Join Our Telegram channel to stay up to date on breaking news coverage

Chainlink (LINK) has drawn attention due to its regular token unlock events. Despite a recent increase in circulating supply from the 18.75 million LINK tokens unlocked (worth $215 million), on-chain data suggests the possibility of a price rally. History shows that LINK has often seen upward momentum after unlocks, with seven out of the last eight events resulting in gains.

LINK Key Statistics

- Current Price: $11.3

- Market Cap: $7.09 billion

- Trading Volume (24h): $216.51 million

- Circulating Supply: 626.85 million LINK

- Total Supply: 1 billion LINK

- CoinMarketCap Ranking: #14

Chainlink is currently trading 10.62% below its highest price in the last 30 days and 3.48% below its 7-day high. However, it has gained 21.28% from its monthly low and 9.78% from its 7-day low, reflecting an overall positive trend.

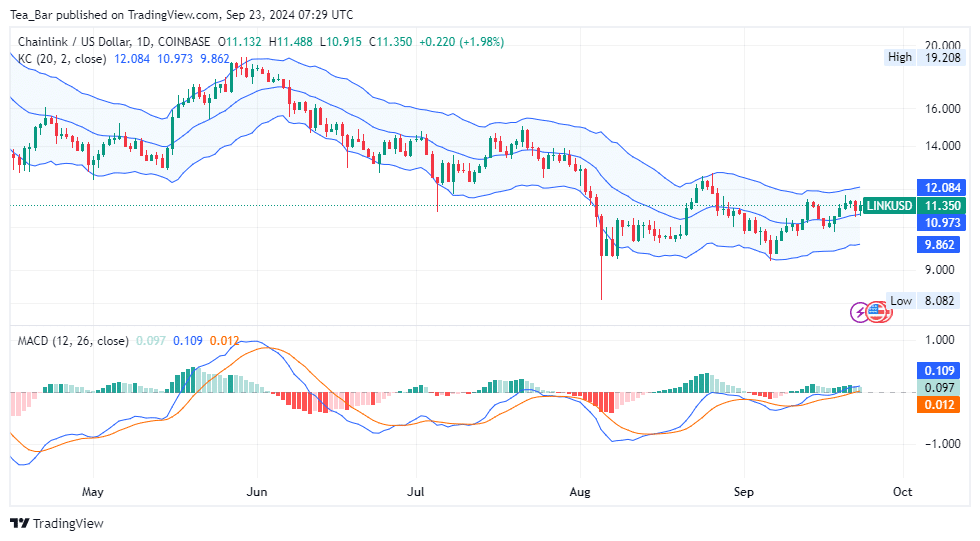

LINK/USD Market Analysis

Key Levels

Resistance: $12, $14, $16

Support: $10, $9, $8

The LINK/USD chart shows the price trading within the Keltner Channel (KC), with LINK currently testing the upper boundary. This indicates potential continued upward movement if the token can break through the $12 resistance. The MACD indicator further supports this bullish outlook, with the blue line crossing above the signal line.

If momentum remains strong, LINK could challenge the $14 resistance level, with an additional target at $16. On the downside, support is present at $10, with stronger levels around $9. A failure to hold these levels could see the price drop to $8, the lowest point observed in recent months.

Will Chainlink’s Cross-Chain Innovations Drive Its Price Beyond $12?

Chainlink’s development in cross-chain functionalities, coupled with the recent token unlocks, suggests potential price growth. The token unlock event, although significant in supply, has historically led to price rallies, as observed in previous instances. Moreover, Chainlink still holds 372.75 million LINK in non-circulating contracts, reducing the risk of oversupply in the market.

Chainlink Could Be Set For A Major Surge Soon

Partnerships like the one with Metis and the integration of Chainlink’s Cross-Chain Interoperability Protocol (CCIP) across decentralized applications (dApps) further enhance its ecosystem. These innovations, paired with Chainlink’s consistent $1.5 billion token unlocks since August 2022, position it for sustained growth. If market conditions remain favorable, LINK could push towards $12 and beyond in the coming weeks.

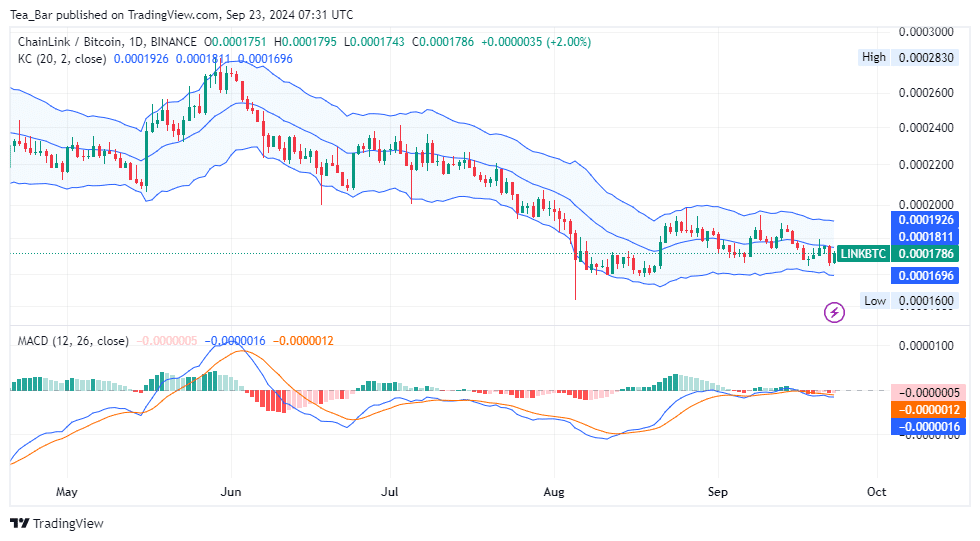

LINK/BTC Performance Insight

Chainlink (LINK) is trading at 0.0001786 BTC, gaining 2.00% over the last 24 hours. The pair is testing the upper boundary of the Keltner Channel, signaling bullish momentum. Immediate resistance lies at 0.000196 BTC, with potential upside toward 0.000220 BTC if buying pressure continues. On the downside, support is strong at 0.0001696 BTC, a key level throughout September. A breakdown below this could lead to further retracement toward 0.0001600 BTC. Overall, the pair remains positive with potential for further gains against Bitcoin.

Overall, the LINK/BTC pair is exhibiting a positive outlook, with potential upside as long as market conditions remain favorable. The increasing use cases for Chainlink’s decentralized oracle services, alongside its strategic partnerships, continue to provide a solid foundation for future price appreciation against Bitcoin.

In a tweet, @cryptogyanpatt noted that Chainlink is outperforming all other ERC20 projects, including Ethereum itself. As a leading provider of oracle services on the Ethereum blockchain, Chainlink’s strong development suggests continued improvements in its offerings. This performance underscores its vital role within the ERC20 ecosystem.

#Chainlink outperforms all other ERC20 projects, including Ethereum itself.#ERC20 projects use a common standard on the #Ethereum #Blockchain. Chainlink provides oracle services for these projects. Its strong development suggests continued improvements in its services.#crypto pic.twitter.com/rj3uCnEWEA

— cryptogyanpatt (@cryptogyanpatt) September 23, 2024

Alternatives to Chainlink

Chainlink continues to be a cornerstone of the cryptocurrency ecosystem, providing indispensable oracle services that bridge smart contracts with real-world data. Its robust cross-chain interoperability also enhances the functionality of decentralized applications. Meanwhile, innovative projects like Pepe Unchained ($PEPU) are making waves in the market. The project’s remarkable presale, which raised over $14.7 million, and upcoming decentralized exchange (DEX) launch demonstrate its potential for substantial growth.

By combining a unique approach to the meme coin sector with Ethereum compatibility, Pepe Unchained presents an attractive alternative to traditional DeFi platforms. Investors are particularly drawn to its staking protocol, which offers a projected 177% annual yield. The project’s Impressive community support, with over 1 billion $PEPU staked, and discounted presale price of $0.00983, further solidify its position in the market. Moreover, Pepe Unchained’s engaged community of 18,500 followers underscores its growing momentum.

Pepe Unchained Presale Update

Following a comprehensive analysis, Pepe Unchained emerges as a promising investment opportunity, poised for significant appreciation. Its robust community engagement and technological advancements position the project for sustained success in the dynamic cryptocurrency landscape.

Related News

-

Top Crypto Gainers Today Sep 08 – Big Time, Quant, Echelon Prime, Chainlink

-

Cilinix Crypto Pepe Unchained’s Presale Update – Will $PEPU 10X After Launch?

Most Searched Crypto Launch - Pepe Unchained

- Exchange Listings December 10

- ICO Sold Out Early

- Featured in Cointelegraph

- Layer 2 Meme Coin Ecosystem

- SolidProof & Coinsult Audited

Join Our Telegram channel to stay up to date on breaking news coverage