Join Our Telegram channel to stay up to date on breaking news coverage

XRP has experienced a significant decline of around 11% over the past day, hitting a low of $0.511 early on October 3. This downturn is primarily driven by a broader slump in the cryptocurrency market and is exacerbated by the ongoing lawsuit from the U.S. Securities and Exchange Commission (SEC) against Ripple, which continues to pressure XRP’s price.

XRP Key Statistics

- Current Price: $0.52

- Market Cap: $29.66 billion

- Trading Volume (24h): $3.29 billion

- Circulating Supply: 56.56 billion XRP

- Total Supply: 99.99 billion XRP

- CoinMarketCap Ranking: #7

Recent developments highlight the weight of the legal battle on Ripple’s native token. Just yesterday, XRP was trading above $0.60 but now struggles around $0.52. This sharp drop followed the SEC’s appeal of a prior court ruling, which stated that secondary XRP sales do not qualify as securities transactions. Despite the current grim outlook, historical trends indicate that this dip could be a precursor to a strong rally, similar to the rebound seen after the SEC’s initial lawsuit in December 2020.

XRP/USD Market Analysis

Key Levels

Resistance: $0.54, $0.60, $0.65

Support: $0.50, $0.48, $0.38

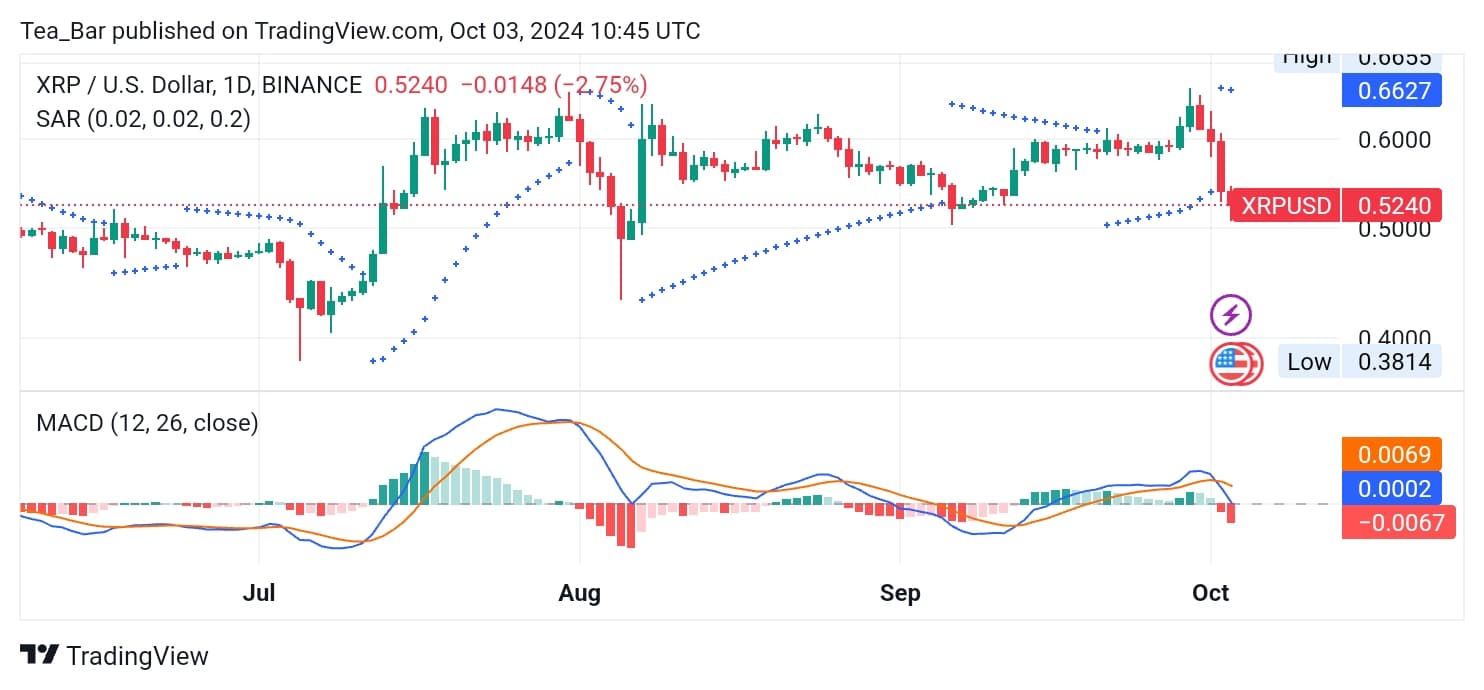

On the XRP/USD chart, the Parabolic SAR indicator has shifted above the price candles, indicating a bearish trend for XRP. This indicates strong selling pressure, and until the dots flip below the price action, XRP may continue to face downward momentum.

The MACD (Moving Average Convergence Divergence) supports the ongoing downtrend, with the MACD line crossing below the signal line, suggesting increasing bearish momentum. The histogram has begun to print red bars, indicating that sellers currently dominate the market in the short term.

Can XRP Bounce Back Amid the SEC Lawsuit Appeal?

Recent price actions underscore XRP’s sensitivity to developments in its legal battle with the SEC. Historically, significant price rallies often follow intense downward pressure, especially tied to major legal news. Investors may wait to see the outcome of the court appeal before making major moves, as a favorable ruling could trigger a sharp rally.

IT IS NOT OVER FOR XRP

If XRP can maintain above $0.50, a rebound could drive the price back toward the $0.54 resistance level. A breakout above $0.60 would be essential to regain bullish momentum, targeting $0.65. Conversely, if XRP drops below $0.50, it could retest the $0.48 support, with further declines potentially extending down to $0.38 if selling pressure persists.

Despite current bearish sentiment, XRP’s strong community and role in cross-border payments remain long-term value drivers. While short-term conditions may be unfavorable, the token’s future outlook could improve if the market stabilizes.

XRP/BTC Performance Insight

XRP/BTC is trading at 0.00000860 BTC, reflecting a 3.15% decline in the past 24 hours. This pair shows signs of weakness, testing support at 0.00000800 BTC. The Parabolic SAR indicates further downside risk, with the MACD displaying bearish momentum. Immediate resistance lies at 0.00001020 BTC; overcoming this level is necessary for the pair to regain bullish momentum. A break below 0.00000800 BTC could lead to further declines toward 0.00000690 BTC.

Shortly before the SEC’s appeal, an important announcement surfaced regarding Ripple and XRP. Bitwise, a prominent crypto firm with active ETFs for BTC and ETH, revealed it had filed in Delaware to launch a product tracking XRP’s performance. Analysts view this as a bullish signal for the seventh-largest cryptocurrency.

@CrediBull_Crypto, an influencer with 423,000 followers on X, suggested that the XRP ETF could be the next approved in the U.S. While this may be unlikely in the near term due to the SEC’s role in ETF approvals, a favorable outcome could trigger a significant rally for XRP.

Yes, I'm aware of the SEC appeal on the @Ripple case, but at the same time in the last 12 hours (seemingly unbeknownst to a lot of crypto twitter) @BitwiseInvest just filed for an $XRP ETF.

XRP will be the next approved ETF after $BTC and $ETH imo.

As far as narratives go, I… https://t.co/CBwx6IT9nc

— CrediBULL Crypto (@CredibleCrypto) October 2, 2024

Alternatives to XRP

XRP has consistently demonstrated its value in cross-border payments, leveraging its robust community and innovative technology. However, the evolving landscape has birthed exciting projects, with Pepe Unchained emerging as a notable contender. This groundbreaking meme project merges the iconic Pepe the Frog brand with Layer-2 technology.

Pepe Unchained has attracted significant investors’ attention, with its presale surpassing $17.1 million. By combining meme appeal with practical utility, it has carved a niche in the cryptocurrency ecosystem. The project’s Layer-2 network, tailored for Ethereum, facilitates ultra-fast transactions and minimal fees, creating a hub for meme coin traders.

PEPE UNCHAINED – THE NEXT BIG THING IN CRYPTO

Additionally, Pepe Unchained’s staking application boasts estimated APYs of 130%, enhancing investors’ confidence. With over 1.1 billion PEPU already locked in staking, its long-term growth potential looks promising. Its rapid online growth and community of over 26,200 Twitter followers highlight its rising prominence, positioning Pepe Unchained as a noteworthy player in the cryptocurrency space.

Related News

Most Searched Crypto Launch - Pepe Unchained

- Exchange Listings December 10

- ICO Sold Out Early

- Featured in Cointelegraph

- Layer 2 Meme Coin Ecosystem

- SolidProof & Coinsult Audited

Join Our Telegram channel to stay up to date on breaking news coverage