Join Our Telegram channel to stay up to date on breaking news coverage

Headlines about rising prices are everywhere these days. Experts disagree about who’s to blame, but everyone agrees that inflation is here – and it’s shrinking your paycheck.

Inflation hits record 8.6% for 19 countries using the euro – PBS NewsHour

Inflation goes global: It’s not just rising in the U.S. – but Europe, South Korea and More – Forbes

Inflation rates in Europe by country revealed as continent battles with price hikes – Express

‘Ugly’ inflation numbers make a recession more likely in 2022, economist says – CNBC

Your money buys less than it did a month ago. And economists agree it’s going to get worse before it gets better.

You must invest intelligently to protect your family’s financial well-being.

How to invest when your money is worth less every day

In the United States, government auditors say the annual inflation rate climbed to 9.1% in June.

That’s the highest rate in 40 years.

The EU’s Eurostat division reports that similar rates are raging across Europe.

Which means that every 100 euros you receive in salary buys you about 91 euros worth of groceries.

But that’s not the worst of it.

The inflation rate is accelerating

Economists are signaling that they expect national currencies to continue losing value at an accelerated rate.

Most investors don’t understand just how bad this is.

Asked whether inflation “swindles equity investors,” investing guru Warren Buffet replied, “Inflation swindles the bond investor too. It swindles the person who keeps their cash under their mattress. It swindles almost everybody.”

Swindled. Because people are able to buy less and less with the same amount of money.

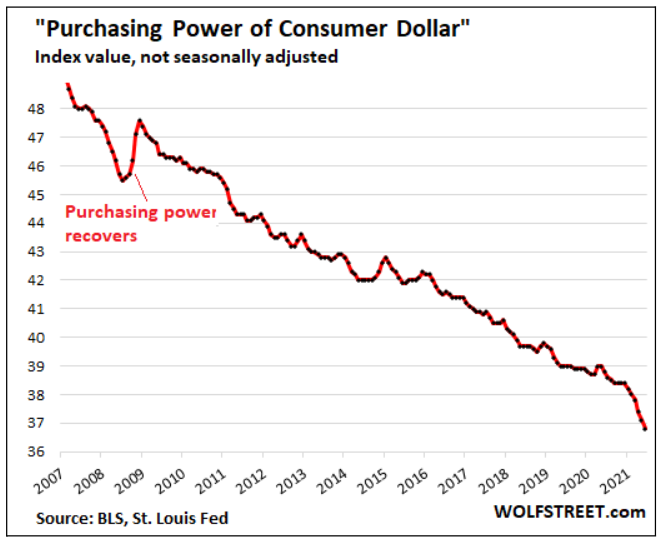

Here’s how purchasing power has declined over the past 15 years:

That’s an unrelenting drop in consumer purchasing power.

So even if you’re making a pretty good return on your investments, your gains could be net losses. You have more money but you can buy less.

That’s inflation.

It’s like a thief stealing from your savings, the value of your home, and your investment portfolio.

The last time inflation rates rose this high, they decided an American presidential election

In 1976, incumbent Gerald Ford got his campaign to print up millions of buttons for supporters to wear. They said WIN – Whip Inflation Now.

Challenger Jimmy Carter delivered a harsh dose of reality. He turned his button upside down so it read NIM – No Immediate Miracles.

Tired of politicians’ empty promises, voters swept Carter into the White House amid hopes of straight talk.

We’re not going to promise to whip inflation now.

But we do recommend a proven investing strategy that can generate returns no matter what happens to the euro’s purchasing power. A strategy that means you can profit even if inflation continues to accelerate.

The strategy we recommend could be regarded as boring. We’re not promising immediate miracles or overnight Lamborghinis.

Many crypto investors try to get rich overnight, and they end up losing money instead.

Here’s what they should be doing

The single best strategy for everyday investors is to cost-average into cryptocurrencies that have demonstrated long-term rising trends.

This means that every week or every month you buy the exact same amount of the crypto of your choice.

This is the strategy top investment advisors recommend. It’s a time-tested way of generating consistent returns over the long run and slowly building wealth.

This strategy is so reliable and so easy to follow that at Kriptomat we’ve decided to offer an automatic way for investors to cost-average their crypto investments.

We call it Recurring Buy.

It’s so easy you can set it up in seconds. Just pick the crypto you want to buy, the frequency, and the amount. Recurring Buy will take care of the rest automatically.

The cost averaging strategy behind Recurring Buy has been shown to help investors beat inflation, protect their portfolios, and achieve financial freedom in the long term.

- Cost averaging relieves you of the difficult task of predicting price changes and timing transactions to take place at market highs and lows.

- It minimizes the impact of market volatility by averaging out the peaks and valleys on price charts.

- It allows you to start meeting your financial goals immediately, without waiting to build up a big investment fund.

- It eliminates the harmful effects of hunches and emotions in making investment decisions.

- It accumulates more crypto when prices are low, reducing your cost basis and maximizing returns when you sell.

At Kriptomat, there’s a sixth benefit: You can set it up with a credit card for as little as €15 a month and have the regular purchases made automatically while you get on with your busy life.

Yes, it’s a slow and boring process.

But if you’re looking for overnight riches you’re much more likely to wake up broke.

Don’t let inflation steal your portfolio away.

About Kriptomat

Founded in 2018, Kriptomat revolutionized the cryptocurrency world with the introduction of the simplest platform in Europe. Kriptomat makes digital finance so simple that everybody everywhere can access the freedom, fairness, and fulfillment that crypto represents.

Hundreds of thousands of customers across Europe and in 120 countries worldwide trust Kriptomat when they buy, sell, swap, earn, share, and invest in crypto.

Join Our Telegram channel to stay up to date on breaking news coverage