Join Our Telegram channel to stay up to date on breaking news coverage

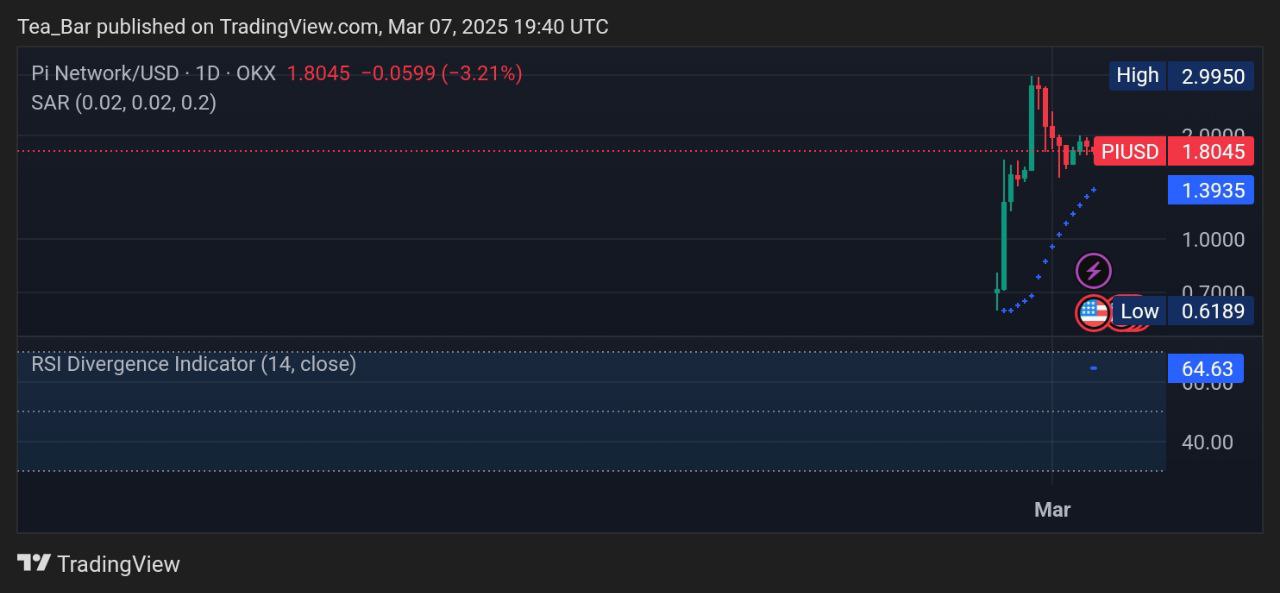

Pi (PI) is navigating a pivotal phase after a sharp rally to $2.9950 lost steam, bringing the price down to $1.80. While the market recalibrates, traders are eyeing key resistance at $1.99, which could determine the next major move. With increasing attention from investors and technical signals hinting at a potential breakout, PI’s trajectory remains a focal point in the crypto space.

PI Key Statistics

- Current Price: $1.80

- Market Cap: $12.7 billion

- Trading Volume (24h): $371.9 million

- Circulating Supply: 7.1 billion PI

- Total Supply: 100 billion PI

- CoinMarketCap Ranking: #11

Pi Network is a cryptocurrency project launched in 2019 that allows users to mine Pi coins on their mobile devices without high energy consumption. Developed by Stanford graduates, it aims to create a decentralized digital currency, but its mainnet remains in a closed phase, limiting transactions outside its ecosystem.

PI/USD Market (Daily Chart)

Key Levels

- Resistance: $1.99, $2.29, $2.99

- Support: $1.39, $1.00, $0.61

The daily chart for PI/USD reflects an intriguing market structure following its listing on February 20. After an explosive rally to $2.9950, the price has entered a phase of correction, currently sitting at $1.8045. This pullback appears healthy, as markets often retrace before resuming their trend. If bullish sentiment strengthens, PI/USD could first test resistance at $1.9935, a level that previously acted as a supply zone. A successful breach could open the door to 2.2950, with the ultimate bullish target set at $2.9950. However, failure to reclaim momentum may lead to further declines, where the first key support lies at $1.3935. Should selling pressure persist, the next safety nets stand at $1.0000 and $0.6189, which may act as a strong accumulation zone.

The Parabolic SAR suggests a potential shift, but confirmation is required before declaring a trend reversal. Market participants should closely watch whether buyers can defend the support at 1.3935, as a rebound from this zone could signal renewed optimism. On the other hand, if PI/USD remains below resistance and the RSI starts dipping further, the selling trend might extend. The next few sessions will be critical in determining whether the bulls can regain control or if the bears will tighten their grip. A decisive breakout above $1.9935 could spark fresh buying interest, while failure to hold above $1.3935 may invite further downside pressure.

Pi (PI/USD) Targets $3.00: Can Bulls Regain Control?

Pi (PI/USD) is at a crucial turning point after its surge to $2.9950 lost momentum, leading to a pullback at $1.8045. To reignite bullish momentum, the price must overcome selling pressure at key hurdles that previously halted its advance. A steady climb with increasing volume and favorable technical indicators could set the stage for a breakout toward new highs. If buyers reassert control and sustain upward pressure, the $3.00 mark may come back into focus.

Pi Network: More Updates from the CEO

On the fundamental side, Pi’s long-term potential hinges on ecosystem growth and mainstream adoption. Rising community engagement, developer activity, and potential exchange listings could inject renewed confidence into the market. However, liquidity constraints and regulatory uncertainty may slow progress. If Pi Network can solidify its utility and attract broader institutional interest, its climb past previous highs may become a matter of when, not if.

PI/USD (4H Chart)

On the 4-hour chart, PI/USD is consolidating near 1.8072, showing signs of indecision as traders assess the next move. The RSI at 47.28 indicates neither overbought nor oversold conditions, suggesting the market is in equilibrium. The Parabolic SAR dots hovering above the candles hint at bearish pressure, which could deepen if the price fails to reclaim 1.9935. If selling resumes, the first line of defense remains at 1.3935, followed by 1.0000 and a worst-case dip to 0.6189. However, if buyers step in and push the price above 1.9935, PI/USD could resume its bullish trajectory, aiming for 2.2950 and beyond. The market’s next move hinges on whether bulls can gather enough momentum to break through resistance or if bears will force another leg down.

Crypto enthusiast Coinvo, who has a strong following of over 326,000 on X, pointed out that Pi Network has been surpassing the performance of the two largest cryptocurrencies for the past two weeks. This consistent outperformance suggests growing momentum for PI, potentially attracting more attention from investors and the broader crypto community. As confidence in its market potential increases, PI could solidify its position as a competitive digital asset with promising future prospects.

$PI has outperformed the two biggest cryptocurrencies for two weeks now! 🚀 pic.twitter.com/nl4saWJxby

— Coinvo (@ByCoinvo) March 7, 2025

Alternatives to PI

Pi’s long-term growth depends on ecosystem expansion and broader adoption. Increasing community engagement, developer activity, and potential exchange listings could enhance its market appeal. As discussions around Pi’s accessibility continue, there is a possibility it could be integrated into Best Wallet in the future. Best Wallet, a cutting-edge multi-chain platform, provides a seamless and secure way to acquire, store, and manage digital assets across over 60 supported blockchains, including Bitcoin, Ethereum, and Solana.

More than just a storage solution, Best Wallet offers a comprehensive crypto ecosystem designed for convenience and financial flexibility. Its DEX aggregator connects users to over 200 decentralized exchanges and 20 cross-chain bridges, ensuring optimal trading rates. Additionally, fiat conversions are supported across 100+ currencies, enabling effortless transitions between traditional and digital assets. Users can also enjoy exclusive iGaming rewards and the Best Card, which integrates seamlessly with Google Pay and Apple Pay for everyday transactions. By combining advanced security with an intuitive interface, Best Wallet positions itself as a leading solution for managing digital assets efficiently.

Best Wallet – Fully Anonymous Bitcoin Wallet

At the core of Best Wallet’s ecosystem is the $BEST token, which provides premium benefits such as reduced transaction fees and governance participation. Currently in its presale, $BEST offers an attractive investment opportunity, especially with its staking program delivering an impressive 159% APY. Having already raised over $10. 9 million, $BEST stands out as a strong contender in the evolving crypto landscape. For investors seeking to diversify their portfolios, $BEST presents a compelling alternative to Pi, offering strong utility and long-term growth potential.

Related News

- Pi Network Price Prediction: PI Is No. 1 Trending Crypto On CoinGecko Ahead Of Pi Day, But Traders Buy This ICO For Hot Tips

- Why Best Wallet Stands Out as a Secure and User-Friendly Crypto Wallet in 2025

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage