Join Our Telegram channel to stay up to date on breaking news coverage

Chainlink (LINK) is currently trading at $11.6, marking a 2.42% increase in the last 24 hours. After a strong resurgence in the past month, LINK continues to solidify its position in the gaming, DeFi, and banking sectors through strategic partnerships. This momentum is reflected in its price performance, as large investors have shown renewed interest in the token.

LINK Key Statistics

- Current Price: $11.6

- Market Cap: $7.31 billion

- Trading Volume (24h): $136.80 million

- Circulating Supply: 626.85 million LINK

- Total Supply: 1 billion LINK

- CoinMarketCap Ranking: #14

Over the past 30 days, LINK is down 9.87% from its maximum recorded price and up by 0.17% from its 7-day maximum. From its lowest recorded price during the same period, LINK has surged 13.68% in the last month and 10.07% in the last 7 days.

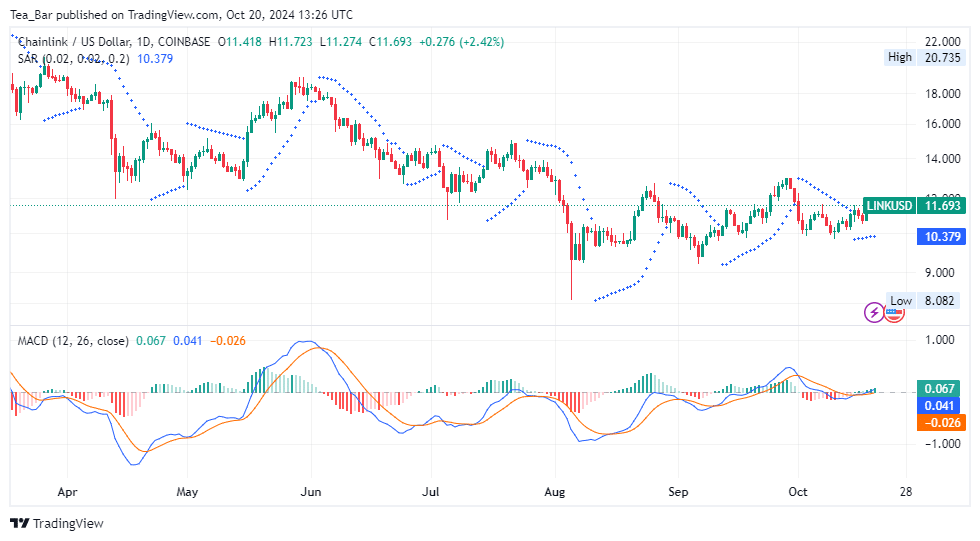

LINK/USD Market Analysis

Key Levels

Resistance: $12, $13, $14.

Support: $10, $9, $8.

On the daily LINKUSD chart, Chainlink’s price has been following a robust upward trajectory. This price action has been bolstered by the Parabolic SAR indicator, which now shows dots forming consistently below the price, a strong sign of bullish momentum. Such a signal typically reflects that the current trend may continue its upward movement in the near term.

Furthermore, the MACD indicator has confirmed a bullish crossover, as the MACD line has risen above the signal line. This crossover is accompanied by a growing positive histogram, further indicating increasing buyer strength. The convergence of these technical indicators suggests a shift in market sentiment toward optimism, reinforcing the likelihood of sustained gains for LINK.

The daily chart illustrates a bullish trend, with LINK currently testing its $12.00 resistance level, setting the stage for a possible rally to $13 and eventually $14 if the buying momentum persists.

Can Chainlink’s Expansion Drive a Major Price Upsurge?

Chainlink is making significant strides in multiple sectors. It is expanding its influence through major partnerships in gaming, DeFi, and banking. In gaming, Sony’s Soneium leverages Chainlink’s Cross Chain Interoperability Protocol (CCIP) and Data Feeds to enhance blockchain adoption in the industry.

In DeFi, Aave utilizes Chainlink Oracles for secure price feeds and cross-chain lending, while in banking, ANZ uses Chainlink to enhance cross-border payments and tokenize assets. Additionally, CitiBank is working with Chainlink to integrate DeFi into traditional finance.

Chainlink Whales Are Buying Big

These partnerships are driving growth for Chainlink, helping push blockchain technology into mainstream use. As a result, LINK’s price has remained resilient, attracting renewed interest from institutional investors, positioning the token for potential long-term growth.

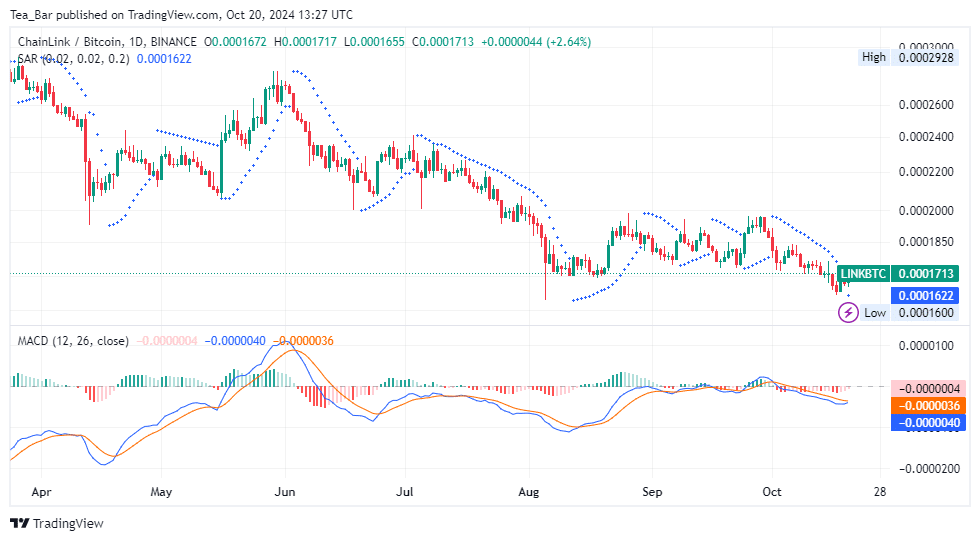

LINK/BTC Performance Insight

In the LINK/BTC pair, Chainlink is trading at 0.0001713 BTC, with resistance at 0.0001850 BTC and strong support at 0.0001622 BTC. The Parabolic SAR dots are changing positions even though they are above the price action. Additionally, the MACD is approaching a crossover, suggesting the possibility of an upward breakout.

The LINK/BTC chart reflects an optimistic view for Chainlink with the potential for a bullish reversal, driven by Chainlink’s strong fundamentals and ongoing developments. If LINK manages to break past the 0.0001850 BTC resistance level, the next target could be 0.0002000 BTC.

In a recent post on X (Twitter), DeFi Dynamos brought attention to rumors about Google potentially acquiring Chainlink. Followers were encouraged to watch a linked video and explore Chainlink’s partnership details, suggesting that such a deal could positively impact Chainlink’s market position and growth. The post also raised the intriguing question of whether Google might buy Chainlink or if Chainlink could acquire Google instead.

There have been rumors that #Google wants to acquire #Chainlink. Looking at the video below and Chainlink’s partner information, do you think Google will buy Chainlink or Chainlink will buy Google? 😁#Chainlink #Google #Blockchain #Acquisition #Crypto pic.twitter.com/fbObSShVjq

— DeFi Dynamos (@DeFiDyn) October 20, 2024

Alternatives to LINK

While Chainlink continues to lead the decentralized Oracle sector through significant partnerships in gaming, DeFi, and banking, other promising projects such as Pepe Unchained are gaining notable momentum. Pepe Unchained ($PEPU) is establishing itself as a formidable entrant in the meme coin market, poised to disrupt the landscape with its advanced Layer-2 technology.

The upward trajectory of Pepe Unchained is further supported by a successful presale that raised $20.9 million, in addition to a staking platform offering estimated annual percentage yields (APYs) of 130%. Its active and expanding community, which boasts over 51,300 followers on X, underscores the project’s ability to engage a diverse audience.

Pepe Unchained Ready To Rocket In The Upcoming Meme Rally

With robust fundamentals and a scalable framework, $PEPU is positioned to emerge as a significant player in the cryptocurrency arena. Its innovative blend of utility and entertainment presents a compelling investment opportunity within the rapidly evolving crypto landscape. By integrating the appeal of meme culture with practical applications, Pepe Unchained addresses the increasing demand for efficient and cost-effective blockchain solutions.

As Pepe Unchained gains further traction, its unique value proposition and dedicated community suggest a promising outlook. Aiming to transform the meme coin space, $PEPU is on a path to make a substantial impact in the realm of cryptocurrency.

Related News

Most Searched Crypto Launch - Pepe Unchained

- Exchange Listings December 10

- ICO Sold Out Early

- Featured in Cointelegraph

- Layer 2 Meme Coin Ecosystem

- SolidProof & Coinsult Audited

Join Our Telegram channel to stay up to date on breaking news coverage