Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin’s value remains volatile despite long-term projections suggesting potential growth to $1.8 million by 2035. Investors are cautiously rebalancing portfolios from cryptocurrency toward safer assets like gold and currencies. New crypto listings face challenging market conditions as global trade tensions and political uncertainties limit risk appetite.

Since early 2025, gold has significantly outperformed Bitcoin, rising 23%, while Bitcoin has dropped over 10%. Tokenised gold trading volume reached a two-year high, demonstrating shifting investor preferences during uncertain times. Despite short-term market hesitation, analysts maintain that Bitcoin’s decreasing volatility presents opportunities for conviction-based investment strategies.

New Cryptocurrency Releases, Listings, & Presales Today

Best Wallet simplifies crypto with multi-chain swaps, staking, a debit card, and 50+ blockchain integrations. With over $11 million raised, its presale success reflects growing trust and widespread utility adoption.

1. Levva Protocol ($LVVA)

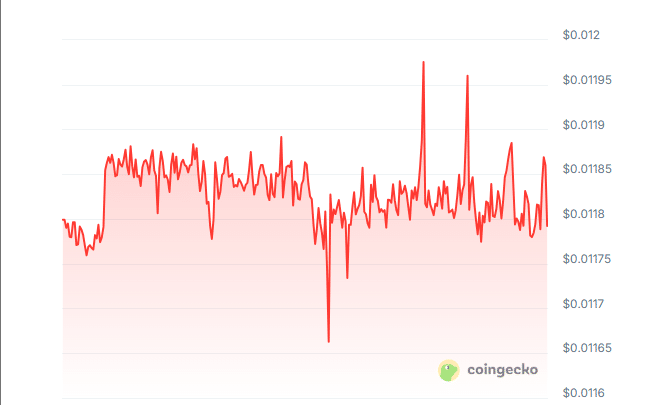

Levva Protocol uses artificial intelligence to introduce an intelligent and automated way to manage decentralised finance assets. It simplifies portfolio management by tailoring strategies to user goals, optimising yield, and ensuring effortless control without any unnecessary complexities. Whether you’re a novice entering the decentralised world or a seasoned expert, Levva enables optimised engagement through a secure, non-custodial framework. It offers passive income opportunities, yield farming, and risk-adjusted strategies while maintaining complete transparency. The AI-powered copilot provides personalised financial guidance while ensuring that user funds remain untouched and under their full control. Consequently, Levva provides a revolutionary gateway to streamlined digital wealth management.

Levva vaults are designed to allow individuals or groups to provide and manage liquidity with high autonomy. These immutable and non-custodial vaults are open to anyone who wishes to deploy, manage, or participate in passive income generation. Participants can conveniently enter or exit the vault, reflecting Levva’s emphasis on decentralisation and flexibility. Additionally, various entities can manage vaults, including individuals, AI systems, or professional asset managers. A robust access control system ensures safety, while the vault infrastructure allows for optimised yield extraction and risk mitigation. Thus, Levva vaults act as reliable tools for creating sustainable digital wealth.

Levva’s lending pools operate as isolated money markets where collateral and debt are dynamically managed using pool tokens. These pools autonomously monitor borrowing positions and execute liquidations when needed, rewarding liquidity providers with surplus liquidation funds. Integrated oracles from Uniswap, Curve, Pyth, Pendle, and Chainlink ensure accurate pricing and fair transactions. The connection to decentralised exchanges through adapter systems enhances trading efficiency and liquidity movement. Lending pools allow a seamless borrowing and lending experience without sacrificing decentralisation or risk transparency. These features collectively reinforce Levva’s mission to create a safer and smarter decentralised financial experience.

📣 Update to Lock & Earn Boosts 📣

Our previous +10% bonus for 1-month staking expired yesterday.

But good news 👇

You can still lock, earn, and grow with our updated rewards (one-time & expiring):

🔒 1 month – +5% bonus

🚀 6 months – +30% bonus

🏆 12 months – +50% bonus… pic.twitter.com/uTNlw0W0pa— Levva (@levva_fi) April 9, 2025

In a recent update, Levva revised its Lock & Earn bonus system, replacing the expired +10% one-month staking incentive. However, users still benefit from updated, time-sensitive rewards for staking and growing their assets. This timely change aligns with Levva’s evolving yield enhancement strategies and keeps users actively engaged.

Levva has secured strategic alliances with Ramses and DODO to enhance operational efficiency. Ramses contributes to capital efficiency through incentive-aligned concentrated liquidity services. Meanwhile, DODO’s advanced decentralised trading features integrate seamlessly with Levva’s yield optimisation framework.

2. DPIN ($DPIN)

DPIN is reshaping the technological future by converging blockchain, artificial intelligence, and 5G into a revolutionary computing framework. As demand for high-performance computing grows with AI and cloud gaming expansion, current infrastructures fail to meet scalability and accessibility needs. DPIN’s “Cloud & Chain” approach democratises computing power, allowing individuals and organisations to afford the necessary resources. DPIN aims to bridge the global divide in computing access by utilising a decentralised infrastructure and ensuring fair participation. This reimagined model fosters innovation, scalability, and performance while addressing the limitations of traditional centralised systems. Ultimately, DPIN envisions a world where computing power is a universally accessible asset rather than a restricted resource.

DPIN addresses a pressing challenge—the centralised control of computing resources that limits scalability and innovation in emerging industries like AI and cloud gaming. Through decentralised frameworks, DPIN allows global contributors to offer and access high-performance computing affordably and transparently. This design reduces dependency on monolithic corporate infrastructures while improving system responsiveness and flexibility. With this democratisation, developers and gamers can experience enhanced capabilities at significantly reduced costs. Additionally, the system encourages fair competition by offering global players equal access to computational tools. DPIN is not merely a service—it is an infrastructure paradigm that unlocks digital equity.

Real-world use cases for DPIN include powering e-sports hotels, cloud gaming services, internet cafes, AI model training, and GPU-intensive computing tasks. E-sports venues benefit from stable, high-speed computing to improve customer satisfaction and gaming quality. AI developers utilise DPIN to accelerate model training, reduce research timelines, and scale innovation. Internet cafes can minimise hardware maintenance while maximising computational uptime using DPIN’s decentralised computing nodes. Cloud gaming becomes universally accessible on any device, minimising latency through localised resource allocation. GPU rendering and deep learning workflows benefit immensely from DPIN’s scalable and cost-efficient processing power.

DPIN has recently partnered with Roland Ong to boost e-sports hotel operations in Southeast Asia, combining gaming insight with advanced computing. Collaborations with Samsung Odyssey focus on refining user experience through computing infrastructure tailored for immersive digital environments. CESS and QPIN contribute to storage and decentralised cloud services, completing DPIN’s integrated service delivery.

3. Best Wallet Token ($BEST)

Best Wallet Token is rapidly gaining traction as a reliable, easy-to-use digital wallet with impressive month-on-month user growth. Its current momentum reflects strong user confidence and utility as it targets 40% of the $11 billion non-custodial wallet segment by 2026. The wallet simplifies crypto management, supporting over 50 chains, including Bitcoin and Ethereum, enabling users to buy, swap, sell, and hold in one app. Its all-in-one approach eliminates complexity and provides seamless access to the entire crypto universe. With a well-structured user interface and top-tier asset support, Best Wallet is ideal for both newcomers and experienced users. Its consistent growth is a testament to its strategic design and utility.

The introduction of the Best Card further enhances user convenience by linking crypto assets directly to real-world spending. Users can earn cashback on purchases while enjoying reduced transaction costs through staking. Like a traditional debit card, the Best Card allows seamless spending across all Mastercard-supported merchants worldwide. This bridges the gap between decentralised assets and everyday usability. It turns digital wealth into practical, spendable value while keeping it within the secure boundaries of Best Wallet. This integration adds a strong utility layer, increasing token relevance in real-life scenarios.

Best DEX supports cross-chain swaps, aggregating liquidity from over 50 decentralised exchanges for optimal trading efficiency and cost savings. It ensures users get the best route and lowest possible fees when conducting asset exchanges. With support for more than 50 chains, it provides unmatched flexibility in managing digital assets across diverse blockchains. Best DEX simplifies the entire transaction process by embedding this functionality directly within the wallet. It represents the future of non-custodial asset management by reducing reliance on centralised exchanges. Together with Best Wallet, it creates a seamless trading experience built on transparency and efficiency.

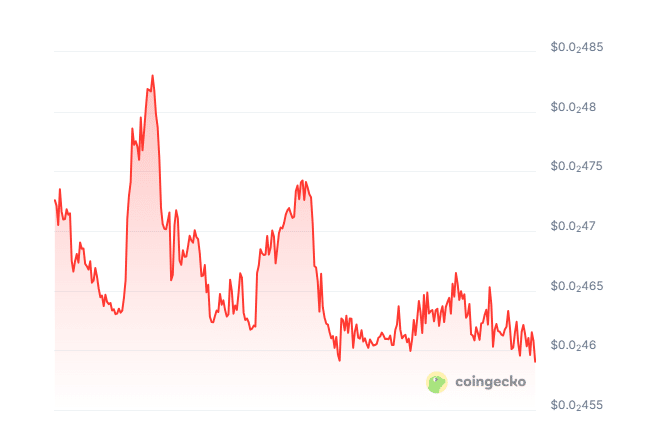

Currently in its presale phase, Best Wallet Token has raised $11,672,903.33 and is priced at $0.024725 per token. Featured in outlets like Cointelegraph, Techopedia, and Cryptopolitan, the project has garnered significant industry attention. These mentions position Best Wallet Token as a high-visibility asset ready for widespread adoption.

Visit Best Wallet Token Presale

4. GASP ($GASP)

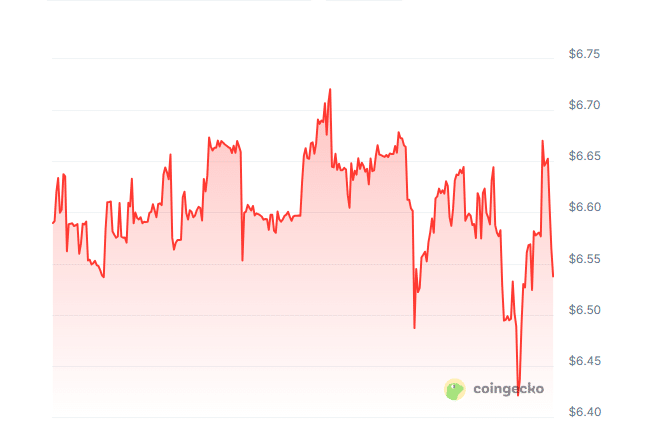

GASP stands out by solving critical issues in cross-chain trading and interoperability between major blockchain networks. Traditional bridges often suffer from centralisation risks and technical inefficiencies, compromising trust and usability. GASP avoids such pitfalls by enabling fast, secure, and trust-minimized asset transfers between Ethereum L2s, Solana, Bitcoin, and even rollups and gaming ecosystems. With its purpose-built blockchain architecture, GASP supports seamless trading for institutional and retail users while managing high transaction volumes. It offers unmatched speed and reliability without sacrificing security. GASP is a critical infrastructure in advancing blockchain interoperability and user adoption.

Through its cross-chain liquidity vaults and advanced routing, GASP ensures deep liquidity and stable transactions on both ends of a swap. Liquidity is automatically allocated to high-demand pools to minimise slippage and delay, providing a smooth user experience. The vaults adapt to market dynamics while preserving enough reserves for active trades, allowing capital to work efficiently. GASP’s vault system is intelligent, scalable, and designed to support high-frequency users and liquidity providers. These features deliver trading reliability while generating optimised yields for participants. Therefore, GASP not only facilitates exchange but also maximises financial efficiency.

MEV protection is a significant innovation embedded in GASP, shielding users from transaction manipulation such as front-running or sandwich attacks. By hiding transaction data until execution, it ensures a secure and fair trading experience. This fosters user trust and levels the playing field in digital asset trading. Moreover, gas-free swaps are another breakthrough feature, reducing the cost burden and eliminating hidden fees. A simple 0.3% commission structure ensures predictable pricing for all users. These combined benefits empower users to trade confidently in a low-cost and secure environment.

Turbo speed unlocked… we're going supersonic with @SonicLabs! ⏩

Gasp now supports any asset on Sonic. Deposit, swap, create pools, and add liquidity to Sonic tokens through our purpose-built trading chain. 🔄

Check out $S and other Sonic ecosystem assets on Gasp now! 🔥 pic.twitter.com/RoQ3egmXga

— Gasp (🔮,🔮) (@Gasp_xyz) April 9, 2025

In recent developments, GASP has integrated with SonicLabs to offer turbo-speed support for Sonic assets. Users can now deposit, swap, and provide liquidity for Sonic tokens through GASP’s infrastructure. These updates and new crypto listings reinforce GASP’s mission to revolutionise multi-chain trading.

Alliances with Signum Capital, Cluster Capital, and Top Trader Ventures back GASP’s growing credibility. Signum brings investment insight in distributed technologies, while Top Trader supports disruptive crypto startups. Cluster Capital connects GASP with influential builders and visionaries from the decentralised finance industry.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage