Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin has been tumbling down since November 8th, after the FTX debacle. Things haven’t been looking bright for a variety of cryptocurrencies too, since then. From Alameda Research’s collapse to Genesis on the verge of filing bankruptcy, there is not much that needs to be said about why the Bitcoin price is crashing. However, exploring the “why” once again will reveal the crypto market’s pitfalls that new investors can avoid. So, let us examine the many reasons why Bitcoin is in its current state.

Why is the Bitcoin Price Crashing?

The moment Fortune magazine called the Bitcoin crash the fifth biggest wipeout of all time is when many realized that things would never be the same for Bitcoin. Now it is getting harder than ever to find more cryptocurrency adopters. In fact, recent sell-offs suggest that many might be thinking of leaving the crypto market altogether. How did we get here? Why, what was once one of the most lucrative digital investments of all time, turn into one of the biggest crashes of all time, wiping out billions from the market?

The Terra Crash

2022 was an interesting year for crypto. It was just coming out of the high-flying success of 2021, which saw many cryptocurrencies reaching their all-time high values. Bitcoin peaked at $67k in the same year. However, the massive sell-off that happened soon as many investors started to cash out saw the Bitcoin price retracing to $45k as it entered 2022.

It was expected since 2022 was the year of halving – cutting the bitcoin mining rewards in half. However, when LUNA, one of the most trusted crypto assets of that time, went into a death spiral, the market collapsed. It led to billions of dollars disappearing from the market and TerraUSD losing value. It was the first time since 2017 that crypto markets started to struggle brutally. The bearish sentiments it formed in the community seeped into Ethereum, dropping its price, and soon, Bitcoin followed. The value of the world’s leading cryptocurrency went down by more than 50% of its early 2022 levels and started hovering around $20k. It created a buyer’s market with fewer people trusting in cryptocurrency.

Celsius, a well-known crypto lending firm that popularized the term “unbanking yourself”, disappeared. Three Arrows Capital and Voyager suffered the same fate. Even prominent cryptocurrency exchanges, like Crypto.com, started to cut down their workforce.

Amidst this chaos emerged a saviour who appeared to better the entire ecosystem, and his name was Sam Bankman-Fried, the CEO of FTX and Alameda Research. This simple-looking person, who looked like he could be a poster child of a frugal lifestyle, sought to protect the markets from the crypto winter contagion. His efforts of rescuing multiple crypto lending and crypto VC firms were well advertised. The entire crypto market was thankful for it – not paying mind to the reality that none of his efforts was actually bearing any fruit.

The FTX Collapse

After the end of “Septembear”, signs emerged of the cryptocurrency market recovering. The last days of October saw the Bitcoin price inching above the $20k mark. And then came the FOMC statement that hinted that the Feds would put a leash on the inflation rate by delaying the interest increase for a while. It pushed Bitcoin above $21k and kept it at that level. The US jobs report further pushed the bulls to act in force and keep the value of crypto sustained at that level.

Then the CPI data and the midterms created a push-pull action, leading the BTC price to accumulate between $20k and $21k.

But things changed when there was a whale movement in the FTT price. FTT, the native cryptocurrency of the FTX exchange, was valued at $22 during the transfer. as it involved Binance, the Binance head soon came on Twitter to clarify that they would be liquidating their FTT holdings as a pre-emptive risk management effort. Crypto Twitter didn’t understand the move at first, but it became clear DirtyBubbleMedia dropped a bombshell.

The publication revealed the research done by CoinDesk, where it was found that the majority of Alameda Research’s assets (88%) were in the form of FTT tokens. It pointed to the basic flywheel scheme that involves;

- Creating a token

- Pumping its price

- Marking the price pump as “gains” in the balance sheet

- Showing these “gains” to investors

- Raising cash through equity and loans

Raising funds is a good advertisement as it pumps the token’s price again. The pump is again marked as “gains” in the balance sheet and then used as collateral to borrow even more funds. That revelation hit the entire crypto market as a whiplash and divided it. On the one hand, you had major publications ready to brush this wrongdoing off as a “young entrepreneur mistake.” On the other hand, the investors were becoming increasingly suspicious.

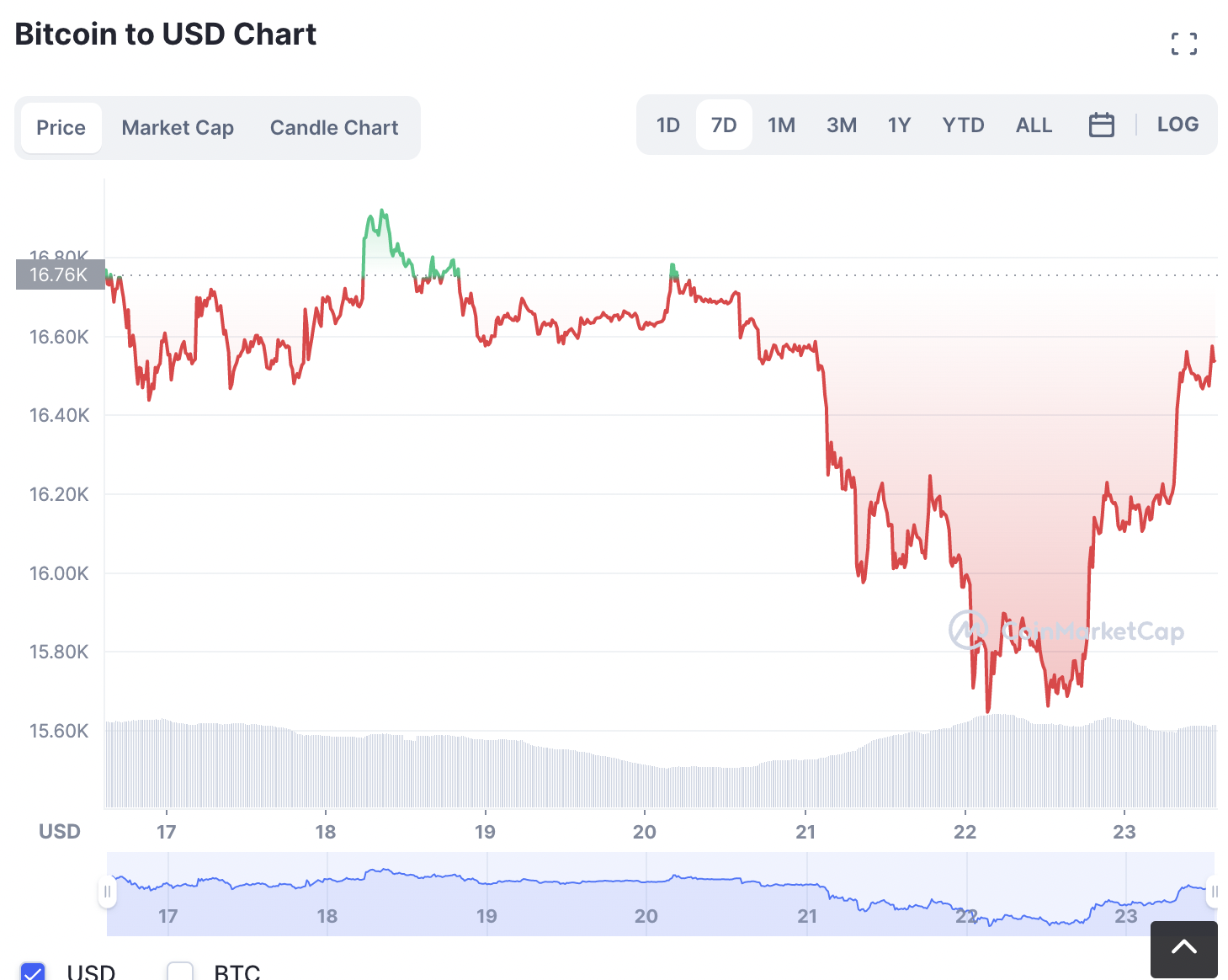

These events led to FTT collapsing and Bitcoin plunging below $20k and reaching the $15.8K level. Bulls acted quickly to raise the price after Binance announced that it would take over FTX. However, as more information was revealed about the FTX debacle, Binance pulled back, causing Bitcoin to struggle to stay above $16k.

What Should you be Doing Now?

Most of the current trading cryptocurrencies are going through a bearish phase. So, unless you are willing to research and understand their utilities to learn about their long-term use cases, the recommended option would be to hold off on investing.

However, there are certain presale cryptocurrencies you must consider buying right now for two reasons.

- All of them have major utilities

- They allow you to profit from the price appreciation through presale stages.

One of them is Dash 2 Trade, a cryptocurrency powering a crypto intel platform designed to deal with exact issues that the current market is suffering from. Featuring tools such as strategy building, backtesting, social analytics, off-chain analytics, and presale assessment, to name a few, Dash 2 Trade is one of the biggest presale crypto successes this year. It is currently in the third stage of its presale and has raised over $6.8 million. Invest in it today at a discount price of $0.0513.

Other presale cryptocurrencies that are making waves are IMPT.io and Calvaria. IMPT.io is a green crypto offering that aims to make the carbon credits trading system more inclusive. It has already raised more than $13 million in the presale.

P2E enthusiasts can go for Calvaria, a card game in the blockchain domain with great gameplay and amazing earning mechanics. Its native token, RIA, has raised close to $2 million in its presale. These presale offerings will give you the right starting point to investing in crypto without dealing with volatility in the current market.

Related Articles

- Dash 2 Trade Price Prediction

- Calvaria Price Prediction

- RobotEra Presale Passes $170k – Where to Buy TARO?

Join Our Telegram channel to stay up to date on breaking news coverage