Join Our Telegram channel to stay up to date on breaking news coverage

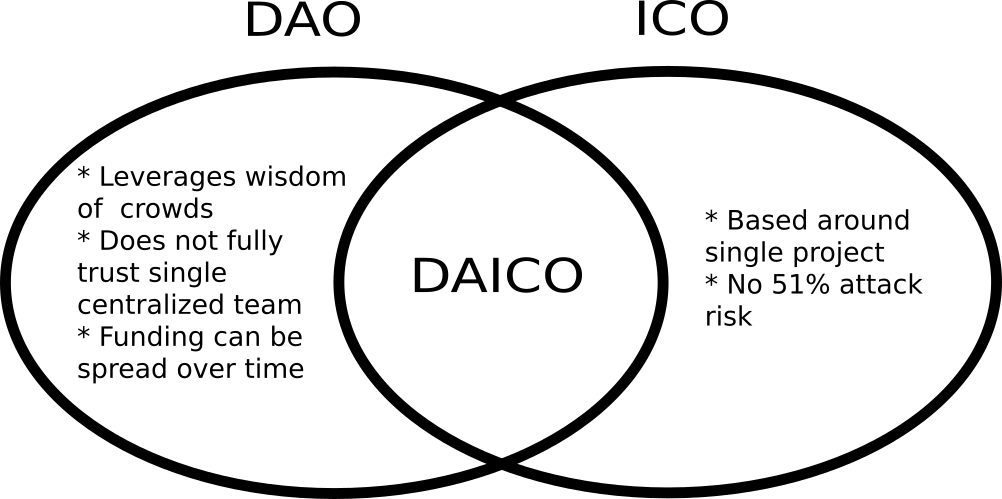

The Ethereum creator has proposed a new decentralized fundraising model called the DAICO. Using “some of the benefits” of Decentralized Autonomous Organizations (DAOs), Buterin hopes to make Initial Coin Offerings (ICOs) more responsible and further democratized.

Also read: Seattle Man Is the First Ever to Purchase a Home With Bitcoin Cash

Join the Bitsonline Telegram channel to get the latest Bitcoin, cryptocurrency, and tech news updates: https://t.me/bitsonline

Buterin: DAICO Is “Improving the ICO Model”

On January 5th, Buterin uploaded a post entitled “Explanation of DAICOs” to the Ethereum Research forum. In it, the young Russian-Canadian programmer proposed merging characteristics of DAOs and ICOs to create what he dubs a “DAICO.”

A Decentralized Autonomous Organization, of course, is a decentralized organization whose rules are governed by a smart contract. So in bringing aspects of DAOs to Initial Coin Offerings, he hopes to make funding projects through Ethereum more reasonable and contingent upon developers’ results.

A sketch by Buterin.

He explained:

“The idea is as follows. A DAICO contract is published by a single development team that wishes to raise funds for a project. The DAICO contract starts off in ‘contribution mode’, specifying a mechanism by which anyone can contribute ETH to the contract, and get tokens in exchange. This could be a capped sale, an uncapped sale, a dutch auction, an interactive coin offering, a KYC’d sale with dynamic per-person caps, or whatever other mechanism the team chooses. Once the contribution period ends, the ability to contribute ETH stops, and the initial token balances are set; from there on the tokens can become tradeable.

“After the contribution period, the contract has one major state variable: tap (units: wei / sec), initialized to zero. The tap determines the amount per second that the development team can take out of the contract.”

According to Buterin, then, this model puts more power in contributors’ hands because it allows for building community consensus regarding how much raised funds a given project can go through, say, monthly.

That’s because, in a DAICO, there is a “mechanism through which token holders can vote on resolutions,” which occurs either by raising the “tap” or by obliviating a DAICO’s smart contract.

As Buterin notes:

The intention is that the voters start off by giving the development team a reasonable and not-too-high monthly budget, and raise it over time as the team demonstrates its ability to competently execute with its existing budget. If the voters are very unhappy with the development team’s progress, they can always vote to shut the DAICO down entirely and get their money back.”

Security, Game Theory-Style

In explaining how DAICOs would be secured, Buterin qualified that all votes of any kind are susceptible to manipulating. Even still, he argued that merging DAOs with ICOs could mitigate most kinds of manipulation.

Let’s say a 51 percent attack increases a DAICO’s tap. Then, per Buterin, an honest developer or developers could just as easily lower the tap again.

Moreover, to respond to rogue developers who are “spending funds on lambos instead of real work,” Buterin claims investors can use the DAICO model to stop this dynamic by collectively refusing to rapidly raise the tap.

And if a 51 percent attack self-destructs a DAICO “maliciously,” then the developers could just as easily create a new DAICO.

The benefits of this new proposed fundraising system is that it would necessitate simultaneously compromising both 51 percent of any given vote and a development team for significant damage to be possible.

So, while days ago Buterin made his frustrations clear with the rampant greed-driven mania in the cryptocurrency space, he’s clearly spent some of the ensuing time

Read more:

Join Our Telegram channel to stay up to date on breaking news coverage