Join Our Telegram channel to stay up to date on breaking news coverage

Self-custody is one of the most prominent ways crypto holders can secure their funds by taking ownership of private keys into their own hands. This principle has recently been embraced by Tether, the largest stablecoin issuer, with its investment into the self-custody oriented Zengo Wallet.

With stablecoin adoption growing rapidly, this investment strengthens Zengo’s mission to provide secure, user-friendly access to stablecoins like USDT and aligns with the demand and use cases in today’s fast-changing crypto landscape.

Zengo Wallet’s Unmatched Security

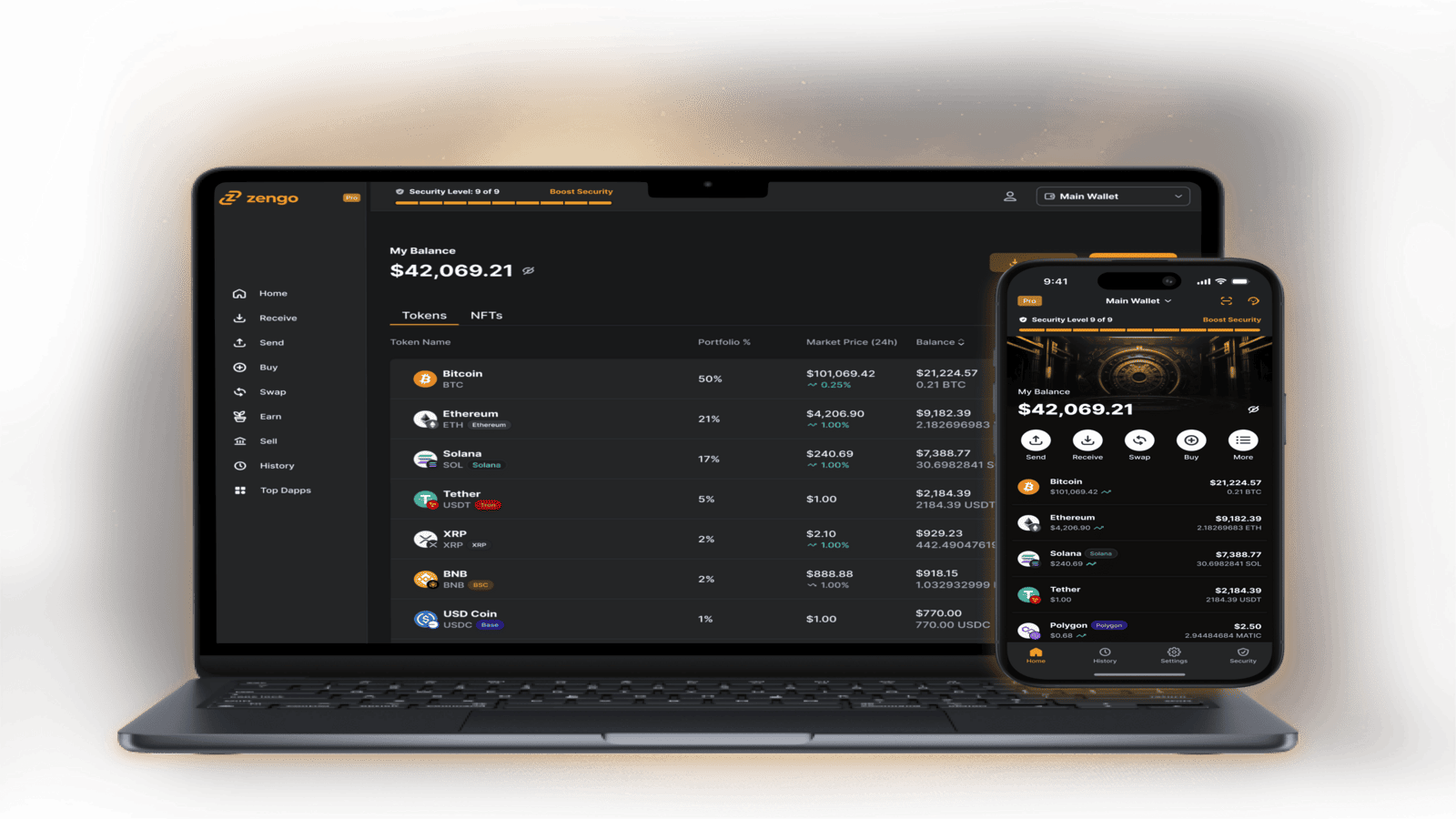

Taking a modern approach to self-custody, Zengo Wallet has positioned itself as a leading choice among secure crypto wallets. Its non-custodial app gives users complete control over their holdings, as it allows them to take ownership of the private keys associated with their assets.

To provide an additional level of security, the wallet employs next-generation Multi-Party Computation (MPC) technology to eliminate seed phrase vulnerability. Under this method of securing assets, the private key is split among multiple parties, which enhances security without compromising on accessibility and ease of use.

Powered by MPC technology and 3FA recovery, Zengo Wallet has proved a popular choice among users, serving 1.5 million worldwide. It has also kept an immaculate safety record, with no reported hacking or phishing incidents that would dissuade newcomers from picking up the app.

On top of security, Zengo Wallet supports multiple chains, enables users to buy, sell, and swap in just a few taps, and connects to dApps for easier access to crypto tools.

Tether’s Strategic Investment in Zengo

As an MPC wallet with no seed phrase vulnerability, Zengo’s approach to security and usability aligns with Tether’s goal of providing users around the world with secure and accessible financial tools.

“Tether is committed to delivering reliable and secure tools that empower users to take control of their digital assets. Our investment in Zengo reflects that commitment,” said Paolo Ardoino, CEO of Tether. “By supporting Zengo’s innovative approach to self-custody, we aim to help more people worldwide access blockchain technology with confidence, ease, and security. Together, we are shaping the future of how stablecoins are used and adopted.”

Zengo Pro’s Premium Features for Paid Users

The investment from Tether will support the development and growth of Zengo Pro, a premium offering that provides its users with unparalleled security and exclusive cost-saving benefits, such as discounted fees, free tax reports, and priority customer support.

In this paid subscription service, users get the usual no-seed phrase vulnerability, secure wallet recovery, and NFT spam filters, but also gain access to advanced self-custody tools such as multiple wallets, premium theft protection, and a Web3 firewall.

Notably, Zengo Pro customers can access their assets using their unique 3D FaceLock biometrics, get access to a private Bitcoin Vault with a TimeLock, and can leverage a Private Transact Mode to manage crypto assets with confidence.

In addition to it all, the premium service enables a secure hereditary transfer of digital assets to future generations. These features make Zengo Pro a potent solution for power users, but also fit institutions looking for enhanced asset control.

Simplifying USDT Access Across Chains

Unlike volatile cryptocurrencies, stablecoins maintain a consistent value by being pegged to major fiat currencies like the US dollar. When it comes to the leading USD stablecoin, USDT, it allows global access to a stable currency even where direct access to USD itself may be difficult. Since it exists on numerous blockchains, investors with network preferences or geodistributions can access the token easily.

The Zengo Wallet provides multi-chain support for USDT, all through a single interface, allowing anyone to send, receive, and manage their USDT across these various networks. This interoperability lowers the barrier to entry for non-crypto-natives, especially less technical users, enhancing convenience and improving user experience.

This flexible blockchain-agnostic design was built to help integrate assets from various ecosystems, allowing users to explore the broader crypto ecosystem freely and access diverse opportunities, while staying protected from centralized failures, data breaches, and hacks.

Enabling Smooth Cross-Border Movement

By offering multi-chain USDT support, Zengo is empowering not just traders and investors but also individuals who use stablecoins for everyday payments, remittances, or DeFi participation.

In the realm of cross-border money movement, stablecoins have emerged as an efficient alternative that offers faster transactions and lower fees. Even banks and financial institutions are turning to stablecoins to simplify and optimize cross-border transactions.

The stablecoin space is dominated by Tether’s USDT, capturing a market share of over 61%. This makes USDT the largest stablecoin, boasting a market cap of $151.23 billion spread across Tron, Ethereum, Solana, and others. It also records the most volume on a daily basis and has a global user base of over 400 million, which is now being further expanded through Zengo’s non-custodial offer.

Signaling a New Era of Institutional Self-Custody

The Tether-Zengo partnership comes at a time when USDT is being subjected to increasing regulatory pressure in the EU. This has led many centralized exchanges (CEXs) to delist the stablecoin to comply with the Markets in Crypto-Assets (MiCA) framework.

At a time like this, Tether’s investment in Zengo marks a major move as, unlike CEXs, these self-custodial wallets fall under completely different legal frameworks, making them much more difficult to regulate on any one country’s whim. Users of Zengo’s non-custodial wallet are essentially their own bank, and can operate with their USDT freely and with complete confidence.

The alignment with MiCA and global regulatory clarity signal a broader trend toward institutional-friendly wallets, which comes amidst the growing institutionalization of the crypto sector.

Final Thoughts

As crypto captures a new wave of relevance and stablecoins cement their importance within the ecosystem, Zengo Wallet gives users the best means to operate with their assets safely and with long-term confidence. Its secure self-custody approach eliminates vulnerabilities and ensures an unprecedented freedom of holding and trading assets for years to come.

Tether’s key strategic investment in Zengo marks a new page for both stablecoins and the non-custodial wallet, with the world’s largest stablecoin provider signaling increased confidence in self-custody solutions provided through wallets like Zengo Wallet. If you’re curious about managing digital money with stronger security and more independence, look no further than Zengo Wallet.

FAQs

Is Zengo Wallet safe?

Can I store USDT on Zengo?

What makes Zengo different from MetaMask or Ledger?

Should I get Zengo Pro?

Join Our Telegram channel to stay up to date on breaking news coverage