Join Our Telegram channel to stay up to date on breaking news coverage

This Friday at 8 AM UTC, Deribit, the leading crypto derivatives exchange, will witness an eye-popping $10.18 billion in Bitcoin (BTC) and Ethereum (ETH) options expiring. This amounts to over 40% of Deribit’s total open interest, currently exceeding $23 billion. Such colossal quarterly expirations typically trigger heightened market volatility, with traders scrambling to adjust their positions, making price movements highly unpredictable.

According to Luuk Strijers, Deribit’s CEO, $2.7 billion of these options are poised to expire profitably (in-the-money) out of a total notional value surpassing $10 billion. This imminent event will shake the market significantly as traders brace for potentially massive shifts. Despite recent decreases — Bitcoin down nearly 9% and Ethereum almost 10% this month — investors are actively pursuing higher premiums for call options. This suggests a bullish sentiment, hinting at expectations for a market rebound despite recent price pressures.

Biggest Crypto Gainers Today – Top List

Axelar, Flare, Injective, and Convex Finance have emerged as today’s top gainers, driven by significant movements in their respective markets. Axelar distinguishes itself with its secure cross-chain communication infrastructure, enhancing its appeal among developers and users. Meanwhile, Flare adopts EVM-based technology to facilitate decentralized data access, fostering innovative dApp solutions and expanding its utility.

Injective excels in DeFi with a decentralized order book and cross-chain capabilities. In contrast, Convex Finance boosts liquidity provider rewards in the Curve ecosystem, influencing DeFi strategies. These gainers showcase varied blockchain innovations poised for growth in the crypto market.

1. Axelar (AXL)

Axelar aims to deliver secure cross-chain communication for Web3. It provides a decentralized network and essential tools for developers of decentralized applications (dApp). Its protocol suite includes a decentralized network and a software development kit (SDK) of protocols and APIs. Additionally, it features gateway smart contracts designed for seamless cross-chain connectivity.

It differentiates itself through its approach to secure cross-chain communication via dynamic validators. This distinguishes it from projects using optimistic setups or federated multi-sig. Powered by a decentralized validator network and employing a proof-of-stake (PoS) consensus mechanism, Axelar enables open participation.

Axelar simplifies dApp development with protocols, APIs, and tools, enabling cross-chain applications without the need to learn new programming languages. It also allows users to access decentralized web services seamlessly with a single click.

🚨 $axlSAGA is now supported on 19+ EVM chains 🚨@Sagaxyz__ is an L1 protocol that allows developers to automatically spin up VM-agnostic, parallelized & interoperable dedicated chains – “Chainlets” that provide apps w/ infinite horizontal scalability.

Swap on @squidrouter! pic.twitter.com/LCQ0VX9oEK

— Axelar Network (@axelarnetwork) June 25, 2024

Axelar’s current price is $0.55398, reflecting a 1.41% increase in the last 24 hours. With a market cap of $372M and a 24-hour volume of $45.69M, it has a high liquidity ratio of 0.1228. The 14-day RSI is 54.13, indicating a neutral sentiment. It has had 14 green days in the past 30 days, with a 30-day volatility of 21%. It’s trading 15.92% above its 200-day SMA of $0.477891. AXL’s price has increased by 38%, exceeding the performance of 40% of the top 100 crypto assets. Compared to Injective’s higher RSI, Axelar appears less overbought, suggesting a more stable short-term outlook.

2. Flare (FLR)

Flare is an EVM-based layer 1 blockchain designed to provide decentralized access to high-integrity data from other chains and the internet. This enables developers to create dApps interacting with multiple chains through a single deployment, fostering new use cases and monetization models.

Flare’s State Connector securely acquires event information from blockchains and the internet. The Flare Time Series Oracle (FTSO) delivers decentralized prices and data series. These protocols ensure reliable access to cryptocurrency prices, transaction data, and Web2 event information, enhancing dApp utility and reach.

The FLR token is used for payments, transaction fees, and staking in validator nodes, protecting the network from spam attacks. FLR can be wrapped into an ERC-20 variant, WFLR, which can be used for FTSO data provider delegation or governance in EVM-compatible dApps.

Get ready for FIP.09, a proposal to fuel the growth of the Flare ecosystem ☀️

Flare Foundation introduces a framework to distribute an initial 510 million $FLR from the 20 billion incentive pool to attract builders & support liquidity on @FlareNetworks.https://t.co/SvzfOSlsuA pic.twitter.com/R1vk5m9OfV

— Flare ☀️ (@FlareNetworks) June 25, 2024

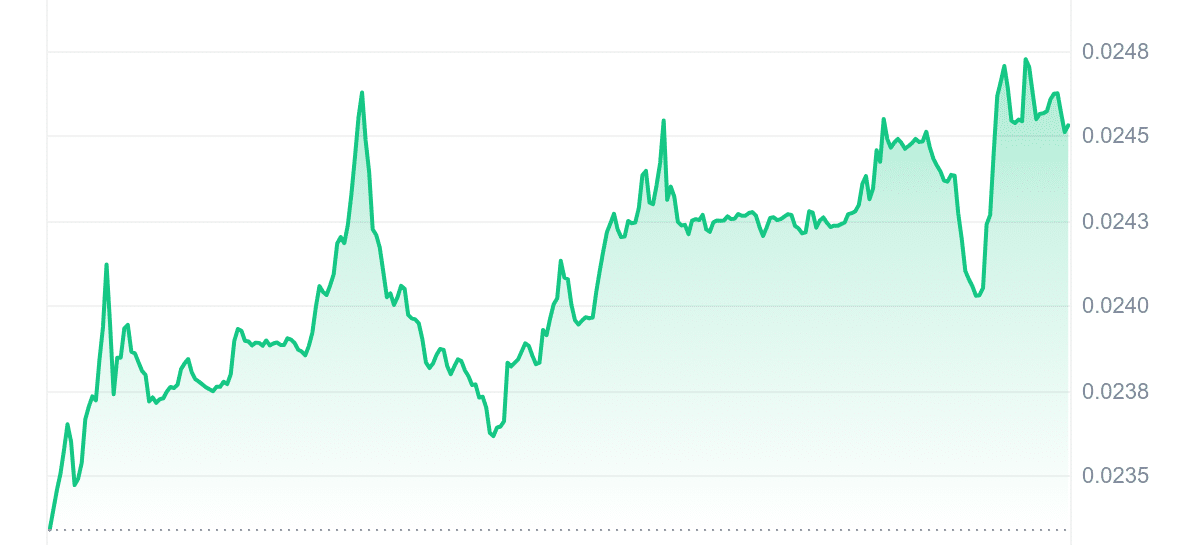

Flare’s price is $0.024541, rising by 5.15% in the last 24 hours, showing strong daily performance. With a market cap of $1.00B and a 24-hour volume of $11.99M, its liquidity ratio is 0.0120, indicating medium liquidity. The 14-day RSI is 50.48, reflecting a neutral stance.

FLR has had 10 green days in the past 30 days and a 30-day volatility of 7%. It’s trading 14.94% below its 200-day SMA of $0.028852. Over the past year, Flare’s price has increased by 59%, outpacing 47% of the top 100 crypto assets. Despite a lower RSI than Injective, Flare’s significant daily surge and low volatility offer a different risk profile than the more volatile Axelar.

3. 99Bitcoins ($99BTC)

The crypto learning platform 99Bitcoins has reached a pivotal stage in its highly anticipated presale. With a robust user base exceeding 700,000 and over 2 million registered course takers, 99Bitcoins is a key player in crypto education. Notably, the platform has successfully raised over $2.3 million in its presale, marking a significant milestone.

https://www.youtube.com/watch?v=G2trqq3KNYE

99Bitcoins ($99BTC) allocates 10.5% of its tokens to the presale, 14% to staking rewards, and 17% to community incentives. Additionally, 27.5% is dedicated to project development, 23% to marketing efforts, and 8% to liquidity.

In 2024, 99Bitcoins plans to complete its presale, introduce staking mechanisms, and enable token claims by Q3. The platform will launch in 2025, integrating interactive learning features, crypto tools, and expanding educational content. Furthermore, strategic partnerships and community initiatives will drive the growth and adoption of $99BTC.

🎉 Exciting milestone alert! 🎉

We have now raised over $2.2 MILLION in our $99BTC presale! 🚀

Secure your spot now before the #Presale price increases! 👀

Don’t miss out—get started today!

👉 https://t.co/NXD7DAamqr#99Bitcoins #BTC #Crypto #L2E pic.twitter.com/xQC6lg0euI— 99Bitcoins (@99BitcoinsHQ) June 17, 2024

Post-presale, the focus shifts to developing 99Bitcoins’ platform for interactive crypto learning, offering rewards, BRC-20 tools, and trading signals. Anticipated full platform release in 2025 includes content expansion and collaborations, enhancing industry integration. With a high staking APY exceeding 4500% and promising potential for price appreciation, the 99Bitcoins presale and airdrop offer a compelling investment opportunity. Investors can purchase tokens using ETH, USDT, BNB, or fiat via debit/credit cards.

4. Injective (INJ)

Injective is a blockchain built for finance designed to reshape decentralized finance (DeFi) applications. It supports various DeFi solutions, including decentralized exchanges, prediction markets, and lending protocols. A standout feature is its fully decentralized, MEV-resistant, on-chain order book. Injective’s cross-chain bridging infrastructure works with Ethereum, IBC-enabled blockchains, and Solana, enabling seamless asset transfers.

The platform features a highly interoperable smart contract environment based on CosmWasm, integrated with the Cosmos SDK. It also uses the Tendermint-based Proof-of-Stake consensus mechanism. This setup ensures instant transaction finality and high performance, handling over 25,000 transactions per second. The Injective ecosystem is backed by investors like Binance, Pantera Capital, Jump Crypto, and Mark Cuban. The INJ token is used for governance, staking, and unique burn auctions, reducing the token supply and potentially increasing its value.

Brand new website just dropped for the Injective Builder House!

The exclusive event will bring together the best developers, institutions and companies in all of Web3 during @EthCCweek.

Register Here: https://t.co/JvUu2Qj58o pic.twitter.com/X3qndZ7wtB

— Injective 🥷 (@injective) June 20, 2024

Injective’s price is $23.23, up 2.28% in the last 24 hours, making it one of the top gainers. It boasts a market cap of $2.16B and a 24-hour volume of $332.06M, yielding a high liquidity ratio of 0.1535. The 14-day RSI is 79.76, suggesting it is overbought and may face a price drop. Injective experienced 13 green days in the last 30 days (43%), with a 30-day volatility of 11%. It’s trading 110.24% above its 200-day SMA of $11.02. Over the past year, INJ’s price has surged by 206%, surpassing 78% of the top 100 crypto assets. This performance is significantly higher than Axelar’s and Flare’s, highlighting its strong market position.

5. Convex Finance (CVX)

Convex Finance is a DeFi protocol that enhances capital efficiency for Curve liquidity providers. Instead of staking directly on Curve, LPs can stake with Convex to earn boosted CRV and liquidity mining rewards. This positions Convex as a key player in the “Curve wars,” a competitive race to control CRV tokens and influence interest rates on Curve, the largest DEX by TVL.

The protocol aggregates individual stakes liquidity, providing rewards that would be hard to achieve alone. Investors can earn interest on liquidity, Curve trading fees, boosted rewards, and CVX tokens. Staking CRV tokens yields cvxCRV, veCRV rewards, Convex trading fees, CVX tokens, and airdrops for veCRV holders. The network’s security is ensured by a 3-of-5 multisig treasury and an audit by MixBytes.

CVX’s current price is $3.18, showing an 8.98% increase in the last 24 hours, making it a notable gainer. It has a market cap of $305.80M and a 24-hour volume of $81.79M, giving it a high liquidity ratio of 0.2675. The 14-day RSI is 48.22, indicating a neutral sentiment. Convex Finance recorded 16 green days in the past 30 days, with a 30-day volatility of 17%.

With recent activity, $CVX wrappers are showing some signs of strength. The flywheel is intact! pic.twitter.com/xnpqiUWDZs

— Convex Finance (@ConvexFinance) June 18, 2024

It’s trading 11.59% below its 200-day SMA of $3.61. Over the past year, CVX’s price has decreased by 12%, outperforming only 14% of the top 100 crypto assets. Compared to Axelar, Injective, and Flare, Convex Finance shows weaker yearly performance yet exhibits strong daily performance and the highest number of green days.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage