Join Our Telegram channel to stay up to date on breaking news coverage

The cryptocurrency market remains highly unpredictable, with price fluctuations driven by shifting economic policies and investor sentiment. Recent performance and prevailing market moods also play a crucial role in identifying potential investment opportunities.

Moreover, many crypto projects have different features and goals. Several tokens stand out due to their unique mechanics, recent performance, or innovative approaches. This guide explores some of the top cryptocurrencies to invest in now, including Lido DAO, Flare, and Ondo, providing straightforward insights into their current trends.

Top Cryptocurrencies to Invest in Now

Flare recently destroyed 66 million $FLR tokens as part of a larger strategy to cut its total supply by 2.1 billion by January 2026. Meanwhile, Bitcoin Cash (BCH) sits at $296.00, reflecting an 8.30% increase lately, with 15 days of gains over the past month.

Moreover, BTC Bull Token has raised over $4.5 million in its ongoing initial coin offering, indicating solid investor attention. In the broader news, Binance has increased its market share even as Bitcoin trading volume has dropped by 77% from its yearly high.

1. Flare (FLR)

Flare operates as an EVM-based layer 1 blockchain designed to improve developers’ data use. It provides access to trustworthy information from other blockchains and the Internet, opening doors to new applications and ways for developers to earn revenue.

Unlike traditional setups, Flare lets decentralized apps work across multiple chains with just one deployment. Its system relies on validators and data providers to supply real-world data efficiently and at a low cost. The platform uses unique consensus methods and data-checking processes to keep things secure and reliable.

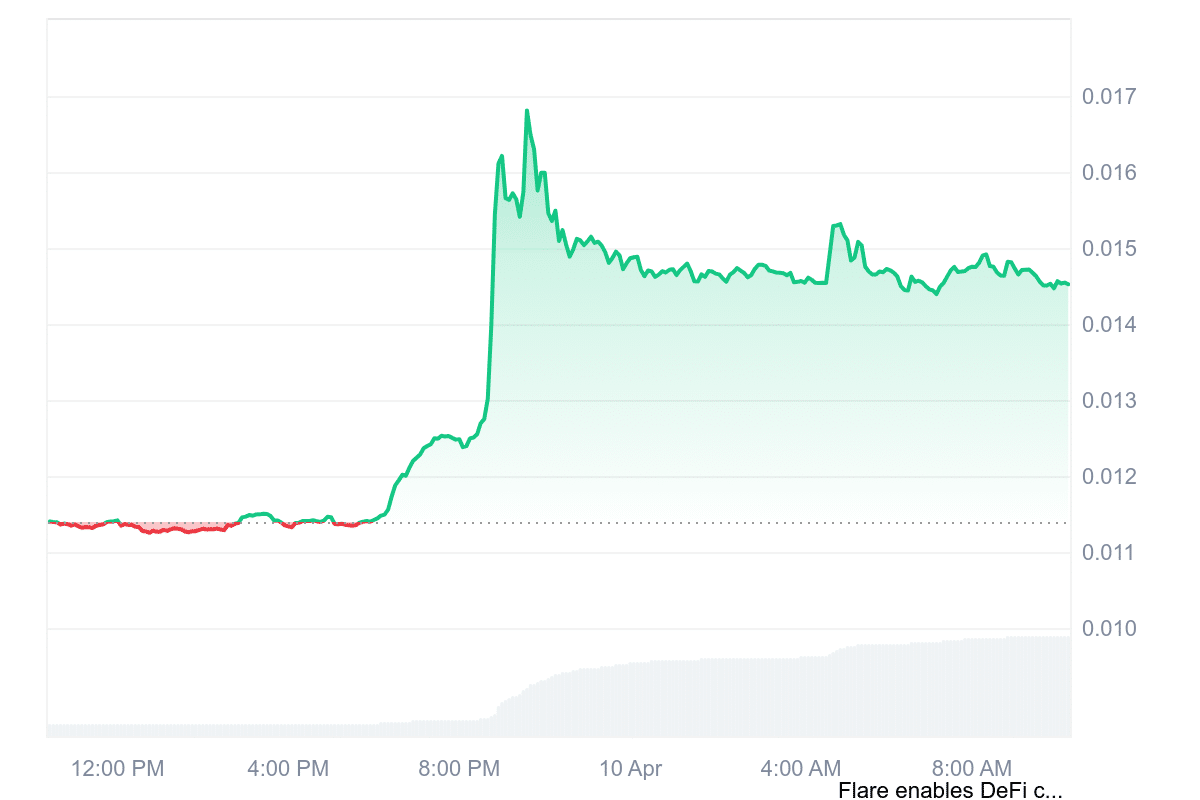

Meanwhile, Flare recently burned 66 million $FLR tokens, part of a plan to eliminate 2.1 billion by January 2026. This reduces the total supply, which could influence its value over time. As of April 10, FLR trades at $0.01448, up 27.47% in the past day.

Every day, Flare dApps proliferate & grow together.

Congrats @SparkDEXAI Eternal on integrating @SceptreLS sFLR! Users can now trade & open positions using sFLR.

A milestone for Flare DeFi, leveraging FTSO's pioneering Custom Feeds. https://t.co/osTWsBM8RW

— Flare ☀️ (@FlareNetworks) April 7, 2025

Its market cap is valued at $911.56 million, with a 24-hour trading volume of $52.78 million recording a sharp 630.93% jump. This gives it a volume-to-market-cap ratio of 0.0572, suggesting decent liquidity. The 14-day RSI, a tool showing price momentum, is 50.48, meaning the token is not overbought or oversold and might stay steady. Over the last 30 days, volatility is low at 7%, indicating smaller price swings.

2. Bitcoin Cash (BCH)

Bitcoin Cash (BCH) operates as a decentralized digital currency, focusing on peer-to-peer transactions without intermediaries. It prioritizes quick payments, low fees, privacy, and a larger block size compared to Bitcoin.

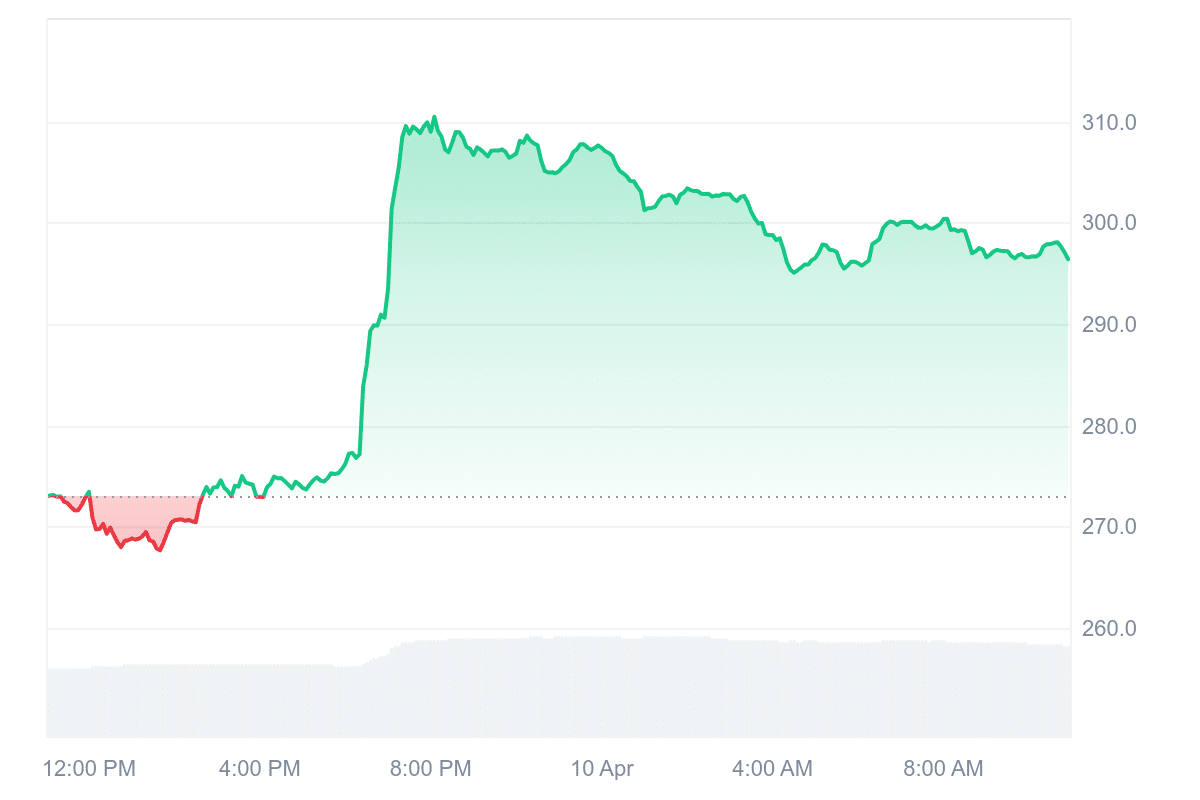

At the time of writing, BCH trades at $296.00, up 8.30% recently, with 15 positive days in the past month. Its 24-hour trading volume to market cap ratio sits at 0.1026, suggesting decent liquidity for its size.

The 14-day Relative Strength Index (RSI) measures 40.09, indicating that the token is currently neutral and may trade sideways. Yearly inflation stands at 0.84%, below 2%, indicating that new coins enter circulation slowly, which could help maintain value over time.

Despite these traits, BCH remains 93% below its all-time high. It trades 81.69% under its peak this cycle, though it’s 284.44% above its lowest point. This shows significant volatility. A current price prediction estimates a 30.52% increase to $400.90 soon.

3. Ondo (ONDO)

Ondo aims to connect traditional finance with blockchain technology, creating a system for real-world assets like stocks or bonds to exist on-chain. This means taking assets typically managed by banks or investment firms and making them available on decentralized platforms. The project collaborates with well-known companies such as Franklin Templeton, Wellington Management, and Google Cloud, which help design its blockchain framework.

It has expanded access to tokenized U.S. Treasuries across nine major blockchains. Over 15,000 users engage with these assets through over 80 integrations, showing steady adoption.

At Ondo, we’re helping lead the world’s most robust real-world asset ecosystem alongside a growing network of institutions and service providers.

From global asset managers and major TradFi firms to DeFi-native platforms, the Ondo Ecosystem brings together those working to bring… pic.twitter.com/sKkLgWZH3A

— Ondo Finance (@OndoFinance) April 3, 2025

Furthermore, the upcoming launch of the Ondo Global Markets plans to bring publicly traded securities, like stocks and ETFs, onto blockchains. This could allow developers to build new financial tools using these assets, a concept known as composability.

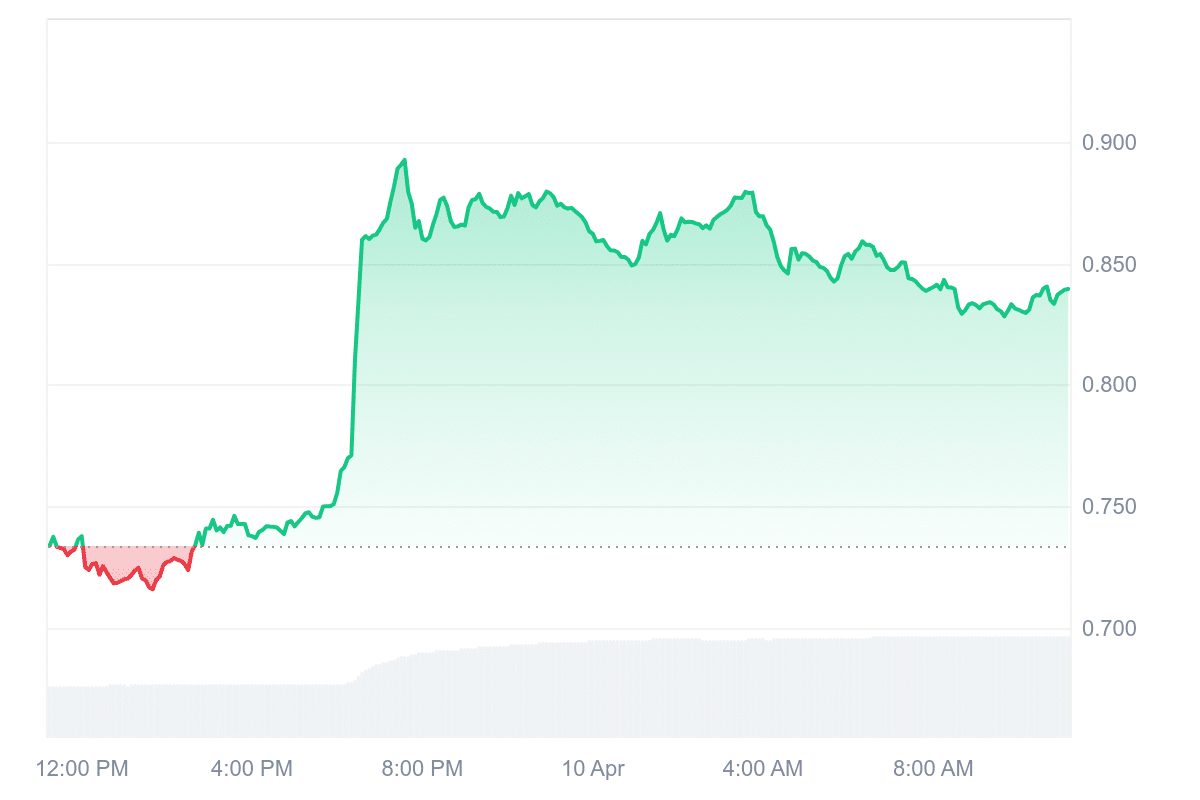

Meanwhile, ONDONDO is exchanging hands at $0.8401, recording an intraday surge of 14.48%. Over the past year, its price rose 8%, outperforming 77% of the top 100 cryptocurrencies. In the last 30 days, it saw 15 days of gains, reflecting consistent activity. The 24-hour trading volume to market cap ratio is 0.6833, indicating solid liquidity.

4. Lido DAO (LDO)

Lido DAO (LDO) operates as a decentralized autonomous organization that runs on community decisions rather than a central authority. It focuses on staking, where users lock up cryptocurrency to support blockchain networks and earn rewards. Specifically, Lido simplifies staking for Ethereum.

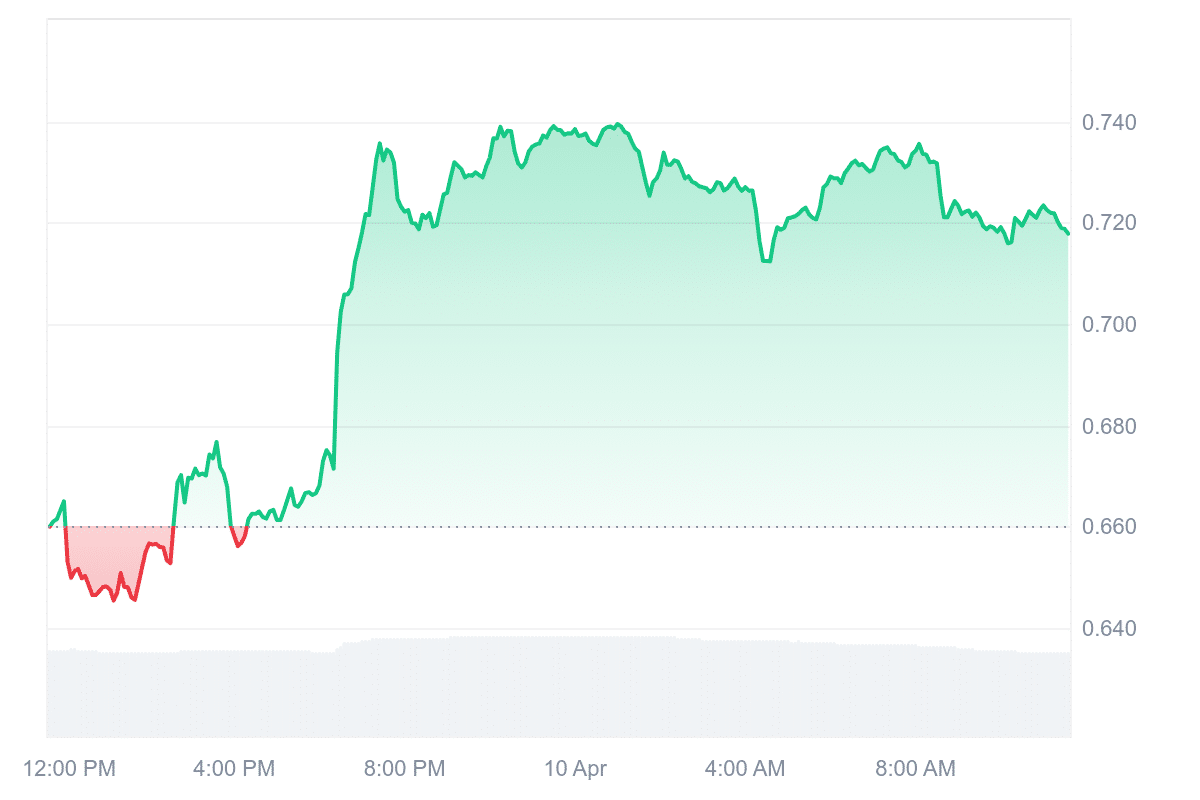

The system relies on Ethereum’s smart contracts—self-executing programs—to handle deposits and distribute rewards. Governance involves the community, while audits help ensure security. Meanwhile, LDO’s price is $0.71, up 8.76% in 24 hours.

Its market cap sits at $639.02 million, with a high trading volume of $210.90 million, suggesting active interest. The volume-to-market-cap ratio, at 0.3306, indicates decent liquidity for its size. The 14-day Relative Strength Index, a tool measuring price momentum, is 57.80. This score suggests LDO isn’t overbought or oversold, so it might trade steadily for now.

Yearly inflation is just 0.07%, far below 2%, so the token supply barely grows. Moreover, LDO stands out for its staking focus, placing the token among the top cryptocurrencies to invest in now.

5. BTC Bull Token (BTCBULL)

BTC Bull Token aims to tie its value to Bitcoin’s price movements in a fresh way. Unlike many meme coins driven by hype, this project rewards holders with Bitcoin airdrops whenever Bitcoin hits a new price peak. The project also shrinks its supply through “burn events.”

When Bitcoin reaches $125K, $175K, or $225K, BTC Bull Token permanently removes some tokens from circulation. This reduces the total number available, which could push the price up over time by creating scarcity.

Its initial coin offering (ICO) has already raised over $4.5 million, showing steady interest. The presale offers tokens at a set price, which might appeal to those wanting in before exchange listings, though later rounds will cost more. For those holding tokens, staking on Ethereum provides a way to earn extra, with a current return of 92% per year.

Fiat is the illusion. Bitcoin is the escape. 🐂 pic.twitter.com/N4s1wlAU0l

— BTCBULL_TOKEN (@BTCBULL_TOKEN) April 9, 2025

BTC Bull Token blends Bitcoin’s milestones with a meme coin twist, adding staking and burns. It’s not just about fun; it’s structured to incentivize holding as Bitcoin climbs. While analysts note its potential, the project’s success hinges on Bitcoin’s performance and broader market trends.

Visit the BTC Bull Token Presale

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage