Join Our Telegram channel to stay up to date on breaking news coverage

Searching for significant prospects beyond Ethereum and Bitcoin? With their genuine utility, devoted communities, and revolutionary technology, specific projects subtly create waves in the ever-evolving altcoin landscape. For investors looking to add purpose-driven cryptocurrency assets to diversify their holdings, Ravencoin, DigiByte, and Ronin are fantastic options.

What is causing these coins to gain popularity right now? What issues are they resolving that others are not? This article explains why each of these altcoins merits further investigation and, potentially, inclusion in your cryptocurrency plan.

5 Best Altcoins to Buy Now

Ravencoin focuses on asset tokenization, providing users with a simple method of generating and moving digital or physical assets on the blockchain. With more than ten years of solid track record, DigiByte delivers speed, security, and real decentralization. Meanwhile, Ronin was created for the upcoming Web3 gaming age as the foundation for some of the most popular blockchain games available today.

1. Ravencoin (RVN)

Ravencoin was introduced in 2018 as a Bitcoin fork to resolve the protocol’s shortcomings in asset issuance and transfer. Without the need for intermediaries, it allows users to design tokens that represent tangible assets such as stocks, commodities, and collectibles, guaranteeing safe and effective transactions. The platform uses the KAWPOW mining algorithm, which resists ASIC supremacy and permits mining with consumer-grade GPUs, thus fostering decentralization.

In contrast to many other blockchain platforms, Ravencoin is made especially to let users create tokens equivalent to actual assets. This ability has drawn numerous businesses to tokenize commodities, art, and real estate on its blockchain. Furthermore, Ravencoin’s use of the KAWPOW algorithm guarantees a more decentralized mining process by permitting mining with conventional GPUs, hence avoiding centralization by massive mining operations.

Global shipping deserves global trust

With $RVN, Ravencoin brings traceability, transparency, and tokenization to logistics

No lost data. No doubt. Just blockchain certainty@Maersk — ready to sail with Web3?#Ravencoin #Shipping #Logistics #BlockchainSupplyChain #Web3ForTrade pic.twitter.com/DiZypKIur9— RVN NL (@Sportfest2) May 18, 2025

While the low was $0.0118, the intraday high was $0.0127. This price fluctuation indicates a growing investor interest and a good short-term trend. However, RVN’s highest point was $0.29 on February 20, 2021, and its lowest was $0.0087 on March 13, 2020.

In recent years, decentralized finance (DeFi) protocols have been included in Ravencoin’s ecosystem, increasing its usefulness and marketability. Due to its decentralized structure and low fees, the platform has also experienced a rise in the production and exchange of non-fungible tokens (NFTs). In addition, Ravencoin is investigating Layer-2 scaling options to boost transaction volume and save costs, increasing its competitiveness for extensive use cases.

2. DigiByte (DGB)

DigiByte sets itself apart with technological advancements such as DigiShield, which modifies mining difficulty in real time to prevent hash rate swings, and MultiAlgo mining, which uses five cryptographic algorithms to improve security and decentralization. Additionally, DigiByte’s early implementation of Segregated Witness (SegWit) increased transaction scalability and efficiency.

DigiByte released Core v8.22.0 in January 2025, incorporating Taproot and Schnorr signatures to improve smart contract functionality and privacy. The update also introduced the Dandelion protocol, which enhances transaction privacy by hiding the origin of transactions; later updates fixed memory alignment problems and enhanced blockchain verification procedures.

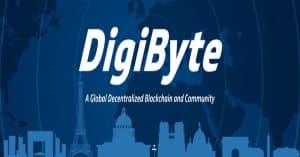

DGB’s market capitalization is approximately $155.66 million, and its 24-hour trading volume is $4.83 million. As of May 20, 2025, DGB is trading at about $0.0102, down 0.01992% from the previous close. The circulating supply is approximately 17.68 billion DGB, out of a maximum supply of 21 billion.

Notably, the partnership seeks to advance a decentralized internet by fusing DigiByte’s blockchain with ThreeFold’s peer-to-peer cloud computing infrastructure. Additional collaborations include integrations with V-ID for digital file validation, AntumID for safe digital identity verification, and UTRUST for processing bitcoin payments. These partnerships increase the practical uses and uptake of DigiByte.

3. Ronin (RON)

Sky Mavis, the developers of Axie Infinity, created the Layer 1 blockchain Ronin to solve Ethereum’s scalability and cost problems. Ronin, which was created especially for gaming applications, is perfect for high-volume operations like in-game microtransactions since it provides instantaneous transactions and low fees. Because of this expertise, developers can design smooth gaming experiences without being constrained by conventional blockchains.

It demonstrates its ability to manage extensive gaming ecosystems by integrating well-known titles like Axie Infinity. Ronin and Compound have teamed to increase the adoption of decentralized finance (DeFi) by providing $1 million in prizes in the form of COMP and RON tokens. Furthermore, Ronin moved its traditional bridge to Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to improve security and interoperability.

Welcome to Ronin, @Rocket_Pool!

Earn ETH staking yield on the chain forged for gaming ⚔️

Ethereum’s leading decentralized liquid staking protocol is bringing rETH to Katana and freshly-loaded rewards to the rETH <> ETH liquidity pool.

Get rETH now 👇

🔗 :… pic.twitter.com/9eFEbrs5nw

— Ronin (@Ronin_Network) May 20, 2025

The price of RON is currently around $0.7089, up 12.12% from the last close. The intraday low was $0.6275, and the intraday high was $0.7091. With a 24-hour trading volume of $37.54 million, RON’s market capitalization is around $430.79 million.

Strategic alliances have been essential to Ronin’s expansion. The platform’s ecosystem has grown through partnerships with game developers, and additional blockchain-based games have been added. These collaborations demonstrate Ronin’s dedication to emerging as a preeminent blockchain for gaming applications.

4. Pendle (PENDLE)

Pendle transforms yield management through tokenizing and trading future yield streams from yield-bearing assets. With this innovation, consumers can liberate funds attached to long-term yield-generating positions without giving up their main investments, addressing DeFi’s liquidity concerns. By separating the yield and primary components of assets, Pendle creates a secondary market for future yields, giving users additional investment and yield farming techniques and freedom.

It essentially creates a yield trading marketplace by tokenizing future yields. This strategy lets customers speculate on future yield variations or lock in rates to manage risk and reward better. Unlike other AMMs, Pendle’s time-decaying AMM model maximizes capital efficiency and guarantees detailed pricing of time-sensitive assets.

Aave 🤝 Pendle

More PT markets on the way soon – exactly what the yield chef (you) ordered pic.twitter.com/uylVl11Zx9

— Pendle (@pendle_fi) May 20, 2025

PENDLE exhibits robust market activity with $219.59 million in 24-hour trading volume and a market capitalization of over $711.80 million. Given that the price is currently 41% below its peak of $7.46 on April 11, 2024, a further increase may be possible.

Recently, Pendle expanded its liquidity and yield farming potential by partnering with Rings Protocol to debut on the Sonic Network. The wcgUSD stablecoin also gained additional yield methods through a partnership with Cygnus, who integrated it into Pendle’s YT Mode to trade and isolate yield streams from the underlying asset.

5. Solaxy (SOLX)

Solaxy has raised over $38 million since its December 2024 presale debut, attracting considerable attention. With the SOLX token now trading at about $0.001714, investors have the chance to get involved in a project well-positioned to handle Solana’s scalability issues.

We’re going interstellar! 🛸

38M Raised! 🔥 pic.twitter.com/udfUBJ0GBC

— SOLAXY (@SOLAXYTOKEN) May 20, 2025

One notable aspect of Solaxy is its staking scheme, which enables investors to lock up their tokens and earn significant profits. The community’s faith in the project’s long-term prospects is demonstrated by the approximately 6.5 billion SOLX tokens that have already been staked, with annual percentage yields (APY) reaching up to 1,653%.

Projects like SOLX, which provide concrete answers to current problems, are becoming increasingly popular as the cryptocurrency industry develops. For investors wishing to participate in the next stage of blockchain development, SOLX offers an alluring prospect with its creative approach to scalability, alluring staking incentives, and ambitions for cross-chain connectivity.

Learn More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage