Join Our Telegram channel to stay up to date on breaking news coverage

As of today, with the total crypto market capitalization at $2.44 trillion, Bitcoin’s price has risen by 1.51% in the last 24 hours, reaching $66,820. This increase brings its market cap to $1.32 trillion. Bitcoin’s dominance is 53.92%, highlighting its significant influence in crypto.

However, the Bitcoin market remains complex and nuanced, with traders reacting to economic data and hedging strategies. A notable bearish sentiment persists despite a breakout above $66,000 post-CPI inflation report. Investors are paying premiums for short-term downside protection, reflecting caution and market uncertainty. Moreover, four distinct tokens have surged impressively amidst this market activity today. Continue reading for more insights.

Biggest Crypto Gainers Today – Top List

Today’s top crypto gainers represent diverse niches within the cryptocurrency market. Reserve Rights surged by 20.63%, focusing on stablecoin over-collateralization and governance. 0x experienced a remarkable increase of 23.87%, serving as a decentralized exchange protocol facilitating ERC20 token trading.

Gnosis witnessed a surge of 14.53%, supporting prediction markets and various dApps. SSV Network showcased a remarkable 12.58% increase, enhancing Ethereum’s staking infrastructure through decentralization. Explore the investment potential of these fascinating projects, uncover valuable insights, and enjoy the read.

1. Reserve Rights (RSR)

Reserve Rights is an ERC-20 token that supports the Reserve Protocol. It ensures the over-collateralization of Reserve stablecoins (RTokens) through staking. Additionally, it governs the RTokens by allowing RSR holders to propose and vote on changes.

RSR holders stake their tokens to backstop Reserve stablecoins, covering losses if collateral tokens default. They can stake on one or multiple RTokens or choose not to stake. In return, RSR stakers receive a portion of the revenue from the RTokens they insure. This model ensures that late participants don’t subsidize early ones.

Unlike USD-backed stablecoins, Reserve stablecoins are managed by smart contracts and backed by a diverse basket of cryptocurrencies, including USDC, TUSD, cUSDC, and aDAI. Future baskets might diversify further, including fiat currencies, securities, and derivatives. Furthermore, Reserve Rights is an ERC-20 token on the Ethereum blockchain. It is secured by Ethereum’s proof-of-work consensus mechanism, supported by thousands of miners.

If you’re looking for a sign to create a crypto token comprising any combination of ERC-20 collateral assets you can dream up, this is it 🛑👉https://t.co/YYeXma0o4r pic.twitter.com/wrUpw880td

— Reserve (@reserveprotocol) May 17, 2024

Currently, RSR is priced at $0.008307, showing that it has surged by 20.63% in the last 24 hours and 177% over the past year. It trades 225.03% above its 200-day simple moving average of $0.002552. The 14-day Relative Strength Index (RSI) is neutral at 45.56, suggesting sideways trading. RSR has shown low volatility, with a 30-day volatility rate of 6%. It maintains high liquidity, with a market cap of $419.77M and a 24-hour trading volume of $158.77M, suggesting a positive outlook for investment.

2. 0x (ZRX)

0x is a protocol for decentralized exchange. It enables users to trade ERC20 tokens and other assets across different blockchains without relying on centralized intermediaries. Also, it uses open-source smart contracts to create a flexible, low-friction trading protocol.

The protocol powers web3 apps like wallets, DEXes, and portfolio trackers, facilitating over $200B in trading volume. ZRX, an ERC20 governance token, enables holders to participate in protocol governance and manage its community treasury.

0x supports fungible (ERC20) and non-fungible (ERC-723) tokens, enabling permissionless trading of Ethereum assets. It can be used for digital goods marketplaces, OTC trading desks, DeFi protocol, and decentralized exchanges.

0x also integrates into products where asset exchange is secondary, like in-game purchases and portfolio management platforms. The Ethereum blockchain secures 0x, with its smart contracts audited by firms like ConsenSys Diligence. The protocol maintains a bug bounty program to detect and fix vulnerabilities.

Leading DeFi applications are monetizing the trading activity of their users and driving millions of dollars in revenue 💸

Find out what you need to know to build a sustainable Web3 business in our inaugural industry report, Monetization Across DeFi 👇https://t.co/VzcUdGMLOb

— 0x (@0xProject) May 16, 2024

At $0.606171, ZRX has surged 23.87% in the last 24 hours and 165% over the past year. Trading 52.26% above its 200-day SMA of $0.397272, it signals the potential for a price decline with a 14-day RSI at 72.71, indicating overbought conditions. The past 30 days have witnessed 15 green days, indicating balanced performance. Additionally, ZRX maintains low volatility at 6% and high liquidity, making it an appealing investment option.

3. WienerAI (WAI)

WienerAI has garnered over $2 million in its presale, setting the stage for a highly anticipated public launch. Beyond its playful branding, it offers substantive technological innovation, featuring an AI-powered trading bot designed to simplify crypto investing. This sophisticated bot leverages advanced predictive models to identify lucrative trading opportunities. It is coupled with a user-friendly interface, streamlining execution across multiple decentralized exchanges (DEXs).

New Crypto Presale to Watch: WienerAI Meme Coin Hits $2M Milestone @WienerDogAI https://t.co/tcy2iOs0zG

— Bitcoin.com News (@BTCTN) May 17, 2024

Notably, the team’s commitment to security and transparency is evident through actions like a comprehensive smart contract audit by Coinsult, ensuring a secure launch. However, this presale success comes amid a broader trend of increased investor interest in early-stage crypto projects. It reflects a growing appetite for high-growth opportunities within the crypto market.

WienerAI’s unique blend of AI technology and meme-inspired branding has captured the attention of over 8,900 followers on Twitter. All eyes are on the project as anticipation mounts for its exchange debut. They’re eager to see if WAI’s early momentum translates into sustained success within the dynamic crypto ecosystem.

4. Gnosis (GNO)

Gnosis is a decentralized infrastructure project built on Ethereum. It aims to foster experimentation and provide decentralized solutions for the Ethereum ecosystem. Originating in 2015 with a focus on prediction markets, Gnosis evolved to develop infrastructure such as Gnosis Safe. It operates as a decentralized autonomous organization (DAO), supporting various decentralized applications (dApps).

Gnosis stands out for incubating projects like Gnosis Safe, Cow Protocol, Conditional Tokens, Gnosis Auction, and Zodiac. These projects collectively contribute to Ethereum’s decentralized ecosystem. The CoW Protocol utilizes multi-token batch auctions for decentralized exchange.

SafeDAO governs the customizable multi-sig wallet, Gnosis Safe. Additionally, the Gnosis Chain serves as an execution-layer EVM chain. It leverages xDai stablecoin transactions secured by the Gnosis Beacon Chain’s proof-of-stake consensus.

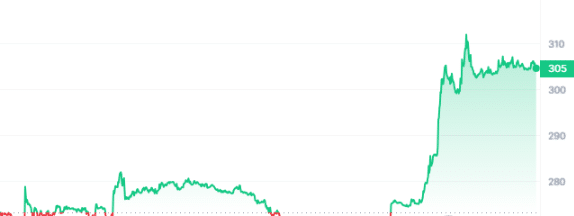

GNO has experienced significant price movements, with its current price at $ 304.54, reflecting an increase of 14.53% in the last 24 hours. Over the past year, the price has seen remarkable growth, increasing by 167%. It trades 126.28% above the 200-day SMA, indicating strong bullish momentum.

Hello, wise owls!🦉

The updated deposit UI is now live!

→ https://t.co/Z0HOxJr8jU

Updated Deposit UI brings you;

• The auto claim function

• Support for more wallets and features – @WalletConnect and @CoinbaseWallet

• Works for both Chiado and Gnosis Chain

• And… pic.twitter.com/gKmxbX6x9p— Gnosis Chain 🦉 (@gnosischain) May 16, 2024

However, the 14-day RSI suggests that the gainer is overbought, potentially signaling a forthcoming correction. Despite this, most of the last 30 trading days have been positive, with 50% representing green days. Furthermore, Gnosis maintains medium liquidity, with a volume-to-market cap ratio of 0.0231, ensuring stability amid market fluctuations.

5. SSV Network (SSV)

SSV Network is a decentralized staking infrastructure designed to enable the distributed operation of an Ethereum validator. The protocol enhances nodes’ robustness, liveliness, and fault tolerance across the Ethereum ecosystem by splitting a validator key between four or more non-trusting node instances.

This innovative approach transforms a validator key into a multisig construct governed by a consensus layer. It improves vital storage, redundancy, customizability, and security through a threshold signature scheme.

The protocol’s unique features offer various use cases within the Ethereum ecosystem. It enhances the security and reliability of validator nodes by enabling offline storage of validator keys and implementing an ‘active to active’ redundancy mechanism.

Additionally, node instances can be customized to suit different requirements, fostering flexibility and adaptability in staking operations. Moreover, the threshold signature scheme ensures enhanced security and integrity in executing validator duties.

SSV now has 20,000 Validators on mainnet 🤖

The future of resilient re/staking is DVT.

🔗 https://t.co/hUfaEQybYO pic.twitter.com/DSOGCC2b4V

— SSV Network (@ssv_network) May 16, 2024

SSV trades at $41.70, showcasing a 12.58% surge in the last 24 hours and a remarkable 79% increase over the past year. Moreover, it trades above the 200-day SMA, standing at 120.29%, reflecting its bullish momentum. While the 14-day RSI suggests a neutral market sentiment, the project maintains high liquidity, with a volume-to-market cap ratio of 0.2792. Additionally, with 50% of the last 30 trading days being positive and a 30-day volatility below 30% at 10%, SSV shows stability in the market.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage