Join Our Telegram channel to stay up to date on breaking news coverage

The crypto market has recently experienced a significant downturn, leading to widespread liquidations. Bitcoin dropped 3.5% to $67,275, while Ethereum fell 4.6% to $3,495. This resulted in approximately $270.4 million in leveraged positions being liquidated, with Binance leading the way with $99.7 million in liquidations.

The market turmoil coincides with anticipation of critical macroeconomic updates, including the monthly Consumer Price Index (CPI) report and a Federal Reserve monetary policy announcement. Hence, investors await these reports for insights into the economic outlook, which are expected to influence market sentiment and trading strategies. The strong correlation between Bitcoin and traditional assets shows that broader market movements influence cryptocurrencies.

Biggest Crypto Gainers Today – Top List

Today, 23% of cryptocurrencies are experiencing positive movement. Leading the pack as the top gainer is io.net, surging by 30.16% in the last 24 hours, while Baby Doge Coin trails as the biggest loser, down by 8.17%. Among the notable gainers, Stacks, Helium, Aelf, and Kaspa stand out for their impressive performance and unique features.

Stacks, leveraging Bitcoin for smart contracts, has surged by 5.11% in the last 24 hours, with a 313% increase over the past year. Helium, enhancing IoT connectivity, is up 6.99% today and has gained 175% over the past year. Aelf, with its modular blockchain technology, shows a 3.87% increase in the last 24 hours, marking a 63% rise over the past year. Kaspa, utilizing the GHOSTDAG protocol, has also made significant strides, with a 2.97% gain today and a staggering 922% increase over the past year.

1. Stacks (STX)

The number one gainer, Stacks, is a Bitcoin layer for smart contracts. It enables decentralized applications to use Bitcoin as an asset and settle transactions on the blockchain. Stacks unlocks $500 billion in BTC capital using the Bitcoin Layer 1 (L1) as settlement for these applications. With Proof of Transfer consensus and Clarity language, Stacks can read from Bitcoin anytime. All transactions on Stacks are hashed and settled on the Bitcoin L1, securing them with 100% Bitcoin hash power.

It uses Bitcoin’s Proof of Work consensus for security, combining thousands of miners and nodes to prevent attacks by making them computationally and financially unfeasible. In the latest version of Stacks, the blockchain’s transactions scale independently of Bitcoin, which only provides final verification and security. This results in thousands of Stacks transactions producing a single hash on Bitcoin’s blockchain.

Stacks is the only blockchain protocol that rewards $STX stakers with native $BTC yield. @Stacks utilizes a Poof of Transfer (PoX) mechanism where validators spend BTC to validate new blocks in exchange of new STX.

Stacks token-emissions halving is scheduled for January 2025… pic.twitter.com/O69Id9Kwt5

— Sakemate (@apebayc) June 10, 2024

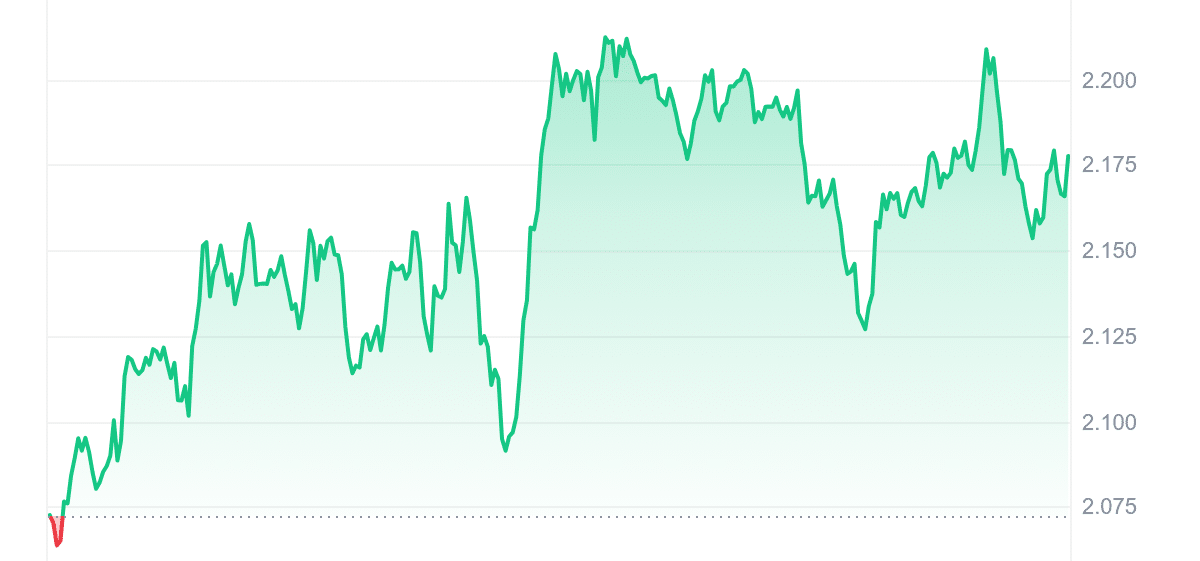

Stacks is performing well price-wise. Its value is $2.19, up 5.11% in 24 hours and 313% over the past year. It outpaced 75% of the top 100 crypto assets, trading 124.15% above its 200-day Simple Moving Average (SMA) of $0.97. The 14-day Relative Strength Index (RSI) is 37.18, indicating a neutral market. Stacks had 13 positive days in the last 30, with a 7% volatility. Its market cap is $3.19 billion, with a 24-hour volume of $256.01 million, resulting in a high liquidity ratio of 0.0803.

2. Helium (HNT)

Second in line is Helium, a blockchain-based network that connects IoT devices. It enables communication between these devices by sending data across network nodes called Hotspots. These Hotspots provide public network coverage using LoRaWAN, a protocol with a cloud component. Helium is one of the largest LoRaWAN networks, with over 25,000 Hotspots.

WiFi supports IoT devices but raises privacy concerns. Helium solves this with a decentralized architecture, offering 200 times greater coverage. The network relies on HNT holders who manage nodes, incentivizing participation. Helium also uses Data Credits for transaction fees.

The Proof of Coverage mechanism is unique to Helium, based on the HoneyBadger Byzantine Fault Tolerance protocol. This allows consensus even with varying connection rates. Also, this mechanism supports Challengers, Transmitters, and Witnesses, validating network activities.

🎉@getmntd_ becomes the first third-party MOBILE Hotspot vendor on the @Helium Network.

“The Helium Foundation is thrilled to continue working with the MNTD team as one of the most long-term aligned vendors in decentralized wireless. The MOBILE Network continues to see steady… pic.twitter.com/iLXd2kpIy9

— Helium Foundation 🎈 (@HeliumFndn) June 6, 2024

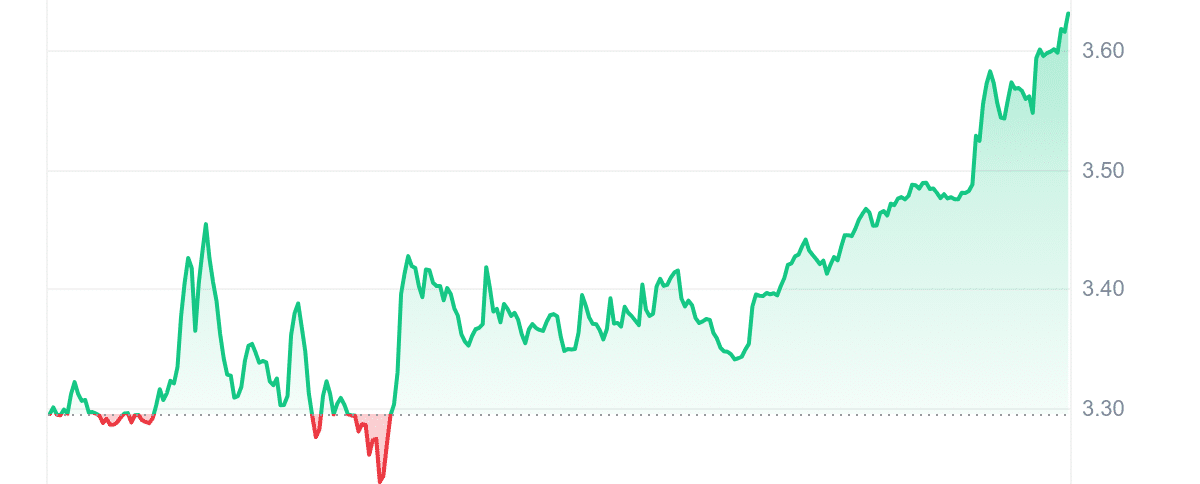

HNT has shown impressive performance, with its price currently at $3.47, marking a 6.99% surge in the last 24 hours. Over the past year, HNT has increased by 175%, outperforming 64% of the top 100 crypto assets. It is trading 54.21% above its 200-day SAM of $2.25.

Despite its strong performance, the 14-day RSI at 74.77 indicates it is overbought and may soon experience a price correction. With 40% of the last 30 days being positive and a low 30-day volatility of 9%, Helium maintains medium liquidity.

3. 99Bitcoins (99BTC)

Surpassing the $2 million milestone, the presale of 99Bitcoins’ BRC-20 crypto token is capturing the attention of investors far and wide. Through this Learn-to-Earn (L2E) project, users engage with challenges and lessons to earn 99BTC tokens, enhancing interaction and rewards. Also, with an enticing staking model boasting an impressive 855% APY, the platform offers a compelling opportunity.

🎉 BIG NEWS! 🎉

We’ve officially raised over $2 MILLION in our $99BTC #Presale! 🚀🔥

A massive THANK YOU! 🙌

Join the ultimate learning tool where you can earn while you learn.

Don’t miss out—get started today! 👉 https://t.co/NXD7DAamqr#99Bitcoins #BTC #Crypto #Learn2Earn pic.twitter.com/zpDn90jBM3

— 99Bitcoins (@99BitcoinsHQ) June 10, 2024

Since its establishment in 2013, 99Bitcoins has emerged as a cornerstone of cryptocurrency education, leading transformative initiatives within the crypto sphere. Initially providing detailed guides on trading, wallets, and earning crypto, the platform has evolved remarkably.

Boasting over 2 million registered course users and over 700,000 YouTube subscribers, 99Bitcoins has solidified its position as a top resource in the crypto community. Introducing the $99BTC token, ICO has enhanced the platform’s offerings.

Strategically timed with its impending migration to the BRC-20 token standard in Q3 2024, 99Bitcoins further cements its appeal. Analysts foresee exponential growth and a $100M market value for the platform, with forthcoming listings on prominent exchanges. The trajectory of 99Bitcoins signals a promising future in the dynamic world of cryptocurrency.

4. Aelf (ELF)

The next gainer is Aelf, the pioneer Layer 1 blockchain, offering modular systems, parallel processing, and multi-sidechain technology for unlimited scalability. Founded in 2017 and based in Singapore, Aelf leads Asia in integrating AI into blockchain.

Aelf supports building and deploying smart contracts and dApps with its native C# SDK and others like Java, JS, Python, and Go. It focuses on side chains and a unique governance system to solve blockchain issues. Side chains handle specific smart contracts and communicate through the main chain, enhancing scalability and preventing network bloating.

Aelf’s Delegated Proof-of-Stake (DPoS) consensus system involves ELF holders voting for mining nodes. These nodes then decide how to distribute mining rewards. This democratic approach and the ability to add or remove side chains ensure efficiency and cater to commercial app needs.

We were honoured to participate in the inaugural AI Apex Asia 2024 conference in Singapore and contribute to @AIApexAsia’s mission of driving collaborative efforts to enhance progress and access to AI technology.

Our COO, Brian Liang, had the privilege of participating in a… https://t.co/eHQIHihVx7

— ælf (@aelfblockchain) June 7, 2024

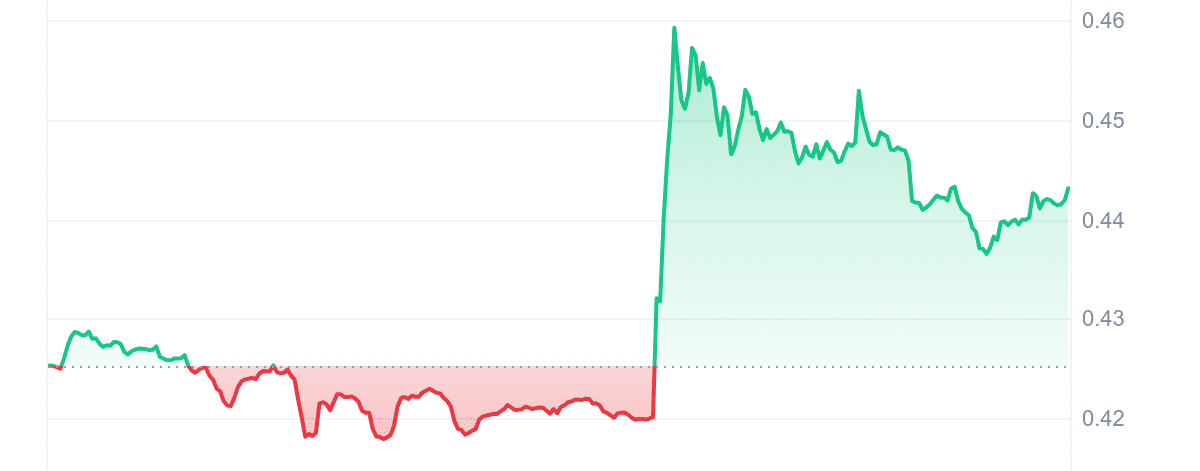

ELF is now $0.442498, reflecting a 3.87% surge in the last 24 hours and a 63% increase over the past year. However, it only excels 35% of the top 100 crypto assets and trades 17.38% below its 200-day SMA of $0.53559.

With a 14-day RSI of 31.40, it shows neutral trading conditions, suggesting potential sideways movement. In the past 30 days, 33% have been positive, with a low volatility of 5%. Aelf maintains high liquidity with a market cap of $321.82 million, a 24-hour trading volume of $11.56 million, and a volume-to-market cap ratio of 0.0359.

5. Kaspa (KAS)

The last gainer is Kaspa, a proof-of-work cryptocurrency leveraging the GHOSTDAG protocol, creating a blockDAG structure that enables parallel blocks to coexist without orphans. This setup enhances security and allows for high block rates, aiming to achieve 100 blocks per second. Kaspa’s design features include Reachability for DAG topology queries, block data pruning, SPV proofs, and future support for subnetworks, making implementing layer two solutions easier.

Kaspa’s unique monetary policy, known as the chromatic phase, reduces emissions geometrically over time, inspired by the 12-note scale of music. Activated on May 7, 2022, with a block reward of 440 KAS, the reward halves annually, with a monthly reduction factor. This policy ensures the emission rate remains consistent, adjusting rewards based on block rate changes. The initial block reward corresponds to the frequency of note A4, with each year termed an octave.

📣 NEW LISTING!

#Kaspa is now LIVE on @CoinWOfficial $KAS X $USDTTrade now: https://t.co/zNQvfuG2C0#DigitalSilver #Cryptocurrency #CryptoTrading #L1 #PoW #BlockDAG pic.twitter.com/RYFQ4URxzB

— Kaspa (@KaspaCurrency) June 11, 2024

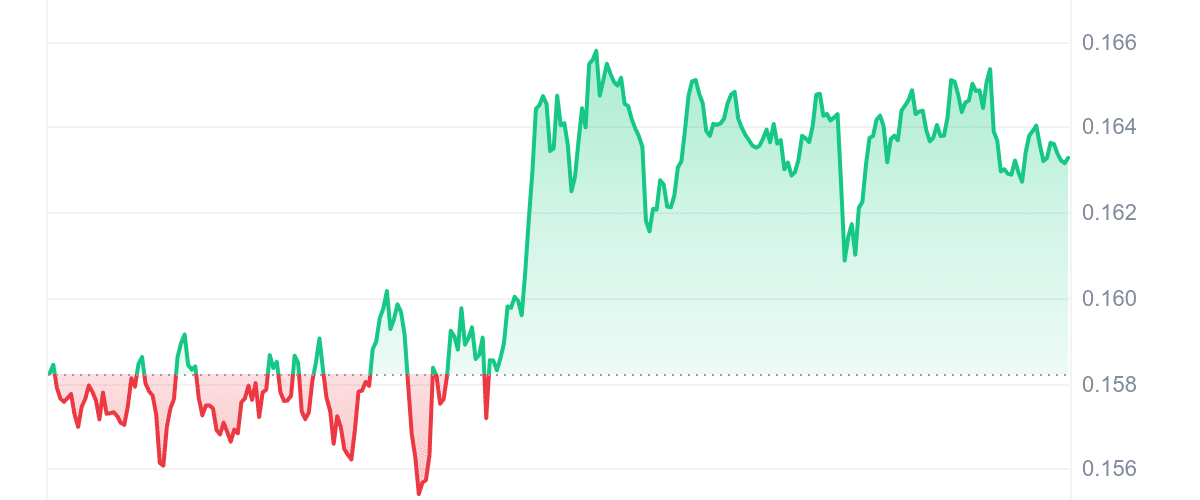

Kaspa is currently making waves in the market, selling at $0.165641, up by 2.97% in the last 24 hours. Over the past year, it has seen a staggering surge of 922%, surpassing 92% of top crypto assets. It’s trading above its 200-day SMA of $0.063593, with a 14-day RSI of 54.20, indicating a neutral stance. Despite its high performance, Kaspa maintains a low 30-day volatility of 13% and high liquidity with a volume-to-market cap ratio of 0.0919.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage