Join Our Telegram channel to stay up to date on breaking news coverage

Top gainers and worst losers are commonplace in the crypto market. Let’s journey through historical data to see how the market has evolved up to the present times. Over the past year, we’ve witnessed remarkable fluctuations in cryptocurrency values. Pepe Coin stands out as the top gainer, with an extraordinary gain of 71,396,781.17%, while ApeCoin experienced a significant loss of -51.95%. Beginning the year on a high note, Dogwifhat boasted a notable gain of 1,493.63%, juxtaposed by FTX Token’s substantial loss of -36.40%.

Today’s market movements reflect this inherent volatility. Ondo Finance leads as the top gainer with a 28.48% increase. Meanwhile, Reserve Rights lags with a -3.73% loss over the last 24 hours. This journey through historical and present-day data highlights the dynamic nature of crypto investment. It underscores the importance of informed decision-making in navigating its complexities.

Biggest Crypto Gainers Today – Top List

Scrutinizing every gaining coin for substance has never stopped yielding significant results for a wise investment. Today’s focus is Chromia, THORChain, Centrifuge, and Nervos Network, all exhibiting noteworthy price increases. Beyond mere statistical fluctuations, these projects epitomize innovation and promise within blockchain. Understanding the underlying dynamics propelling their ascent offers invaluable insights for investors navigating the complexities of digital asset investment.

1. Chromia (CHR)

Chromia emerges as a versatile blockchain platform, fostering the creation of decentralized applications (DApps) across diverse sectors like gaming, finance, and real estate. Founded by ChromaWay in 2014, it introduces innovative features to revolutionize blockchain development.

Utilizing a relational blockchain architecture, it optimizes transaction speed and scalability, setting it apart from traditional blockchains. Each DApp operates within its local state, streamlining consensus and reducing complexity. Developers benefit from an open-source environment, employing familiar languages like SQL and JavaScript for DApp creation.

Chromia’s adaptability shines through its support for public, private, or hybrid blockchain models, granting users control over data governance and access. Its scalability is remarkable, accommodating up to 100,000 cell updates per second and enabling parallel transaction processing.

Why was #Chromia the right choice for @VfB's Digital Collectibles Marketplace?

💪 Seamless onboarding using $USDC or fiat

✅ Account abstraction allowing for email login or wallets

⛓️ Their own chain with no congestion from other #dapps— Chromia | Power to the Public (@Chromia) March 24, 2024

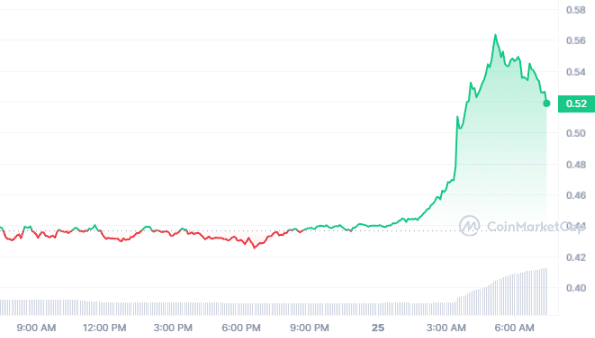

The current price of Chromia is $0.521227, reflecting a 19.31% surge in the last 24 hours. With a market dominance of 0.02%, its price has surged by 236% in the past year. Trading significantly above the 200-day SMA at $0.122226, it exhibits neutral signals with a 14-day RSI of 69.74. The last 30 days saw 50% green days, with a volatility of 7%. With a volume-to-market cap ratio of 0.3841, Chromia boasts high liquidity with a market cap of $426.93M and a 24-hour volume of $163.97M.

2. THORChain (RUNE)

THORChain is a decentralized liquidity protocol facilitating seamless cryptocurrency exchanges across various networks. Users retain full asset custody while swapping assets without order book reliance, relying instead on pool ratios to maintain market prices. RUNE serves as the native utility token for governance and security within this system, requiring node operators to commit a minimum of 300k RUNE for consensus participation.

The protocol supports native asset settlement across nine blockchains, eliminating the need for asset wrapping or pegging. It employs slip-based fees to mitigate impermanent losses for liquidity providers. THORChain utilizes innovative technologies like one-way state pegs and a TSS protocol for permissionless cross-chain swaps, ensuring accessibility for all traders.

Furthermore, it operates on a non-profit basis, directing all generated fees to participants, including node operators and liquidity providers. Streaming Swaps and Savers enable cost-effective swaps and single-sided liquidity provision, respectively. Additionally, the platform offers a lending protocol without liquidations, interest, or expiration.

1) The Bitcoin is not wrapped

2) 102 Nodes hold key shares across 5 14of20 TSS vaults locked in an economic Mexican standoff; secured 2:1 in value.Btw anyone can become a node. Good luck 🫡 https://t.co/nP65ko5tMj

— THORChain (@THORChain) March 24, 2024

RUNE stands out with a remarkable 7.39% surge in the last 24 hours and an astonishing 533% surge over the past year. Currently trading an impressive 198.56% above the 200-day SMA, it boasts robust liquidity, boasting a volume-to-market cap ratio of 0.0949. Yet, amidst this stability, the 14-day RSI signals a neutral stance, hinting at potential exciting trading opportunities.

3. Smog (SMOG)

Smog, a multi-chain meme coin, has captured the attention of investors as one of the top meme coins. Launched on the Solana blockchain and listed directly on the Jupiter decentralized exchange (DEX) in February 2024, the $SMOG token wasted no time making waves. Within 24 hours, its market cap surged from $28 million to an impressive $139 million. The project now boasts over a million dollars in daily trading volume and a loyal community of over 100k holders, surpassing many projects with wider exchange listings.

The developers of Smog have set ambitious objectives, aiming for it to ascend as the predominant coin within the Solana blockchain ecosystem. The team’s commitment to fairness and community engagement is evident in their execution of a transparent token launch. Investors who purchase $SMOG now stand eligible for one of Solana’s most substantial token airdrops.

Season 2 Begins Now! 🚀Introducing #SmogSwap! 🔥🐉

Season 2 is more weighted to buying and holding $SMOG, and will look at all on-chain activity as well as @zealy_io. 💸

Season 2 will award XP based on buying, holding, and swapping $SMOG since the token launch date – so fill…

— SMOG (@SMOGToken) March 15, 2024

Prospective investors can easily acquire $SMOG using $ETH or $USDT on the Smog website, and holding or staking the tokens offers additional benefits. The Smog project incentivizes long-term engagement with a 42% Annual Percentage Yield (APY) for staking, participation in the Smog Zealy campaign, and completing quests for airdrop points. It fosters loyalty among its community members.

4. Centrifuge (CFG)

Centrifuge serves as a link between decentralized finance (DeFi) and tangible real-world assets (RWA). It strives to diminish capital barriers for small and mid-sized enterprises (SMEs) while furnishing investors with stable income avenues. The project’s core objective lies in extracting profits detached from the volatile nature of crypto assets. It endeavors to transfer real-world monetary value into cryptocurrencies seamlessly.

Companies are leveraging Centrifuge to tap into DeFi’s expansive liquidity. Through tokenizing real assets, these enterprises can utilize the resultant tokens as collateral. They access financing via Tinlake, a decentralized application (DApp) lending protocol. Centrifuge’s blockchain infrastructure is engineered on Polkadot for enhanced speed and cost-efficiency. It is complemented by Tinlake and designed to harness liquidity from the Ethereum network.

Investors partake in Centrifuge’s ecosystem by receiving income and rewards from CFG tokens. Meanwhile, borrowers revel in the ability to finance real assets sans the involvement of traditional banking institutions. The protocol tokenizes real-world assets into non-fungible tokens (NFTs) before channeling them through Tinlake. Furthermore, Centrifuge integrates seamlessly with other DeFi protocols, bolstering liquidity and mitigating risks for all stakeholders.

We're happy to be partnered with @KintoXYZ — and we support their proposal for ARB incentives for protocols launching on their L2! https://t.co/F8RuMu8yF7

— Centrifuge (@centrifuge) March 22, 2024

Centrifuge continues its ascent, with a 17.12% increase in the last 24 hours and a remarkable 249% rise over the past year; it exemplifies robust growth. Trading 163.50% above the 200-day SMA, CFG maintains a moderate level of liquidity with a volume-to-market cap ratio of 0.0205. While its stability is apparent, the 14-day RSI signals neutral trading conditions, suggesting potential exciting market opportunities.

5. Nervos Network (CKB)

Nervos Network is an open-source blockchain ecosystem with a dual-layer architecture. This architecture, with its multiple layers and protocols, reflects the team’s innovative approach to blockchain design. It includes a base layer, the Common Knowledge Base, for consensus and asset storage and a computation layer for transaction processing. CKB is its native cryptocurrency, incentivizing miners, managing network resources, and facilitating user transactions.

Developers leverage Nervos Network to create decentralized applications (dApps) across various blockchain systems. It combines the security of Proof-of-Work (PoW) with scalability to streamline dApp creation and usage. Its scalable economic model rewards participants for utilizing platform features, providing access to a decentralized, open, and censorship-resistant environment. Users can store assets on the platform, pricing based on storage requirements and duration.

CKB presents a compelling case for both short and long-term investors. It exemplifies substantial growth potential with a remarkable 12.48% spike in just 24 hours and an impressive 329% increase over the past year. Most of the last 30 trading days have been positive, with 60% recording gains. With 30-day volatility below 30%, Nervos Network demonstrates stability. Additionally, it boasts a high liquidity ratio of 0.1706 volume to market cap, making it an attractive proposition for investors seeking growth opportunities in the cryptocurrency market.

#TeamCKB Latest Update:

⏩ Introduced Rich-Indexer for advanced queries

🤗 #Cobuild with Omnilock

🔜 Payment Channel Network on #CKBhttps://t.co/UemjdQhXwm

— CKB Dev↾⇃ (@CKBdev) March 22, 2024

Shifting focus from today’s crypto gainers, Blast’s Ethereum layer-2 blockchain is buzzing with gaming activity led by Crypto Valleys. Like DeFi Kingdoms, the game lures players with NFT-based seeds, offering high rewards and opportunities to mint valuable character NFTs amid its growing popularity.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage