Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin’s recent price dip to $94,000, despite a 13% gain over the past month, comes amid renewed institutional interest, with MicroStrategy’s co-founder Michael Saylor hinting at another major BTC acquisition. Meanwhile, demand from U.S. spot Bitcoin ETFs continues to outpace miner supply, underscoring growing investor appetite for digital assets.

As such, investors are scanning the crypto market for the top cryptocurrencies to buy now to capitalize on market momentum and sector developments. This article analyzes and highlights some digital assets market participants can include in their market portfolio.

Top Cryptocurrencies to Buy Now

Chainlink’s LINK token is currently priced at $13.77. While it has seen a 2.15% decline in the last 24 hours, it holds a 30-day gain of 6.84%. The BTC Bull token has raised more than $5 million in its ongoing ICO. Meanwhile, ONDO continues to expand its infrastructure, with recent progress marked by the integration of its USDY token.

1. Polkadot (DOT)

Polkadot is a blockchain protocol designed to enable different blockchains to work together. Unlike traditional blockchains that operate in isolation, Polkadot connects multiple specialized chains within a unified network. This design helps facilitate the transfer of any data or asset across chains.

Furthermore, the Polkadot ecosystem features the Relay Chain, which coordinates communication and security among various connected blockchains. These chains can be public or private, permissioned or permissionless. The protocol also supports connections with oracles and other external data sources. This cross-chain communication is designed to happen securely and trustless, meaning no centralized party is needed to facilitate it.

Polkadot’s architecture helps simplify the process of building decentralized applications and services. By providing shared security and interoperability, developers can focus on creating unique features rather than infrastructure from scratch.

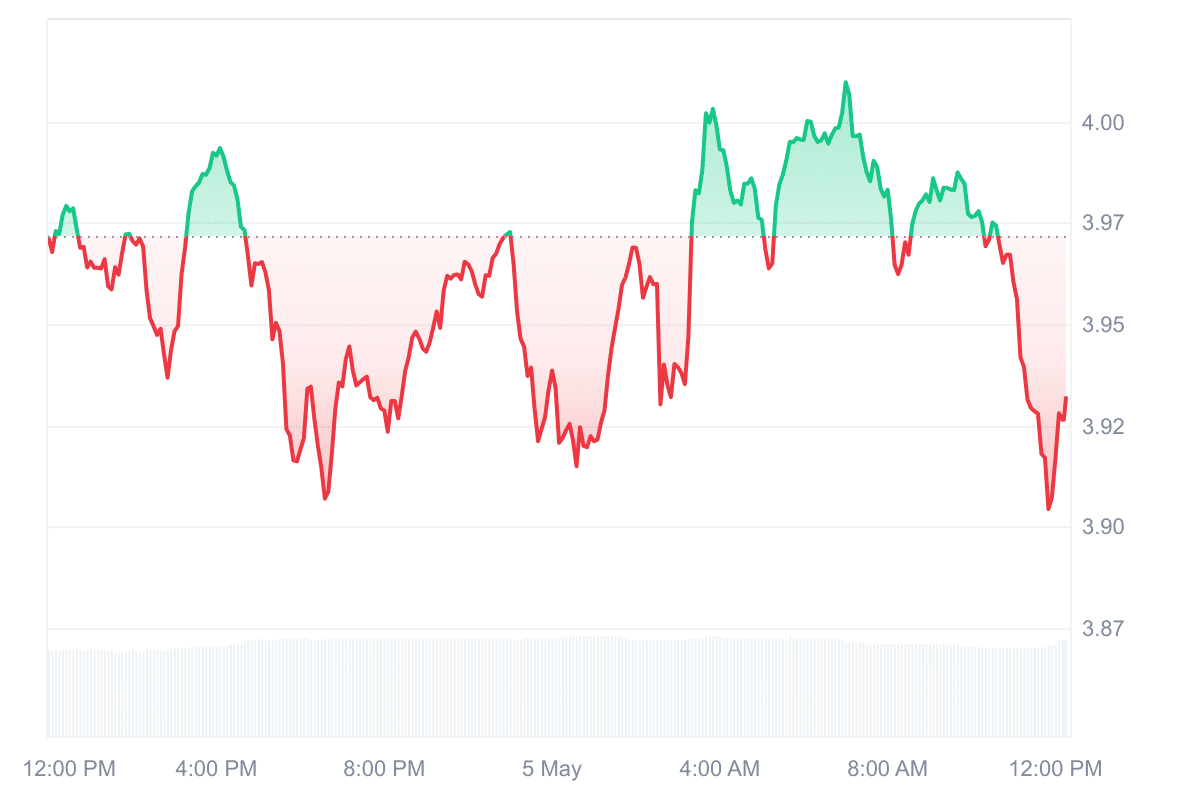

Meanwhile, the token is priced at $3.91, recording an intraday dip of 1.29%. Its 14-day Relative Strength Index (RSI) currently sits at 49.70. This value suggests a neutral momentum with the potential for sideways price movement. Its 30-day price volatility is at 7%, which remains relatively low, indicating a period of stability.

2. Chainlink (LINK)

Chainlink is a blockchain infrastructure project that connects smart contracts with external real-world data. Its core function is to act as a bridge between blockchains and off-chain systems like financial data, APIs, or payment platforms. This is possible through a decentralized network of oracles.

The Chainlink Network is maintained by a broad community that includes developers, researchers, node operators, and auditors. This open participation helps support the system’s decentralization and reliability. A recent development involves Elixir, a digital asset liquidity protocol that adopted Chainlink’s Cross-Chain Interoperability Protocol (CCIP).

The platform also supplies trusted price data through its Price Feeds. These feeds now support secure markets for deUSD across several blockchains, including Avalanche, Arbitrum, Ethereum, Optimism, and Polygon. Price feeds are critical in decentralized finance (DeFi), helping ensure trades occur at accurate market values.

Elixir, an institutional-focused protocol with $180M+ in TVL, has upgraded to Chainlink CCIP to power cross-chain transfers of deUSD across @avax and @ethereum—and will be upgrading the rest of its bridging routes to CCIP over time.@elixir has also upgraded to Chainlink Price… pic.twitter.com/phQMED1yEh

— Chainlink (@chainlink) May 2, 2025

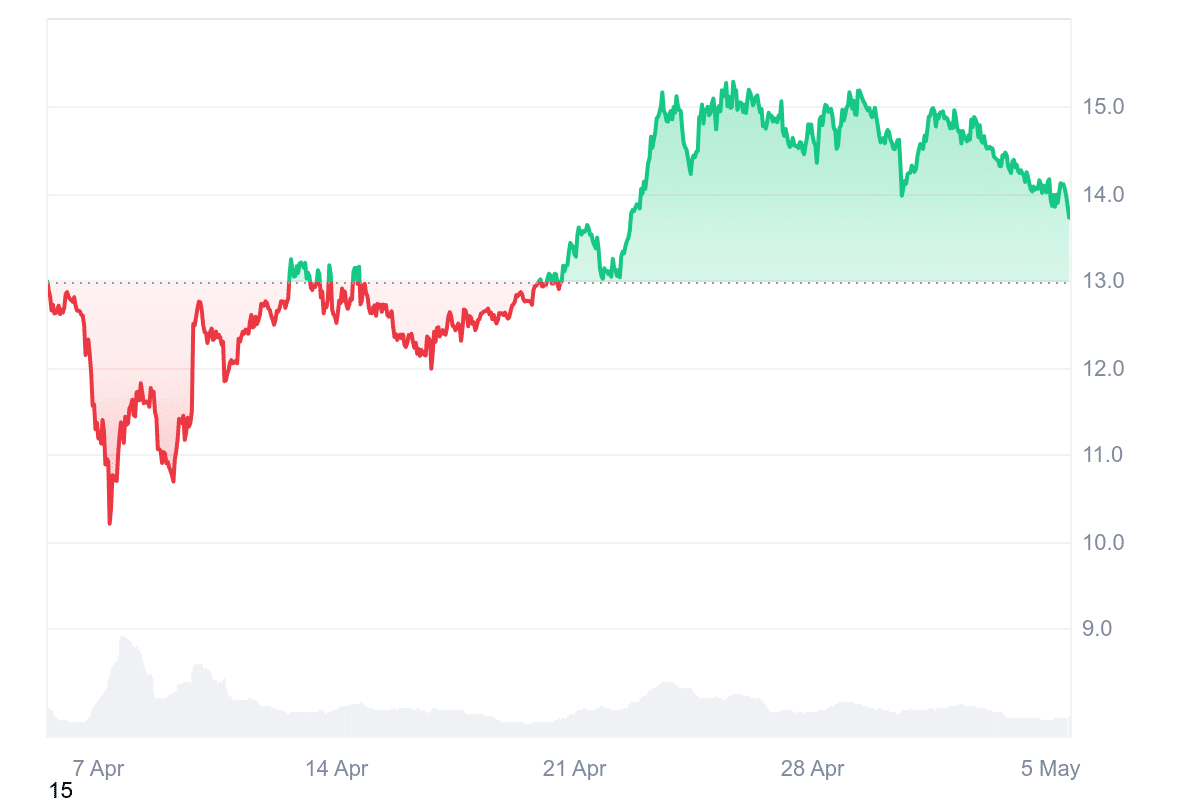

As of now, Chainlink’s LINK token trades at $13.77. Despite a 2.15% drop over the past day, it remains up 6.84% in the past 30 days. The token’s liquidity appears strong, with a 24-hour volume-to-market cap ratio of 0.0512. Technical indicators like the 14-day Relative Strength Index (RSI) at 62.87 suggest a neutral stance, and its volatility over the past month remains relatively low at 9%.

3. Uniswap (UNI)

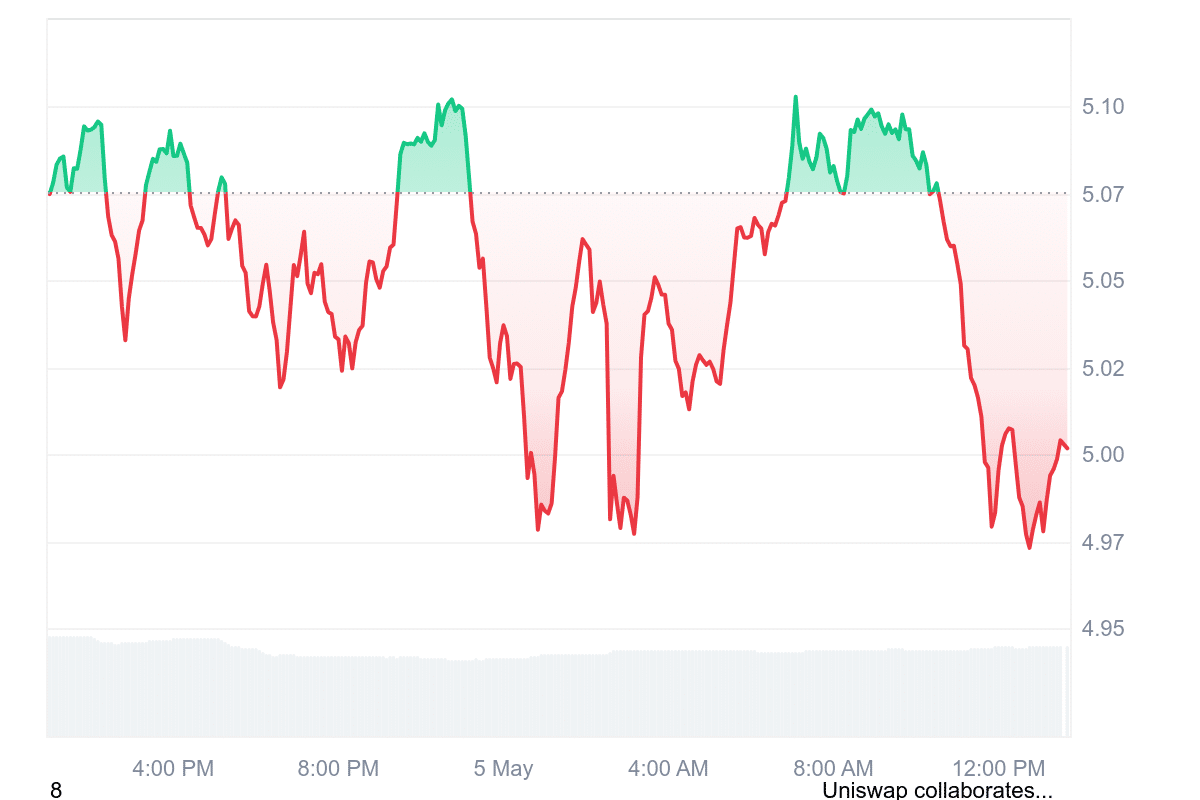

Uniswap, currently valued at $5.00, has seen a slight daily decline of 1.59%. Despite recent market price dips and bearish sentiment, Uniswap maintains relatively strong liquidity, as shown by its 24-hour volume-to-market cap ratio of 0.0554. The token is trading well below its 200-day simple moving average, down about 54% from the $10.79 mark.

Technical indicators such as the 14-day Relative Strength Index (RSI) stand at 56.09, signaling a neutral trend with the potential for sideways price movement. The token has recorded 14 green days out of the past 30, suggesting some inconsistency in short-term performance. Also, nearly $13 billion in volume has already passed through Uniswap v4 in the past 90 days, signaling continued usage despite the recent downtrend.

In terms of network development, Uniswap Labs recently collaborated with Unichain and introduced the use of Trusted Execution Environment (TEE)-based block construction on Unichain’s Layer 2 network. This partnership with Flashbots and Unichain focuses on implementing Trusted Execution Environment (TEE)-based block construction on Unichain’s Layer 2 network, a first in the industry.

90 days in and volume on Uniswap v4 has nearly crossed $13B

— Uniswap Labs 🦄 (@Uniswap) May 3, 2025

TEE is a secure processor area that ensures transaction data is processed privately and verifiably, reducing manipulation risk during block creation. This marks a first for Layer 2 blockchains, enabling more reliable and transparent transaction sequencing.

4. BTC Bull Token (BTCBULL)

BTC Bull Token (BTCBULL) is a new digital asset currently in presale that aims to align itself closely with Bitcoin’s price movements. Its primary feature is a reward system that reacts to Bitcoin’s market performance.

$5M RAISED. 🐂💥

No gloves. No brakes. pic.twitter.com/7ZZMEZcZoU— BTCBULL_TOKEN (@BTCBULL_TOKEN) April 28, 2025

As Bitcoin reaches specific price milestones, the BTCBULL project permanently removes a portion of its token supply. This process, known as a burn mechanism, reduces the total available supply and is designed to create scarcity, which may influence the token’s price over time. The project also includes airdrops and positions itself as a meme-inspired token with added utility.

The token has raised over $5 million and is priced at $0.002495 in its current presale round. These presale stages are structured with scheduled price increases, potentially giving early participants lower entry points. However, there are no guarantees about future price performance, and presales inherently carry risk.

BTCBULL also offers a staking option on the Ethereum network. By locking up tokens, holders can earn a reported annual return of 77%. However, returns can change depending on various factors, and staking involves keeping assets locked for a specific period.

Visit the BTC Bull Token Presale

5. Ondo (ONDO)

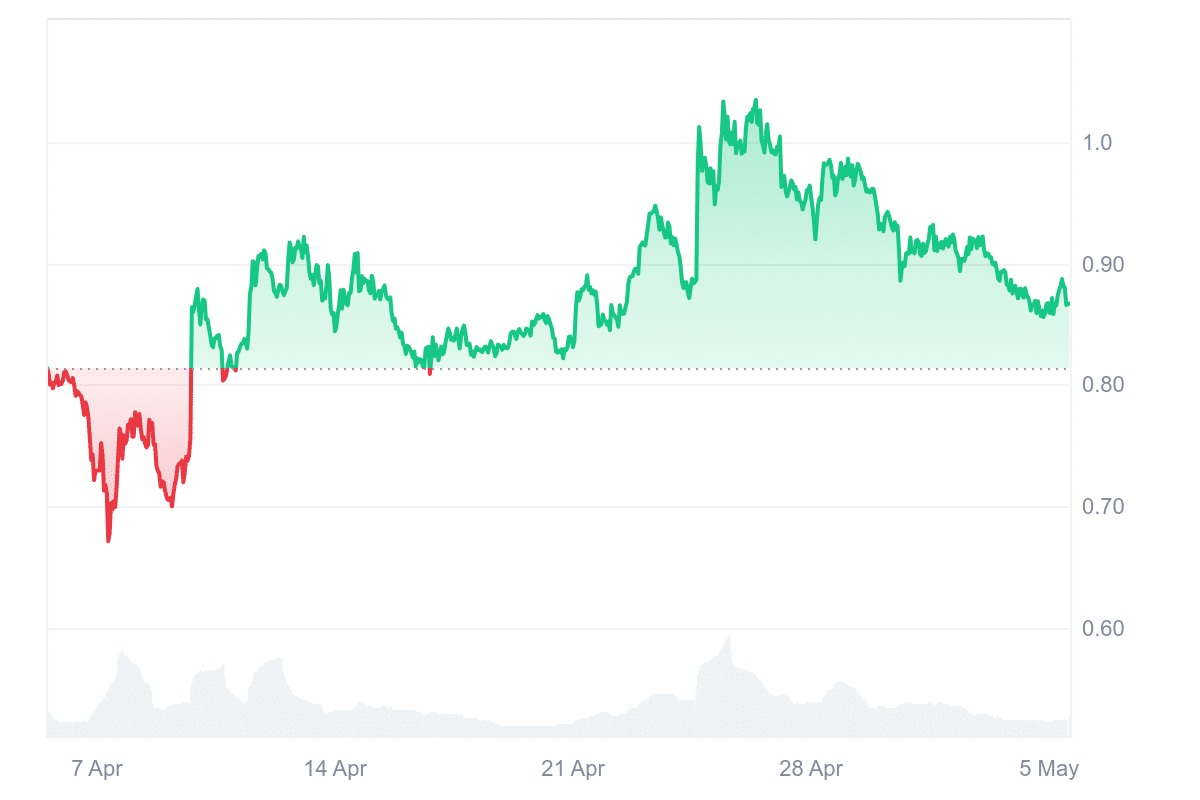

Ondo (ONDO) has drawn investor interest due to its focus on real-world asset (RWA) tokenization and its recent price activity. Currently priced around $0.8655, ONDO has demonstrated bullish behavior, recovering from key support levels and maintaining a steady upward trend over the past month. The asset has posted gains in the past 30 days, suggesting sustained market interest and relatively stable demand.

The project has made notable strides in expanding its infrastructure, particularly through the integration of its USDY token, a tokenized bond backed by U.S. Treasury assets, onto the Solana blockchain. This was achieved via a bridge built in partnership with LayerZero, a cross-chain messaging protocol.

1/ A new era for RWAs begins on @Solana.

Today, we’re expanding our first-of-its-kind bridging solution for tokenized real-world assets to Solana.

Now, USDY, the world’s leading tokenized treasuries asset, can seamlessly move between EVM and Solana ecosystems via… pic.twitter.com/gokyBtfciH

— Ondo Finance (@OndoFinance) May 1, 2025

ONDO also shows high liquidity relative to its market capitalization, as reflected in its 24-hour volume-to-market cap ratio of 0.2240. This metric indicates the asset is actively traded, which can reduce slippage for larger transactions.

From a historical performance perspective, ONDO has experienced cyclical price rallies. It rose from $0.20 in February 2024 to $1.00 in April, followed by another surge to $1.40 in June. After a correction during the summer, the token has since traded in a tighter range, possibly building support for future movement.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage