Join Our Telegram channel to stay up to date on breaking news coverage

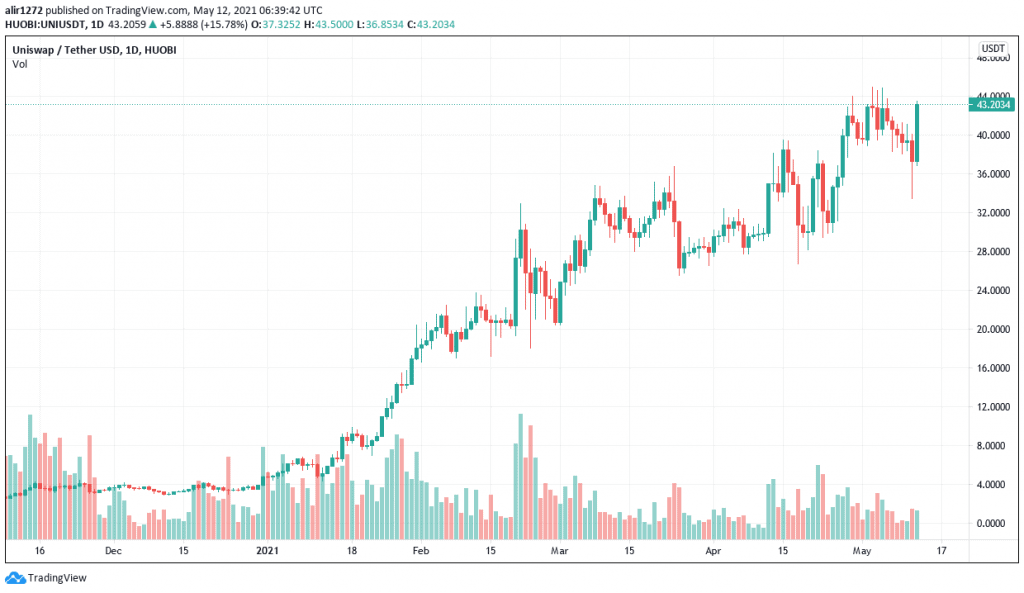

For two consecutive days, the daily liquidity provider (LP) fees generated on Uniswap has been greater than the revenue paid to Bitcoin (BTC) miners in transaction fees. The weekly LP fee figures are showing similar Uniswap outperformance.

The trend was highlighted on CryptoFees, a site that compares daily fees on leading blockchain networks.

The data was later analyzed by Evan Van Ness, a crypto blogger.

Hayden Adams, Uniswap’s founder, also posted about the development, noting that “Uniswap v2 LP fees finally passed Bitcoin network fees on the 7-day average. Would be even higher if [cryptofees] tracked v3.” The weekly average for Uniswap stands at $5.9 million in LP fees compared to $5.3 million from Bitcoin mining fees.

👀 @Uniswap v2 LP fees finally passed Bitcoin network fees on the 7 day average

🤑 Would be even higher if https://t.co/lUNKPjwNZB tracked v3 pic.twitter.com/aH4Vr9kB7o

— hayden.eth 🦄 (@haydenzadams) May 11, 2021

High Gas Fees on Uniswap

Critics have stated that Uniswap’s high gas fees have been the cause of the increased revenues. However, Uniswap’s founder quickly dismissed this, saying the data did not include gas fees but rather represented swapping fees paid to liquidity providers.

However, Ethereum (ETH) is still taking the lead in liquidity provider fees. The network is still way ahead of Uniswap and Bitcoin, with its daily fee total standing around $90 million. However, this is attributed to the network’s high gas fees.

Ethereum is still ahead of Bitcoin and Uniswap with daily gas fees generated standing at around $90 million. However, this is attributed to the network’s high gas costs.

The founder of Uniswap had earlier posted about the urgency of implementing the Eth2 upgrade. He added that the $42 million spent in gas fees was five times the transaction fees recorded on the Bitcoin network for the same period.

Uniswap’s Layer 2 solution

Uniswap’s gas fees increased after version 3.0 of the token was created. The average gas fees on the platform increased to a record high of $68, according to data provided by Bitinfocharts. On the Ethereum network, the projects struggling with increasing gas costs include DEX token swaps and those most dependent on a high number of smart contract computations, where gas fees have reached, in some cases, over $200.

To reduce this, Uniswap needs to look for a way to speed up implementing a layer-2 version. Lark Davis, a crypto YouTuber also responded to Adams’s tweet, asking when Layer 2 would be implemented, “Great, now implement some layer 2 scaling so that Uniswap is actually usable by non-rich users. Polygon is ready and waiting. Aave, Curve, Sushi, Pool together all on it. Optimism is months away. Why wait?”

On the other hand, there’s still growing optimism around DeFi projects such as Uniswap. The automated market maker protocol now has higher trading volumes than centralised exchanged such as Coinbase. Synthetix, another top DeFi project, is also attracting positive attention after it completed its own Layer 2 upgrade recently, although trading on it has yet to start.

Get free crypto signals – 82% win rate!

3 Free Crypto Signals Every Week – Full Technical Analysis

Join Our Telegram channel to stay up to date on breaking news coverage