Join Our Telegram channel to stay up to date on breaking news coverage

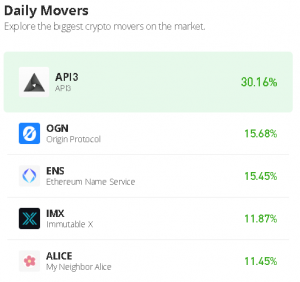

If the Origin Protocol price prediction prepares for the uptrend, the coin will be technically and fundamentally ready to break above $0.25.

OGN Prediction Statistics Data:

- OGN price now – $0.23

- OGN market cap – $92.4 million

- OGN circulating supply – 388.5 million

- OGN total supply – 1.0 billion

- OGN Coinmarketcap ranking – #186

OGN/USD Market

Key Levels:

Resistance levels: $0.40, $0.45, $0.50

Support levels: $0.10, $0.06, $0.02

OGN/USD is seen trading towards the 9-day and 21-day moving averages as the coin may kick-start an additional bullish run above $0.30 if the market price crosses above the upper boundary of the channel. However, the break above this barrier is the first signal needed for a bullish to press higher. Nevertheless, OGN/USD has to break above $0.25 before hitting $0.35.

Origin Protocol Price Prediction: What to Expect from Origin Protocol

Looking ahead, if the buyers continue to grind higher, the first resistance level may come at $0.30 as this could also be followed by $0.20. However, additional resistance may also be found at $0.40, $0.45, and $0.50 respectively. On the other side, if the Origin Protocol price moves below the lower boundary of the channel, it could hit the first support level at $0.25.

Beneath this, staying below the moving average may lead to the critical support levels at $0.10, $0.08, and $0.02. Meanwhile, the technical indicator Relative Strength Index (14) poked itself above the 40-level, which indicates the buyers are attempting to gain control of the market momentum and this, could also mean that another signal of OGN could be pushing back above $0.23 soon.

Against Bitcoin, the daily chart shows that the Origin Protocol price is attempting to cross above the upper boundary of the channel around the 1053 SAT. However, as much as the coin is above the 9-day and 21-day MAs, there is a possibility that additional benefits could be obtained in the long term. Therefore, the next resistance key above this level is close to the 1200 SAT level. If the price keeps rising, it could even break the 1500 SAT and above.

However, if the bears regroup and move below the moving averages, the support level of 800 SAT may play out before rolling to the critical support at 700 SAT and below. The Relative Strength Index (14) is moving to cross above the 60-level, suggesting more bullish signals.

Read more:

Join Our Telegram channel to stay up to date on breaking news coverage