Join Our Telegram channel to stay up to date on breaking news coverage

The crypto lending market has contracted significantly, falling 43% to $36.5 billion by late 2024. Major centralised finance lenders collapsed during market volatility, drastically reducing investors’ available borrowing options. New crypto listings face challenging market conditions, with CeFi lending experiencing a severe 68% decline.

Decentralised finance platforms have achieved remarkable growth amid centralised lending’s struggles, increasing 959% since 2022. DeFi platforms operate across twenty lending applications and twelve different blockchain networks worldwide. Investment decisions increasingly favor decentralised options as three firms control 88.6% of remaining centralised lending.

New Cryptocurrency Releases, Listings, & Presales Today

SUBBD revolutionises fan-creator engagement with blockchain and AI, eliminating middlemen for direct monetisation opportunities. Coverage from CoinDesk and Cryptopolitan boosts visibility, while its presale shows strong momentum and investor interest.

1. Solayer USD ($SUSD)

Solayer USD is a hardware-accelerated blockchain network that delivers exceptionally high throughput and near-zero latency for advanced applications. It scales the Solana Virtual Machine efficiently by leveraging InfiniBand, RDMA, software-defined networking, and a multi-executor architecture. Solayer allows developers to secure valuable block space and prioritise transaction execution without compromising speed or composability. This architecture redefines decentralised performance, breaking through conventional scaling limits in most blockchain infrastructures. It creates an optimised layer for next-gen applications demanding swift execution, atomicity, and seamless interoperability. Hence, Solayer is a fundamental layer for the high-performance decentralised economy.

The InfiniSVM technology powering Solayer is tailored to process more than 1 million transactions per second while achieving over 100 Gbps in network bandwidth. It deploys a distributed execution model across microservices and hardware accelerators, preventing fragmentation and ensuring synchronous global state updates. Traditional scaling solutions often sacrifice atomicity or decentralisation, but InfiniSVM retains both without introducing bottlenecks. Developers benefit from ultra-low latency and deep composability, vital for financial applications, trading engines, and high-speed decentralised finance tools. It pushes performance to the limits of hardware potential, encouraging the development of responsive, efficient applications.

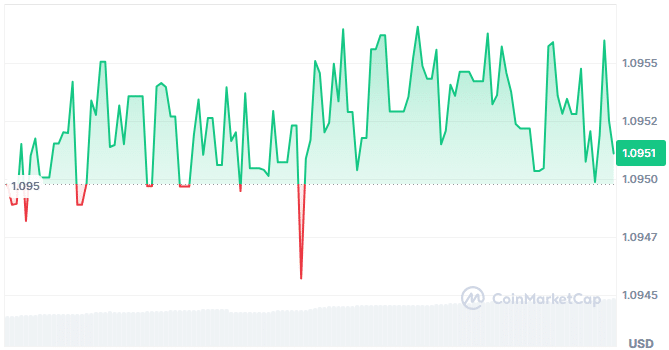

Solayer’s utility extends through native assets like sSOL and sUSD, which are designed to enhance participation and liquidity across its network. sSOL is a liquid staking representation of deposited SOL, enabling users to maintain capital efficiency while earning staking rewards. This dual advantage unlocks participation in DeFi without locking funds, a critical feature for active traders and users. Meanwhile, sUSD is the first yield-generating stablecoin on Solana, pegged 1:1 to the US Dollar and backed by US Treasury Bills. This stable asset preserves capital value and delivers a consistent 4–5% yield with high security. These financial primitives empower Solayer to attract liquidity and utility simultaneously.

Solayer has attracted strategic partnerships with well-respected venture capital firms that bring capital, mentorship, and blockchain industry experience. Race Capital invests heavily in foundational infrastructure startups and has a strong record of nurturing transformative technologies. Polychain Capital is known for actively managed portfolios and long-term commitment to blockchain innovation. Big Brain Holdings specialises in early-stage investments and provides expert insight into the evolving crypto landscape. Lvna Capital focuses on public and private blockchain ventures, contributing to network adoption and developer outreach.

2. SUBBD ($SUBBD)

SUBBD transforms how content creators and their audiences interact by merging blockchain with AI to revolutionise digital engagement. It empowers creators to offer exclusive content while providing fans with gamified incentives, AI assistants, and low-fee interactions. Unlike conventional Web2 models, where creators surrender hefty fees to middlemen, SUBBD ensures maximum earnings through blockchain-native ownership. With over 250 million influencers in its network, it gives fans direct access to creators through tokenised perks and personalised content. SUBBD supports crypto payments, content scaling via AI, daily livestreams, creator academies, and custom fan requests. As a result, creators scale more efficiently while fans receive immersive, personalised experiences.

SUBBD addresses key problems in the content industry by focusing on direct monetisation and simplified management using AI. For fans, the platform enables real-time custom content, enhanced access, and daily behind-the-scenes updates using staking incentives. Automation handles scheduling, moderation, and content creation for creators, freeing them to focus on brand growth. Web3 tools embedded in SUBBD promote digital ownership of all interactions and better reward mechanisms. The token-native model ensures transparency while creating stronger, more authentic fan-creator connections. SUBBD is replacing outdated models with personalised, efficient, and trustless content experiences.

Let’s be real – no one subscribes just to wait around.

You’re in the mood now. But instead…

You're stuck refreshing, hoping for a reply, or waiting days for that one custom you paid for.

It’s slow. It’s awkward. And honestly? It kills the vibe.🫠

Here’s how SUBBD fixes all… pic.twitter.com/NPHXZFxHsb

— SUBBD (@SUBBDofficial) April 15, 2025

SUBBD has built a strong foundation in crypto media and has gained widespread exposure in well-known publications. Cryptopolitan, Coinpedia, and NEWS BTC have all recognised the innovation behind the AI-driven approach and content tokenisation. Additionally, a feature on CoinDesk validates the legitimacy and traction of the project within the broader blockchain space. These media partnerships are crucial in informing the public and building trust around the SUBBD brand. Strategic visibility has driven more creators and users to participate in the presale and adopt its services. Media validation continues to expand SUBBD’s credibility and reach.

The presale is actively underway, with a current raise of $169,600.72 out of its $374,481 goal, showing strong early investor interest. The current presale price of $0.05515 allows early supporters to gain access before broader market exposure. With significant momentum, SUBBD’s introduction to new crypto listings is expected to attract even more attention and demand for tokens.

3. Silentis ($SILENTIS)

Silentis is reshaping the AI software landscape by creating an open-source, privacy-first, and entirely offline solution. It integrates powerful AI models into a standalone application that runs efficiently on CPU and GPU without internet connectivity. This unique approach is crucial in today’s privacy-conscious world, where data breaches are increasingly common. Silentis eliminates cloud dependency, giving users complete control over their data and processing. It is designed for high compatibility and supports low-end devices, making sophisticated AI features accessible to everyday users. Its lightweight nature and decentralised funding mechanism make it one of the most democratic AI tools available.

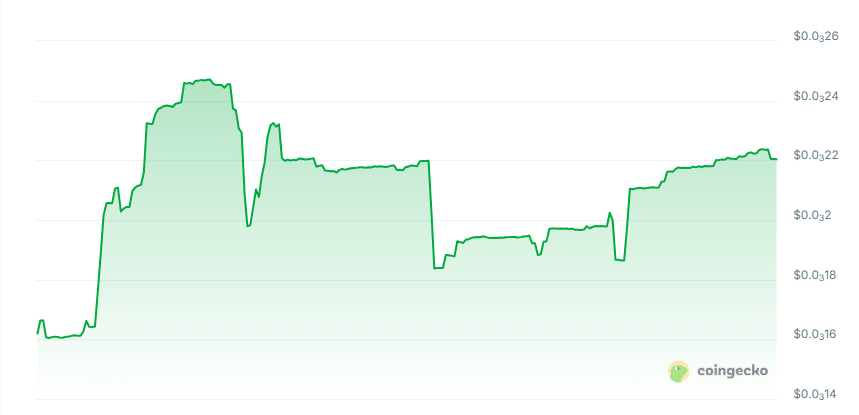

Silentis recently celebrated a key milestone as it became available for trading on AscendEX, expanding access and increasing liquidity for its token. The $SILENTIS/USDT trading pair has been launched, giving traders and holders an easy entry point. The listing on AscendEX is also being highlighted across several new crypto listings directories, driving greater awareness.

🚀 Deposits are now available on #AscendEX ! We’re thrilled to announce the listing of @Silentisproject (#SILENTIS) under the trading pair #SILENTIS/USDT . Below are the key details:

✅ Deposit: Available now

✅ Trading: April 15 at 10:00 AM UTC

✅ Withdrawal: April 16 at 10:00…— Silentis AI (@Silentisproject) April 14, 2025

Traditional AI platforms demand constant connectivity, risking user privacy and excluding many due to hardware requirements or centralised control. Silentis changes this by offering offline functionality, robust privacy, and optimised performance for even modest computing environments. The BSC-based utility token serves multiple roles—fueling governance, rewarding contributors, and enabling premium features within the application. Unlike centralised services, users have a direct say in how the tool evolves. The ability to run advanced AI locally makes Silentis a powerful option for schools, businesses, and individual developers. Therefore, it bridges the gap between usability and privacy in AI.

4. Arcadia ($AAA)

Arcadia is pioneering the future of decentralised finance by providing professional-grade yield strategies to everyday users through intuitive interfaces and user-owned DeFi Accounts. It supports concentrated and virtual liquidity models and integrates directly with DEXs like Uniswap, Aerodrome, and Alienbase. Arcadia streamlines complex DeFi processes, allowing users to batch actions such as asset swaps, lending, and strategy adjustments into a single transaction. These operations, which generally require multiple steps and external tools, are now handled within the Arcadia environment through smart contract automation. This seamless experience empowers even casual users to tap into professional DeFi strategies with built-in risk controls. Consequently, Arcadia reduces the barrier to entry for high-yield crypto investing.

Arcadia DeFi Accounts offer users enhanced control and operational simplicity by functioning like self-custodial wallets with smart automation features. With these accounts, users can simultaneously perform tasks such as rebalancing, liquidating, or leveraging assets. This infrastructure is built with security and autonomy, ensuring that only the owner can execute changes while smart contracts handle execution logic. The embedded margin system enhances flexibility without compromising safety. Additionally, these smart contracts allow on-chain collaboration with third parties and AI tools within pre-approved limits. As a result, users retain ownership while delegating tedious or technical tasks.

Arcadia Lending Pools are isolated liquidity reserves where lenders can supply assets for passive earnings while borrowers use Arcadia Accounts as collateral. This allows for strategic farming where high-yield strategies are backed by real collateral. The pools are protected through smart contract coverage, providing an extra layer of defense against exploits. Borrowers pay interest, which is returned to lenders, creating a sustainable reward cycle. These customisable lending mechanisms give users risk-adjusted access based on their preferences. Consequently, lending on Arcadia is both profitable and flexible.

We have liftoff !!

AAA is live for trading on Aerodrome and airdrop claims are available. ✈️

Be sure to vote on Airdrop Season 2 !

✦ Token Address

0xaaa843fb2916c0B57454270418E121C626402AAa

✦ Pool Address (CL50-USDC/AAA)

0xfd198524340203Da7896909941E92E5EF0D2B753 pic.twitter.com/VsIOTBbUZd— Arcadia Finance (@ArcadiaFi) April 10, 2025

Arcadia Farms streamlines liquidity provision across major DEXs, letting users manage positions with precision using spot or margin accounts. Depending on their risk appetite, users can deploy capital using borrowed assets or direct deposits. The interface displays pool data, fee structures, and risk exposure in real time, making liquidity management easy. Meanwhile, collateralised lending is redesigned to treat the user’s portfolio as a single asset, not fragmented tokens. This model provides capital efficiency and better flexibility in managing leveraged positions. All these tools combined make Arcadia one of the most comprehensive systems for yield generation in DeFi.

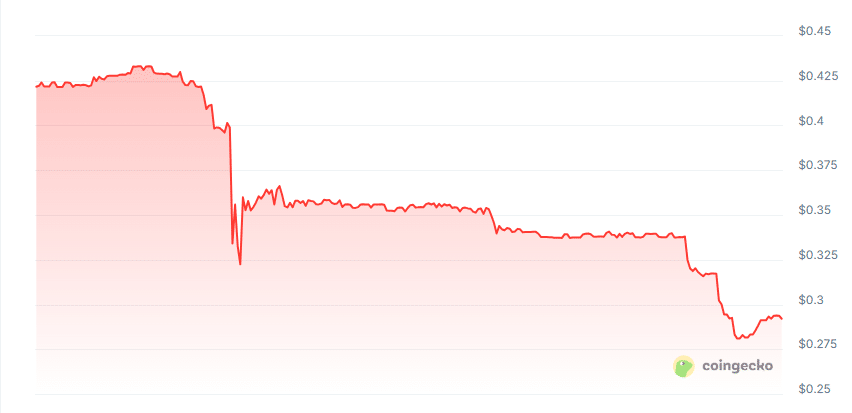

Arcadia announced that AAA is now live for trading on Aerodrome, and eligible users can claim their airdrops immediately. The launch also includes voting opportunities for participants in the upcoming Airdrop Season 2. Since AAA appeared in several new crypto listing announcements and trading platforms, interest has surged.

Arcadia has partnered with notable venture firms committed to pushing decentralised finance to the mainstream. Owl Ventures, managing over $2 billion in assets, brings institutional confidence and educational outreach to the project. Cogitent Ventures supports early-stage blockchain innovation, ensuring that Arcadia receives funding and operational expertise. No Limit Holdings offers global insight and technical experience to scale Arcadia’s vision rapidly.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage