Join Our Telegram channel to stay up to date on breaking news coverage

In the world of cryptocurrency derivatives, Bitcoin ETFs just might be the hottest thing. So far, it’s been a long road for companies trying to get through the regulatory hurdle of listing a Bitcoin ETF. This involves going through one of the toughest regulators in the world—the U.S. Securities and Exchange Commission (SEC) to list Bitcoin ETFs, but have all failed up to this point.

The SEC definitely has a long history of turning down Bitcoin ETF proposals. In August 2018 alone, the agency pulled the plug on about 9 ETF proposals, using pretty much the same language in its releases.

That’s where the problem lies; the SEC’s reasons. In its rejection of the proposal from ProShares, it claimed that “The Exchange has not met its burden under the Exchange Act and the Commission’s Rules of Practice to demonstrate that its proposal is consistent with the requirements of the Exchange Act Section 6(b)(5), in particular the requirement that a national securities exchange’s rules be designed to prevent fraudulent and manipulative acts and practices.”

Its rejection of Direxion’s proposals contained precisely the same thing. Essentially, this means that all of these Exchanges simply were unable to prove that their products would guarantee investor protection; something which has dogged cryptocurrencies since they were first introduced.

In a way, the agency isn’t wrong. A Bitcoin ETF would trade securities- not just exchanging cryptocurrencies for cash. Therefore, it’s important for it to satisfy the agency’s security requirements. Ordinary funds have these same requirements, and it’s only expedient for cryptocurrency-based funds to be held to the same standards.

The agency’s reasons are pretty simple enough

The SEC’s discontent with Bitcoin ETFs rests on two feet; their susceptibility to market manipulation, and exchange security.

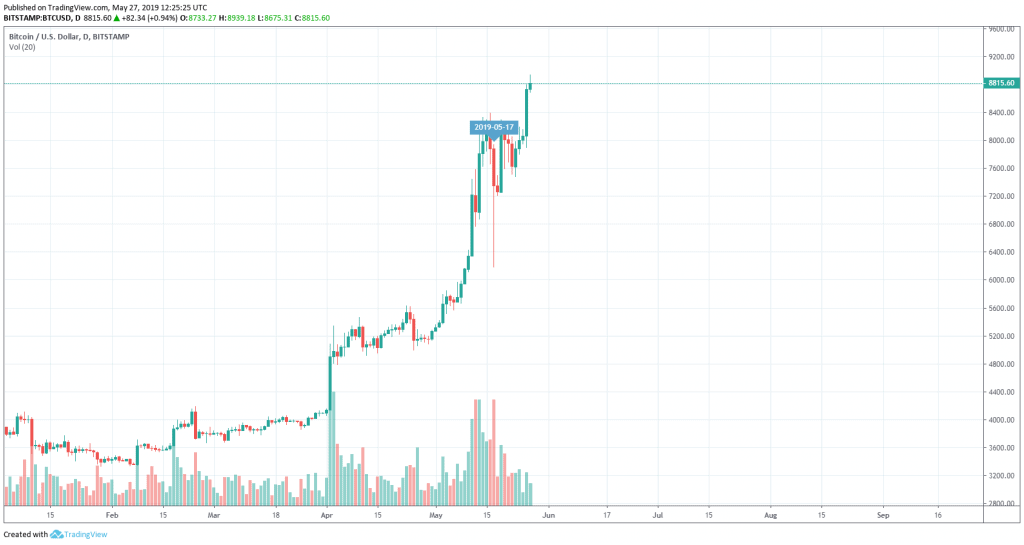

On May 17, a massive Bitcoin selloff caused the asset’s price to crash briefly to $6,400. While the asset has rebounded since then, this goes to show just how volatile Bitcoin still is, and according to Eric Connar, product designer at Gnosis, it could mean that the long-awaited ETFs aren’t coming soon. Exchange security, on the other hand, is an issue that no one needs an introduction to. Hacks and scams are rampant, and the total losses sustained by users are expected to exceed $1.2 billion this year, according to a report from CipherTrace.

Not everyone sees things like this, however. Gabor Gurbacs, Director of Digital Strategy at VanEck (a company whose ETF proposal is still being reviewed), touted the security of Bitcoin ETFs, adding that they provide better investments that exiting investment vehicles.

Historically, the regulator’s job was to review if product disclosures are appropriate. Then the market decides if it wants the product or not. Today, it feels like regulators are playing god & decide on the merits of products. That’s not their job. #makemarketsfreeagain #MMFA

— Gabor Gurbacs (@gaborgurbacs) May 20, 2019

Obviously, the agency doesn’t think so. If only they weren’t around, right?

Hope on the horizon?

Of course, when it comes to crypto, no situation is so bleak; even with EFTs. In an interview with CNBC’s Bob Pisani last week, ETF.com Managing Director Dave Nadig argued that the approval of ETFs is just not imminent.

In part he said, “Based on the comments we saw last week, it’s clear the SEC is still in information-gathering mode, not ‘Let’s sit at the table and make a decision’….. I think things are pointing toward a resolution for Bitcoin bulls, but… I think we’re at least a quarter out.” Nadiq also pointed out that it is important for the market to still mature, claiming that this way, regulators would get more comfortable with them.

Apart from Nadiq, Robert J. Jackson Jr., a commissioner with the SEC, also claimed back in February that Bitcoin ETFs would be approved eventually. “Eventually, do I think someone will satisfy the standards that we’ve laid out there? I hope so, yes, and I think so,” Jackson said. Commissioner Hester Pierce called for fast-tracked regulations earlier this month, adding that the agency’s reluctance has stifled innovations.

However, if these concerns aren’t convincingly addressed, it doesn’t seem like a Bitcoin ETF will materialize.

Join Our Telegram channel to stay up to date on breaking news coverage