Join Our Telegram channel to stay up to date on breaking news coverage

The overall feeling in the market was positive from the close of October 2024 until the beginning of this year, but things have been sluggish for the past month. After a month of bearishness and losses, many investors hope to make gains reminiscent of the November/December 2024 bull run.

Determining the next cryptocurrency to explode might be challenging as most funds are attracted to pumping assets. However, this article will explore the performance of cryptocurrencies with much growth potential, especially before the year runs out. The aim is to identify coins with some potential and help investors and traders make informed decisions about each token.

Next Cryptocurrency To Explode

Today’s article discusses the performance of potentially explosive cryptos that investors should add to their watchlist. It also includes a special mention of the presale token Solaxy. This new meme coin offers a unique blend of these two dynamics by combining meme coins’ excitement and reward potential with the practical utility of a Layer 2 blockchain solution.

1. Vana (VANA)

Vana is making waves in the blockchain space with its innovative data ownership and monetization approach. Built as a Layer 1 blockchain compatible with the Ethereum Virtual Machine (EVM), Vana allows users to transform their data into financial assets.

By pooling private datasets for AI training, individuals can tokenize and profit from their data through Data Decentralized Autonomous Organizations (Data DAOs). This framework secures user data and ensures individuals retain control over how their information is shared and utilized.

A milestone came on December 16, 2024, when Vana officially launched its mainnet alongside its native token, $VANA. This marked a significant step in advancing AI technology while prioritizing privacy and fair data distribution. Since then, the project has gained strong momentum in the market.

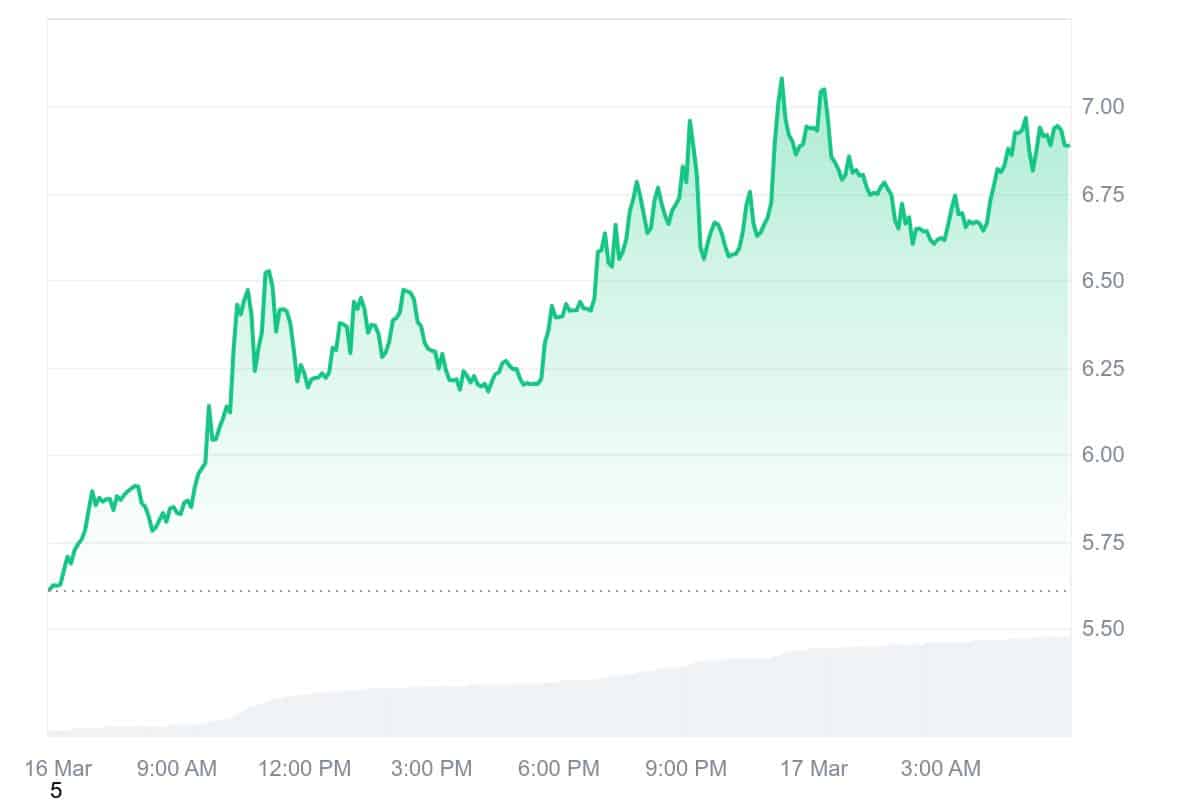

$VANA has experienced a notable rebound despite early hurdles. Over the past 24 hours, the token’s price surged by 22.63%, contributing to an impressive weekly increase of 33.57%. The project’s market capitalization mirrored this growth, climbing by 22.63%, while trading volume skyrocketed by 1,072.59%. These figures reflect increasing investor confidence and renewed optimism around Vana’s potential.

Data is everything. It’s everywhere; in every search, every tap, every movement you make.

It fuels AI, powers billion-dollar companies, and shapes the internet itself.

Big platforms profit. You get nothing.

That’s changing. A movement is emerging—where people reclaim the value… pic.twitter.com/4lUIIl5AjL

— vana (@vana) March 15, 2025

Adding to its progress, Vana has secured an important partnership with Vyvo Smart Chain, a blockchain specializing in health data management. The collaboration, announced on October 18, 2023, and set to roll out on February 26, 2025, will allow Vyvo users to export health data from IoT devices and receive tokenized rewards.

With a solid foundation and a growing community, Vana appears poised for long-term success. Experts suggest that strategic partnerships and favorable market conditions could push $VANA’s value past $19.52 by 2025. However, the token could dip to around $8.99 if market conditions weaken. Regardless, Vana’s vision of a decentralized data economy continues to gain traction, making it a project to watch.

2. Axie Infinity (AXS)

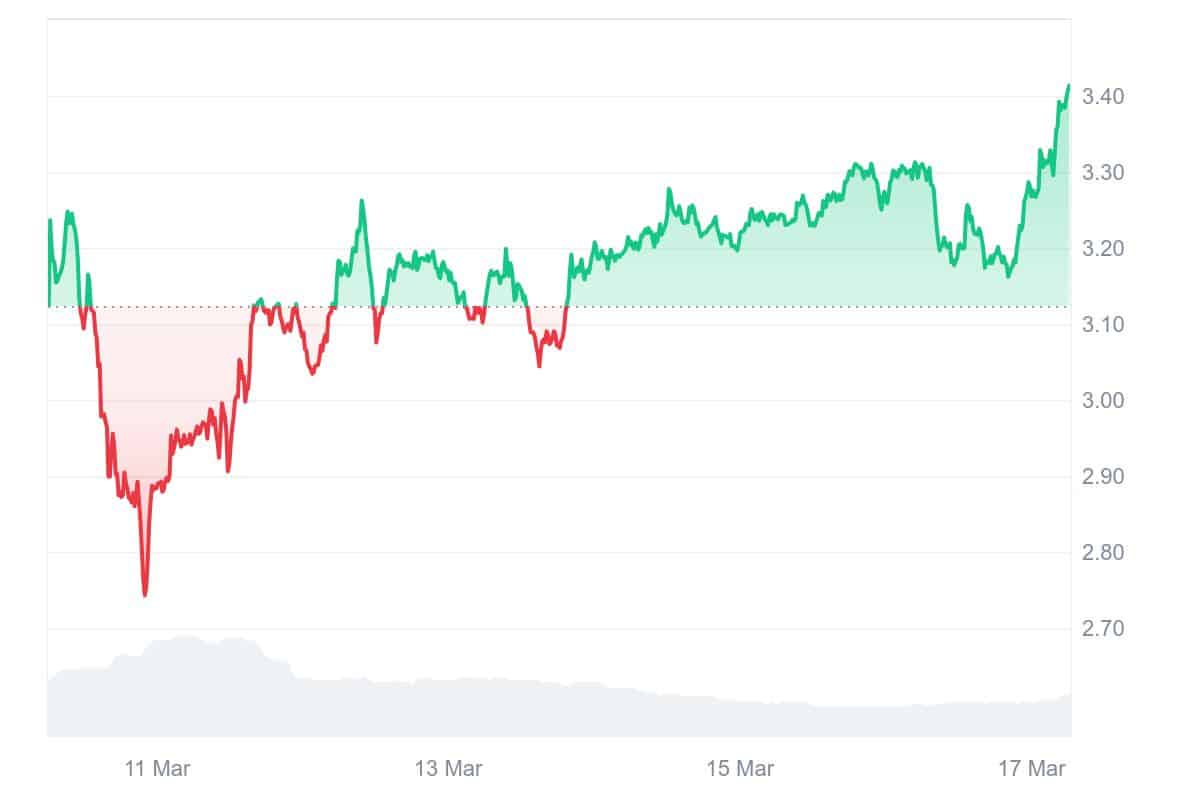

Axie Infinity’s native token, AXS, has been navigating a challenging market, but signs of a turnaround are emerging. The token has been stuck in a falling wedge—a bullish reversal pattern—since facing resistance at $10.26 in early December. Over the past three months, AXS has lost over 75% of its value, hitting a low of $2.51 on March 11.

However, momentum is shifting in favor of the bulls. Over the past week, AXS climbed 9.26%, with a 24-hour trading volume increase of 34.25% to $24.45 million. Moreover, the token is approaching a breakout from its current triangle pattern, signaling growing investor confidence. The Relative Strength Index (RSI) is also trending upward, nearing the overbought zone, which suggests rising demand among buyers.

Currently, AXS is trading at $3.41, pressing against the wedge’s upper resistance. If it successfully breaks through and confirms the move with a retest, the next target could be around $4.18, aligning with the 50-day moving average (MA). If buying pressure intensifies, the rally could extend to the $5.66 mark, near the 100-day MA—representing a potential 72% upside from current levels.

Axie Discord Fiesta is BACK!

A non-stop weekly dose of games and fun is coming back with the Axie Discord Fiesta!

• Join us every Monday at 1PM UTC | 9PM PHT | 8AM EST in the Axie Discord Fiesta Stage. ⏰

• Win rewards from the total reward pool of 25 AXS every week by… pic.twitter.com/EoSfx0pAh4

— Axie Infinity (@AxieInfinity) March 17, 2025

Despite recent price struggles, Axie Infinity remains a dominant force in the crypto and blockchain gaming space. Since its launch, the token has delivered an impressive return on investment (ROI) of 1,798.81%, attracting interest from investors looking for the right moment to enter the market. With the possibility of a bullish breakout, many are now watching closely to see if AXS can regain its upward momentum.

3. Solaxy (SOLX)

As Solana marks its fifth anniversary, the blockchain is at a crossroads. Once celebrated for its high-speed transactions and low fees, the surge in meme coin activity has overwhelmed the network, causing congestion and raising concerns about future scalability. However, a potential solution has emerged for this milestone—Solaxy (SOLX).

Solaxy has already raised an impressive $26.7 million in its presale. The project aims to tackle Solana’s congestion issues by offloading transaction processing through a Layer 2 scaling solution. By reducing the computational strain caused by meme coins, Solaxy could significantly improve network efficiency.

Choose Wisely. 🛸 $SOLXhttps://t.co/mdaTX9aVVx pic.twitter.com/luQGRA5vlX

— SOLAXY (@SOLAXYTOKEN) March 16, 2025

Solaxy’s approach is a Layer 2 technology called rollups. Instead of processing all transactions directly on Solana’s Layer 1 blockchain, Solaxy groups multiple transactions on its sidechain before submitting them in batches for final validation.

Investors are already betting on Solaxy’s success. Since its presale launch in mid-December, the project has gained significant traction, drawing interest from retail and institutional investors. Crypto analysts are also optimistic about its potential. 99Bitcoins, a well-known YouTube channel with over 725K subscribers, has suggested that SOLX could see a 100X surge after launch.

Solaxy’s strategy follows a model that has already proven successful in the Ethereum ecosystem. Solutions like Arbitrum and Optimism have demonstrated that Layer 2 rollups can scale a blockchain without compromising security. If Solaxy achieves similar success, it could be crucial in optimizing Solana’s performance.

Beyond reducing congestion, Solaxy has bigger ambitions. The project will bridge Solana and Ethereum, forming a unified Web3 ecosystem. Solaxy could establish SOLX as a key transaction medium between the two largest blockchain networks by enabling seamless interoperability.

4. Berachain (BERA)

Despite recent challenges, Berachain is steadily making its mark in the blockchain space. One key development is the success of Infrared Finance, a liquid staking protocol built on the Berachain network. Infrared Finance secured $14 million in a Series A funding round led by Framework Ventures, bringing its total funding to $18.75 million. This investment, finalized in January 2025, follows an earlier $2.25 million round in June 2024, signaling strong investor confidence in Berachain’s ecosystem.

However, the $BERA token has dropped 77% from its peak and is currently trading around $6.6. Concerns about investor control over the token’s supply have also emerged, adding uncertainty to its price movement.

Despite these setbacks, Berachain is gradually regaining momentum. At press time, $BERA is valued at $6.58, reflecting a 2.44% gain in the past 24 hours, a 7.93% increase over the week, and a 9.68% rise in the past month. The token’s market cap has also climbed to $707.53 million, while trading volume has surged by 169.49% to $183.24 million.

From a technical standpoint, $BERA is in a consolidation phase, with support at $7.60 and resistance at $7.70. If the token breaks past this resistance, it could rally toward the $7.80 to $8 range. However, if it drops below $7.50, a retest of $7.20 may follow.

One of the driving forces behind Berachain’s success is its proof-of-liquidity (PoL) consensus mechanism, which has gained widespread community support. The team also added a touch of humor to its mainnet launch announcement, playfully stating that it would happen in “Q5”—an imaginary quarter beyond Q4.

5. Litecoin (LTC)

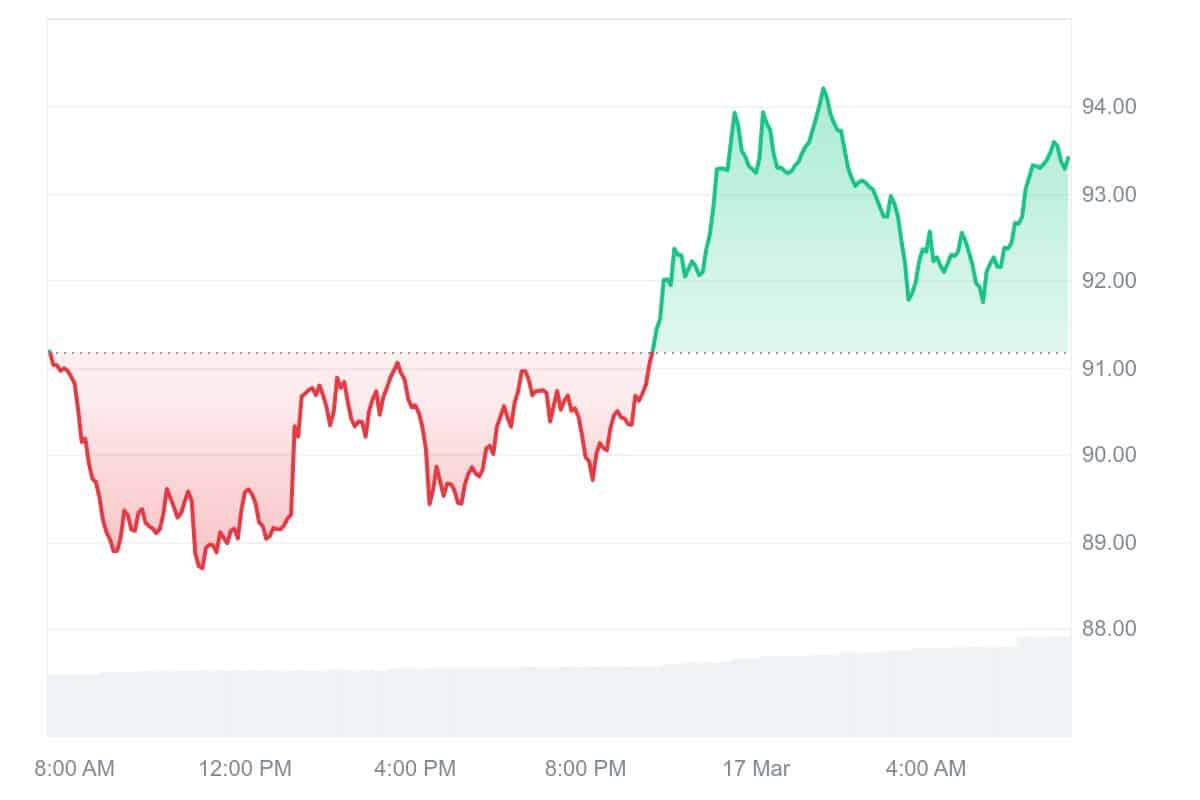

Litecoin has seen a modest price increase, climbing 2.24% in the past 24 hours to trade above $93. One key driver behind this uptick is growing optimism around the potential approval of cryptocurrency exchange-traded funds (ETFs).

According to Bloomberg analysts James Seyffart and Eric Balchunas, ETFs tracking assets like Litecoin, Solana, Dogecoin, and XRP have a strong chance of approval. They estimate that the likelihood of a Litecoin ETF—filed by Canary Capital and Grayscale—receiving regulatory approval now stands at 90%.

Despite broader market struggles, Litecoin has shown resilience. While Ethereum (ETH) suffered a sharp 31% decline in February, LTC managed to hold steady, closing the month with a slight 1% gain. This stability has led analysts to predict Litecoin could push past $200 by April 2025.

One of the biggest factors contributing to Litecoin’s current momentum is increased network activity, primarily fueled by expectations surrounding the SEC’s potential approval of a Litecoin ETF. Bloomberg’s 90% approval estimate significantly outpaces projections for an XRP or Solana ETF, reinforcing investor optimism.

I'm going to repeat this again…don't tell me nothing is possible anymore for Litecoin. https://t.co/20zRT1p43p

— Litecoin (@litecoin) March 17, 2025

On-chain data also supports Litecoin’s bullish outlook. According to analyst Ali Martinez, its market value to Realized Value (MVRV) ratio currently stands at 15.91%. This metric helps investors gauge market phases, with higher ratios often signaling profit-taking periods. Litecoin could see a strong rebound in the coming months if key support levels hold.

Market opinions on Litecoin’s recent price movement remain divided. Some analysts believe the increase is linked to short liquidations rather than fundamental changes in market demand. However, CoinCodex data suggests Litecoin could surge to $224 by April 2025. Whether this prediction materializes will depend on broader market trends and regulatory decisions.

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage