Join Our Telegram channel to stay up to date on breaking news coverage

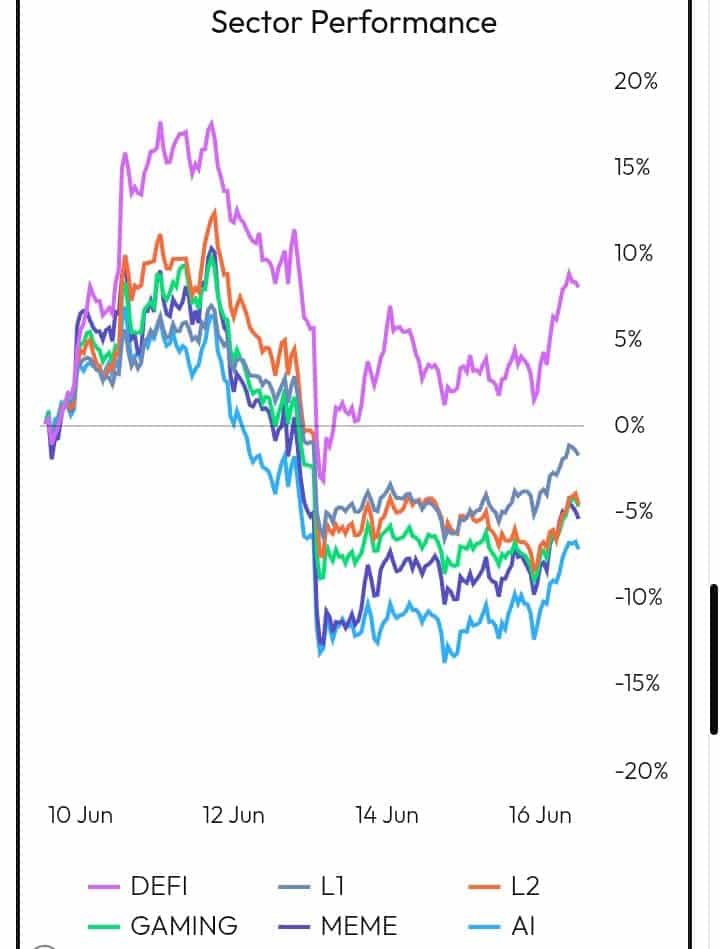

The decentralised finance (DeFi) sector is a testament to blockchain technology’s transformative power, with a robust and continuously expanding ecosystem. Reflecting significant user engagement and capital flow, the Total Value Locked (TVL) across DeFi protocols currently stands at approximately $113 billion, highlighting the substantial trust and participation within this innovative financial frontier. This dynamic environment is characterised by rapid technological advancements and shifting market interests.

Understanding which tokens are driving key market activity is crucial in this evolving landscape. We delve into the recent performance, critical updates, and underlying utility of leading DeFi tokens such as Uniswap (UNI), a pioneer in decentralised exchanges; EigenLayer (EIGEN), which is redefining restaking; Theta Fuel (TFUEL), powering a decentralised video network; and OriginTrail (TRAC), a leader in decentralised knowledge graphs. Exploring these diverse projects provides insights into the forces fueling momentum in today’s DeFi market.

Biggest DeFi Token By Market Activity Today – Top List

Uniswap is a leading decentralised exchange (DEX) built on Ethereum, offering permissionless token swaps through automated liquidity pools. EigenLayer is a restaking protocol on Ethereum that allows users to reuse staked ETH to secure other networks. Theta Fuel is the operational token of the Theta Network, a decentralised video and data delivery platform. OriginTrail is a decentralised knowledge graph protocol that connects real-world data across supply chains, AI, and Web3. Let’s thoroughly explore why these tokens are ranked among the leading DeFi tokens by market activity today.

1. Uniswap (UNI)

Uniswap is a leading decentralised exchange (DEX) built on Ethereum, offering permissionless token swaps through automated liquidity pools. It revolutionised DeFi by removing intermediaries, enabling anyone to list or trade tokens directly from their wallet. Its simple design and broad token support make it a go-to platform for decentralised trading.

The UNI token serves as the governance token of the protocol. Holders vote on key proposals for fee structures, upgrades, and treasury usage. While not required for trading, it gives users a voice in how the protocol evolves and grows.

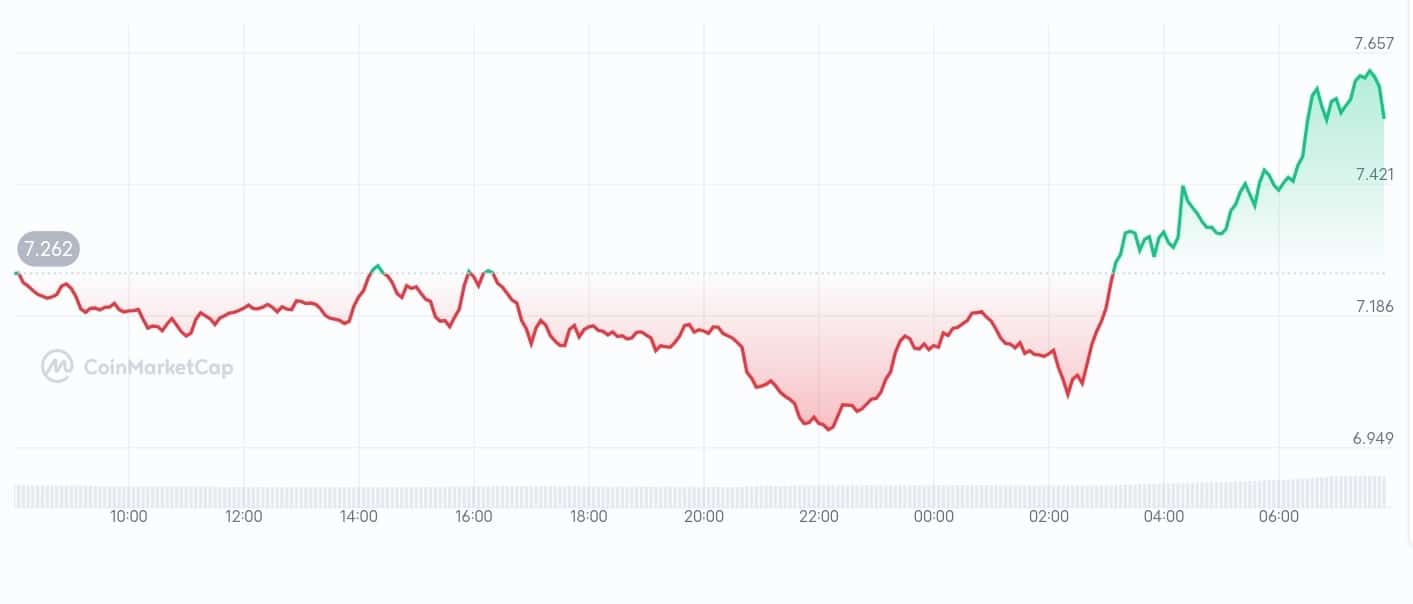

Uniswap (UNI) is trading around $7.61, up 5.1% in the last 24 hours and 29% over the past month. It has experienced 16 green days in the previous 30 days (53%). Its price today ranges between $5.98 and $6.18, showing strong recovery and renewed trader interest in AMM-led DeFi.

A new era of wallet UX is here 🦄

Uniswap Wallet users can now enable smart wallet, unlocking one-click swaps with bundled transactions

Smarter swaps. Lower costs. pic.twitter.com/xP1YnRhWs1

— Uniswap Labs 🦄 (@Uniswap) June 12, 2025

Uniswap just rolled out its new Smart Wallet feature, now available in the Uniswap Wallet. It allows users to perform one-click swaps with bundled transactions powered by the EIP‑7702 standard. The update improves user experience and efficiency by reducing gas costs and simplifying interactions.

This smart wallet upgrade makes Uniswap more accessible, especially for users new to DeFi. Bundling actions into a single click and cutting fees lowers friction and encourages more usage. For investors, enhanced UX and efficiency can drive adoption and boost Uniswap’s long-term value in the decentralised exchange space.

2. EigenLayer (EIGEN)

EigenLayer is a restaking protocol on Ethereum that allows users to reuse staked ETH to secure other networks. It enables shared security by letting validators opt into multiple services, boosting decentralisation and efficiency. This innovation is helping redefine how Ethereum infrastructure can scale securely.

The EIGEN token powers governance and coordination within the protocol. Users use it to vote, align incentives, and potentially receive rewards for helping secure third-party services through restaking. It plays a key role in the protocol’s decentralised trust layer.

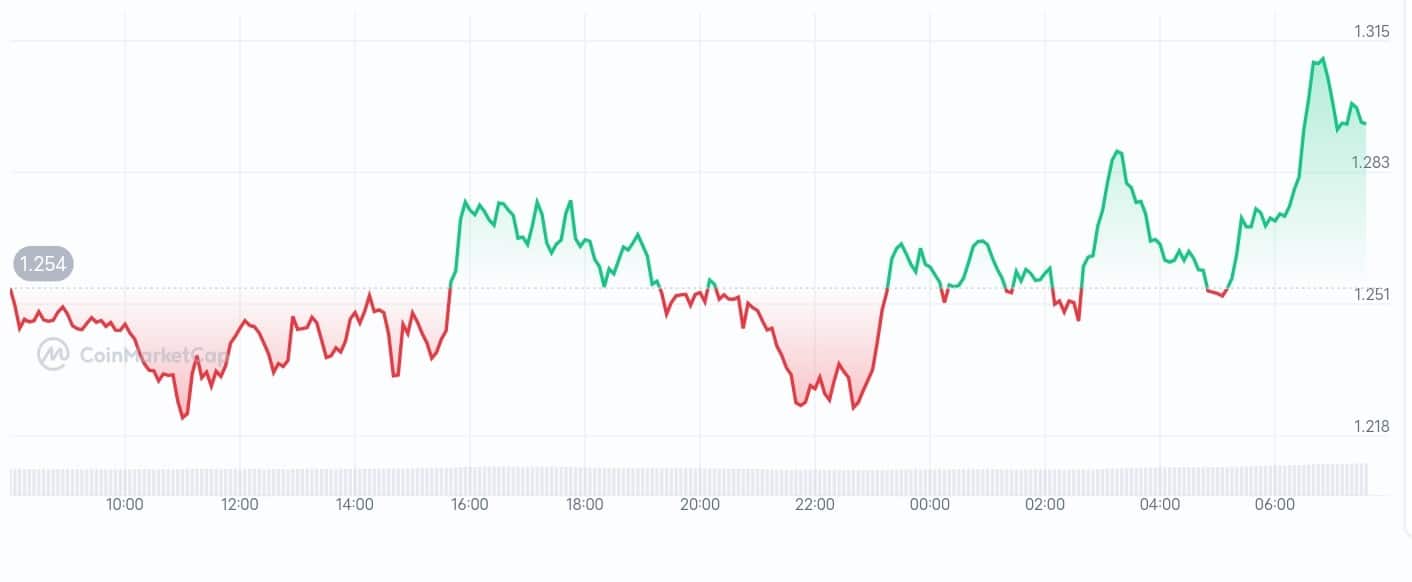

EigenLayer (EIGEN) is currently $1.31, up 4.6% today; it has experienced 18 green days in the last 30 days (60%). Its price ranges from $1.25 to $1.31 in the previous 24 hours, reflecting the growing interest in retaking platforms amid mixed sentiment.

22 big updates from across the EigenLayer ecosystem this week:

☑️ AI agents upgraded

☑️ $817M+ ATH staked with Eigen infra

☑️ Coordinated Eigen Bootcamp cohort 2 kicks off

☑️ Real-time DA metrics go live

☑️ Agent OB-1 squashes a bug in 10 minThe future’s not coming. It’s… https://t.co/TE2tSf61D3

— EigenLayer (@eigenlayer) June 15, 2025

EigenLayer shared “22 big updates” from its ecosystem this week, highlighting that AI agents have been upgraded and noting an all-time high of over $817 million staked using EigenLayer infrastructure.

This shows that EigenLayer is rapidly evolving with growing adoption and added utility. For investors, the staking and AI integration boost signals a strong foundation and rising demand, pointing to promising long-term growth in the ETH restaking and Web3 infrastructure space.

3. SUBBD Token (SUBBD)

SUBBD is an AI-driven platform transforming content monetisation within the creator-subscriber space. It combines AI tools with Web3 technology, empowering creators to manage and monetise their content efficiently, bypassing intermediaries. Featuring AI live streams, voice generators, and a 24/7 personal assistant, SUBBD presents a decentralised alternative to platforms like OnlyFans.

The $SUBBD token powers the platform, enabling access to content, offering tips, and facilitating creator requests. Currently in presale at $0.055675, having raised over $668,000, the token provides exclusive benefits, VIP access, and a 20% annual return through staking. A tenth of the total supply is designated for airdrops and rewards.

Pay with crypto to unlock the heat!

Most platforms don’t offer this, we do 😏♥️

The future is digital currencies, the future is $SUBBD 💰 pic.twitter.com/BqjewB6OV4

— SUBBD (@SUBBDofficial) June 12, 2025

SUBBD has garnered attention on prominent cryptocurrency platforms, including Cryptonomist, Coinspeaker, Bitcoinist, 99Bitcoins, and TradingView via NewsBTC, underscoring its growing presence in the AI and Web3 domains. The platform’s expanding influence is evident, with the launch of the AI Personal Assistant enhancing creator-fan engagement and support. As AI and Web3 reshape digital content, SUBBD is at the forefront of the future of creator earnings.

4. Theta Fuel (TFUEL)

Theta Fuel is the operational token of the Theta Network, a decentralised video and data delivery platform. It helps power interactions across the network, from streaming rewards to relayer payments. Theta reduces CDN costs by leveraging idle computing and bandwidth from users globally.

TFUEL is used to pay for on-chain transactions and smart contract operations. It also acts as a reward for relayers who share bandwidth or process video streams. It ensures the Theta ecosystem remains fast, scalable, and incentivised.

Theta Fuel (TFUEL) sits at $0.0333, ticked up 1.8% today, with 17 green days in the last 30 days (57%), and trading between $0.0328 and $0.0338 today, indicating stable usage trends in the Theta streaming network.

THETA and TFUEL are now available for trading/deposit/withdrawal on https://t.co/U3lWlcpLtA for all US users!https://t.co/IgJgVGllZRhttps://t.co/39262cBEcUhttps://t.co/U3lWlcpLtA is also now a US custodian for THETA/TFUEL & will soon stake to a Theta enterprise validator. https://t.co/7qv9YeJjLH

— Theta Network (@Theta_Network) June 12, 2025

Theta Network just announced that THETA and TFUEL are now available for trading, deposits, and withdrawals on Crypto.com for all US users. Expanding to Crypto.com’s US platform opens Theta to a massive new user base. For investors, this means easier access, better liquidity, and enhanced visibility—key factors that could drive adoption and token demand.

5. OriginTrail (TRAC)

OriginTrail, the last token on the list of leading DeFi tokens by market activity, is a decentralised knowledge graph protocol that connects real-world data across supply chains, AI, and Web3. It enables verifiable data sharing across pharmaceuticals, logistics, and IoT industries. The project bridges traditional systems with blockchain to ensure transparency and trust in global trade.

The TRAC token powers network data publishing, discovery, and validation. It incentivises node operators, governs data markets, and is essential for accessing OriginTrail’s decentralised services. It brings utility to a system designed for secure, trusted information exchange.

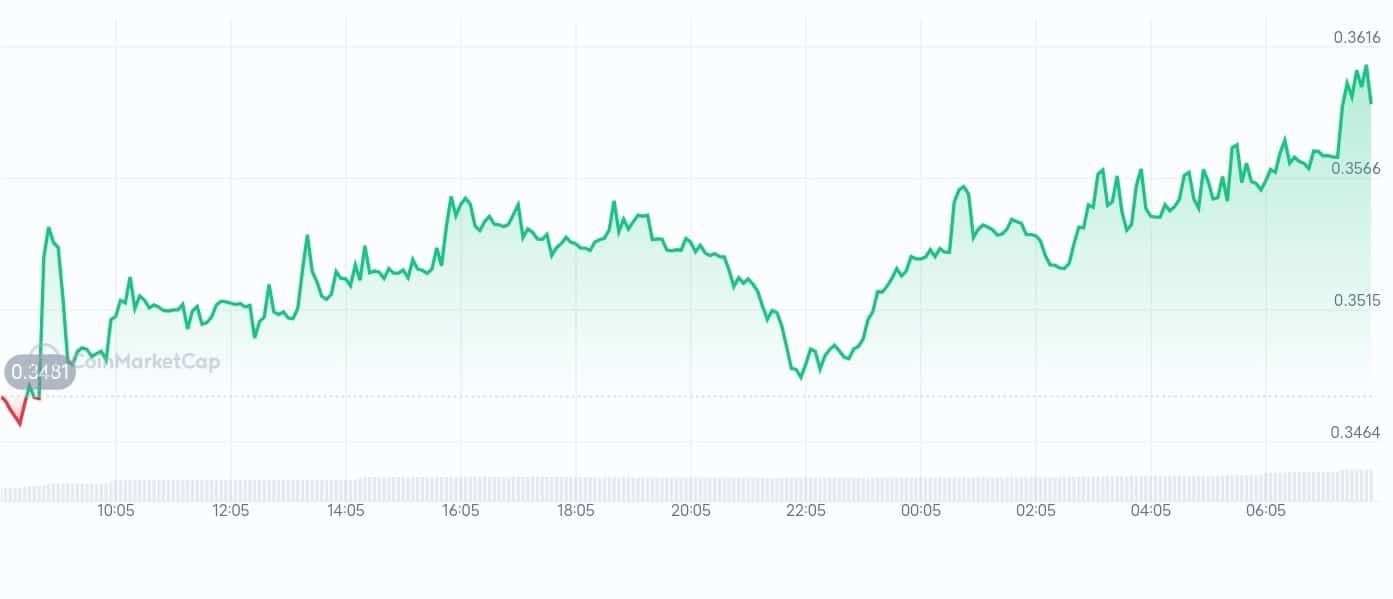

OriginTrail (TRAC) is trading near $0.395, trading above the 200-day simple moving average, with a price range between $0.386 and $0.412, showing signs of short-term pressure but still supported by interest in decentralised supply-chain data tools.

[NEW RELEASE – FINAL V8.1.0 RELEASE CANDIDATE] 🚀

The final DKG v8.1.0 node release has just landed on @origin_trail testnet!

It ties together all Random Sampling features, and presents the final Release Candidate before the upcoming V8.1.0 mainnet release, fully unlocking… pic.twitter.com/hF8RP1BkZe

— OriginTrail Developers (@OriginTrailDev) June 12, 2025

OriginTrail has released its DKG node’s final v8.1.0 Release Candidate on testnet, marking a key step before the mainnet launch. This version integrates all Random Sampling features and unlocks TRAC rewards for node delegators, alongside enhancements like auto-proofing, auto-claiming, and improved syncing of Knowledge Assets.

This release strengthens OriginTrail’s decentralised knowledge ecosystem by boosting efficiency and rewarding participation. For investors, it signals growing utility for TRAC and more mature infrastructure, both of which can build confidence and long-term value in the project.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage