Join Our Telegram channel to stay up to date on breaking news coverage

The recent performances of these digital assets reflect not just market dynamics but also the growing adoption and trust in their respective platforms. As the DeFi industry develops further, tokens like COMP, DCR, LDO, and CAKE are leading the way, spurring innovation and providing a wide range of options for both novice and experienced investors.

Biggest Crypto Gainers Today- Top List

Compound has played a key role in transforming DeFi’s loan and borrowing market. Decred is distinguished by its distinct governance approach, which seamlessly combines Proof-of-Stake and Proof-of-Work processes. Lido DAO addresses the liquidity issues that come with staking in the cryptocurrency market. Furthermore, PancakeSwap offers yield farming opportunities and smooth token exchanges, enabling users to profit by supplying liquidity. Why should investors pay attention to these top crypto gainers today?

1. Compound (COMP)

Compound enables users to lend and borrow digital assets without the need for middlemen, completely changing how people use their cryptocurrencies. It provides a more effective and accessible substitute for the inefficiencies of conventional financial systems.

Launched in 2020, COMP enables users to earn interest on their cryptocurrencies by depositing them into liquidity pools. In return, they receive cTokens, which represent their stake and earn interest over time. Borrowers can also get loans by pledging collateral, with loan-to-value ratios varied depending on the asset.

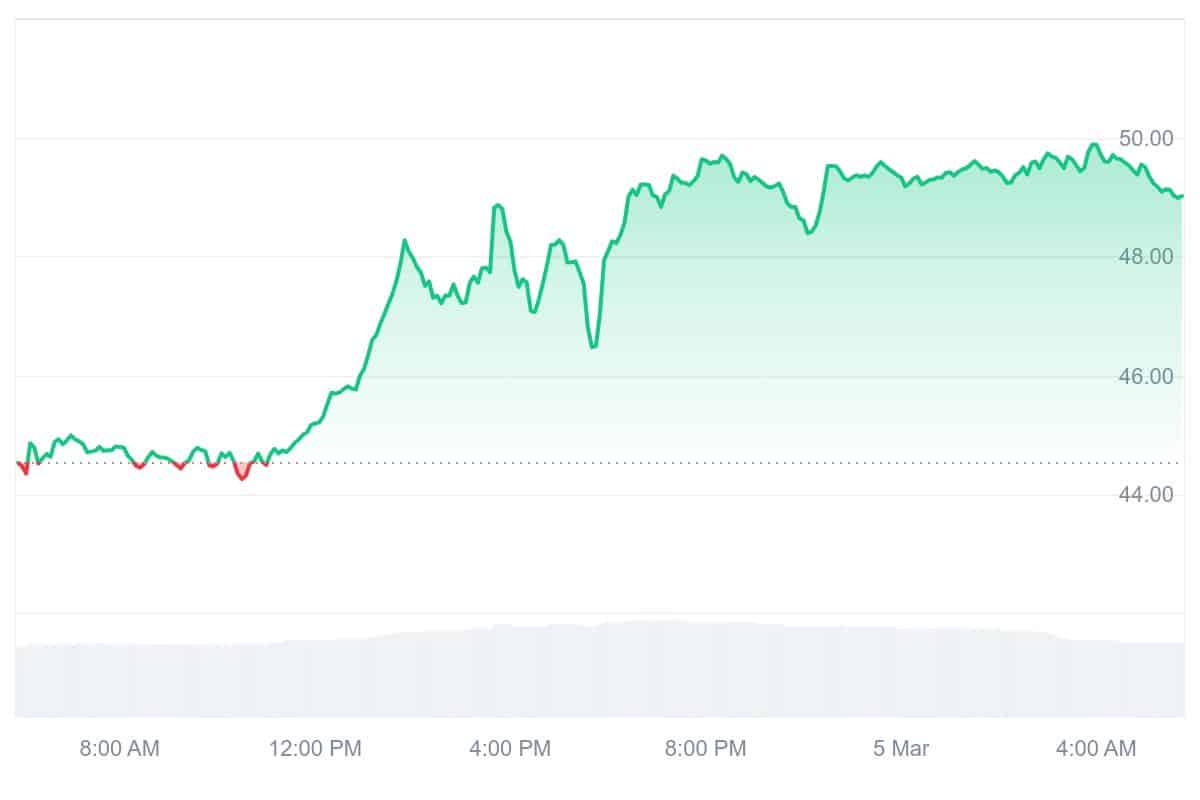

COMP is exhibiting long-term reliability as it trades at about $49.89 per token. It has increased by 0.13% over the last day, with intraday fluctuations ranging from a low of $43.96 to a high of $49.92. Its position as a major player in the DeFi industry is reflected in its current market capitalisation of over $440 million.

Collaborations with platforms like Coinbase and integration with various DeFi projects have expanded its reach and utility. These alliances underscore Compound’s commitment to interoperability and user accessibility as a top crypto gainer.

2. Decred (DCR)

In 2016, Decred was created to address the governance and funding issues that early digital currencies, such as Bitcoin, encountered by using a hybrid consensus process that combines both Proof-of-Work (PoW) and Proof-of-Stake (PoS).

Community members can vote on and submit different initiatives through the Politeia platform, guaranteeing democratic and transparent decision-making. DCR makes sure that stakeholders and miners have a say in its development, encouraging a more flexible and decentralised system.

On April 17, 2021, the coin hit a record high of $248.38. It has since corrected to its current price of $13.98, which reflects general market movements. The capacity of the cryptocurrency to maintain a sizable market presence in the face of volatility is an indicator of its resilience.

The Predatory Environment of Token Launches pic.twitter.com/ifmDvydfnR

— Decred (DCR) (@decredproject) February 27, 2025

DCR has recently made notable strides in enhancing its ecosystem and expanding its reach. One significant development is its listing on the KuCoin cryptocurrency exchange, which allows users to trade DCR with pairs like DCR/BTC and DCR/ETH. This move provides DCR with increased liquidity and accessibility, enabling a broader audience to engage with the cryptocurrency.

3. Solaxy (SOLX)

Developed on the Solana network, Solaxy is a groundbreaking Layer 2 blockchain. With more than $4.5 million raised so far in its presale phase, Solaxy has demonstrated that investors strongly believe in its ability to transform the cryptocurrency industry.

The primary goal of this project is to solve the Solana network’s scalability issues, especially when transaction volume is large. SOLX seeks to eliminate transaction failures, improve scalability, and ease congestion by processing transactions off the main Solana chain and combining them prior to final settlement. This strategy guarantees that users will continue to gain from Solana’s decentralisation and security while having a more effective transaction experience.

Investors looking to diversify their portfolios with innovative blockchain solutions should consider SOLX‘s presale. The project’s dedication to improving the Solana ecosystem and its quick fundraising success make it a bright prospect in the cryptocurrency market. By taking part in the presale, investors can maximise their potential earnings by gaining early access to SOLX tokens and reaping the benefits of its significant staking incentives.

4. Lido DAO (LDO)

Lido DAO allows users to stake Ethereum (ETH) and get stETH tokens in exchange through its liquid staking services. These stETH tokens represent the staked assets and can be utilised across various decentralised finance (DeFi) platforms, ensuring liquidity while still earning staking rewards.

With the platform’s v3.0 update, staking functions have been upgraded, providing increased user experience, efficiency, and security. This upgrade has contributed to increased transaction activity among major holders, signaling robust engagement within the ecosystem.

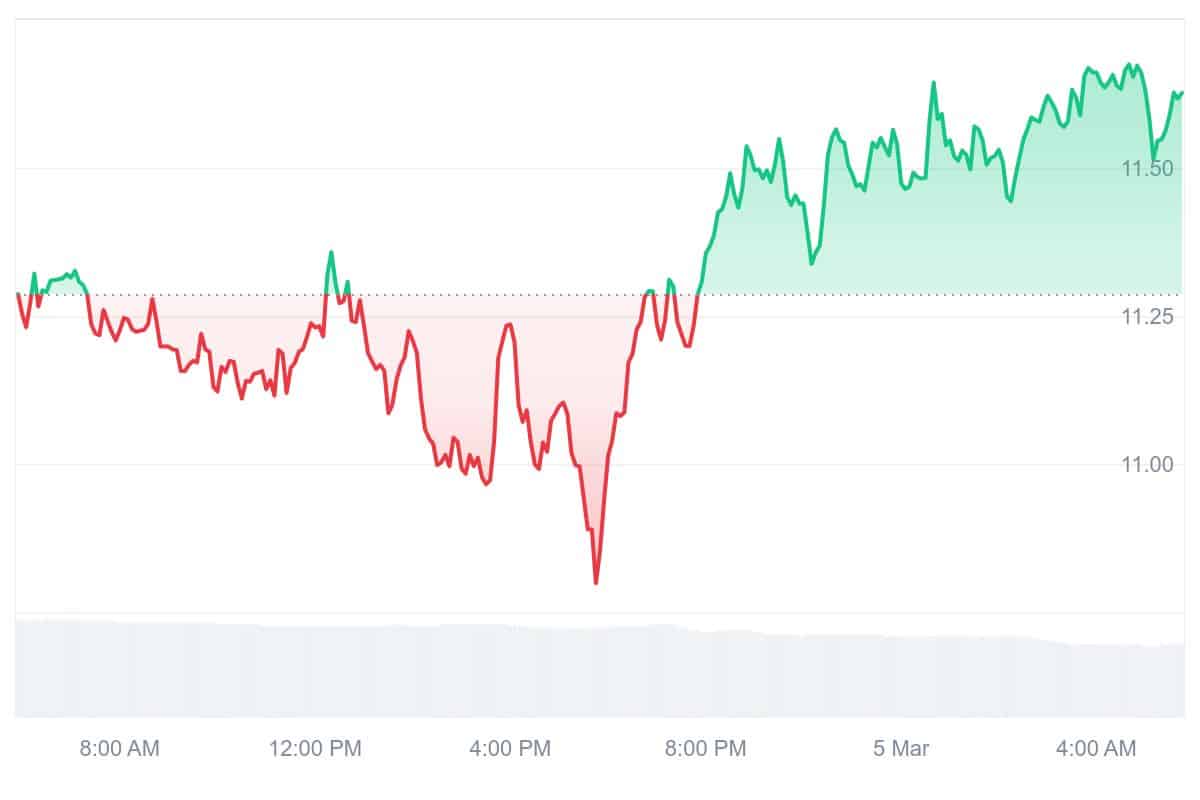

On November 16, 2021, LDO hit a record high of $18.62, and on June 18, 2022, it hit a record low of $0.406 as well. The current price of $1.26 shows renewed investor interest and flexibility in a turbulent market, marking a remarkable recovery from its lowest point. LDO’s protocol has a huge total value locked (TVL) of $23.13 billion, demonstrating the platform’s significant role in the DeFi ecosystem.

The upcoming Pectra hardfork requires adjustments to several core components of the Lido protocol to stay aligned with Ethereum’s evolving consensus rules.

These changes are essential to maintain operational stability during the upgrade.

— Lido (@LidoFinance) February 28, 2025

Nonetheless, Lido DAO has encountered legal issues as well. U.S. District Judge Vince Chhabria recently ruled that the decentralised collective and its venture capital supporters might be held accountable for selling securities that were not registered. This ruling emphasises the growing scrutiny DAOs are subject to and the necessity of well-defined regulatory frameworks in the cryptocurrency sector.

5. PancakeSwap (CAKE)

As an automated market maker (AMM), PancakeSwap was introduced in September 2020 to enable users to exchange cryptocurrencies without the necessity of a centralised middleman. This model facilitates liquidity provision through user-generated liquidity pools. Participants can also receive rewards in the form of CAKE tokens.

During a massive token burn in September 2024, the platform eliminated more than 9 million CAKE tokens, which is approximately $15 million. This action was taken in an attempt to lower the amount in circulation and probably raise the token’s value.

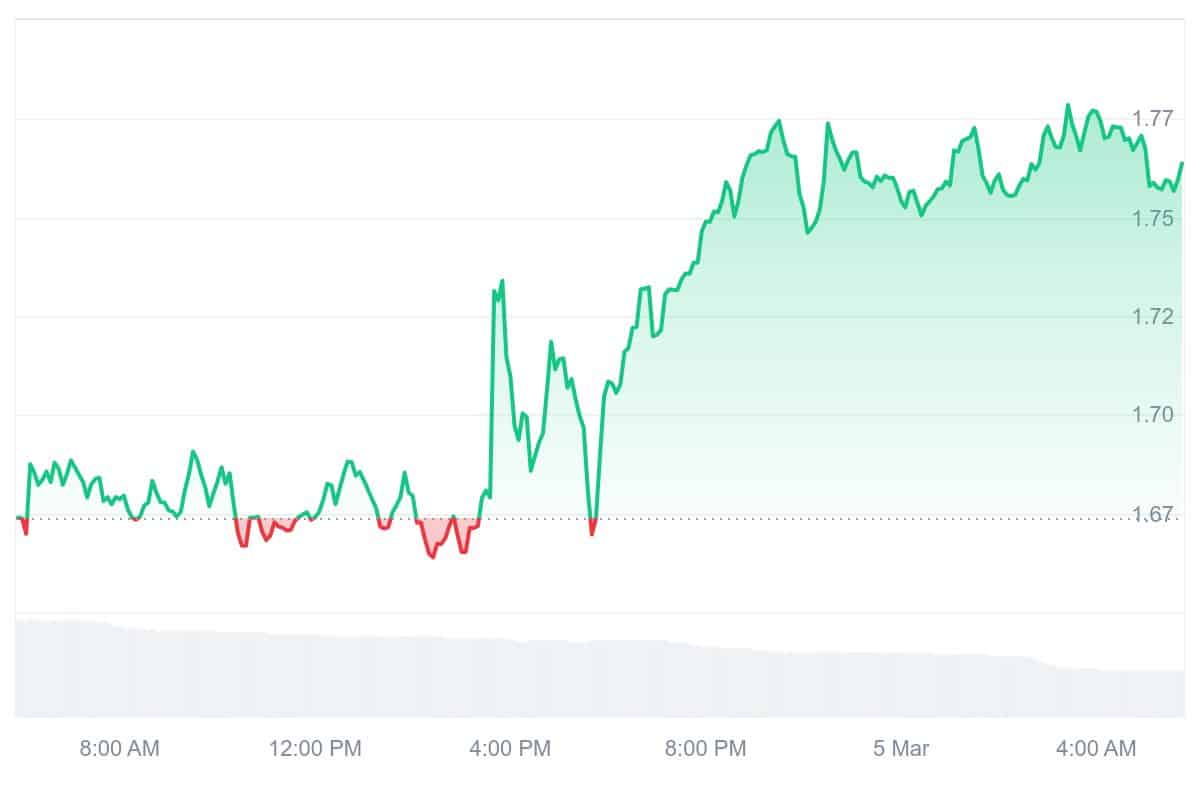

Due to heightened whale activity and fresh hope for BSC tokens, the token notably jumped by almost 58.75% in a single day, reaching $3.05. Recent assessments, however, point to possible bearish trends, with CAKE possibly breaking out from the $1.60 support region, which could lead to further declines.

🥞 1 Trillion in Trading Volumes & Counting!

✨ PancakeSwap officially crossed $1 trillion in trading volumes last month – a testament to our community’s trust & support. But this is just the beginning!

🎥 See what our @Headchef_pcs, has to say: 👇 pic.twitter.com/dxeLQS5DHX

— PancakeSwap (@PancakeSwap) March 5, 2025

The platform also announced its v4 update after reaching a milestone of over $836 billion in trading volume. This update addresses the current issues surrounding automated market maker (AMM) models by improving scalability, interoperability, and liquidity provision.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage