Join Our Telegram channel to stay up to date on breaking news coverage

South Korea’s National Pension Service (NPS) has made a 39% unrealized profit on Coinbase shares after the pensions giant added a crypto company to its US stock portfolio for the first time.

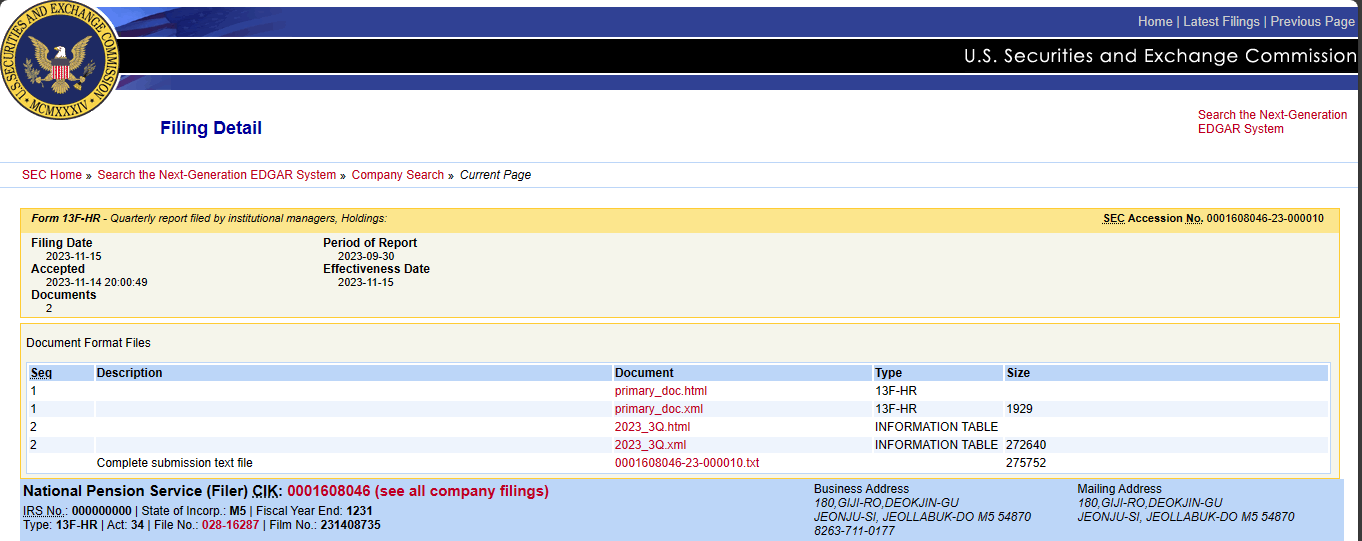

Based on data from a stock holdings report filed with the US Securities and Exchange Commission (SEC), the NPS bought 282,673 Coinbase shares in the third quarter of this year.

The SEC filing shows that NPS, which says it is the world’s third-biggest pension fund, bought the Coinbase shares in a batch, at an entry price of $19.9 million. TradingView shows that these shares are now valued at about $27.7 million, an almost 40% increase that would return a profit of about $7.8 million.

South Korean news agency News1 reported that the NPS investment in the exchange marks its first and only purchase into Coinbase stock. Its policy is not to directly invest in cryptocurrencies such as Bitcoin because of volatility.

The policy follows a 2021 attack against the NPS by the country’s National Assembly. At the time, the government authority criticized it for investing in a cryptocurrency-related business. The NPS said then that had not invested in cryptocurrencies, but only an exchange.

NPS Among Organizations Benefiting From A Skyrocketing Coinbase Stock

NPS is among the organizations that have benefitted from the growth in the value of Coinbase stock, which has skyrocketed by 170% this year. The stock remains 74% down from its all-time high of $300 in September 2021..

The growth came even as the exchange navigates regulatory turbulence in the US. In June, the US Securities and Exchange Commission (SEC) levied charges against the exchange citing securities law violations since 2019. This was almost two years before its initial public offering (IPO) in April 2021.

Today we charged Coinbase, Inc. with operating its crypto asset trading platform as an unregistered national securities exchange, broker, and clearing agency and for failing to register the offer and sale of its crypto asset staking-as-a-service program.https://t.co/XPG2gDkxtV pic.twitter.com/hCdVMw8B2v

— U.S. Securities and Exchange Commission (@SECGov) June 6, 2023

The SEC said Coinbase’s staking program featured five stackable crypto assets, that made the staking program an investment contract and, therefore, a security.

Coinbase has vehemently refuted the claims, and even disputed the financial regulator’s authority in the cryptocurrency realm. The exchange’s bone of contention was that the “SEC’s definition of security is too wide.”

The same charges were levied against Binance in July, with both crypto trading platforms accused of selling unregistered securities.

Binance CEO Changpeng Zhao also challenged the SEC, citing regulatory overreach and saying, “If you have to pick a fight with everyone, maybe you are the one at fault.”

If you have to pick a fight with everyone, maybe you are the one at fault. 🤷♂️

— CZ 🔶 BNB (@cz_binance) June 6, 2023

As it stands, exchanges are calling out the financial regulator for its reliance on an enforcement-only approach, with Coinbase CLO Paul Grewal saying the SEC does not have clear rules for the digital asset industry, a stance that continues to hurt America’s economic competitiveness.

Also Read:

- Coinbase Accuses SEC Of Overreach in Lawsuit, Says It Wants Regulatory Authority To Match Its ”Ambition”

- Coinbase and SEC Lock Horns over Securities Regulation

- SEC Wants Judge to Deny Coinbase’s Motion to Dismiss Lawsuit

- Binance and Changpeng Zhao Seek Dismissal of SEC Lawsuit, Citing Regulatory Overreach

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage