Join Our Telegram channel to stay up to date on breaking news coverage

KAVA token started the year with a bullish streak, rising 114% from the $0.5 support floor on January 2 to a high of $1.11 on January 18. However, the rally was interrupted when bears thrust into the market and spent the next 12 days giving bulls a run for their money. Bulls took back control on January 31, and have registered four straight green bars to today’s intraday high of $1.05.

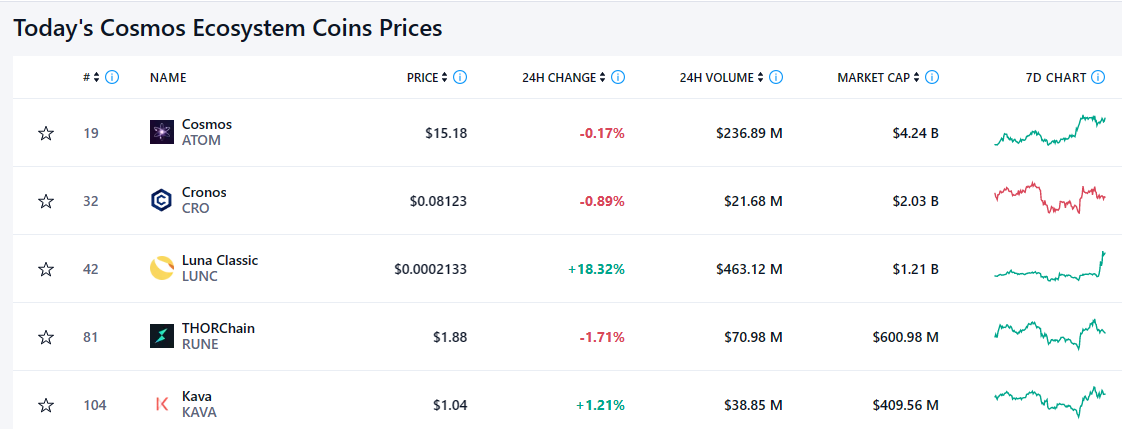

It is worth mentioning that the January rally earned the token a place in the “top 10 Cosmos ecosystem coins by market volume.”

At the time of writing, the token was trading at $1.041 after gaining 4.65% on the last day. The Layer-1 blockchain asset recorded a 24-hour trading volume of $37.1 million, 32% higher than its Thursday score, suggesting an influx in trading activity among KAVA holders. With a live market cap of $414.1 million, the asset stood at #93 on the CoinMarketCap list.

Kava is a decentralized Layer 1 blockchain combining Cosmos’ speed and interoperability with Ethereum’s developer power.

KAVA Lists On Coinbase Exchange

The recent rally for Layer 1 token comes in light of recent advancements in the Kava ecosystem, starting with the listing of the KAVA token on the cryptocurrency exchange Coinbase.

I'm happy to say that @KAVA_CHAIN is now listed on Coinbase.

This is a significant step for the platform in terms of expanding its audience, particularly among Coinbase users.$KAVA #Kavalry #KavaHub pic.twitter.com/GXeftNlk2n

— John Innocent 🥷 (@SacrosancCrypto) February 1, 2023

The move is a valuable addition to the Kava ecosystem and is expected to help expand its audience, particularly among Coinbase users.

On January 18, when the listing news broke out, KAVA soared 24% with $5.537 million in trading volume on the day, evidence of investor hype about the advancement of Ethereum-Cosmos interoperability. Citing Kava Labs CEO Scott Stuart on the development:

I look forward to growing Kava’s exposure to new users, which will have downstream effects for all protocols in the Kava Rise program and the Cosmos ecosystem.”

Notably, Kava Rise is a developer incentive program combining on-chain and off-chain growth mechanisms to establish a new standard for enabling growth and demand for thousands of Web 3.0 protocols.

Coinbase has listed Kava and will launch a massive ‘learning rewards campaign’ to educate its user base about how Kava is leading the world to Web 3.0.”

Stuart also said it was exciting to see the Layer 1 token listed on the largest U.S.-regulated crypto exchange, lauding Coinbase for setting the “standard as most important on-ramp for new users and capital into the blockchain ecosystem.”

Still on Kava ecosystem advancements, the network recently partnered with DAO labs for the Kava hub platform, currently in the soft launch stage debuted on December 14. The social mining platform provided by DAO labs looks to incentivize the Kava community.

I do social mining with Kava Hub, started by TheDAOLabs Team. #Kava

I invest in #Crypto by actively using my social media accounts without allocating a budget.#KavaHub for those who want to earn in crypto

👇👇https://t.co/HhOLY80QFm#KAVA_CHAIN $KAVA @KAVA_CHAIN #Airdop pic.twitter.com/q9HkhMA3Sx

— SerdenETH (@serden_eth) February 2, 2023

So far, Kava Hub has upwards of 787 active users, among them social miners from DAOVERSE and veteran Kava fans. Citing DAO Labs CEO Malte Christensen on the collaboration during an AMA on the Kava platform’s official telegram:

Our track record and achievements are solid, and I believe we can help KAVA weather the storm that this bear market is.”

DAO Labs helps streamline social media, output organized content, and initiate non-custodial soft staking. The partnership will, therefore, “reduce the floating value of KAVA on the secondary market by creating opportunity cost for users in terms of voting power and social media hierarchies in different language tiers.”

Will KAVA Price Retest The November 8 High?

At the time of writing, KAVA was trading at $1.041 with green bars as bulls led the market. The price was sitting on the immediate support at $1.0 as it prepared for more gains, with the first roadblock presenting at the $1.2 level. A daily candlestick close above this resistance level would open the path for the KAVA price to reach for the $1.3 resistance level embraced by the 200-day Simple Moving Average (SMA).

Notice that the $1.3 level provided formidable support for the KAVA price in the past, up until November 8 when it was flipped to resistance. This was around the same time when crypto exchange FTX suffered a liquidity crisis that led to a fall in crypto prices across the market as fear and uncertainty filled investors.

With investor confidence resurging and if bulls’ ambition remains intact, KAVA price could flip this resistance along with the slow-moving average (200-day SMA) and restore them as support to ramp the Layer 1 token towards the $1.618 target, last recorded on October 26. If such a scenario prevails, it will mark a 54.99% ascent from the current levels.

KAVA/USD Daily Chart

The uptrend was highly likely as the price had strong downward support. Other than the immediate one at $1.0, the KAVA bulls had a resting shed around the $0.92 level embraced by the 100-day SMA at $0.916. This level served them well recently when it provided the jumping-off point for the recent breakout that began on January 31.

The bullish narrative was supported by the upward-facing 50-day SMA and the rising Relative Strength Index (RSI) at 61, approaching the overbought region. This suggested that the market favored the bulls, thereby adding credence to the continuation of an uptrend.

On the downside, if buyer momentum declined or investors decided to book early profits by selling their KAVA holdings, the price could lose immediate support at $1.0, exposing the Layer 1 token to the bears’ grip. Such an outcome could see the price drop lower than the $0.92 support level and the 50-day SMA support at $0.8. In extreme cases of massive sell-offs, the KAVA price could retest $0.6 support, or worse, the $0.5 swing low.

The Moving Average Convergence Divergence (MACD) indicator was flattening out, a sign of easing buyer momentum. This is days after it had sent a sell signal when the 12-day exponential moving average (EMA) in blue crossed below the 26-day EMA (line in orange). Similarly, the histograms were still red to signify overhead pressure.

Switch Your Gaze From KAVA

Instead of stressing over KAVA, investors are now switching their gaze to the more risk-averse alternatives. First on the list is MEMAG, the ticker token for Meta Masters Guild. MEMAG token has better odds, with investors flocking to buy while it is still affordable in the presale stage at 0.021 USDT each.

With barely six days to Presale Stage 5, the price will go higher in the next phase. The presale has already raised more than $2.63 million. Do not miss out for any reason!

Read More:

- Render Token Price Down 6% As DAO Approves Burn And Mint Framework

- Rocket Pool Price Prediction As $18 Million Trading Volume Comes In – $100 RPL Incoming?

- Connext Upgrade Should Improve UX And Help Developers

Join Our Telegram channel to stay up to date on breaking news coverage