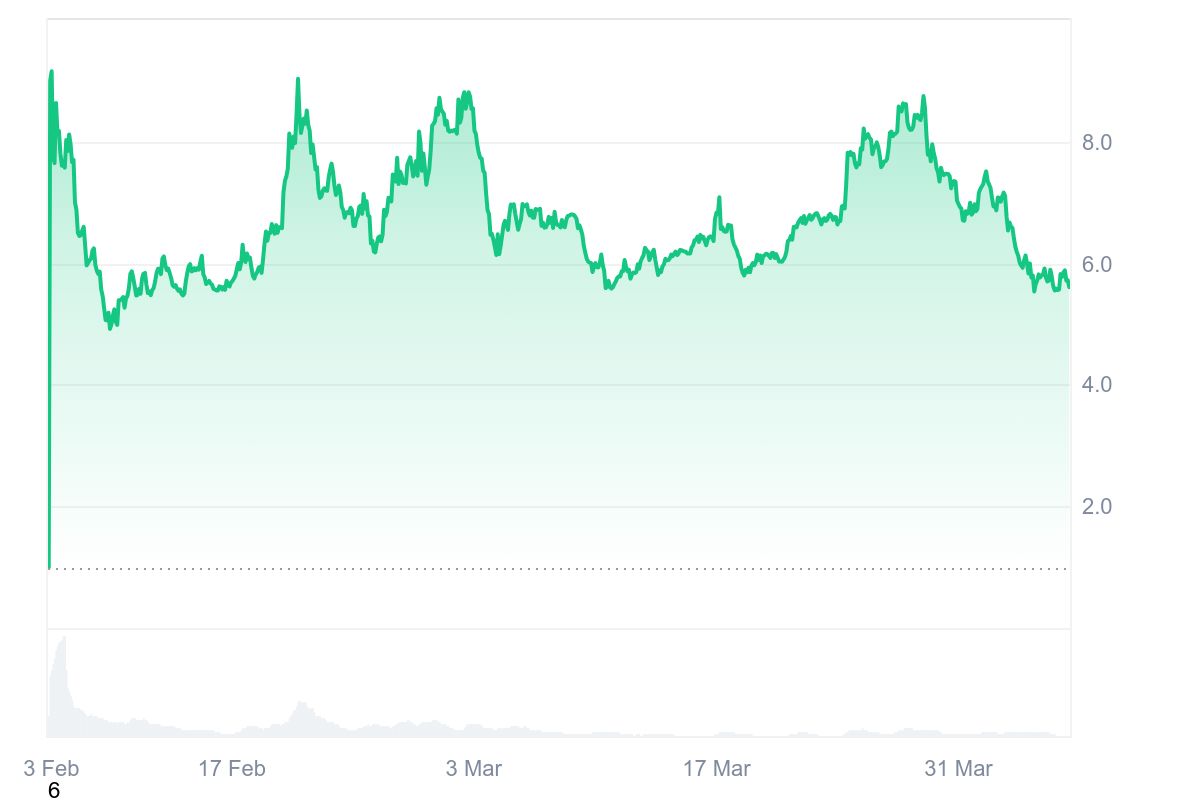

MANTRA (OM) has faced a few bumps recently, with its price falling 4.38% over the past month. However, signs are pointing toward a possible recovery. In just the last 24 hours, OM has risen nearly 2%. Looking further back, its yearly performance shows a stunning gain of more than 820%. Its trading volume has also jumped by 481.32% in a single day, reaching $481.32 million. These numbers suggest a fresh wave of investor interest and momentum.

Right now, OM is trading between $5.74 and $6.46. It is approaching a critical resistance level at $6.40. If it breaks past that point, the next target could be $6.87, representing a potential 9.4% upside from its current position.

MANTRA is gaining attention because of its higher projected annual percentage return (APR) than Ethereum. This has encouraged many users to move their assets to the MANTRA chain. So far, over one million OM tokens have been bridged since the chain launched, pointing to growing adoption and confidence in the network.

Moreover, MANTRA has launched a massive Ecosystem Fund valued at $108,888,888 to support startups working on tokenizing real-world assets. This step reinforces MANTRA’s goal of connecting blockchain technology with real-world financial services.

Today, we’re announcing the launch of the MEF – a $108,888,888 million investment initiative designed to propel real world asset innovation, adoption and growth.

But we’re not doing this alone. We’ve got leading incubators, accelerators and capital partners by our side;… pic.twitter.com/oyeCOJ9QrE

— MANTRA | Tokenizing RWAs (@MANTRA_Chain) April 7, 2025

Backed by key partners like Google Cloud, Three Point Capital, and DAMAC, this fund shows that MANTRA is serious about long-term impact. Despite recent price setbacks, the project continues to build, innovate, and earn its place as a forward-thinking player in the crypto world.

5. IoTex (IOTX)

IoTeX (IOTX) is gaining traction as a flexible, cutting-edge provider for decentralized physical infrastructure networks (DePIN). Instead of using a one-size-fits-all design, IoTeX provides modular building blocks that allow developers to create decentralized, interconnected, and easily customizable projects.

IoTeX combines its native DePIN Infrastructure Modules (DIMs) and open-access tools with outside modules from partners such as Filecoin, Risc0, NearDA, and Espresso. These collaborations help create a larger, more diverse ecosystem that supports various use cases.

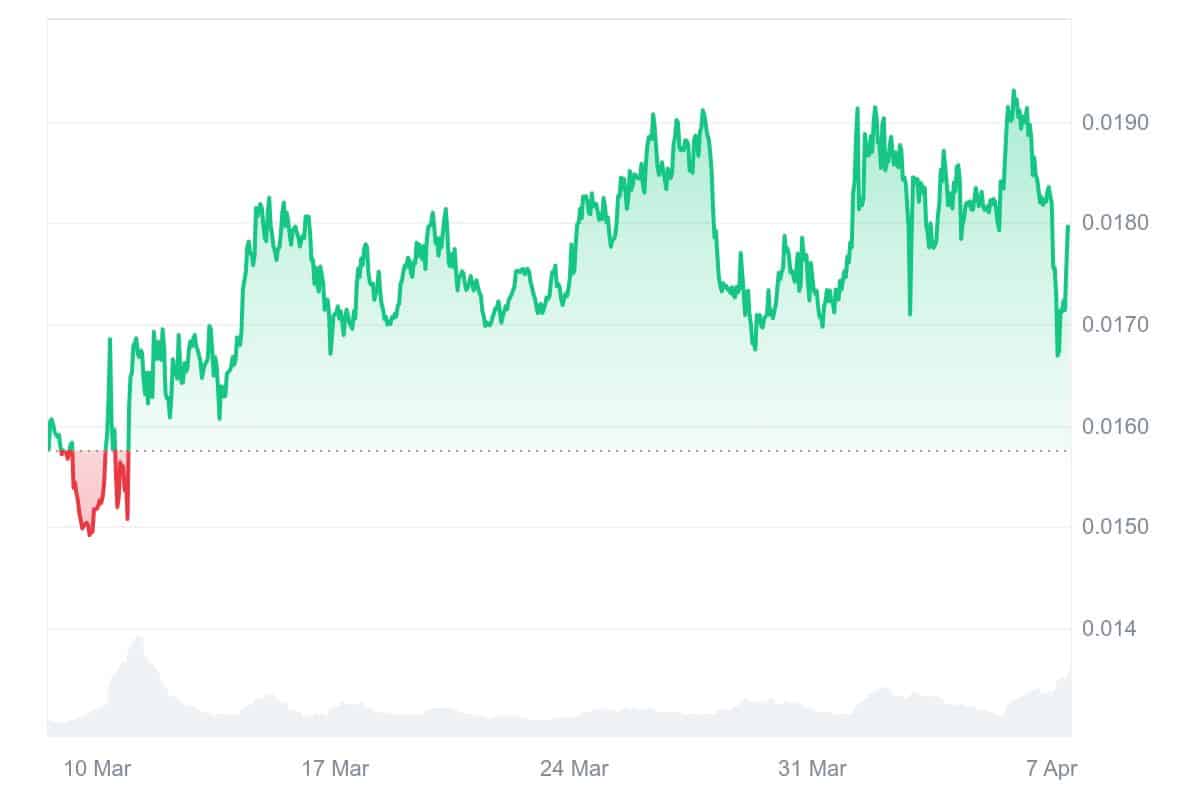

Currently, IOTX is trading at $0.01793, reflecting a solid 13.61% gain over the past month. Over the past week alone, it has climbed by 3.81%. The token is 19.18% above its 200-day Simple Moving Average (SMA), which sits at $0.041767, showing a positive long-term trend. It has also recorded 16 green days out of the last 30, indicating consistent upward movement.

Despite this, the overall market mood toward IOTX remains cautious. According to the Fear & Greed Index, which stands at 23, the market is currently in “Extreme Fear.” Even so, predictions for the second quarter remain hopeful. Analysts expect the token to reach prices between $0.049215 and $0.059493. If the optimistic scenario plays out, IOTX could rise to $0.052755—offering investors more than 10% in possible returns from its current level.

With its focus on creating modular infrastructure and its continued strong market performance, IoTeX stands out as a smart option for investors looking for long-term opportunities in the blockchain space.

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage