Join Our Telegram channel to stay up to date on breaking news coverage

The decentralized finance (DeFi) space has continued to see growing adoption as assets locked are holding steady on top DeFi platforms.

While there is a lot to be done to get the market back to previous levels, the current dip provides an opportunity to buy DeFi coins and set yourself up for significant gains.

Investors looking to bet on DeFi will be on the lookout currently – just like traditional crypto investors. With that in mind, we have some of the most interesting DeFi platforms and their coins that you might want to get in on now as they have some significant upside. Take a look below:

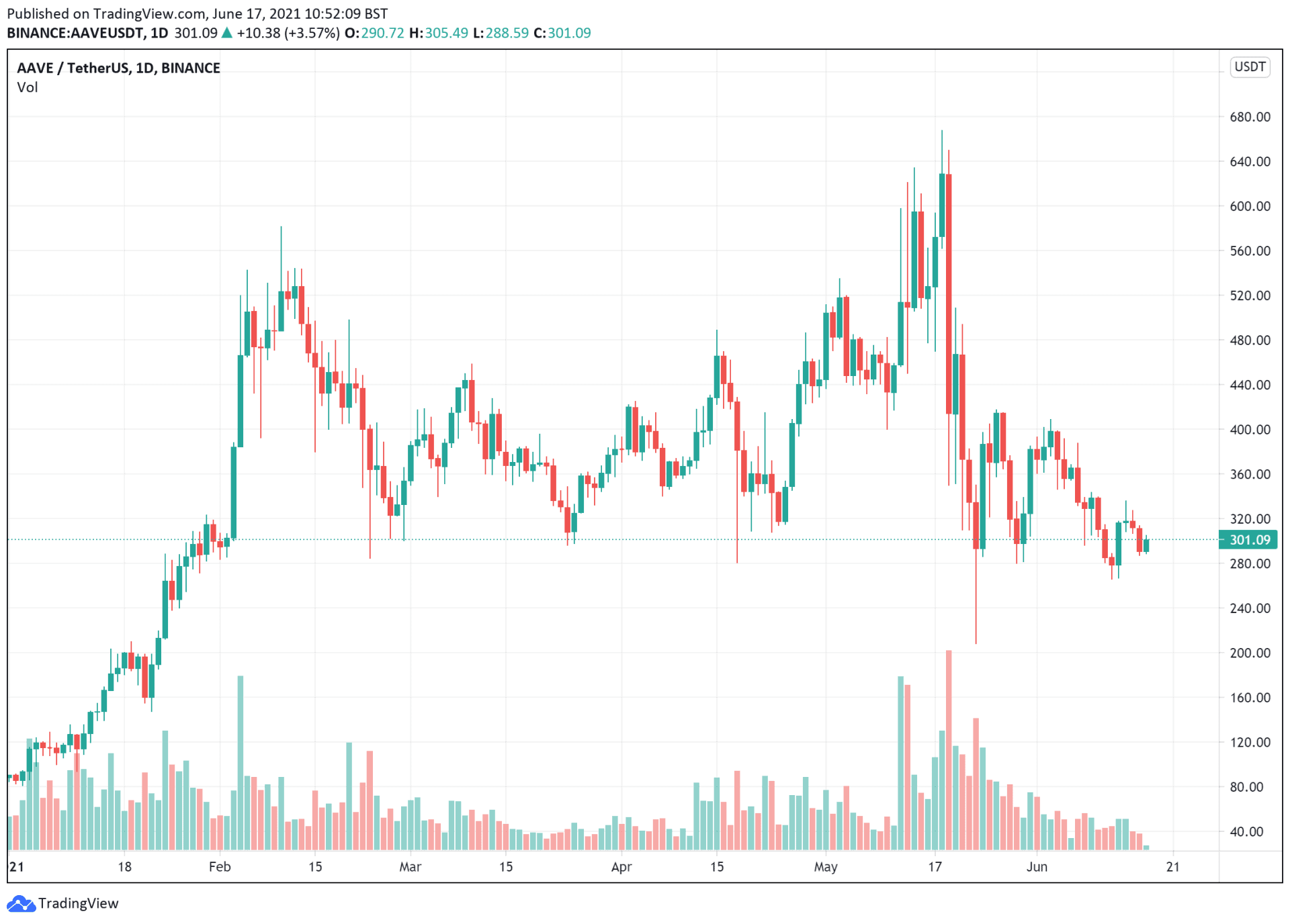

1. Aave (AAVE)

When it comes to DeFi platforms, hardly does any match the popularity of Aave. It is the leading DeFi platform according to DeFi Pulse, and it specializes in providing seamless lending opportunities to investors.

In fact, of the current $61 billion in assets locked across DeFi, Aave holds $12 .39 billion. Those are pretty big numbers. The platform’s token, AAVE, is among the DeFi blue-chip coins, and there is a lot of upside to it.

Like many coins, AAVE has been working to get back to its all-time highs. It fell from $670.83 to $209.21 in just five days, and it has been working its way up since. The current price of $301.16 marks a 43 percent jump from its bottom.

While June hasn’t been so great for AAVE, the asset definitely has a lot of upside. Aave – the DeFi platform – implemented layer-two functionality via Polygon recently, and its volume locked even surged past $20 billion at the beginning of the month.

AAVE might still be caught amid the market struggle, but its technicals look strong. The asset’s relative strength index (RSI) stands at 56.32, showing that it isn’t overbought. It is also holding above its 20-day simple moving average (SMA) of $296.45.

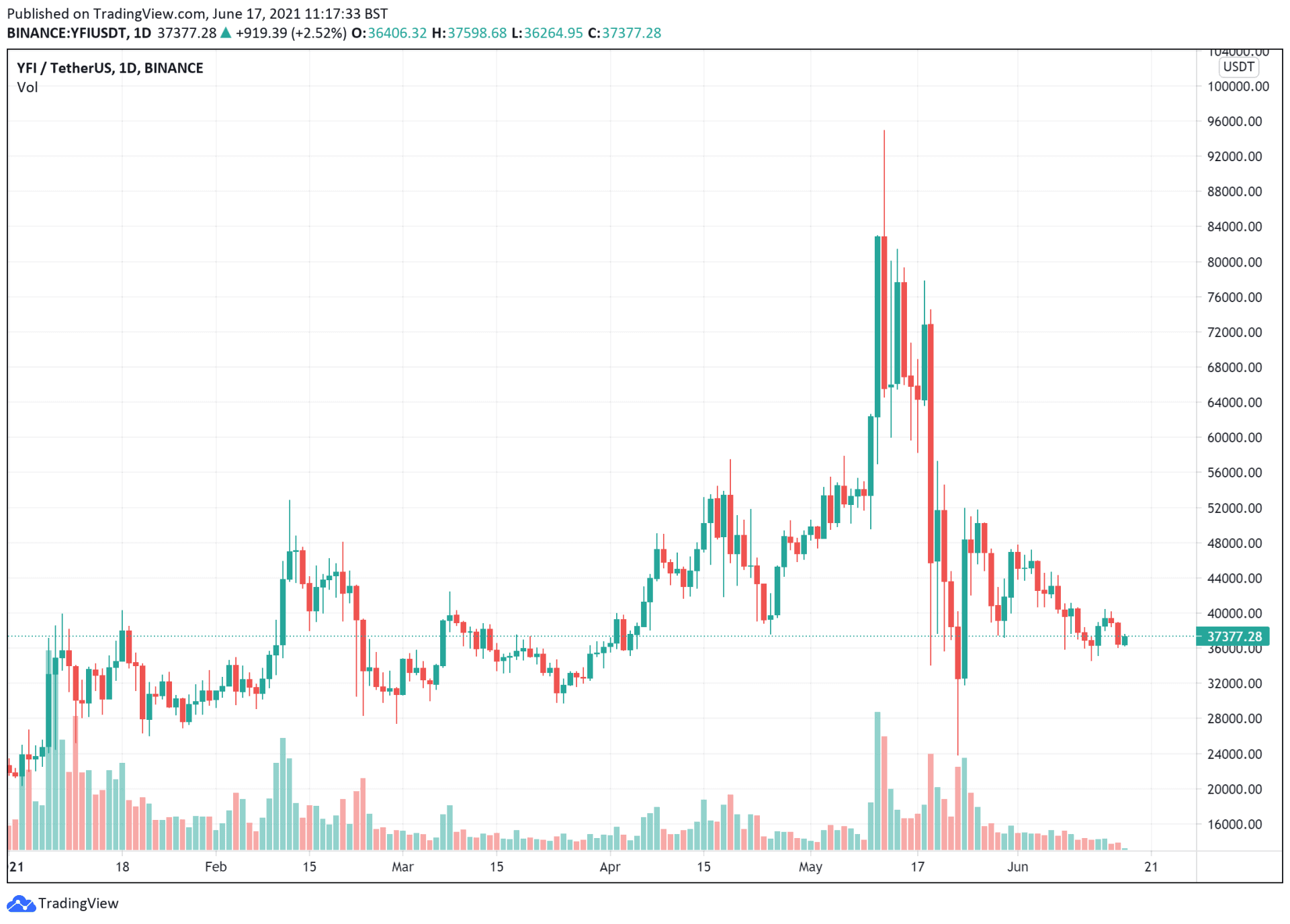

2. Yearn.Finance (YFI)

Very few DeFi platforms made as much noise as Yearn Finance in 2020. The Yearn Finance platform consists of several DeFi tools that aim to provide investors with the best yields on their investments.

Yearn Finance provides several impressive tools, all of which take your funds and look for the best strategies to help you make the most money. With many people not understanding how DeFi protocols work, Yearn Finance makes things much easier.

The platform’s token, YFI, is another that you should consider if you want to buy DeFi coins. YFI is especially popular because of its hard cap – only 30,000 of those are available. The token came into 2021 with a bang, racing from $29,827 and establishing its place in the high $50,000 range as of March.

When May came around, YFI hit its all-time high of $994,794.25. Its price eventually dropped – perhaps the hardest. YFI bottomed out at $26,347.93, but the asset’s price has since risen by 41 percent to #37,352.25.

Despite the jump, YFI is still a far way off from its all-time high. This presents an opportunity. With an RSI of 42.69, YFI is hoping to clear its 20-day SMA of $38,237. Doing that could give the asset the momentum it needs to break the $40,000 barrier once and for all.

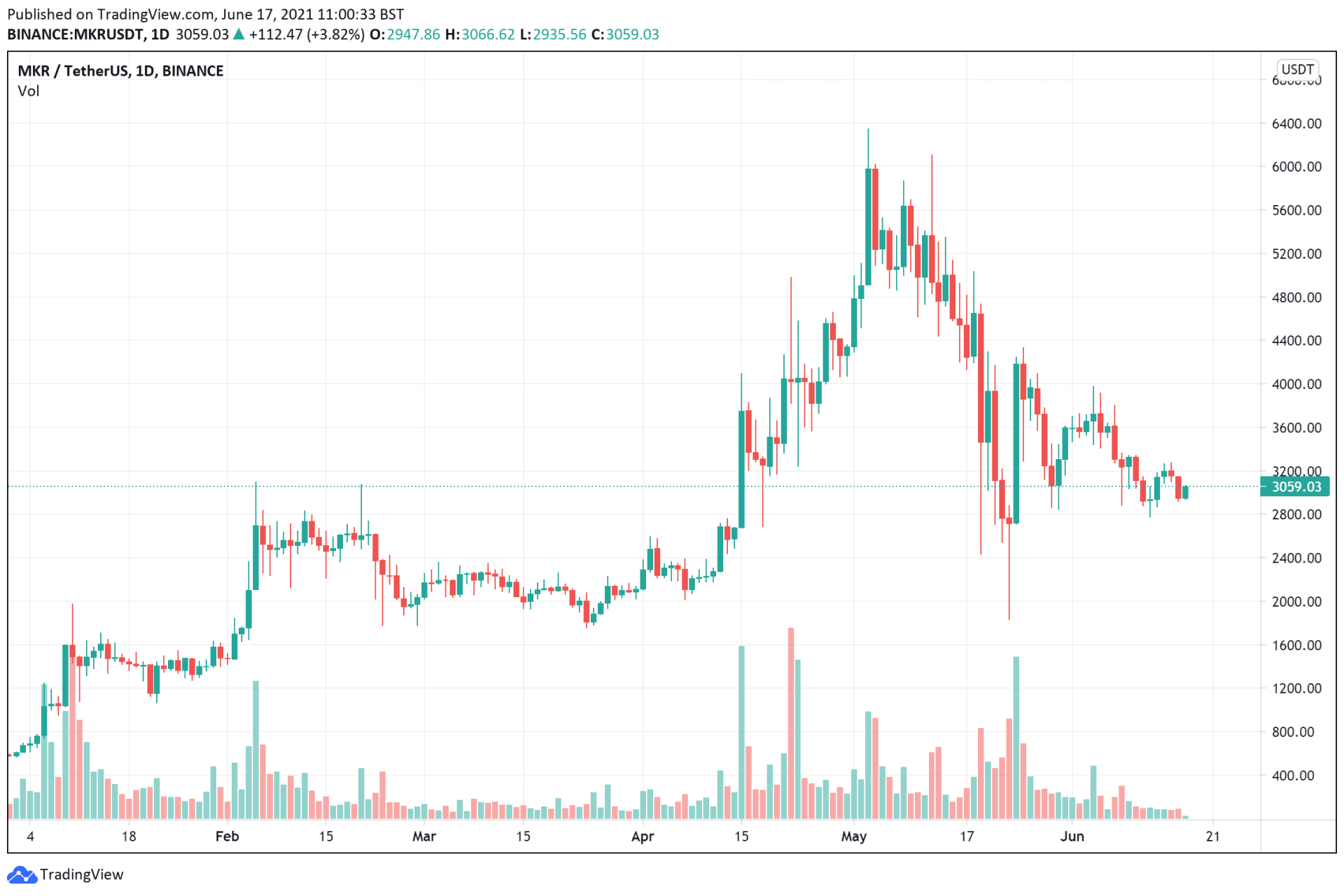

3. Maker (MKR)

Maker is one of the top DeFi platforms, and it has held a position atop the DeFi Pulse rankings for as long as the industry has been mainstream.

Also a lending protocol, Maker is only second to Aave in the official ranking of DeFi platforms. Its token, MKR, should definitely be on the list of anyone looking to buy DeFi coins.

Like AAVE, MKR has also suffered some big drops recently. The asset entered 2021 trading at $556, and it rose to new heights of $6, 349.02 on May 3. Sadly, the market downturn came and hit its price, with MRK bottoming at $1,825.64 on May 23.

The past month has seen some progress with MKR. The asset has tried to break through the $4,000 barrier this month, but it hasn’t quite been able to. It currently sits at $3,059.03 – a 667 percent increase from May’s bottom.

MKR is incredibly underbought, with an RSI of 43.24. Its price is moving quickly towards the 20-day SMA of $3.925.47 – a move that could signal an imminent uptrend.

4. DeFi Coin (DEFC)

If you’re an investor who loves to buy DeFi coins before they break out, then we’ve got just what you need. Say hello to DeFi Coin (DEFC) – a community-driven DeFi token that is making the rounds.

DEFC is the token for the DeFi Coins protocol – a DeFi platform that facilitates decentralized digital currency trading.

The coin is available to promote several community functions, including static rewards, manual burning, and automatic liquidity pools.

Investors can purchase DEFC at a pre-sale value of $0.10 (OTC). The coins are available for sale here. More details are available via email here.

You can see the contract address for the pre-sale on bscscan.com, permitting public monitoring of both incoming and outgoing purchases and sales.

This is the contract address: 0x9d36c80944ab74930fb216daf0c043d4dccdaeb7

For a deep dive on DeFi Coin, download the whitepaper.

All cryptocurrency investments put your capital at risk. You may lose all of your initial investment

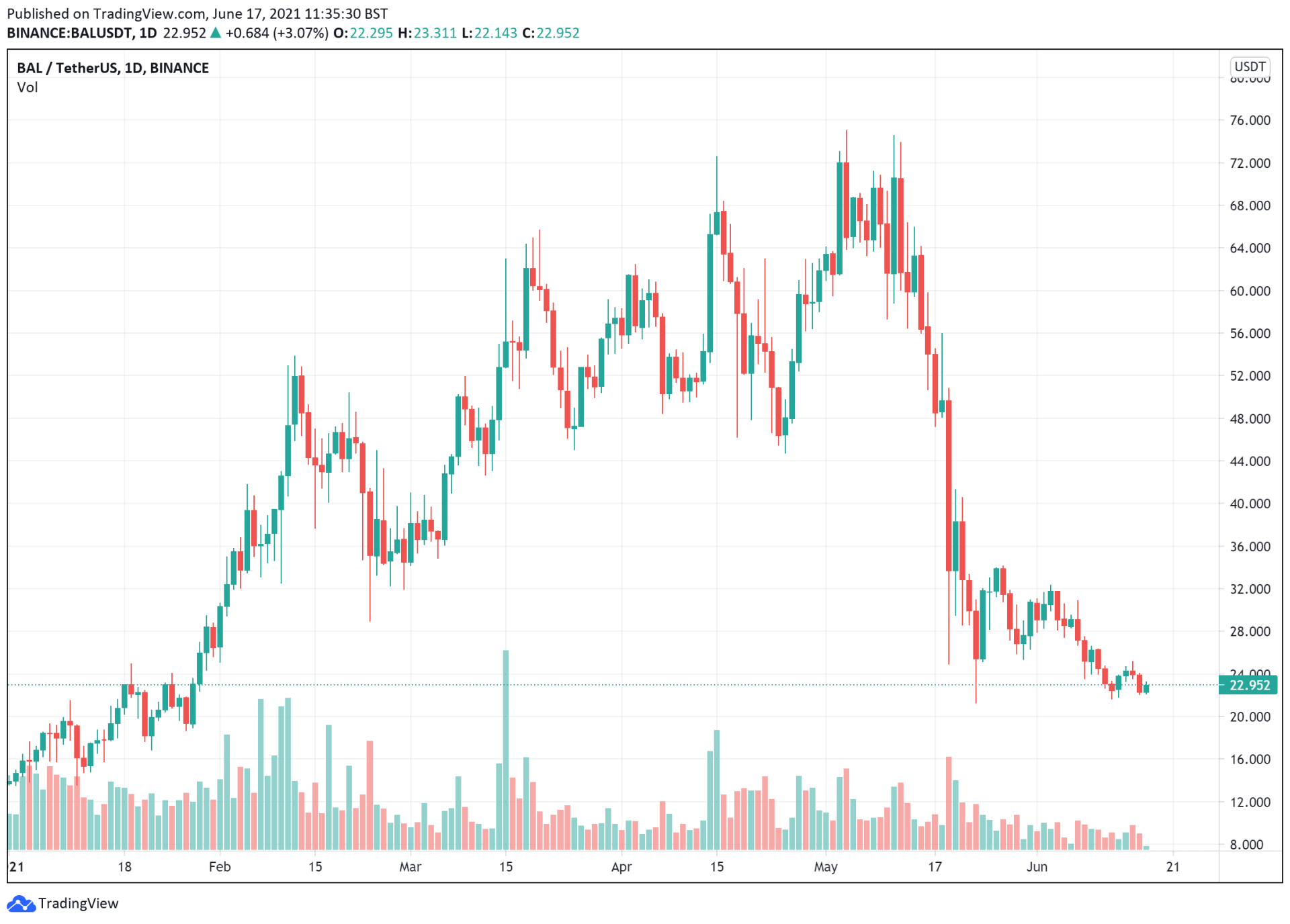

5. Balancer (BAL)

Balancer is one of the top decentralized exchanges (DEXs) in the crypto space. While it doesn’t quite have the same profile as Curve Finance or Unisswap, this exchange is definitely one to look out for.

We especially selected Balancer’s BAL token because you could still get it for a low price – and it has a lot of upside. BAL already hit a value of $74.42, and its current price peg of $22.95 marks a 7 percent increase from its bottom of $21.32.

A 35.32 RSI means that BAL is severely underbought. The smart money will also bet that it hits its 20-day SMA of $26.31 sooner rather than later. That would set it up to break the $30 threshold.

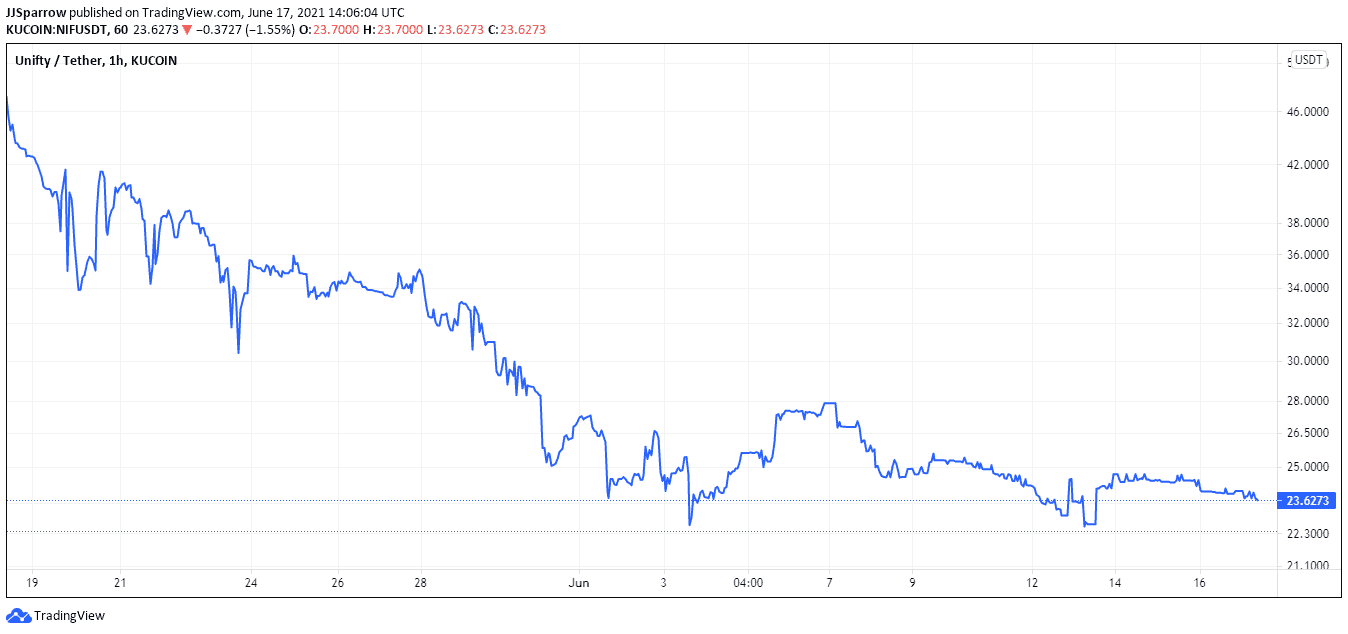

6. Unifty (NIF)

The sixth best DeFi platform to buy now is the no-code non-fungible token (NFT) blockchain protocol Unifty.

The protocol which provides contracts as a service (CAAS) solutions allows digital artists and creators to develop their own contracts (or NFTs) without necessarily having a coding background. Creators are able to mint, buy, sell, swap, and create NFTs in a few clicks while owning the contracts.

Unifty has recently integrated with Polkadot’s smart contract platform Moonbeam to encourage wider adoption of NFTs, per a press release shared with Inside Bitcoins. This will enable Moonbeam developers and users to mint easily NFTs, provide services around decentralized finance (DeFi) and yield farming incentives while also adding functionality to their minted NFTs.

This integration will enable users to utilize Unifty’s NFT Bridge Service, the NFT Swap Service and NFT Marketplace in creating custom-made NFTs and trading these digital collectibles. Unifty’s NIF native token is up 6.41% surging to $23.81 on the 24hr chart.

Join Our Telegram channel to stay up to date on breaking news coverage