Join Our Telegram channel to stay up to date on breaking news coverage

Binance, the largest crypto exchange in the world, has reportedly been using its US-based affiliate to open and operate bank accounts in its name, according to a Monday (June 5) report by Reuters.

The arrangement allegedly allowed Binance to get over limits put in place by US regulators and operate legally and compliantly within the United States without the necessary authorization.

Allegations that Binance is Flouting US Regulations

According to bank records, five bank accounts connected to the crypto giant’s supposedly autonomous U.S. branch, including one that had funds belonging to American consumers, were controlled by a top Binance official. Senior executive Guangying Chen, a close friend of Binance CEO Changpeng Zhao, was reportedly permitted by American lender Silvergate Bank to manage the accounts.

This made it possible for Chen and her deputies to transfer money from the bank accounts. According to company correspondence, Binance.US even required Chen to handle payments, including payroll.

The relationship raises concerns about the impartiality of Binance’s American affiliate as well as possible conflicts of interest. Insiders in the cryptocurrency industry are now debating whether the arrangement was morally right and whether Binance should be held accountable in light of the news.

A Chain of Investigations into Binance’s Operations

Despite both companies insisting that they have always worked separately, Binance seems to maintain strict control over Binance.US. The previously undisclosed bank documents and messages demonstrate that Binance had control over the financial operations of the American company across all of its accounts at Silvergate, and they also provide information on how this privileged access was granted.

The claims are the most recent in a string of articles suggesting Binance’s control over its U.S. subsidiary. Following a lengthy investigation into the company, the U.S. Securities and Exchange Commission filed a civil lawsuit against Binance after this news piece was published.

13 allegations were made against Binance, its CEO Changpeng Zhao, and the manager of its ostensibly independent US exchange by the Securities and Exchange Commission (SEC), which complained to a federal court in Washington, DC.

According to the SEC, Binance manipulated its trade volumes, misappropriated customer funds, and deceived investors about the effectiveness of its market monitoring systems. The SEC further asserted that the cryptocurrency behemoth and its CEO secretly controlled client assets, letting them mix and reroute investor funds “as they please.”

The complaint reads, “As alleged, Zhao and Binance misled investors about their risk controls and corrupted trading volumes while actively concealing who was operating the platform, the manipulative trading of its affiliated market maker, and even where and with whom investor funds and crypto assets were custodied.”

The Commission also claimed that Sigma Chain, a trading company owned and managed by Zhao, participated in “wash trading,” which fraudulently inflated the trading volume of crypto asset securities on Binance from roughly three years ago until June 2022. The commission also stated that Sigma Chain spent $11 million from an account on a yacht.

Who is Binance Founder Changpeng Zhao?

Zhao, 46, was born in China and immigrated to Canada in 1989 when he was 12 years old, two months following China’s repression of pro-democracy protestors in Tiananmen Square.

He founded the crypto exchange Binance in 2017, which surpassed Coinbase as the largest cryptocurrency exchange in the world in less than a year. Today, the crypto giant represents nearly 60% of all cryptocurrency trading volumes worldwide.

Zhao promoted a select group of associates into high-level positions throughout the years, many of whom had worked or studied in China. Co-founder Yi He currently oversees Binance’s $7.5 billion venture capital arm in addition to other crucial divisions.

The 46-year-old assigned Guangying Chen, his Chinese-born head of the back office, is responsible for overseeing the business’ finances. Despite hiring experts from varied traditional financial and regulatory worlds, Zhao’s strict control over his business reportedly persists.

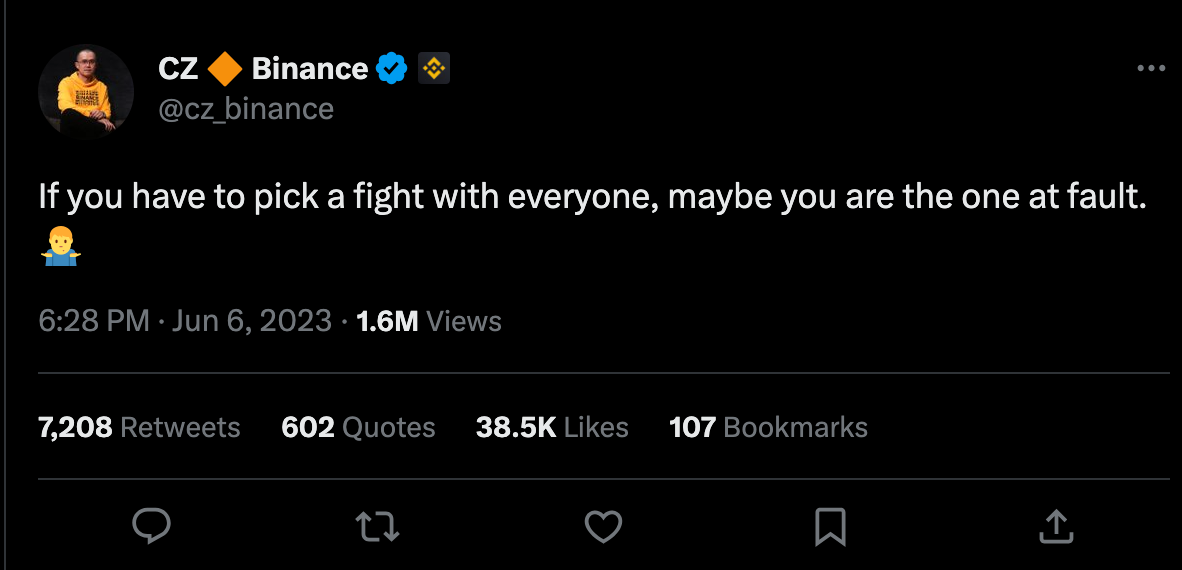

Binance’s Response

Binance has criticized the SEC’s action, calling it a misguided move that jeopardized the US’ position as a pioneer and worldwide hub for financial innovation. The crypto exchange has also denied combining consumer deposits with business cash, claiming that users who deposited money to the account were purchasing Binance’s unique dollar-linked crypto token rather than making deposits.

The operation of Binance’s bank accounts has never been acknowledged by Binance.US. According to Krishna Juvvadi, the company’s head of legal, BAM Trading staff have had “exclusive control” over Binance.US since it was founded in 2019.

Binance’s response when asked about this latest report came through Christian Hertenstein, a spokeswoman for Binance.US, claiming that no one else but Binance.US officials have had access to or control over Binance.US accounts ever since CEO Brian Shroder assumed leadership in late 2021.

According to Reuters, Hertenstein did not explain the difference in the timelines he and Juvvadi provided. Requests for a response from Silvergate, which fell apart in March and is winding down operations, also went unanswered.

Government Coming Down Heavily on Regulatory Violators

In the meantime, following a “significant” increase in illegal activity in the digital asset space, Eun Young Choi, head of the Department of Justice’s (DOJ) National Cryptocurrency Enforcement Team (NCET), declared last month that she intends to crack down on illegal activity in the crypto sector, particularly businesses that commit crimes or enable them to happen.

A prosecution of Binance or Zhao, according to industry watchers, may further upset the cryptocurrency market. However, Choi told the Financial Times that the size of a firm is not something that the department will countenance when weighing charges.

Without naming specific businesses, Choi said that the government cannot be in a position where they give someone a pass because they have assumed they are too big to fail, considering a crypto exchange has amassed a significant market share while flouting U.S. criminal law.

Read More:

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage