Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price edged down a fraction of a percent in the last 24 hours but rose almost 1% in the last week to trade at $83,428 as of 09:59 p.m. EST on trading volume that plunged 68% to $14.5 billion.

The Bitcoin price navigated turmoil after US President Donald Trump’s “Liberation Day” tariffs announcement roiled global markets.

Amid the chaos and carnage, which wiped $2.5 trillion off the S&P 500 index on Friday, BTC is exhibiting early signs of decoupling from equities as investors seek shelter from the storm in safer assets.

#Bitcoin is still holding strong. We didn’t see a major drop over the weekend it’s just moving sideways in the same range.

The market is still uncertain. I was expecting a bigger drop when China retaliated but the fact that Bitcoin is holding strong around $83K despite… pic.twitter.com/Tx8M5H2BcM

— JEXY (@jexybtc) April 5, 2025

And it’s remaining resilient even as some commentators warn of a potential ”Black Monday” tomorrow, when stock markets reopen after the weekend break.

CNBC host and veteran market commentator Jim Cramer is among them, warning that the market could be on the verge of a crash reminiscent of 1987’s “Black Monday.”

NEW: Jim Cramer warns of a 1987 "Black Monday" style stock market crash on Monday, says he is about to be super mad.

"Black Monday" was a global stock market crash where the Dow Jones tanked almost 23% in a single day.

"If the president doesn't try to reach out and reward these… pic.twitter.com/aPwnFzdXBA

— Collin Rugg (@CollinRugg) April 5, 2025

Can the price of Bitcoin remain resilient?

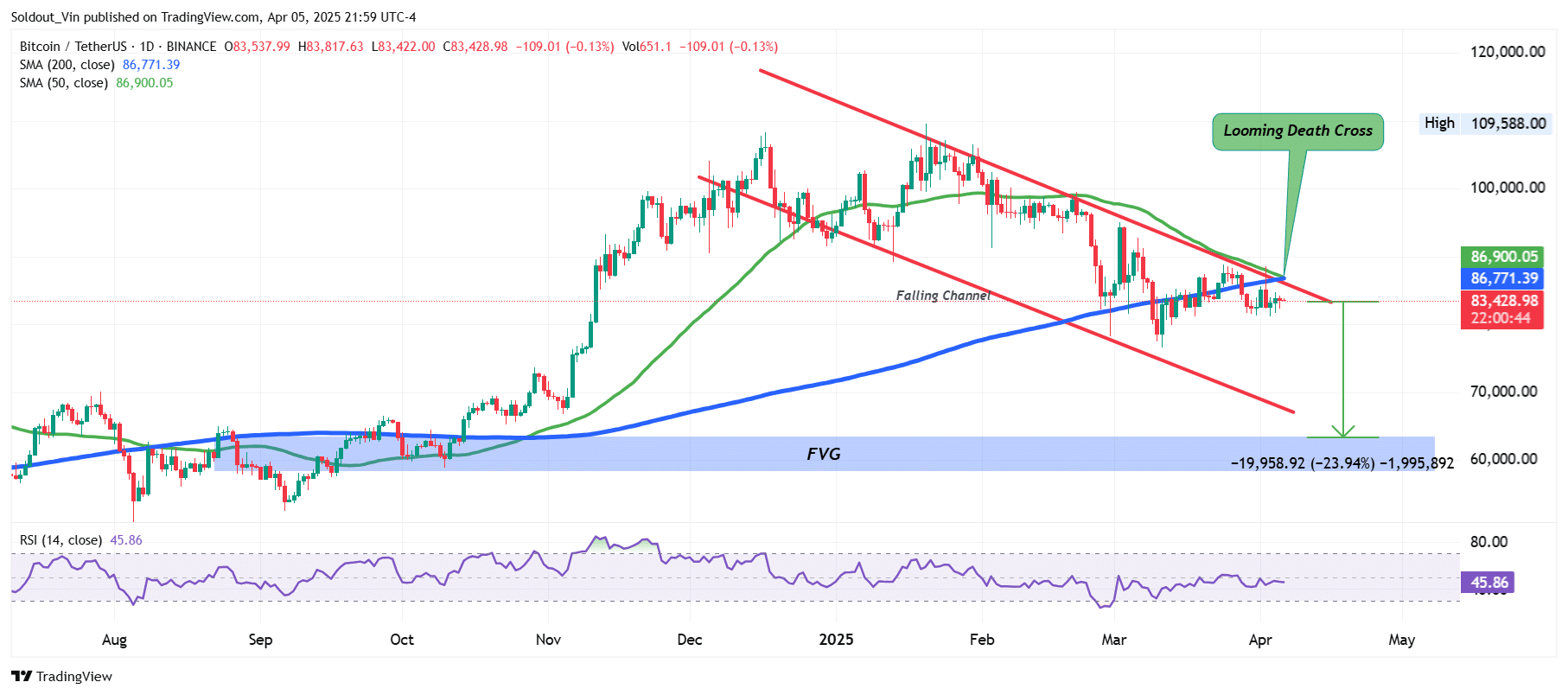

Bitcoin Price Analysis: Bearish Pattern Signals Trend Continuation

The BTC price is trading within a falling channel pattern, which had been dominating price action since mid-February. This pattern is typically a bullish reversal structure, suggesting that once the Bitcoin price breaks upward through the upper trendline, momentum could flip to the upside.

However, in this case, the breakout appears to be weak, as the Bitcoin price action quickly returned to hover just below the breakout point.

BTC is currently trading around $83,428, just below both the 50-day and 200-day Simple Moving Averages (SMAs), suggesting consolidation rather than a clear bullish continuation.

There’s also a visible bearish breakdown scenario, potentially targeting the Fair Value Gap (FVG) in the $60,000 to $65,000 zone, a key liquidity pocket and prior demand area.

A looming structural risk is highlighted by the “Looming Death Cross,” the anticipated bearish crossover of the 50-day SMA below the 200-day SMA.

The Relative Strength Index (RSI) is at 45.86, indicating neutral-to-slightly bearish momentum. It remains below the 50 threshold, which often signals that bears hold a slight edge.

BTC/USDT Chart Analysis (Tradingview)

BTC Price Bearish Patterns Signals 23% Crash

If the death cross confirms in the coming days, combined with continued rejection from the key SMAs, the price of BTC could face significant downward pressure.

The bearish projection on the chart suggests a move down to the FVG zone around $63,000, representing a potential drop of 23.94% from current levels.

On the flip side, if the Bitcoin price manages to reclaim and hold above both the 50-day and 200-day SMAs, the death cross might fail to materialize.

In such a bullish case, the BTC price could reattempt to test psychological levels around $90,000 to $95,000.

Meanwhile, investors are piling into a new Bitcoin-themed meme coin called BTC Bull Token (BTCBULL) that will give free Bitcoin to token holders.

99Bitcoins, a prominent YouTube channel with over 725k subscribers, says BTCBULL has the potential to soar 10X after launch.

BTC BULL Token Amasses Over $4.4M

BTC Bull Token is making headlines as the project rushes towards the $5 million mark in less than two months since it launched.

Every time the price of Bitcoin hits a new milestone, the BTC Bull project will reward holders with BTC airdrops.

The first target is $150k, followed by airdrops for every additional $50,000 increase in the price.

A huge BTCBULL Token airdrop also awaits the strongest hodlers when BTC hits $250,000, weighted by the participant’s Community Sale purchase amount.

🚨 $BTCBULL is Live in Upcoming Tokens! 🚨@BTCBULL_TOKEN is a Bitcoin rewards-based meme token that delivers milestone-based airdrops as Bitcoin hits new price levels.

With built-in incentives for buying, holding, and trading, $BTCBULL gives holders a new way to stack BTC.… pic.twitter.com/BMzBHcLltU

— Best Wallet (@BestWalletHQ) February 10, 2025

Also, each $25,000 upward move in Bitcoin’s price triggers a $BTCBULL token burn, starting at $125k. Fewer tokens in circulation means greater scarcity, putting upward pressure on the $BTCBULL price.

$BTCBULL holders also have an opportunity to earn passively through the project’s staking platform, which offers a massive 94% annual percentage yield (APY).

Investors interested in participating in the presale can visit the official BTC Bull website to buy BTCBULL tokens for $0.002445 each using BNB, ETH, USDT, or a bank card.

Buy before a price hike in less than 3 hours to secure the best deal.

Check out BTC BULL Token here.

Related Articles

- Trending Coins on GeckoTerminal

- What Does Polymarket Show About Where BTC Will Land In 2025?

- Trump Tariffs Hit Ethereum L2s, Too? Not Solana’s First L2 Solaxy

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage