Join Our Telegram channel to stay up to date on breaking news coverage

Michael Saylor maintains his positive stance on Bitcoin despite the recent developments regarding Bitcoin ETF approvals.

During the earnings call on August 1, the CEO of Microstrategy highlighted that the company would retain its distinct status due to its “Bitcoin-centric operational strategy,” even when spot ETFs become available.

He commented to Bloomberg, “As an operational company, we have the ability to utilize leverage, something an ETF can’t do, thus, we see this as advantageous to the entire ecosystem.”

However, he didn’t downplay the potential impact of spot Bitcoin ETFs on the ecosystem. Drawing an analogy, he said, “We are akin to a sportscar, while the upcoming spot ETF will resemble a supertanker.”

He pointed out that if the Securities Exchange Commission approves even one of the nine pending Bitcoin ETF applications, it’s likely that significant entities such as hedge funds and sovereign wealth funds will invest billions into the Bitcoin market.

In the same earnings call, Saylor emphasized that Spot ETFs will cater to a different customer base, contributing to the growth of the whole category in a complementary manner.

Microstrategy Showcases its Outperformance Since Adopting Bitcoin

On August 3rd, Michael Saylor tweeted a graph to showcase the rise of Microstrategy since adopting the Bitcoin strategy.

Consider a #Bitcoin Strategy. pic.twitter.com/MJcGxiVHop

— Michael Saylor⚡️ (@saylor) August 2, 2023

A research report from TD Cowen reveals that the company has generated 254% returns since 2020 after adopting the Bitcoin strategy, outperforming the token itself, which has grown by 145% during the same period.

Stocks like Microstrategy follow the price of digital assets in their balance sheet, so investors often use them to gain exposure to crypto assets without involving a cryptocurrency exchange.

Microstrategy Poised to Buy More Bitcoins

As one of the prominent Bitcoin whales, Microstrategy now owns around $4.5 billion worth of Bitcoin after buying another $341 million worth of BTC in Q2 2023.

The latest purchase came in July when Michael Saylor revealed through his tweet that Microstrategy had bought 467 BTC worth $14.4 million, increasing the company’s holdings to 152,800 BTC.

In July, @MicroStrategy acquired an additional 467 BTC for $14.4 million and now holds 152,800 BTC. Please join us at 5pm ET as we discuss our Q2 2023 financial results and answer questions about the outlook for #BusinessIntelligence and #Bitcoin. $MSTR https://t.co/SCHeBJ80TH

— Michael Saylor⚡️ (@saylor) August 1, 2023

One document filed to SEC revealed that Microstrategy now plans to sell $750 million worth of class A common stock to add more Bitcoin to its existing holdings.

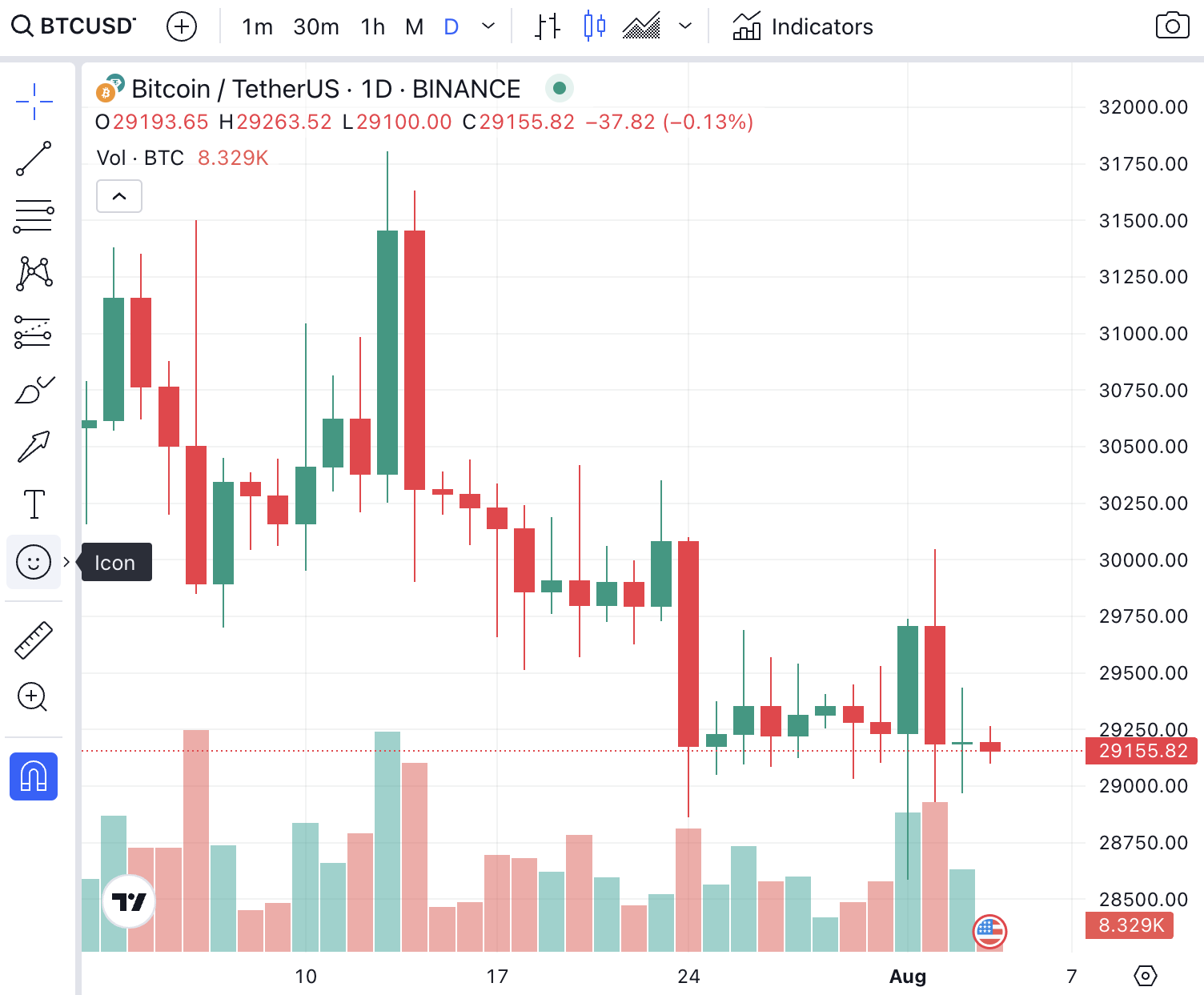

Bitcoin Performance Remains Volatile

Bitcoin’s performance has remained volatile since it pared back from $30k. The latest long red came after it was reported that US prosecutors are considering fraud charges against Binance.

Candle charts show a bearish dominance, which is keeping Bitcoin just above the $29k mark.

The Bitcoin price has experienced a marginal decline of 0.04% in the last 24 hours, accompanied by a minor 0.04% increase in its market capitalization and a steep drop of 17% in its 24-hour trading volume.

Related

- Microstrategy Plans $750 Million Share Offering and Says it Will Add More Bitcoin to $4.5 Billion Holding

- Ether Futures ETFs Had Prices Inflated by Tweeting Bots on X, Study Says

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage