Join Our Telegram channel to stay up to date on breaking news coverage

South Africa is the latest country to try and classify cryptocurrencies as it looks to regulate the industry and generate income tax. According to the country’s Central Bank, digital currencies such as bitcoin (BTC) are mere “cyber-tokens” that don’t meet the criteria to be categorized as money.

South African Cryptocurrency Classification

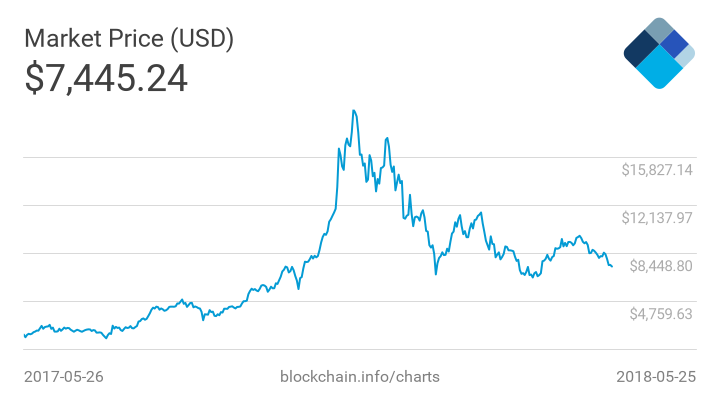

According to Francois Groepe, the Reserve Bank Deputy Governor, it is wrong to use the term “cryptocurrency” because virtual currencies do not function as a stable unit of value. The sentiments come at a time when regulators around the world are trying to find ways to regulate digital currencies despite uncertainty as to how best to classify them.

Francois Groepe

(Source: African Currency Forum)

The Reserve Bank of South Africa has formed a FinTech unit that is to carry out a study on cryptocurrencies and try to come up with an appropriate policy framework as well as a regulatory regime. The unit is tasked with the responsibility of establishing whether cryptocurrencies comply with the relevant financial surveillance or exchange-control regulations.

The Central Bank has since issued guidance regarding its position when it comes to the purchase and transfer of cryptocurrencies. According to the regulator, it is wrong for people to buy and sell crypto assets using international exchanges.

In that regard, South Africans are only allowed to buy cryptocurrencies using a discretionary allowance of R1 million ( $14,757.60) or individual foreign investment of R10 Million ( $14,7576.00) per year. However, the use of foreign direct investment from international exchanges is prohibited.

Taxation of Cryptocurrencies

In April 2018, South African Revenue Service (SARS), stated that cryptocurrencies holders would start paying taxes on their holdings. The revenue agency classified digital currencies as “assets of intangible nature” and not money. Given the classification, cryptocurrencies are regarded as having value received or accrued that is subject to taxation.

That said any income received or accumulated from transactions involving virtual currencies is to be taxed under the gross income tax act. The tax policy applies to all cryptocurrency activities right from mining to trading. People who accept crypto payments will also have to declare such holdings as income tax.

South Africa joins growing list of countries that have moved with speed to generate income tax from the growing cryptocurrency industry. Azerbaijan has also announced similar plans to tax revenues accrued from cryptocurrency-related operations.

In the U.S. cryptocurrency transactions are deemed as taxable income and must be reported and paid as income tax or capital gains. Israel is another country mulling over taxing cryptocurrencies related activities.

Even though cryptocurrencies are not legal in India, reports indicate that the country could as well be on its way to levying goods and services associated with digital assets. Reports suggest that the government may impose an 18 percent tax rate on all cryptocurrency trading activities. The Central Board of Indirect Taxes and Customs (CBEC) is reportedly analyzing the measure.

If approved, digital assets in India will be classified as intangible commodities and not currencies or securities. Taxation of cryptocurrencies if approved would mark a turnaround from strict measures that the RBI has announced regarding the legality of cryptocurrencies.

Even as South Africa moves to generate some income from cryptocurrency related activities, other countries on the continent continue to lag behind. Nigeria, for instance, is maintaining a watch and see approach and Governor Godwin Emefiele has warned that that investing in bitcoin is a “gamble.”

The post South Africa Central Bank: “Cryptocurrencies Don’t Meet Requirements For Money” appeared first on BTCMANAGER.

Join Our Telegram channel to stay up to date on breaking news coverage