Join Our Telegram channel to stay up to date on breaking news coverage

Late in the day on September 14, Vitalik Buterin and a small group of cryptocurrency developers swarmed into a Berlin office to launch The Merge.

Buterin, the 28-year-old co-founder of Ethereum who has been involved in the cryptocurrency industry since he was a teenager, had long since envisioned a system that would essentially operate itself, so there wasn’t a real switch to flick. Developers on the client side would download these pieces of code, the crypto research and developer community would agree on what a change looks like, coders would type out a command and timestamp it, and then at the predetermined time, the system would manifest the change by itself—in this case, The Merge. It altered the way in which transactions on the Ethereum blockchain are confirmed, a long-awaited improvement that has been hailed as a turning point in the cryptocurrency world.

That doesn’t lessen how difficult the current ecosystem of cryptocurrency apps and the blockchain technology they’re based on is for the average person. Buterin appears to be largely aware of this. He compiled some of his earlier works on cryptocurrencies into a book titled Proof of Stake: The Making of Ethereum and the Philosophy of Blockchains prior to The Merge. The book already seems a little antiquated given how quickly crypto technologies are evolving, as it is filled with coins and DAOs that might no longer be in existence and ends with an article from January 2022, just before the crypto market crashed. However, the collection acts as a sort of crypto Old Testament, a first-hand account of a mentality change towards decentralized networks and a historical record that inspires a lot of grandiose promises.

Buterin recently decided to give an interview via Zoom to discuss the recently burst crypto bubble, whether decentralized technology can support society-scale decision-making, and what The Merge may pave the way for in terms of future great innovations.

So I suppose congratulations on The Merge are in order. How do you think it went, overall?

Vitalik Buterin: I’m definitely relieved and thrilled. The Ethereum community as a whole has been working toward this shift for the past eight years. Many people along the line had doubts about whether or not The Merge, this transfer to Proof of Stake, would take place, whether they were members of the Bitcoin community or others who were dubious of cryptocurrencies in general. We’re overjoyed to have finally shown them all incorrect.

To put it very briefly, the alleged benefits of proof stake are that it consumes a lot less energy and has lower entry hurdles, which reduces the possibility of centralization. It is more resistant to attacks. But what are the biggest opportunities that proof of stake creates, in plain English?

I believe there are some. One comes from the financial resources the ecosystem is no longer required to use for proof of work. Projects of all kinds will have a little bit more funding than they did previously.

Another is the increased credibility Ethereum receives as a result of the switch to proof of stake. The proof of work and environmental element have been the major reasons for institutional actors, including governments and companies, to be dubious of or decide against using Ethereum. Following The Merge, Ethereum is no longer a proof-of-work network, which greatly increases the willingness of those who previously had such reservations to use it. Many individuals who have been quietly observing the situation will likely now enter the scene and begin utilizing Ethereum.

A third is that proof of stake offers a variety of opportunities to alter the protocol. Outside of proof of stake or their ability to use them in practice, scalability is likely the issue that people have with blockchains the most. Transaction sending costs are high because blockchains are not highly scalable. The architecture, in which each node in the network must independently verify each transaction, is the cause. To correct this and make Ethereum into a system that handles transactions in a way that is still decentralized but far more effective, we have proposals for technology.

Can you give an example of anything that a developer built that they previously couldn’t build or couldn’t do as effectively?

The main issue is scaling. Ethereum features what is known as a two-layer scaling approach, and the idea is to somewhat improve it by enabling the chain to handle significantly more data. On top of that, there are these other protocols that use that data as an input to build what resembles miniature Ethereums inside of Ethereum. These taken together would be able to handle a lot more transactions. Potentially between 5,000 and 100,000 transactions per second, as opposed to the 20 transactions per second that Ethereum can now handle.

The Ethereum ecosystem has to put a lot of effort into developing these layer-two protocols. The Merge also makes it much simpler. Following The Merge, scaling is most likely the Ethereum ecosystem’s next major development. I think it’s just as thrilling. It might change the game in a similar manner.

What impact, if any, do you think The Merge has had on Ethereum since the crypto market crashed this year?

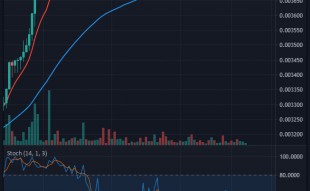

It’s a good question, I suppose. I believe I have expressed publicly on a few occasions that I am somewhat looking forward to the bear market. One of the terrible things about cryptocurrency, particularly during the 2020 and 2021 bubble, is that it grew significantly before it was sufficiently mature to manage the amount of attention it was receiving. If you look at the energy consumption graph for Ethereum, I believe more than half, perhaps more than two thirds, occurred in the previous two years. Things would be much better if The Merge had occurred two years sooner, and much worse if it had been postponed by another five years and occurred following another extremely large crypto boom.

That is also accurate in terms of scalability. Last year, Ethereum transaction costs reached up to $5 and even $20 [per transaction], and if there is another significant price bubble, we might easily see costs reach up to $100 to $200. Talking about the potential of cryptocurrency as a means of empowering the developing world, banking the unbanked, and aiding individuals who are disenfranchised by existing institutions just just starts to appear silly in that kind of society.

Before the ecosystem experiences the next significant increase in acceptance and attention, I’ve always wanted to properly address scalability. We will have the option to do that, which is one of the benefits of prices temporarily falling. Proof of stake does not lower transaction fees, but it is the major hurdle we have to overcome before moving forward with the things that will.

The book’s final article, which you wrote in January 2022, is about NFTs. The market has drastically evolved since then. How sure are you that some of the concepts you were looking into, like the “Proof of Attendance Protocol,” are sound? For what it’s worth, one of the more legitimate uses of NFTs appeared to be event tickets. However, the market for NFT art has just collapsed.

The same as it was a year ago, I still believe that the NFTs that are going to be valuable are the ones that are going to be sustainable. There are kitten photos and tradeable art in the early phases, but a lot of that material has really tanked. There must be advantages to holding an NFT beyond simply being able to state that you do so for it to have long-term worth.

ENS domain names have been the most successful NFT use case to date, and they are so common and successful that few people even consider them to be NFTs. You probably noticed a number of people registering dot-ETH names on Twitter last year. Vitalik.ETH is still with me. Those names are NFTs that are stored in a specific address’ wallet. If you have that NFT, I can type in someone’s dot-ETH name in order to send them Ethereum or communicate with them through an Ethereum application. It’s pretty easy to achieve that—the same kind of role that usernames have in any kind of chat program or domain names on the internet—except in this significant decentralized Ethereum ecosystem.

The entire NFT gaming industry is another intriguing application. Last year, games like Axie Infinity saw great success, although Axie Infinity was later hacked. It hasn’t really been able to heal, even without that. I believe the reason for this is that the designers of these first-generation NFT games approached it with the mindset that the financialization element would suffice to make the game enjoyable on its own. However, it is obviously insufficient, and a good NFT or play-to-earn game must be entertaining even without the monetization component. These are the kinds of enterprises that will succeed—whoever creates a blockchain game that is entertaining first.

You’ve written a lot about governance, therefore I’m curious about how blockchain technology might be used by governments and society. What potential does adopting decentralized systems like Ethereum have for governing social issues, not only cryptocurrency-related issues?

I believe that blockchains can serve as an effective technical foundation for many of these very basic functions. They work well for money. They work well for systems like domain names. Additionally, I believe that it might frequently make sense to put at least some of a governance system’s formal components on a blockchain. However, I want to add a few qualifications because, while governance is also communication and everything else that happens within a system, the majority of that activity will take place on non-blockchain platforms.

Voting on blockchains is an intriguing application. Blockchains are frequently mentioned as having censorship resistance, for instance. And a lot of people think that the term “censorship resistance” means, you know, I want to consume pot without having to ask the government, but they forget that voting necessitates censorship resistance. Your right to vote would be censored by the government, which would mean that democracy as a whole would collapse. Voting systems must have the very strong characteristic that if a person wants to vote, they should be able to do so and be able to be absolutely assured that their vote actually went to where it could be tallied. That’s something that I believe blockchains can effectively provide when used in conjunction with some other types of cryptography that provide features like privacy.

In one of your pieces for the book, you state that historically, ineffective people have a tendency of buying their way into positions of authority and responsibility. Can that be avoided via the blockchain?

Yes, excellent question. This is one of the explanations for my belief in the significance of privacy technologies. I keep bringing up zero-knowledge proofs because I am a firm believer in the value of privacy, which not only serves to shield individuals from unfavorable social structures but is also a crucial component for the existence of many other types of social structures.

Related

- Ethereum Founder Vitalik Buterin’s Massive Prediction for 2040 Bitcoin And Cryptocurrency Prices

- Ethereum Merge Completed. World’s Second Biggest Blockchain Enters New Golden Age

- Top 8 Coolest NFT Projects – Cool Art and Cool Utility

Join Our Telegram channel to stay up to date on breaking news coverage