Join Our Telegram channel to stay up to date on breaking news coverage

The coronavirus has become the catalyst for profound changes in the way many of us work; it also a catalyst for the share prices of tech stocks that could benefit from this red-hot investment theme.

Before we get too carried away, let’s remember that working from home (WFH) is not possible for everyone – especially most essential services.

Indeed, we may have just discovered whose job is really essential and whose isn’t – we need health workers, supermarket staff and electricity grid workers more than we need, say, derivatives traders.

But for those who can work from home it means discovering new tools to get the job done and working in different ways.

Some of those tools we were already familiar with but maybe never felt the need to get too involved with them, or we just didn’t want another app in our life, and yet more notifications. That’s all changing, fast.

Remote working takes off – and the cyber attacks

At the heart of a WFH set-up is the ability to remotely an organisations server, belonging to either a corporate of public sector entity.

Tied to that are the tools we use to collaborate with team members.

When you fire-up Slack or Microsoft (MSFT) Teams or Trello, Cisco (CSCO) Webex, Microsft’s Skype or Zoom (ZM), it involves those applications sending requests and receiving responses from multiple endpoints, where the resource resides

Those endpoints need protection and even more so with hundreds of millions more people accessing servers from home.

The array of possible attack vectors keeps chief technology and operations officers awake at nights – from the relatively low-tech phishing scams to server hacks. This is where CrowdStrike’s (CRWD) cybersecurity services comes in.

CrowdStrike – Next generation anti-virus in the age of Covid-19

CrowdStrike is a software-as-a-system (SaaS) outfit focused on the cloud cybersecurity.

Its services are sometimes described as next-generation anti-virus (NGAV) because of the focus on anticipating attacks before they take place. Machine-learning and other artificial intelligence technology is deployed dynamically in real-time by its Falcon platform.

The cybersecurity firm provides fully managed services for its threat intelligence platform. Demand is strong and expected to strengthen further.

With more corporate networks moving to the cloud, there was already an established trend for CrowdStrike to mine.

Now Covid-19 and WFH promises to take the business to the next level.

As chief executive George Kurtz puts it: “The widespread health and economic impact of the coronavirus has not deterred cyber adversaries. In fact, quite the opposite is occurring. In times of crisis, adversaries often try to exploit the situation, prey on the public’s fear and escalate attacks.”

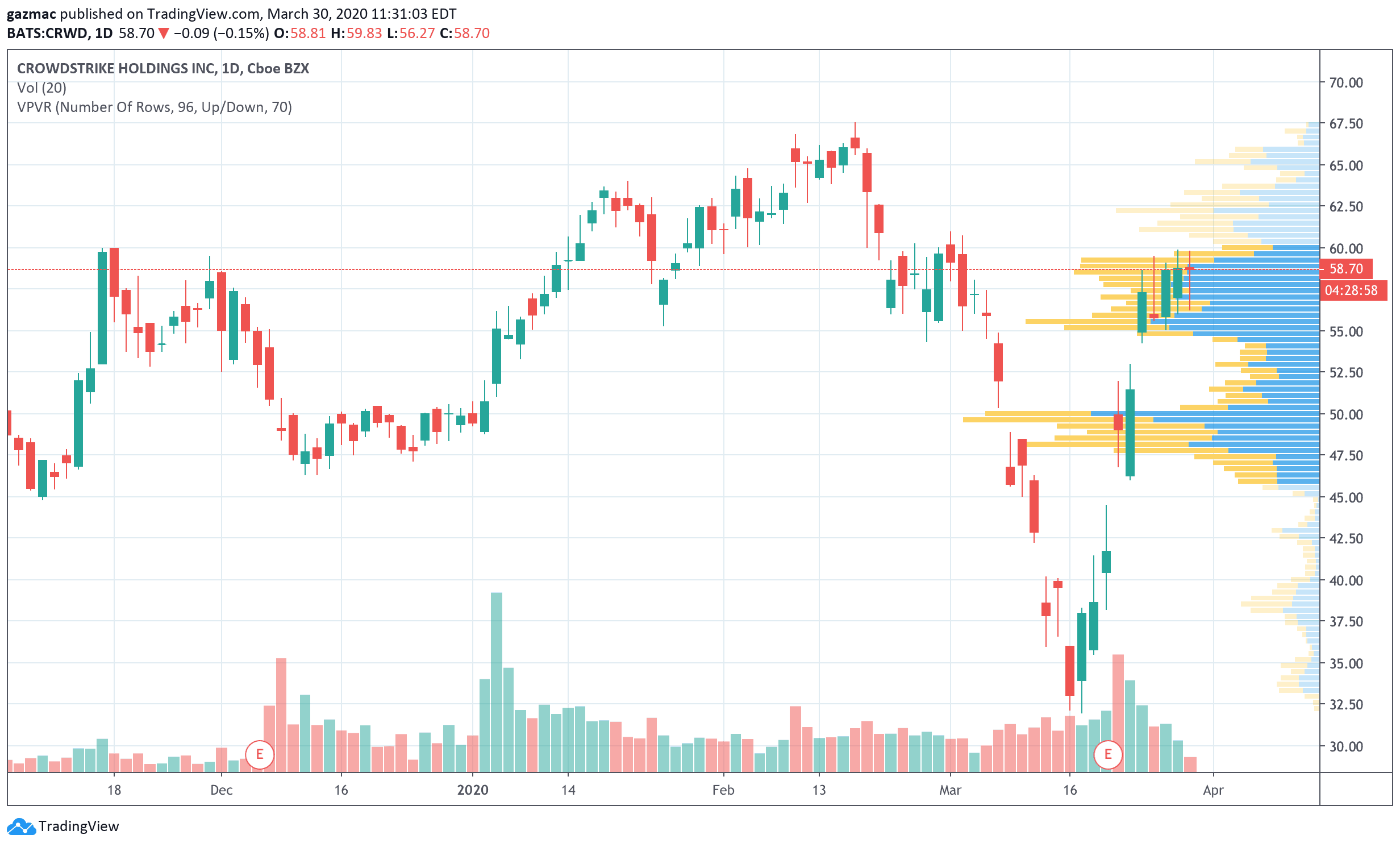

Price jump after CrowdStrike (CRWD) Q4 earnings call

In the Q4 earnings call on 19 March, Kurtz reported the company increased annual recurring revenue (ARR) by $99 million year on year. ARR came in at $600 million to the 12 months to end 2019.

Kurtz said that the “seismic shift to cloud native technologies and cloud workloads… has created massive greenfield opportunities.”

The firm’s subscription revenues have been growing at an impressive clip, at 99%, bringing in $436 million. The customer base is changing as well as it secures business with bigger firms.

Digging deeper into the numbers, non-GAAP net loss narrowed considerably, from $28 million to $3.9 million ($0.02 per share). However, CrowdStrike expects losses to widen again in 2021 as it looks to attack market opportunities.

Positive free cash flow

And in these times or debt gorging, there is welcome quality on the balance sheet, with a positive free cash flow of $50.7 million. Gross margin has improved from 67% to 73% last year.

Analyst consensus had expected CrowdStrike to report a loss of $0.08 per share, so the much smaller $0.02 number was well received by the market, with the price racing 19% higher on the news.

CrowdStrike is currently priced at $58.46 and might be a bit toppy in the sense that shareholders might be expected to want to pocket some of the recent gains.

As far as the competition goes, CrowdStrike is making inroads.

“There’s a lot of inbounds from partners looking to move their customer base to us as Symantec and Broadcom abandon many of the customers that are out there,” says Kurtz.

CrowdStrike is very much alive to the opportunities Covid-19 presents and has launched two new products to meet the WFH challenge – Burst Licensing lets customers agilely add to licence count at no extra cost and Falcon Prevent For Home Use targets security employee-owned devices.

Arguably the firm has some equally nimble competitors, such as FireEye and Absolute Software, the latter with its own particular SaaS endpoint solutions focus.

However, it is CrowdStrike that may be best positioned to exploit the WFH paradigm shift that is upon us.

Analyst roundup

According to MarketBeat.com the average 12-month price target is $75.33.

On the high side, $109 is the richest price target with $43.00 at the low.

Of the 24 Wall Street analysts surveyed only has a sell rating, 18 a buy.

CrowdStrike is up nearly 18% year to date.

Disclosure: The author has a small holding in CrowdStrike

Join Our Telegram channel to stay up to date on breaking news coverage