Join Our Telegram channel to stay up to date on breaking news coverage

The year-long crypto winter has left the digital currency industry in a bad state, leading several companies in the sector to bankruptcy. Apart from FTX which collapsed in November, as well as a number of other major firms that filed for bankruptcy throughout 2022, there have been other cases even now, in 2023, when the market seems to be starting to recover.

One example is Genesis Global Capital, which filed for bankruptcy protection a few weeks ago, on January 19th. Since then, the company has created a recovery plan, and according to the exchange’s lawyers’ statement from yesterday, February 6th, its recovery will also be helped by one of the largest US crypto exchanges, Gemini.

Gemini’s contribution to Genesis

During yesterday’s court hearing, the company’s lawyers stated that Gemini has offered to contribute up to $100 million in cash, earmarked for its customers. This is part of an agreement with Genesis and its parent company, Digital Currency Group.

1/ Today, @Gemini reached an agreement in principle with Genesis Global Capital, LLC (Genesis), @DCGco, and other creditors on a plan that provides a path for Earn users to recover their assets. This agreement was announced in Bankruptcy Court today.

— Cameron Winklevoss (@cameron) February 6, 2023

Given the state of things — meaning the fact that Genesis owes billions of dollars to its creditors, which include Gemini and the company’s users alike — the firm can take all the help it can get. However, as mentioned, it does have a restructuring deal and a recovery plan, both of which were announced during a recent status conference.

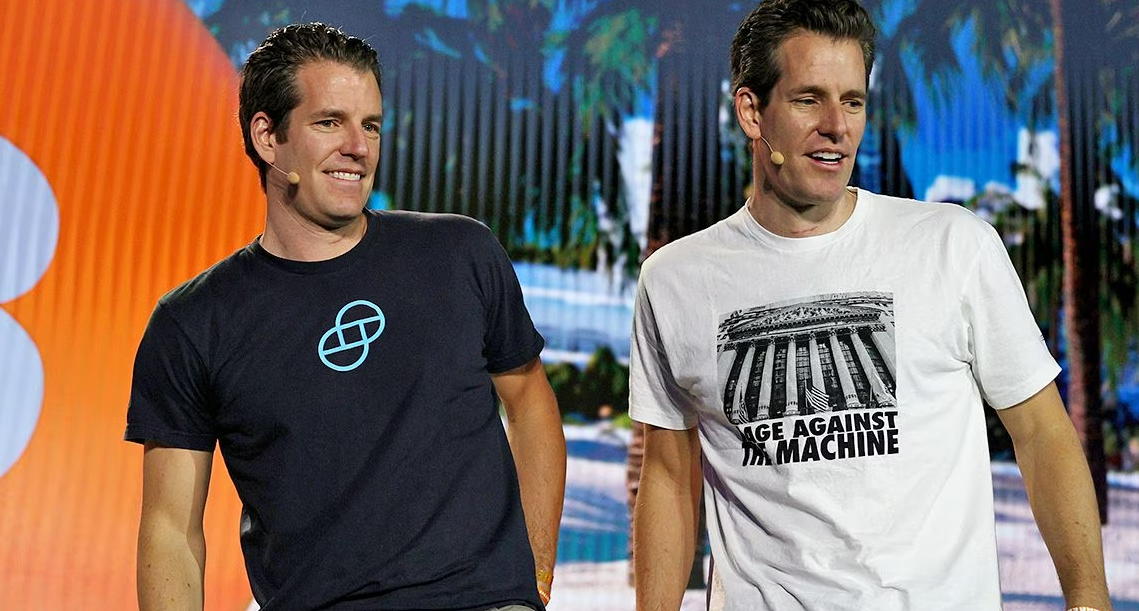

Gemini has been engaged in a high-profile back-and-forth with DCG’s owner, Barry Silbert, for a while now. Gemini’s founders, the Winklevoss twins, blamed Silbert’s mismanagement of the company for issues with the product called Earn, which claimed to offer returns of up to 8% on user deposits.

Explaining the situation to its users, Gemini said that “This plan is a critical step forward towards a substantial recovery of assets for all Genesis creditors. Gemini’s continued commitment to helping Earn users achieve a full recovery.”

3/ In addition, Gemini will be contributing up to $100 million more for Earn users as part of the plan, further demonstrating Gemini’s continued commitment to helping Earn users achieve a full recovery.

— Cameron Winklevoss (@cameron) February 6, 2023

How can Genesis recover?

As for the reconstruction plan, the details of it were revealed in the Manhattan bankruptcy court. The deal includes Gemini, Genesis, DCG, as well as Genesis’ creditors. It mostly revolves around a refinancing of Genesis’ loans to DCG, as the company loaned more than $500 million in both cash and Bitcoin, partially to fund Silbert’s venture investments.

Furthermore, DCG intends to contribute to Genesis’ all equity in Generis’ trading subsidiary. The subsidiary remained operational even after Genesis filed for bankruptcy. Next, DCG intends to provide a two-tranche debt facility, which is expected to mature in June 2024. Apart from that, DCG plans to issue convertible preferred stock to Genesis’ creditors, and it extended a $1.1 billion promissory note to the bankrupt company following the collapse of Three Arrows Capital.

The Winklevoss actually criticized this move, saying that it did nothing to improve Genesis’ immediate liquidity position. They called it a gimmick that didn’t even make its balance sheet solvent. But, the promissory note will be equitized as part of the recovery plan.

Related

- Gemini Review 2023 – READ THIS Before Investing

- Gemini Founders Seek Path To Recover Funds

- Genesis and Gemini Get Sued By The SEC- Find Out More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage