Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin surged approximately 7% to $62,937 on Friday, buoyed by a smaller-than-expected rise in US employment. This sparked optimism for interest rate cuts and enhanced the allure of speculative assets such as cryptocurrencies. The surge compensated for earlier losses incurred during apprehensions about Federal Reserve policy tightening and declining demand for Bitcoin ETFs.

However, despite this price increase, traders are still exercising caution due to Bitcoin’s fall from its March peak. This reaction implies deeper concerns about global macroeconomic risks, which the Federal Reserve or traditional investors may not fully recognize.

Biggest Crypto Gainers Today – Top List

Following yesterday’s surge in Bitcoin’s price, the captain coin maintains its upward trajectory today. At $63,163, Bitcoin boasts a remarkable 6.15% surge in the past 24 hours, propelling its market capitalization to an impressive $1.24 trillion. This bullish momentum extends to other tokens in the crypto market as well. Bitcoin Gold, The Graph, Nervos Network, and Bitcoin SV emerge as top gainers today, showcasing the widespread momentum propelling digital assets forward. Let’s dig into these coins and uncover their lucrative investment opportunities.

1. Bitcoin Gold (BTG)

Bitcoin Gold is a user-friendly alternative to Bitcoin, aiming to combine Bitcoin’s security with opportunities for innovation. Unlike Bitcoin, BTG avoids direct competition and focuses on expanding possibilities for DeFi and DApp developers. BTG’s unique approach lies in its compatibility with Bitcoin’s blockchain while utilizing distinct resources. This presents a coin with implementation capabilities similar to Bitcoin but a broader scope for experimentation and development.

It distinguishes itself through a novel approach to blockchain development and applications. As a hard fork of Bitcoin, BTG seeks to address Bitcoin’s scalability issues by introducing the Equihash PoW algorithm, which favors GPU mining. This innovative solution enhances mining accessibility and decentralization, aligning with BTG’s commitment to open-source governance. Moreover, its early adoption by institutional and enterprise investors underscores its potential as an alternative investment option in the crypto market.

A few days after Bitcoin's halving, but with less fanfare, BTG's halving came at block 840,000.

Block reward is now 3.125 BTG.

Wait, you say… didn't Bitcoin's 2020 halving come *after* BTG's 2020 halving? Why not now? Don't they both come every 210,000 blocks? (1/2)

— Bitcoin Gold [BTG] (@bitcoingold) April 25, 2024

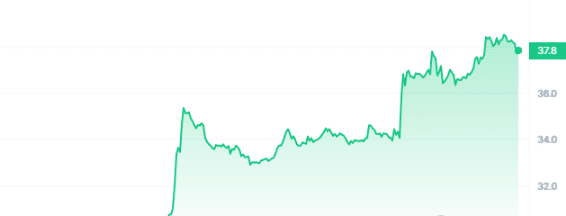

BTG is priced at $37.52, showing a remarkable 27.92% surge in the last 24 hours. With a market dominance of 0.03%, it has seen a substantial 170% increase in price over the past year. It trades 55.87% above the 200-day SMA at $24.16, thus maintaining a solid position. While the 14-day RSI indicates neutrality at 57.26, 11 of the last 30 trading days have been positive. With a 30-day volatility of 17%, BTG offers moderate price fluctuations. However, its low liquidity, with a volume-to-market cap ratio of 0.0085, poses a challenge for high-volume trading despite its $659.57M market capitalization.

2. The Graph (GRT)

The Graph is an indexing protocol powering applications in both DeFi and Web3 ecosystems. It enables the creation of open APIs called subgraphs, allowing accessible data querying using GraphQL for Ethereum and IPFS networks. With over 3,000 subgraphs deployed by developers for various DApps like Uniswap and Synthetix, it aims to democratize access to decentralized public infrastructure.

In recent news, The Graph introduces the Sunrise Upgrade Program, empowering users to freely access information from any source. The program offers opportunities for community members to earn GRT tokens and supports the network’s decentralized data phase. Activities range from content creation to technical contributions, fostering community engagement and ecosystem growth.

Democratize Data. Revolutionize web3. Earn GRT 🌅

The Graph Foundation just launched the 4 million GRT Sunrise Upgrade Program – empowering anyone on the internet to revolutionize how the world accesses data.

Join and complete a variety of fun onchain and offchain missions… pic.twitter.com/J7QP6zTLAu

— The Graph (@graphprotocol) May 2, 2024

In light of these developments, GRT’s performance metrics show promising signs. With a current price of $0.279304 and a 10.08% surge in the last 24 hours, GRT continues its upward trajectory. It trades 137.80% above the 200-Day SMA at $0.117455, GRT reflecting investor confidence. Even with a neutral 14-day RSI of 42.34, it has recorded 14 green candle days in the last 30 days, indicative of market stability. Furthermore, GRT boasts high liquidity, with a volume-to-market cap ratio of 0.0658, ensuring ample trading opportunities.

3. Sealana (SEAL)

Sealana introduces a digital seal character immersed in cryptocurrency trading on the Solana network. This comedic persona resonates with modern crypto investors, embodying their motivations and subcultures. The presale has raised over $180,000 in just a few days, reflecting strong initial investor interest.

The presale model for Sealana simplifies investment by allowing users to send SOL to a designated wallet address. With each SOL contributing, investors receive 6,900 SEAL tokens. This streamlined approach has fueled the presale’s initial momentum, attracting significant investment quickly. However, Sealana’s lack of a predetermined hard cap introduces uncertainty about its future token supply. While the fixed conversion rate ensures scarcity, the open-ended nature of the presale means the final token supply hinges solely on investor demand.

Moreover, Sealana’s integration with Solana unlocks several strategic advantages. It gains a competitive edge by harnessing Solana’s high-speed performance, minimal transaction fees, and flourishing ecosystem. Also, Sealana, as an SPL token, utilizes Solana’s scalability and vibrant developer community. This differentiates it from meme coins that grapple with congestion on Layer 1 networks like Ethereum.

4. Nervos Network (CKB)

Nervos Network is an open-source public blockchain ecosystem with a unique dual-layer architecture. Its base layer, the Common Knowledge Base, handles consensus mechanisms and smart asset storage. The computation layer complements this, processing real-time transactions and reflecting the network’s dedication to innovation. It also facilitates programming tasks, enhancing accessibility within the Nervos ecosystem.

Securing the Nervos Network is a PoW-based Nakamoto consensus mechanism that ensures the integrity of decentralized applications (dApps) and digital assets. The network doesn’t stop there; it also undergoes regular third-party audits by CertiK. Furthermore, it engages with the community through hackathons, offering cash prizes to identify and address potential security vulnerabilities. This helps foster collaboration and continuous improvement.

🔥This year CKB has been on fire as innovators find ways to use CKB as a Bitcoin Layer 2!🧠

Check out the first installment of "The Ultimate Guide to Bitcoin Layer 2's", examining @Liquid_BTC @rootstock_io , @Stacks & RGB (@lnp_bp)!👇https://t.co/op4IKmiFGX pic.twitter.com/MJM2oZQOVr

— Nervos Foundation (@RunningCKB) April 29, 2024

CKB has shown significant growth, with a current price of $0.018848 and an impressive 18.76% surge in the last 24 hours. Over the past year, the price has surged by 415%, indicating strong investor interest in the project. Trading well above the 200-day SMA at $0.007369 by 156.18%, Nervos Network demonstrates the potential for further growth. Although the 14-day RSI stands at a neutral 48.15, 40% of the last 30 trading days have shown positive trends. With high liquidity and a volume-to-market cap ratio of 0.2923, Nervous Network offers abundant trading opportunities for investors.

5. Bitcoin SV (BSV)

Bitcoin SV emerged in 2018 after a hard fork of the Bitcoin Cash (BCH) blockchain. It aimed to fulfill the original vision outlined by Satoshi Nakamoto. It endeavors to offer scalability and stability, adhering closely to the Bitcoin protocol and enabling advanced blockchain applications.

BSV differentiates itself by maintaining loyalty to the original Bitcoin protocol. It emphasizes scalability for efficient electronic cash payments and distributed data applications. With unbounded block size, Bitcoin SV claims to surpass traditional payment processing capabilities at lower costs. This gainer appeals to both consumer and enterprise users. Also, the network is secured by the proof-of-work consensus mechanism, ensuring transaction integrity and immutability.

Dive into the world of BSV Blockchain's Alert System with this informative video! Check out the video now and read up on the BSV Alert System here: https://t.co/n1jkHFazal #BSV #Blockchain #AlertSystem #BSVAssociation

— BSV Blockchain (@BSVBlockchain) May 3, 2024

Analyzing performance metrics, BSV has seen a notable surge of 10.92% in the last 24 hours, reflecting positive market sentiment. It has a neutral 14-day RSI at 39.21, indicating potential sideways movement. However, the coin has shown a 98% increase in price over the past year. Trading above the 200-day SMA at $41.50 and with low volatility at 18%, BSV demonstrates stability. With its high liquidity, Bitcoin SV offers a robust trading environment for investors. The volume-to-market cap ratio of 0.0681 further enhances its appeal, providing opportunities for long-term growth seekers.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage