Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin is projected to hit $185,000 by 2025, with growth attributed to rising interest from institutions, corporations, and even governments. Analysts believe this shift signals increasing trust in cryptocurrencies as a store of value and an alternative financial asset. Ethereum, another major player in the crypto market, is expected to surpass $5,500, driven by staking activity exceeding 50% participation.

Institutional investments and corporate involvement have fueled these predictions. Furthermore, the possibility of nation-states adopting cryptocurrencies adds momentum, potentially redefining their role in global finance. As these developments unfold, interest in cryptocurrencies continues to grow. Many investors and analysts are exploring top crypto to invest in right now.

Top Crypto to Invest in Right Now

Celestia experienced a notable price increase, reaching $5.21, representing a 12.31% gain within the last 24 hours. Similarly, QNT has shown steady growth, currently valued at $111.10 after a 19.22% rise over the past month. In another development, Pyth Network has integrated real-time oil price data into decentralized finance (DeFi), bridging traditional financial markets with blockchain-based ecosystems.

1. Quant (QNT)

Quant aims to connect blockchains and networks globally without sacrificing efficiency or compatibility. It addresses the challenge of interoperability by introducing Overledger, a blockchain operating system designed to link different blockchain networks. This system acts as a bridge, allowing multiple blockchains to work together seamlessly.

The platform focuses on creating a distributed ledger technology that connects diverse networks, simplifying blockchain integration. Quant’s Overledger is presented as the first operating system tailored for blockchains, highlighting its unique approach to solving a fundamental issue in the blockchain ecosystem.

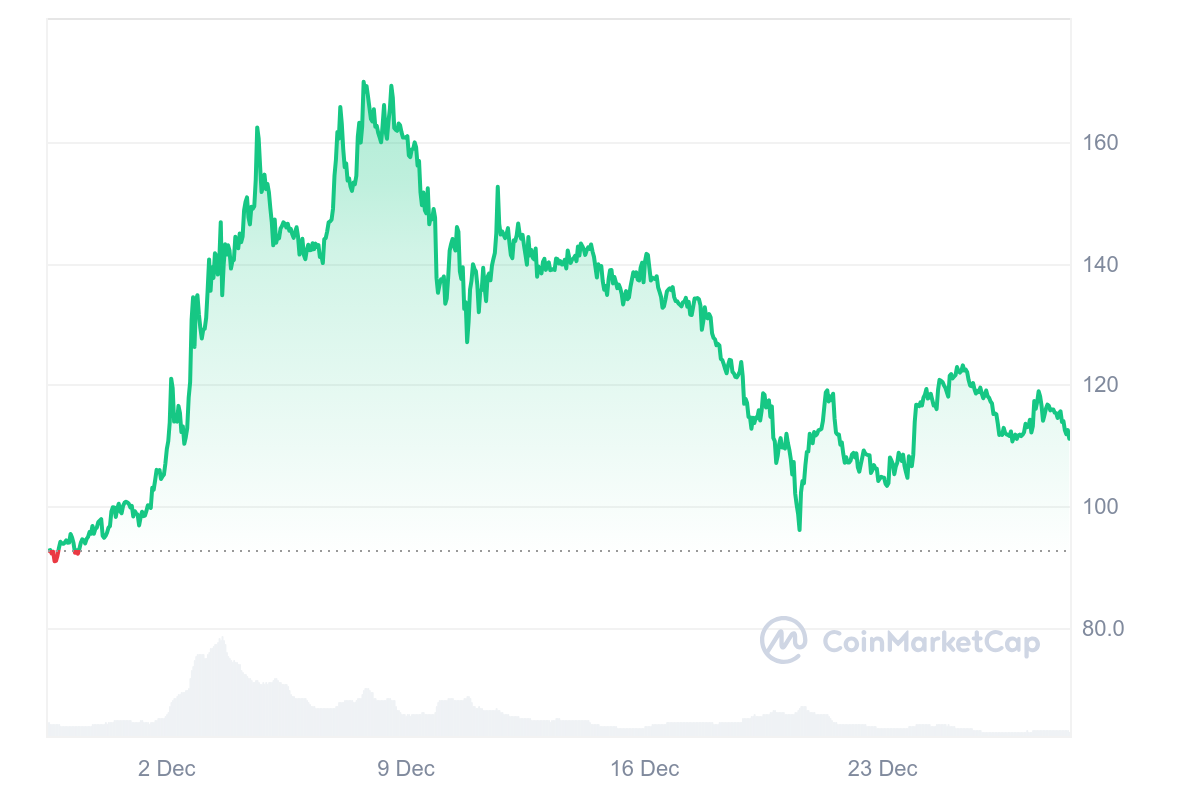

Meanwhile, QNT trades at $111.10, reflecting a 19.22% growth over the past month. The token’s performance shows a neutral market sentiment, with a Fear & Greed Index score of 72, indicating greed. It is trading 23.59% above its 200-day simple moving average of $90.30, suggesting a positive trajectory.

Over the past month, QNT experienced 16 green days out of 30, or 53%. The 14-day Relative Strength Index (RSI) stands at 48.57, signaling neutral momentum and potential sideways trading.

Moreover, predictions suggest QNT could finish the year trading between $112.98 and $114.06. This range implies a modest 2.30% increase from the current price, offering potential returns of 2.68% if the forecast holds.

2. Celestia (TIA)

Celestia recently saw its price rise to $5.21, marking a 12.31% gain in the last 24 hours. Over the past 30 days, it has recorded positive movement on 15 occasions, showing steady performance. Its high liquidity compared to its market value reflects active trading and significant interest from investors.

A notable development is the introduction of the Ginger upgrade on Celestia’s Mainnet Beta. This update aims to improve the blockchain’s performance and prepare it for future scalability. By enhancing efficiency, the upgrade aligns with Celestia’s broader goal of supporting decentralized applications and expanding access to data on the blockchain.

From BTC 🌽 to RWAs

building on four new @Arbitrum Orbit chains

with Celestia underneath 🦣 https://t.co/H2f73qOKU0

— Celestia 🦣 (@celestia) December 23, 2024

The Ginger upgrade focuses on meeting the needs of applications that require handling large amounts of data, such as rollups. Rollups are a method of processing transactions outside the main blockchain while maintaining its security, helping reduce costs and congestion. This upgrade reflects the project’s commitment to decentralization and aims to create a robust blockchain ecosystem that can adapt to increasing demands.

Celestia’s advancements highlight its efforts to improve blockchain infrastructure, enabling more developers and users to engage with decentralized technology. The updates aim to balance efficiency, scalability, and accessibility, making the platform suitable for various uses. These developments suggest ongoing progress in building a system to support emerging blockchain applications.

3. Wall Street Pepe (WEPE)

Wall Street Pepe (WEPE) has gained significant attention in the cryptocurrency market, surpassing $37 million during its presale phase. The tokens are currently available at $0.0003658, but the price will soon increase as the presale moves to its next stage.

One factor driving interest is WEPE’s staking rewards program, which offers up to 39% annual percentage yield (APY). This program allows participants to earn returns on their holdings, making it appealing to retail and institutional investors. Security is another highlighted feature, with the platform aiming to provide users with a reliable and safe environment.

Moreover, WEPE emphasizes community involvement. Token holders gain access to a private group to share trading tips, insights, and analysis. This setup fosters collaboration and helps members stay informed about market trends, potentially enhancing their decision-making.

The project focuses on building an active and engaged community called the “WEPE army.” This approach reflects confidence in the token’s potential for long-term growth and its ability to maintain strong collective support. Many see this as an opportunity to align with a shared vision and benefit from a collaborative network.

Visit Wall Street Pepe Presale

4. Pyth Network (PYTH)

Pyth Network has introduced real-time oil price data to decentralized finance (DeFi), linking traditional financial markets with blockchain-based solutions. By providing live oil price feeds, Pyth aims to enable the development of DeFi applications connected to energy markets. This initiative could pave the way for innovative tools and systems in the decentralized energy sector.

The network gathers real-time data from reliable sources like exchanges, market makers, and index providers. It makes this information accessible across over 80 blockchain ecosystems. Developers can use this data to create applications that directly interact with oil market pricing. This approach combines blockchain’s decentralized nature with traditional market insights.

4.6M PYTH staking rewards have been distributed to stakers helping to protect DeFi through Oracle Integrity Staking.

Want to get started with staking? Link below 👇 pic.twitter.com/ZpMCKxl3cV

— Pyth Network 🔮 (@PythNetwork) December 23, 2024

Pyth Network’s price is $0.3695, reflecting a 2.29% decrease over the last 24 hours. It has shown moderate stability, with 18 green trading days in the past month, accounting for 60% of the period. Its market indicators, such as a 24-hour volume-to-market-cap ratio of 0.0446 and a 14-day Relative Strength Index (RSI) of 51.94, suggest neutral market behavior. These figures imply steady performance without significant price swings.

The introduction of real-time energy data to DeFi highlights a step towards integrating traditional commodities with decentralized platforms. This could broaden DeFi’s use cases, offering a way to connect financial innovations with global energy markets.

5. Sei (SEI)

Sei is currently valued at $0.4106, reflecting a 5.03% drop in its price. Market sentiment appears bearish, but the Fear & Greed Index indicates a score of 72, suggesting a climate of greed among investors. The token’s 24-hour trading volume to market cap ratio is 0.1105, which indicates decent liquidity based on its overall market cap.

The token’s 14-day Relative Strength Index (RSI) is 48.79, placing it in a neutral zone. This suggests the token may trade sideways in the near term without strong momentum in either direction. One positive sign is that Sei remains above its 200-day moving average. This indicator is often seen as a sign of sustained upward pressure, signaling potential for future growth.

This week was gigantic.

Full of massive updates, milestones, and relentless progress, all signs that the Sei community is in full on building mode.

Here's your weekly alpha 👇

🔴 Announcing Giga: Scaling the EVM to 5 gigagas per second, unlocking 50x performance over any… pic.twitter.com/5SA8Kci6ZE

— Sei 🔴💨 (@SeiNetwork) December 20, 2024

If Sei holds its support, potential price targets in the near term include $0.465, $0.540, $0.645, and $0.725. These levels represent milestones that could be achieved if the bullish structure persists. While risks remain, current patterns hint at cautious optimism.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage