Join Our Telegram channel to stay up to date on breaking news coverage

Kraken has officially launched Embed, a new Crypto-as-a-Service (CaaS) solution designed to help financial institutions offer secure and regulated crypto trading within their platforms. Announced on April 30, 2025, Kraken Embed allows banks, neobanks, and FinTechs to integrate crypto investing with minimal technical effort, providing users with direct access to Kraken’s crypto infrastructure via a seamless API.

With this move, Kraken enters the CaaS arena with a sharp focus on regulatory compliance, liquidity, and ease of implementation. The first partner to go live with the Embed solution is Dutch neobank bunq, which now allows its users to invest in over 300 cryptocurrencies directly through its app. The launch makes Kraken Embed a scalable, ready-to-deploy gateway for institutions looking to enter the crypto market without rebuilding backend systems or exposing themselves to compliance risks.

Understanding Kraken’s Embed

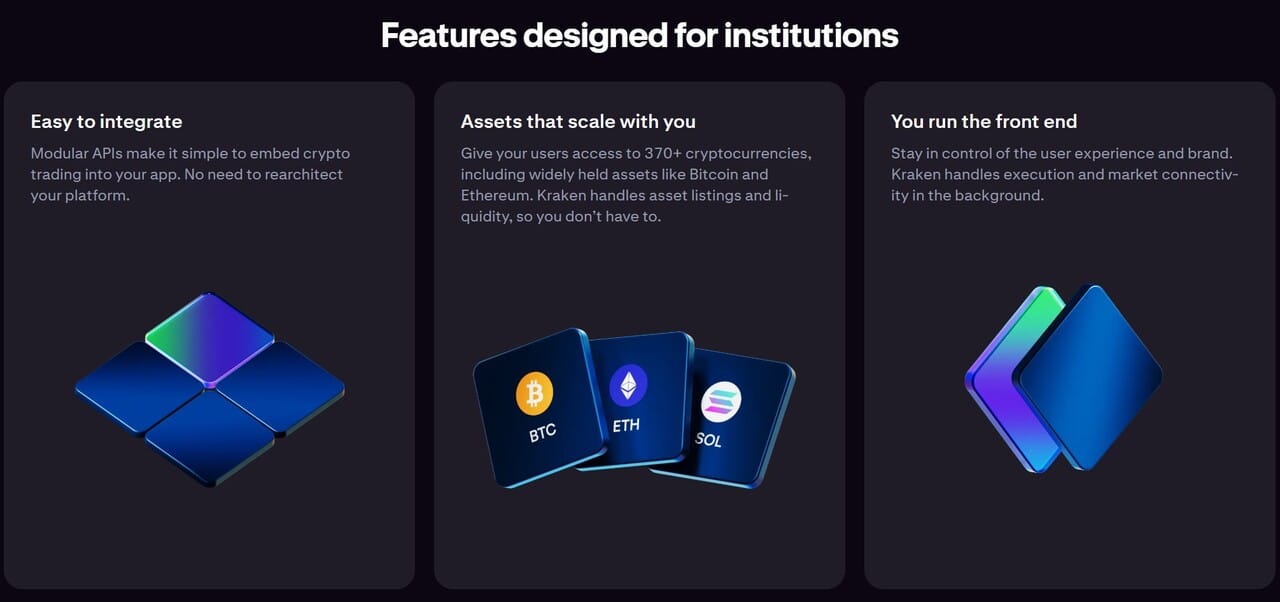

Kraken Embed is a plug-and-play solution that lets financial institutions integrate crypto services into their platforms without taking custody or managing trading infrastructure. It offers a full-stack API integration, giving partners access to Kraken’s liquidity, pricing engine, and regulatory licenses.

The Embed CaaS solution supports rapid deployment, with most integrations going live in weeks, not months. Banks or FinTechs don’t need to handle wallets, private keys, or trading operations. Everything is powered by Kraken’s institutional offering, which already supports billions in crypto trading volume. Kraken Embed is built to be compliant across multiple jurisdictions, aligning with the latest regulatory guidance in Europe and beyond.

bunq Becomes the First Bank to Integrate Kraken Embed

Kraken’s first Embed partner is bunq, one of Europe’s fastest-growing digital banks. Known for its commitment to innovation and user empowerment, bunq has integrated Kraken Embed to bring crypto investing directly into its app, making it one of the few neobanks to offer crypto in a regulated, seamless way.

According to bunq’s April 30 press release, users can now diversify their savings by investing in more than 300 digital assets without leaving the bunq app, which aligns with the platform’s mission of enabling financial freedom.

This partnership shows Kraken’s strength in Europe as the platform fully complies with the EU’s Markets in Crypto Assets (MiCA) regulation.

How Kraken Embed Solves Crypto Challenges for Banks and FinTechs

Kraken Embed stands out as a strategic solution for banks and FinTechs seeking to offer crypto services without building infrastructure from scratch or taking on regulatory risk. By bundling compliance, liquidity, and trading technology into a single API-based service, Embed addresses long-standing barriers that have kept traditional institutions on the sidelines.

Streamlined Setup

Kraken Embed removes the technical complexity of launching crypto services. There’s no need to build out wallets, custody services, or order books. Institutions connect via API, and Kraken handles the rest, from trade execution to compliance checks.

Embed Delivers Ready-to-Use Regulated Crypto Infrastructure

One of the biggest hurdles for banks and FinTechs entering crypto is regulation. Embed solves that by offering access to trading under Kraken’s licenses. This compliance-first model is especially attractive in Europe, where MiCA now sets clear expectations for crypto offerings.

Institutional-Grade Liquidity Backed by Kraken’s Trading Engine

Institutions using Embed tap directly into Kraken’s liquidity pools, order matching engine, and 24/7 trading infrastructure. This ensures tight spreads, deep markets, and high reliability, features banks cannot replicate in-house without substantial cost.

Kraken Embed Aligns With MiCA and the Future of Crypto Policy

The timing of Embed’s launch aligns with a shift in how regulators approach crypto. In Europe, MiCA has established a clear set of rules for digital asset providers, making it easier for licensed firms like Kraken to offer services to institutions. This regulatory clarity prompts traditional finance to move forward with crypto offerings, provided they can partner with compliant providers.

Outside the EU, jurisdictions like the UK, Hong Kong, and parts of the U.S. are also refining their crypto policies. As regulatory pressure increases, the demand for trusted infrastructure will grow, and Embed is positioned to meet it.

Crypto Adoption Grows Among Banks and FinTechs

Financial institutions are increasingly opening their doors to crypto. ING has explored crypto custody, U.S. Bank already offers institutional Bitcoin custody, and projects like Lynq Network are rethinking how digital assets can move within capital markets. Embed fits into this trend by offering a shortcut: it eliminates the multi-year buildout process and offers a turnkey solution backed by a global exchange.

According to PYMNTS and other industry reports, consumer demand for crypto access through trusted banks is rising. Kraken Embed allows institutions to meet that demand without adding operational strain or legal exposure.

Kraken Comments on the Launch of Embed

“Through Embed, Kraken is extending its deep expertise to institutions seeking a reliable, compliant and frictionless entrypoint into crypto,” said Brett McLain, Kraken’s Chief Product Officer.

His statement captures Kraken’s goal: to make crypto accessible through regulated partners while maintaining the exchange’s longstanding focus on security, performance, and transparency.

Kraken Embed Signals a New Phase for Institutional Crypto

With the launch of Embed, Kraken has cemented its role not only as a top-tier exchange but as an infrastructure provider to the broader financial ecosystem. The solution combines regulatory clarity, plug-and-play integration, and deep liquidity, all crucial for any institution entering crypto. As demand for crypto access among end-users grows, Kraken Embed could become the go-to infrastructure layer for banks and FinTechs looking to meet it.

Whether you’re a neobank, a traditional bank, or a FinTech platform, the message is clear: there’s now a faster, safer way to offer crypto to your users without starting from scratch.

FAQs

What is Kraken Embed and how does it work?

Why is Kraken Embed significant for financial institutions?

Which institutions are already using Kraken Embed?

References

Join Our Telegram channel to stay up to date on breaking news coverage