Join Our Telegram channel to stay up to date on breaking news coverage

XRP’s value has soared by 7.4% within the past 24 hours, outpacing the moderate uptick in the broader cryptocurrency market. The surge came amidst a pivotal moment in the ongoing legal skirmish between the fintech company Ripple and the U.S. Securities and Exchange Commission (SEC). The widely anticipated Hinman documents, considered vital to the case’s progression, were finally disclosed.

The price rise indicates investors’ optimistic sentiments towards a favorable outcome for Ripple Labs in the ongoing lawsuit against the SEC.

Remarkably, XRP’s rally occurred despite the Hinman documents not addressing the token directly. Instead, the focus was on clarifying the definition of security, with Bitcoin and Ether being referenced as examples.

Decoding the Hinman Documents

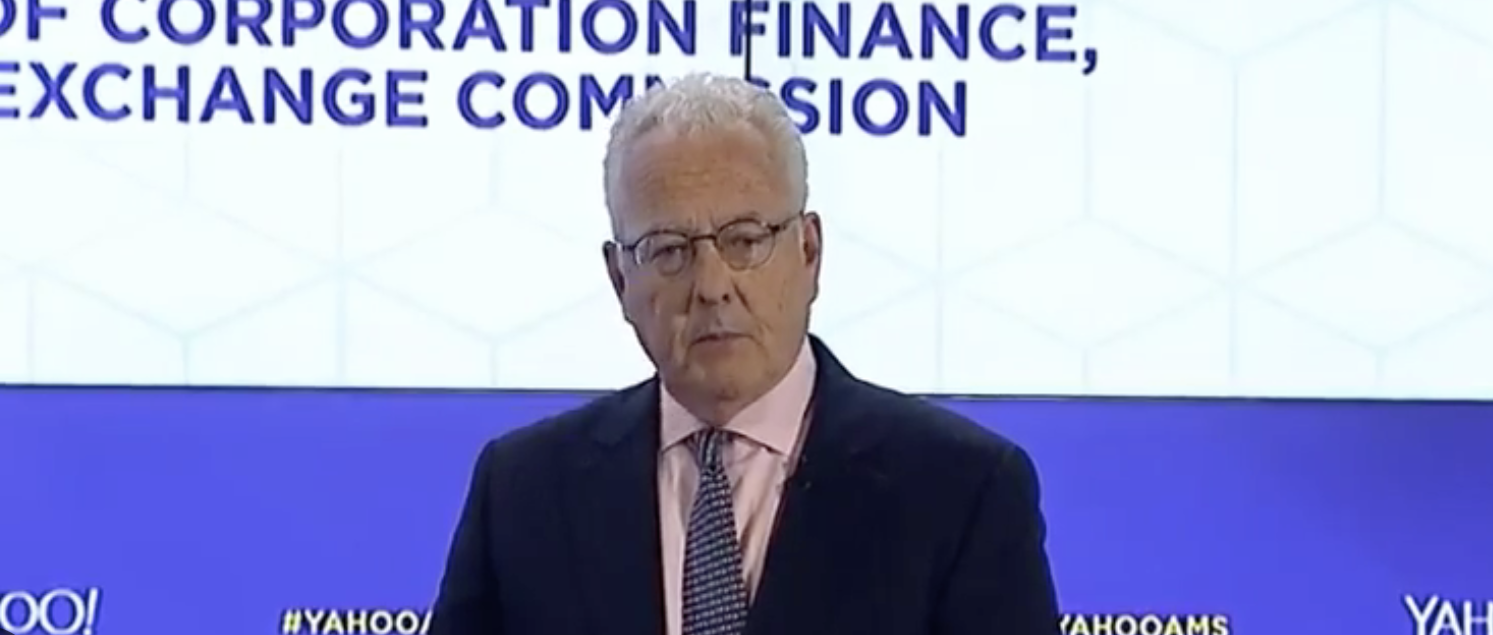

William Hinman held the post of the Director at the SEC’s Division of Corporation Finance from 2017 to 2020. The documents in question pertain to internal SEC discussions related to a 2018 speech delivered by Hinman, where he stated his view that neither Ether (ETH) nor Bitcoin (BTC) fell under the category of securities.

The correspondence reveals SEC officials deliberating whether the speech distinctly declared Ether (ETH) as non-security. Both the emails and a reworked summary judgment motion were publicly released.

An email from Hinman reads, “There is no need to regulate Ether, in its present state, as a security.”

In a correspondence from June 12, 2018, former SEC Director Brett Redfearn suggests, “If a firm declaration is desired that ETH is not a security, the language should be definitive (i.e., make an unambiguous statement). Otherwise, consider a language similar to Bitcoin’s disclosure regimen for consistency.”

Ripple-SEC Legal Tussle: A Snapshot

The SEC accused Ripple of promoting unregistered securities in a 2020 lawsuit. Ripple counterargued that XRP does not qualify as a security or an investment contract under U.S. federal law and that the SEC has been unsuccessful in supporting its claim.

Ripple used Hinman’s statement in their defense, aiming to demonstrate that the SEC does not classify Bitcoin or Ethereum as securities and thus XRP should receive the same classification.

Looking ahead, Ripple was able to secure the contentious documents under the Freedom of Information Act, shedding light on Hinman’s rationale. Despite SEC’s resistance, labeling the documents as irrelevant and Hinman’s views as personal, Judge Analisa Torres overruled the SEC’s motion last month, stating the public should have access to these documents.

The verdict of this case can significantly impact XRP’s price movements, despite Ripple’s attempt to maintain a clear distinction between the XRP Ledger network and the XRP coin.

Wish I could go in depth now, but we’ve waited this long (18+ months), I don’t want to overstep… suffice it to say @s_alderoty and I believe they were well worth the wait.

— Brad Garlinghouse (@bgarlinghouse) June 12, 2023

Exploring Other Cryptocurrency Options

In light of the current market’s volatility, even though there’s a temporary surge, it might be worth considering other investments such as pre-sales cryptocurrencies like Wall Street Memes.

Related Articles

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage