Join Our Telegram channel to stay up to date on breaking news coverage

The allure of alternative digital currencies beyond Bitcoin is undeniable, with their unique propositions and potential for exponential growth. These coins offer investors several alternative opportunities to profit from the crypto market.

However, identifying promising altcoins for investment can be tasking for investors. As such, Insidebitcoins curates a list of the best altcoins, presenting investors with opportunities for their investment portfolio.

7 Best Altcoins to Invest in Right Now

In the past week, Solana surpassed Ethereum in decentralized exchange (DEX) trading volume. According to DefiLlama data, SOL registered $10.1 billion. This surge in Solana’s DEX activity can be attributed to its comparative advantage in lower gas fees than Ethereum, attracting increased attention toward meme coin trading.

1. PancakeSwap (CAKE)

PancakeSwap recently proposed a substantial reduction in its native token supply. CAKE’s proposed reduction will take the token supply from 750 million to 450 million. This move aims to exert tighter control over market dynamics and align with the platform’s growth objectives. Similarly, the proposal reflects PancakeSwap’s shift from its previous hyperinflationary model towards a more sustainable tokenomics approach.

Furthermore, the platform has opened the proposal for feedback before the voting phase. This move highlights PancakeSwap’s commitment to inclusive decision-making and transparent governance, emphasizing community involvement.

Notably, recent enhancements in CAKE Tokenomics v2.5 coincided with the introduction of the veCAKE Gauges System. These projects have laid the groundwork for CAKE’s new transition, setting the stage for a more robust ecosystem.

🐰 PancakeSwap Family!

🥞 We are proposing to reduce the max token supply of $CAKE from 750M to 450M.

💥 After a year of hard work and deflation, we are razor-focused on ultrasound CAKE.

🌟 By reducing our token supply by 300,000,000 $CAKE, we signal PancakeSwap’s successful… pic.twitter.com/PIk3SBEhiJ

— PancakeSwap v4🥞 (@PancakeSwap) December 21, 2023

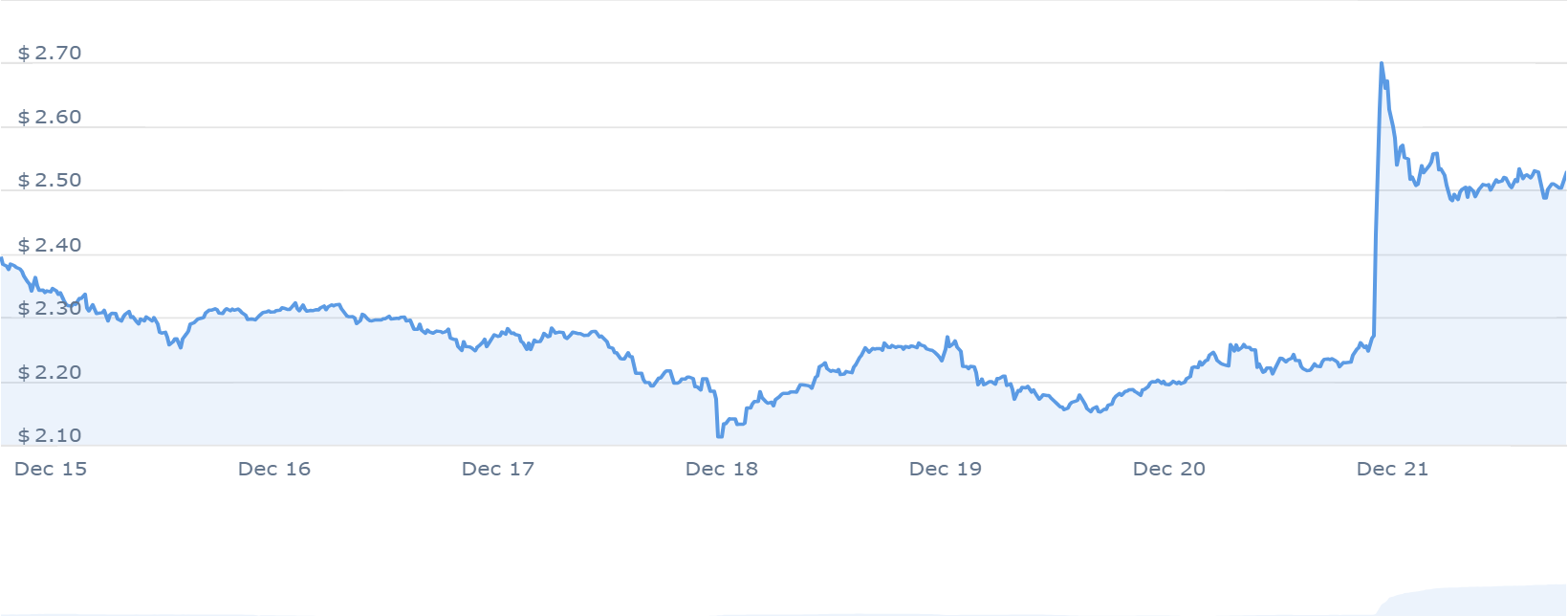

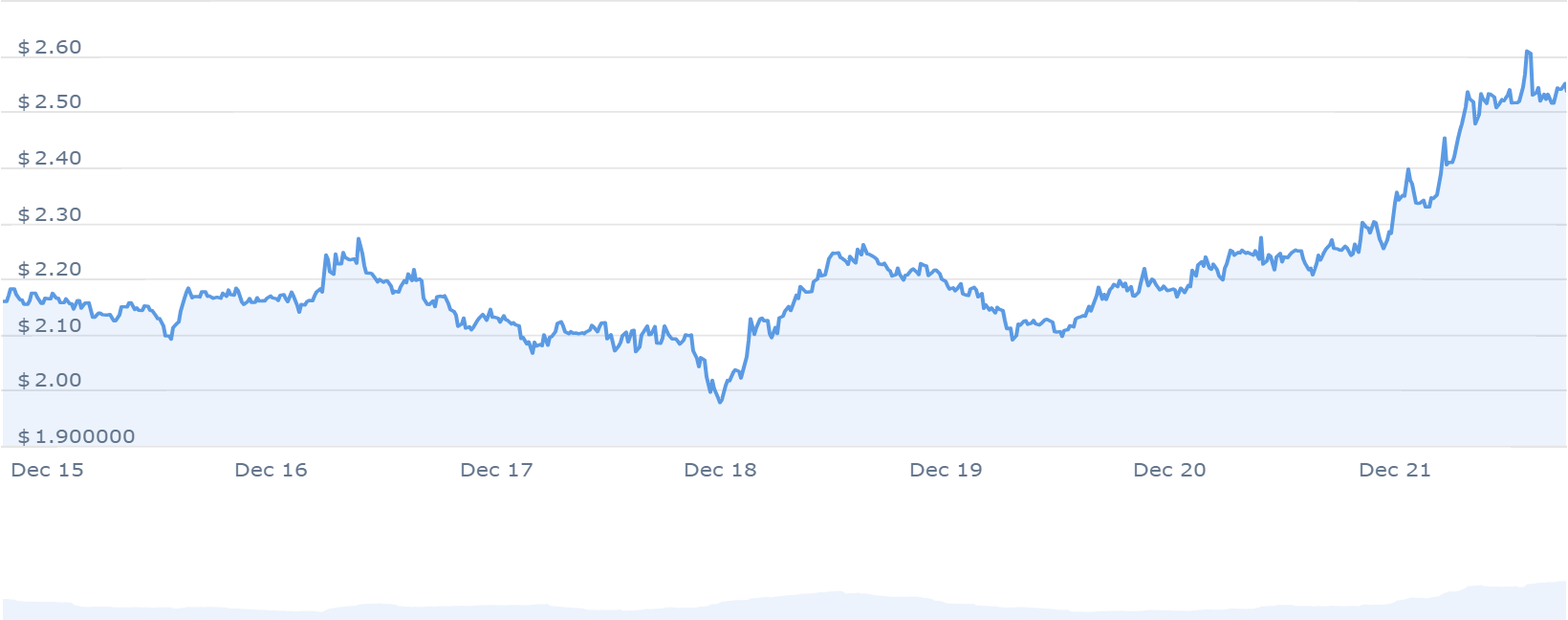

Likewise, the announcement sparked a notable market response, with a 22% surge in CAKE’s value within three hours. This rally spiked the coin from around $2.22 to $2.718, accompanied by increased trading volume.

2. Optimism (OP)

Optimism, a Layer 2 network, has seen a surge in daily transactions. This surge has caused OP to hit a new high for the month. According to Artemis data, in the past 30 days, daily transactions on Optimism increased by 42%, reaching 512,770. This spike is mainly due to a sharp rise in user activity observed last week.

Over the last seven days, the count of unique addresses completing at least one transaction on Optimism rose by 45%. This number totaled 77,470 addresses by December 19th. However, this increase in demand came alongside a rise in transaction fees on the network.

In the larger context of increased interest in Layer 2 solutions, Optimism has shown an impressive 65% Year-to-Date (YTD) rally in TVL. The rise in transaction fees on the Optimism chain has directly impacted its revenue. Token Terminal’s data indicates a 47% increase in network revenue derived from fees. Hence, this resulted in an almost 90% annualized revenue climb, totaling $53.95 million in the last 12 months.

3. Fantom (FTM)

Fantom (FTM) has been on an upward trajectory lately, consistently favoring buyers at higher price levels. Moreover, recent weeks witnessed a notable rally and increased buying volume. This activity hints at the involvement of significant investors eyeing potential growth.

During short-term price declines, buyers have shown a keen interest in accumulating more, indicating a readiness to buy on dips. The crossing of exponential moving averages (EMAs) has further bolstered investor confidence, fueling the ongoing positive momentum.

Introducing the final of four fantastic Sonic Labs mentors, @capitELIst!

We asked Eli from our team at the Fantom Foundation a few questions about himself and what he's bringing to the Sonic Labs teams as a mentor 👇

Can you share a bit about yourself?

Law was my midlife… pic.twitter.com/Y8ykbhZw4g

— Fantom Foundation (@FantomFDN) December 21, 2023

Furthermore, the chart pattern analysis reveals a sustained bullish trend, lacking clear signs of weakness. This suggests a favorable strategy of following the current upward trend for potential long-term gains.

4. EOS (EOS)

Under the guidance of Yves La Rose and the EOS Network Foundation, EOS has made significant strides with its EOS EVM implementation. This move has helped streamline fund transfers from Ethereum and nurturing DeFi applications on its platform.

Recent milestones include EOS EVM v6’s trustless USDT bridging and a strategic partnership with Spirit Blockchain Capital post-funding. Therefore, this hints at a promising trajectory for EOS amid heightened activity in EVM chains due to market surges.

Today an MSIG was passed to withdraw the 108,889 $EOS accumulated via #EOSEVM gas fees from the eosio.evm account.

The 108,889 EOS was used to purchase approximately 1.8gb of #EOS RAM to provide additional memory storage for the EVM.https://t.co/iRk3YCn0rO

— EOS Network Foundation (@EOSNetworkFDN) December 22, 2023

Several indicators also paint a nuanced picture. The Relative Strength Index (RSI) just below 60 hints at a potential shift to a bullish trend without reaching overbought levels. Furthermore, the Stochastic %K at 89.47 signifies heightened market activity, while the ADX’s low score of 15.4 suggests an evolving trend.

5. Chainlink (LINK)

Over the past year, Chainlink has slowly caught investors’ eye with positive performances. Currently, it stands as one of the leading assets in the DeFi Coins sector and ranks second among Ethereum (ERC20) Tokens.

Notably, the price surged to a cycle high of $17.31 from the last cycle low, indicating a bullish sentiment in price prediction. This positive outlook is further reflected in the Fear & Greed Index, which presently sits at 74 (Greed).

In terms of performance, Chainlink has exhibited significant growth, witnessing a 160% increase in price over the last year. Moreover, it has outperformed 72% of the top 100 crypto assets within this period. Technical analysis also showcases its market performance, trading consistently above the 200-day simple moving average.

Accurate, reliable, and decentralized #Chainlink Price Feeds unlock key use cases across the Web3 ecosystem.

Integrate the CELO/USD Price Feed on @CeloOrg to build secure DeFi markets around Celo’s token.https://t.co/v4SvWakKey

— Chainlink (@chainlink) December 22, 2023

The project’s recent track record appears promising, marked by 18 green days out of the last 30, indicating a 60% positive trend. Additionally, it boasts high liquidity, a testament to its substantial market capitalization.

6. Bitcoin Minetrix (BTCMTX)

Bitcoin Minetrix introduces a new method where users can stake BTCMTX tokens for cloud mining credits. The goal is to decentralize control and provide a secure mining experience for token holders.

So far, more than 400,000 BTCMTX tokens are locked in the staking pool, showing considerable interest from users. The project claims an annual percentage yield (APY) of 103,225%, which has caught the attention of the cryptocurrency world. This growth has propelled it to be one of the top-performing cryptocurrencies, partly due to a successful BTCMTX presale.

Marking another major success for #BitcoinMinetrix!

Surpassing the $5,600,000 milestone! 🔥 pic.twitter.com/NtuEkIuHA8

— Bitcoinminetrix (@bitcoinminetrix) December 21, 2023

During the presale, Bitcoin Minetrix raised over $5,746,128 by selling tokens at $0.0123 each, offering 70% (2.8 billion BTCMTX) of the total supply of 4 billion tokens. Investors could buy these tokens using either ETH or USDT.

7. Filecoin (FIL)

Filecoin recently displayed a substantial uptrend, increasing over 20% in just two days. This surge propelled the token beyond the previous price peak of $5.500. Such momentum was supported by a considerable surge in buying volume, indicating a sustained interest in the asset.

During the preceding weeks, Filecoin (FIL) had been consolidating within the $4.000 to $5.500 range, establishing a foundation for its price movement. This consolidation phase signaled a period where buyers absorbed selling pressure, solidifying a near-term base for the asset.

https://x.com/Filecoin/status/1736766402994823307?s=20

Today, Filecoin (FIL) trades at $5.67, showing signs of stability within its recent gains. Predictions from experts suggest a potential rise to $5.750 by the year’s end, with this projection hinging on the growing demand for the coin.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage