Join Our Telegram channel to stay up to date on breaking news coverage

The global crypto market cap is $2.54 trillion, marking a 4.73% increase in the past 24 hours. Despite this rise, overall trading volume has dropped by 21.58%, totaling $145.09 billion. This decline follows growing uncertainty in global markets after former President Trump announced new tariffs on April 2, which took effect on April 5.

Still, some cryptocurrencies have remained stable or shown strength during this period. As prices dip, some investors are taking the opportunity to enter the market at lower levels. For those looking to explore new options, this may be a good moment to research promising altcoins. This article analyzes 5 best altcoins to buy now.

5 Best Altcoins to Buy Now

Chainlink is gaining traction in traditional finance following its recent integration with PayPal and Venmo. This move signals growing acceptance of blockchain technology in mainstream payment platforms. Solaxy has raised nearly $30 million in its ICO, drawing attention for its plans to launch a Layer-2 scaling solution.

Meanwhile, China has allowed the yuan (CNY) to weaken past a key level. This decision likely responds to trade pressure from the United States, particularly tariffs introduced during Donald Trump’s presidency.

1. Chainlink (LINK)

Chainlink (LINK) continues to expand its presence in mainstream finance with the recent integration of its token into PayPal and Venmo. This move allows U.S. users to use LINK for payments and staking, potentially increasing its visibility and everyday utility.

The token serves as the native payment and staking asset for the Chainlink Network, which is designed to support data sharing, computation, and cross-chain connectivity in blockchain systems. Its core function is to connect blockchains with real-world data through oracles, making smart contracts more practical and reliable.

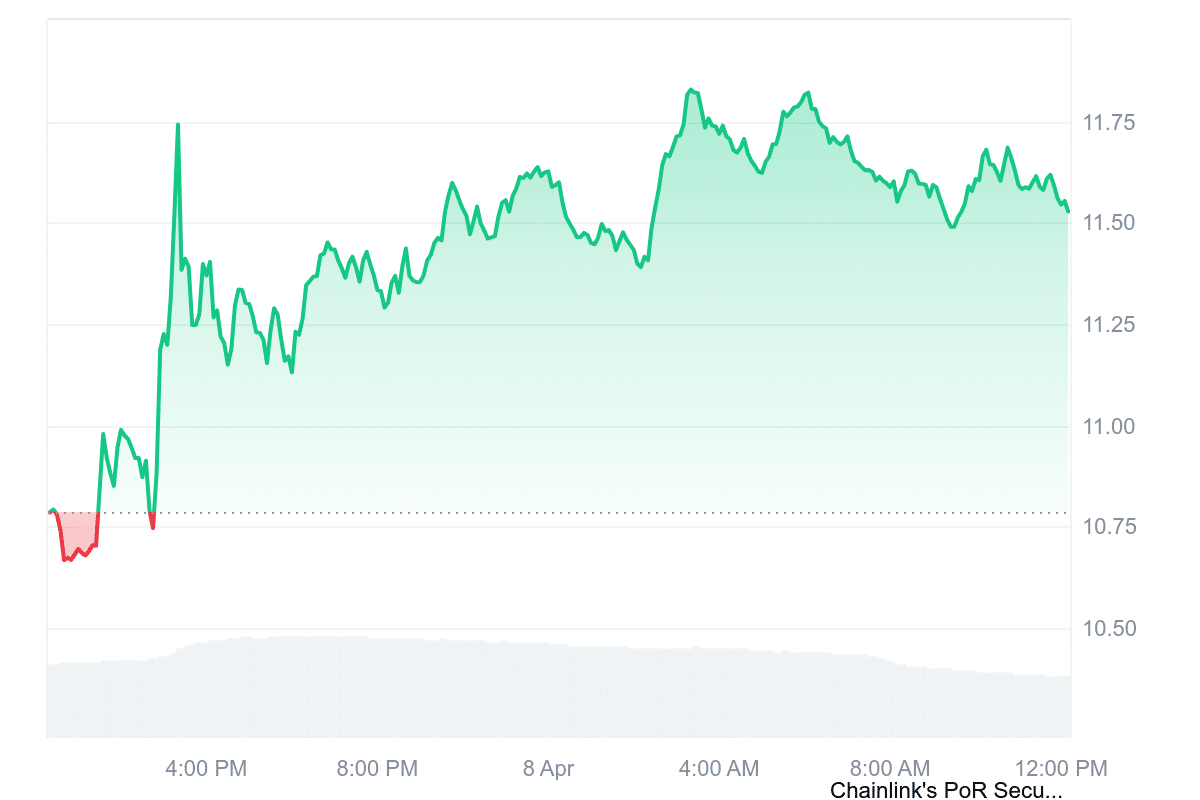

At the time of writing, LINK trades at $11.52, up 6.76% over the last 24 hours. During that period, it ranged from a low of $10.66 to a high of $11.84. It has shown positive momentum, recording gains on 16 out of the past 30 days.

We're excited to announce that $LINK is now available on @PayPal and @Venmo.

Now hundreds of millions of U.S. users across both platforms can access the Universal Gas Token—the native payment and staking token of the Chainlink Network.

Read more: https://t.co/MyaaM6wiXi pic.twitter.com/yxEAS8CBZn

— Chainlink (@chainlink) April 4, 2025

The token also maintains a high trading volume compared to its market cap, with a 24-hour volume-to-market cap ratio of 0.1750. This suggests strong liquidity, making it easier for users to buy or sell without impacting the price significantly.

Chainlink remains a key infrastructure provider in the blockchain space, with a growing role in connecting decentralized systems to real-world applications. Its continued integration into traditional platforms may help support long-term adoption.

2. Monero (XMR)

Monero (XMR) is a cryptocurrency focused on privacy, security, and decentralization. Since its launch, the project has implemented technical changes to strengthen these principles. It shifted to a new database system for improved performance and set mandatory privacy measures like minimum ring signature sizes.

The Monero network fully rewards miners, encouraging participation and maintaining network security. Transactions use advanced cryptography to reduce risk and protect user data. The privacy model is designed to shield users even under legal or political pressure. Monero seeks to make this level of privacy available to all users, regardless of technical knowledge.

Decentralization remains a key priority. The network uses a Proof of Work system that discourages specialized hardware, keeping mining accessible. Development happens openly through global collaboration, with public input encouraged on all major updates.

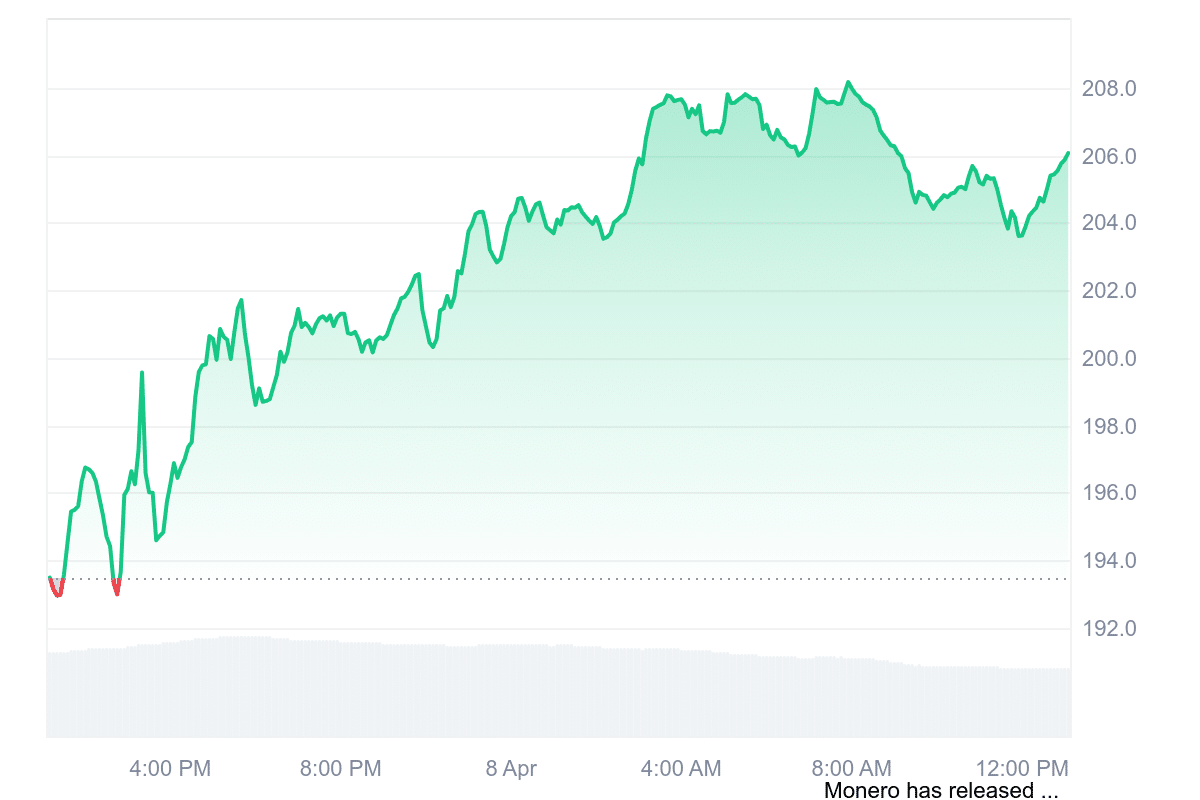

Furthermore, XMR trades at $206.70, up 6.41% in the past 24 hours. It shows strength by holding above recent lows and staying 18.77% above its 200-day simple moving average. The asset had 19 positive trading days in the last month, suggesting consistent market interest.

With a low annual inflation rate of 0.14% and a neutral RSI of 45.60, Monero may trade sideways in the short term. Its 24-hour volume-to-market cap ratio of 0.0325 suggests healthy liquidity for a project of its size.

3. Solaxy ($SOLX)

Solaxy is a blockchain project focused on improving the performance of the Solana network. With nearly $30 million raised during its presale, the project has attracted attention by promising a Layer-2 scaling solution tailored to Solana’s structure.

While Solana is known for its high speed and low fees, it has faced issues during periods of heavy use. Solaxy aims to solve this by using rollups. This reduces the strain on the core blockchain and improves efficiency during high traffic.

$SOLX Engines ON! 🚀

29M Raised! 🔥https://t.co/mdaTX9aVVx pic.twitter.com/iJevYa3Www

— SOLAXY (@SOLAXYTOKEN) April 3, 2025

The current presale price of SOLX, the project’s native token, is $0.001688. Investors are showing interest as the fundraising phase nears its target. Solaxy’s model allows for scalability without disrupting existing Solana operations, and its modular architecture supports developers in building specialized applications. These can range from finance to gaming, with each benefiting from customized scaling options.

Moreover, the project also incorporates staking. Users who hold SOLX can lock their tokens and earn rewards, with the annual percentage yield (APY) currently stated as 138%. This adds a financial incentive for early participation. According to the project’s token distribution, 25% of the total supply is set aside for early supporters as part of its reward system.

The project addresses a known limitation in the Solana ecosystem. By offering a tailored solution through Layer-2 technology, Solaxy positions itself as a technical enhancement rather than a competing chain.

4. Jito (JTO)

Jito Network plays a key role in the Solana ecosystem by offering a liquid staking option called JitoSOL and a range of MEV (Maximal Extractable Value) products. Liquid staking allows users to stake their SOL tokens while keeping them accessible in decentralized finance (DeFi) applications. In exchange for SOL, users receive JitoSOL, which continues to earn staking rewards.

The platform also includes a governance token, JTO, which allows holders to vote on decisions that influence the network’s direction. This setup encourages community involvement and aims to align the project’s growth with the needs of its users and the broader Solana network.

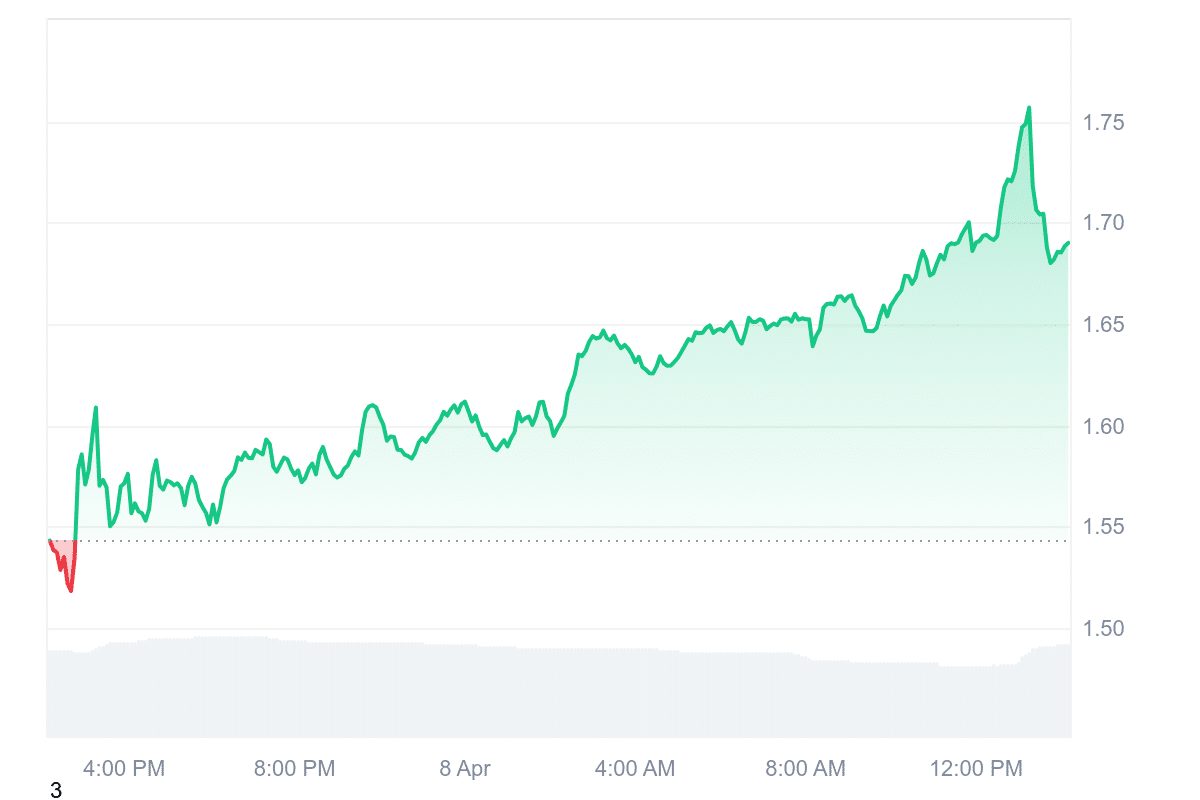

At the time of review, JTO is trading at $1.699 with a 24-hour trading volume of $109.84 million. The market cap stands at $533.81 million, giving it a market dominance of 0.02%. The token has seen a 10.7% price increase in the past 24 hours, suggesting active interest.

Liquidity appears strong relative to its market cap, as shown by a volume-to-market cap ratio of 0.2055. Its 30-day price volatility is currently low at 7%, which indicates relatively stable price movement over the past month.

5. Zcash (ZEC)

Zcash (ZEC) is a decentralized cryptocurrency focusing on privacy through advanced cryptographic methods. It uses a technology called zk-SNARKs, which stands for “zero-knowledge succinct non-interactive arguments of knowledge.” This allows transactions to be verified without revealing the sender, receiver, or amount involved, offering users more anonymity than most other cryptocurrencies.

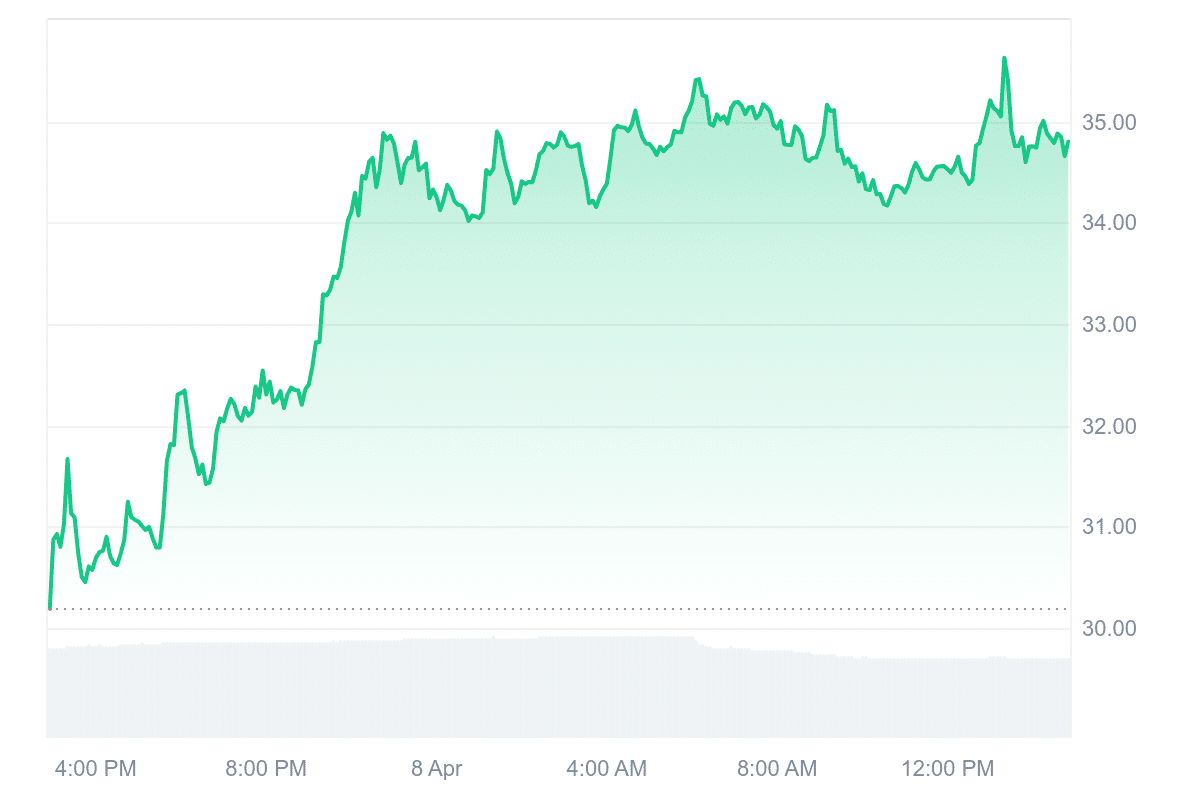

Currently, Zcash is priced at $35.28 and has a 24-hour trading volume of $166.15 million. Its market cap is $560.42 million, giving it a market dominance of 0.02%. Over the past year, ZEC has increased by 24% in value and outperformed 79% of the top 100 cryptocurrencies, including Bitcoin and Ethereum. This performance may reflect increased interest in privacy-focused digital assets.

The Relative Strength Index (RSI), which helps assess if an asset is overbought or oversold, is currently at 28.42. Zcash has also recorded 17 green days in the past month, indicating positive daily closes on more than half of the days tracked.

With a 30-day volatility rate of 9%, Zcash shows relatively low short-term price fluctuations. It also maintains a high liquidity ratio, with its 24-hour volume equal to nearly 30% of its market cap. Additionally, its yearly inflation rate is negative at 2.70%, which could influence supply over time. Current predictions suggest the price may rise to $42.17 in the next month.

Learn More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage